Impact Of Tariffs On Brookfield's US Investment Plans

Table of Contents

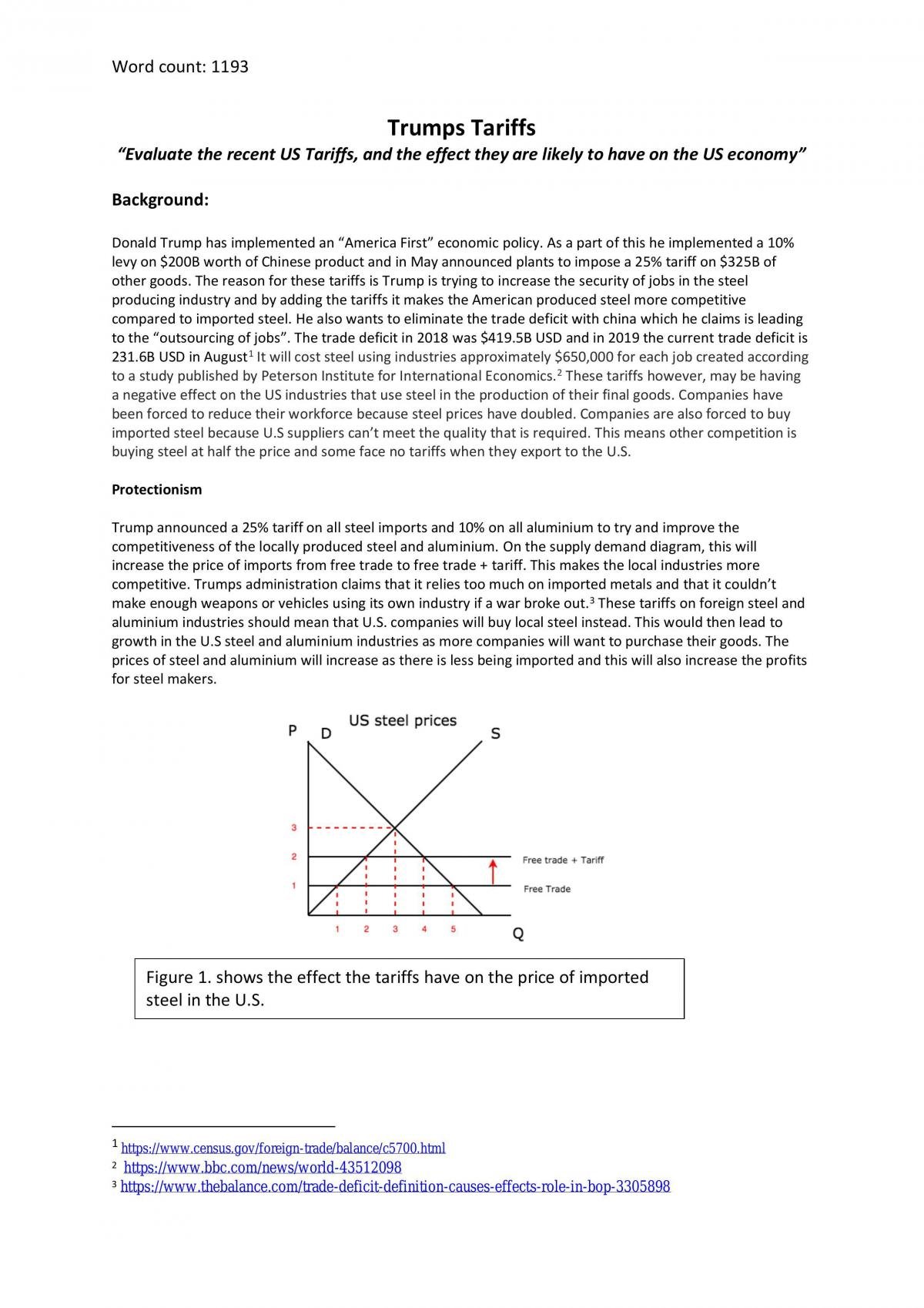

Tariffs and Brookfield's Infrastructure Investments

Increased construction costs and supply chain disruptions are major concerns for Brookfield's infrastructure investments. The keywords here are infrastructure investment, tariff impact, construction costs, material prices, supply chain disruptions, and project delays.

-

Increased Costs of Imported Materials: Tariffs on steel and aluminum, crucial materials in infrastructure projects, directly inflate project budgets. This necessitates careful cost analysis and potentially necessitates renegotiating contracts or seeking alternative materials.

-

Project Delays: Supply chain disruptions caused by tariffs lead to extended lead times for essential materials. This delays project completion, impacting revenue streams and potentially incurring penalties.

-

Risk Mitigation Strategies: Brookfield employs sophisticated risk assessment models to anticipate and mitigate tariff-related challenges. This includes diversifying suppliers, hedging against price fluctuations, and incorporating tariff-related contingencies into project budgets.

-

Case Studies: Analyzing past projects affected by tariffs allows Brookfield to learn from past experiences and refine its strategies for future endeavors. This data-driven approach is key to navigating future challenges.

-

Return on Investment (ROI): Tariffs directly influence the ROI of infrastructure projects. Accurate forecasting, which accounts for potential tariff increases, is vital for successful investment decisions.

Impact on Brookfield's Renewable Energy Investments

Brookfield's renewable energy investments, including solar and wind energy projects, are also vulnerable to tariff impacts. Key terms here are renewable energy, solar energy, wind energy, tariff impact, component costs, manufacturing, and clean energy investment.

-

Component Costs: Tariffs on imported solar panels, wind turbine components, and other critical equipment significantly increase project costs, potentially jeopardizing project viability.

-

Competitiveness: Higher costs due to tariffs can reduce the competitiveness of renewable energy projects against fossil fuel alternatives, particularly in markets sensitive to price fluctuations.

-

Domestic Sourcing and Alternatives: Brookfield is actively exploring domestic sourcing of components and investigating alternative technologies to lessen its reliance on tariff-affected imports.

-

Government Policies and Incentives: Government policies and incentives play a crucial role in mitigating tariff-related impacts on renewable energy investments. Tax credits, subsidies, and supportive regulations can help offset increased costs.

-

Long-Term Growth: The long-term growth of Brookfield's renewable energy portfolio hinges on its ability to successfully navigate the challenges posed by tariffs and fluctuating government policies.

Tariffs and Brookfield's Real Estate Investments

The real estate sector is another area where Brookfield's US investment plans are susceptible to the effects of tariffs. We’ll focus on real estate investment, tariff impact, construction materials, property values, tenant demand, and market fluctuations.

-

Construction Costs: Increased costs of construction materials directly impact the profitability of new real estate developments, potentially affecting project feasibility and return on investment.

-

Property Values: Economic uncertainty caused by tariffs can influence market demand and consequently, property values. A downturn in the economy could significantly affect rental rates and property sales.

-

Building Material Availability and Pricing: Tariffs can create shortages of certain building materials, driving up prices and increasing the costs of construction and renovation projects.

-

Navigating Risks: Brookfield employs various strategies to manage tariff-related risks in the real estate sector, including flexible design plans, hedging against price fluctuations, and careful tenant selection.

-

Macroeconomic Implications: The broader macroeconomic implications of tariffs are closely monitored by Brookfield, as these factors significantly influence the real estate market's overall health.

Brookfield's Overall Investment Strategy in Response to Tariffs

Brookfield's response to tariff-related challenges highlights its commitment to robust risk management and strategic diversification. Key terms include risk management, investment strategy, diversification, due diligence, and geopolitical risk.

-

Risk Assessment and Mitigation: Brookfield uses sophisticated models to assess and mitigate tariff-related risks, proactively adjusting investment strategies as needed.

-

Geographic and Sector Diversification: Diversification across sectors and geographies reduces the impact of any single tariff-related shock on the company's overall portfolio.

-

Enhanced Due Diligence: Brookfield's due diligence processes have been enhanced to explicitly incorporate tariff-related uncertainties into investment evaluations.

-

Identifying Opportunities: Brookfield actively seeks out investment opportunities created by shifts in the market landscape due to tariffs.

-

Long-Term Outlook: Brookfield's long-term investment strategy considers the evolving geopolitical climate and anticipates potential future trade policy changes.

Conclusion

This analysis underscores the substantial and multifaceted impact of tariffs on Brookfield's US investment plans, affecting infrastructure, renewable energy, and real estate. Brookfield's success in navigating these challenges relies on strategic responses, including effective risk mitigation, investment diversification, and adaptation to the changing global economic landscape. Understanding the impact of tariffs on major investors like Brookfield is vital for anyone involved in or following the US market. Stay informed about the latest developments concerning the impact of tariffs on Brookfield's US investment plans and related economic trends. Continue learning more about the complexities of this issue by exploring [link to relevant Brookfield resources or further articles].

Featured Posts

-

Why The Appeal Of Offshore Wind Power Is Diminishing

May 03, 2025

Why The Appeal Of Offshore Wind Power Is Diminishing

May 03, 2025 -

Lotto 6aus49 Ergebnisse Der Ziehung Am 12 April 2025

May 03, 2025

Lotto 6aus49 Ergebnisse Der Ziehung Am 12 April 2025

May 03, 2025 -

Tributes Pour In For 10 Year Old Girl Killed On Rugby Pitch

May 03, 2025

Tributes Pour In For 10 Year Old Girl Killed On Rugby Pitch

May 03, 2025 -

1 Mayis Emek Ve Dayanisma Guenue Tarih Boyunca Meydana Gelen Arbedeler

May 03, 2025

1 Mayis Emek Ve Dayanisma Guenue Tarih Boyunca Meydana Gelen Arbedeler

May 03, 2025 -

Serie Joseph Tf 1 Vaut Elle Le Coup D Il Critique Et Avis

May 03, 2025

Serie Joseph Tf 1 Vaut Elle Le Coup D Il Critique Et Avis

May 03, 2025

Latest Posts

-

Au Dela De La Douleur Emmanuel Macron Emu Face Aux Victimes De L Armee Israelienne

May 04, 2025

Au Dela De La Douleur Emmanuel Macron Emu Face Aux Victimes De L Armee Israelienne

May 04, 2025 -

Macron Et L Etat Palestinien Une Erreur Selon Netanyahu

May 04, 2025

Macron Et L Etat Palestinien Une Erreur Selon Netanyahu

May 04, 2025 -

Netanyahu Critique Vivement Macron Sur La Question Palestinienne

May 04, 2025

Netanyahu Critique Vivement Macron Sur La Question Palestinienne

May 04, 2025 -

Decouvrez La Programmation 2025 2026 De La Seine Musicale

May 04, 2025

Decouvrez La Programmation 2025 2026 De La Seine Musicale

May 04, 2025 -

Agenda La Seine Musicale Concerts Danse Et Cinema 2025 2026

May 04, 2025

Agenda La Seine Musicale Concerts Danse Et Cinema 2025 2026

May 04, 2025