Indian Insurers Seek Regulatory Relief On Bond Forwards

Table of Contents

Current Regulatory Framework and its Limitations

The current regulatory framework governing bond forward investments for Indian insurers is primarily shaped by the Insurance Regulatory and Development Authority of India (IRDAI) guidelines. These guidelines, while aiming to protect policyholder interests, are often perceived as overly restrictive, hindering insurers' ability to effectively manage risk and optimize investment returns. The limitations stem from several key areas:

- Restrictions on notional amounts invested in bond forwards: Strict caps on the notional principal amount limit the scale of hedging and yield enhancement strategies insurers can employ.

- Complex reporting requirements leading to compliance burdens: The intricate reporting requirements imposed by the IRDAI create a substantial administrative burden, diverting resources from core business activities.

- Lack of clarity on permissible strategies for using bond forwards: Ambiguity in the guidelines regarding permissible trading strategies leads to uncertainty and hesitancy among insurers.

- Conservative risk assessment methodologies hindering efficient portfolio management: The current risk assessment methodologies may not adequately capture the nuances of bond forward trading, leading to overly conservative investment strategies.

These limitations collectively impact insurers' ability to compete effectively in a dynamic global market and achieve optimal investment performance. The current IRDAI guidelines on investment restrictions inadvertently stifle innovation and efficient risk management strategies.

Arguments for Regulatory Relief on Bond Forwards

Insurers advocating for regulatory relief on bond forwards argue that easing restrictions would unlock significant benefits. Greater flexibility in utilizing bond forwards would lead to:

- Improved risk management capabilities through effective hedging strategies: The ability to engage in more sophisticated hedging strategies using bond forwards would significantly reduce exposure to interest rate and credit risks.

- Enhanced investment returns through strategic use of yield curve opportunities: Relaxed regulations would allow insurers to exploit yield curve anomalies and optimize their investment portfolios for improved returns.

- Increased competitiveness with global insurance players: More flexible regulations would level the playing field, enabling Indian insurers to compete effectively with their global counterparts who enjoy greater freedom in utilizing these instruments.

- Stimulation of market liquidity and depth in the Indian bond market: Increased usage of bond forwards by insurers would contribute to a more liquid and efficient Indian bond market.

This investment optimization and risk mitigation would be a significant step towards a more robust and competitive Indian insurance industry.

Concerns and Potential Risks of Deregulation

While the benefits of regulatory relief are compelling, it's crucial to acknowledge the potential risks associated with increased usage of bond forwards. These include:

- Increased exposure to market volatility and potential losses: Relaxed regulations could lead to increased exposure to market risks, potentially resulting in significant losses during periods of market volatility.

- Need for enhanced risk monitoring and reporting frameworks: Increased usage demands robust risk monitoring systems and transparent reporting mechanisms to ensure appropriate oversight.

- Potential for misuse and speculative trading activities: Greater freedom could encourage speculative trading practices, potentially destabilizing the market.

- Concerns regarding systemic risk and contagion effects: Uncontrolled usage could potentially lead to systemic risk and contagion effects within the financial system.

The Need for a Balanced Approach

Addressing these concerns requires a balanced approach that combines regulatory relaxation with robust oversight. This necessitates:

- Development of clearer guidelines and improved transparency: The IRDAI should develop clear, comprehensive guidelines that provide greater clarity on permissible strategies and risk management practices.

- Implementation of stricter risk management frameworks and stress testing: Insurers should implement robust risk management frameworks, including regular stress testing to assess their vulnerability to market shocks.

- Strengthened supervision and monitoring by the IRDAI: The IRDAI needs to enhance its supervisory capabilities to monitor compliance with regulations and identify potential risks proactively.

- Enhanced training and capacity building for insurance professionals: Investing in training and development programs for insurance professionals is crucial to ensure they have the necessary skills and expertise to manage the risks associated with bond forwards effectively.

This prudential regulation and risk-based supervision will ensure the sustainable growth of the sector.

Conclusion

The debate surrounding Indian Insurers Bond Forwards Regulatory Relief underscores the crucial need to balance fostering innovation with mitigating risks. While increased flexibility in using bond forwards offers significant potential for improving risk management and investment returns, it's imperative to address potential downsides proactively. A balanced approach incorporating clearer guidelines, enhanced oversight, and robust risk management frameworks is crucial for ensuring the sustainable growth of the Indian insurance sector. The optimal regulatory framework must promote innovation while safeguarding policyholder interests. We urge stakeholders to actively participate in shaping a regulatory environment that supports the responsible and efficient use of bond forwards by Indian insurers, ultimately strengthening the sector's competitiveness and resilience.

Featured Posts

-

White Houses Last Minute Surgeon General Nomination A Maha Influencer Takes The Spotlight

May 10, 2025

White Houses Last Minute Surgeon General Nomination A Maha Influencer Takes The Spotlight

May 10, 2025 -

High Potential Still A Psych Spiritual Success Story After 11 Years

May 10, 2025

High Potential Still A Psych Spiritual Success Story After 11 Years

May 10, 2025 -

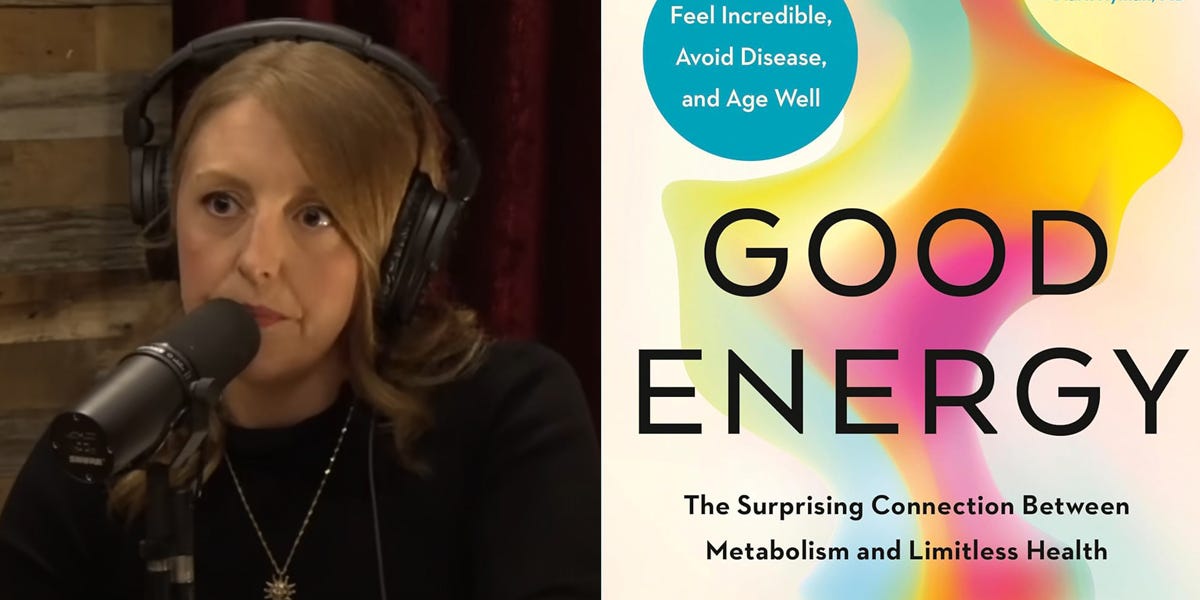

Madhyamik Pariksha 2025 Result Check Merit List Online

May 10, 2025

Madhyamik Pariksha 2025 Result Check Merit List Online

May 10, 2025 -

Brian Brobbey Physical Prowess Poses Europa League Threat

May 10, 2025

Brian Brobbey Physical Prowess Poses Europa League Threat

May 10, 2025 -

West Bengal Board Madhyamik Exam 2025 Merit List Announcement

May 10, 2025

West Bengal Board Madhyamik Exam 2025 Merit List Announcement

May 10, 2025

Latest Posts

-

Edmontons Unlimited Future A Bold New Strategy For Tech And Innovation

May 10, 2025

Edmontons Unlimited Future A Bold New Strategy For Tech And Innovation

May 10, 2025 -

Scaling Tech And Innovation In Edmonton The Unlimited Potential

May 10, 2025

Scaling Tech And Innovation In Edmonton The Unlimited Potential

May 10, 2025 -

Edmonton Unlimited Fueling Tech Growth And Global Impact

May 10, 2025

Edmonton Unlimited Fueling Tech Growth And Global Impact

May 10, 2025 -

New Strategy Positions Edmonton As A Global Tech Innovation Hub

May 10, 2025

New Strategy Positions Edmonton As A Global Tech Innovation Hub

May 10, 2025 -

Edmontons Tech Sector Unlimited Growth With A New Innovation Strategy

May 10, 2025

Edmontons Tech Sector Unlimited Growth With A New Innovation Strategy

May 10, 2025