Indian Stock Market Update: Sensex, Nifty Today's Performance & Key Trends

Table of Contents

Sensex and Nifty Today's Performance

(Note: The following data is hypothetical for illustrative purposes. Replace with actual data for the day of publication.)

Today, the Indian stock market displayed a mixed performance. The Sensex opened at 65,000, reaching a high of 65,300 and a low of 64,700 before closing at 65,100. This represents a 0.15% increase compared to yesterday's closing. Similarly, the Nifty opened at 19,300, reaching an intraday high of 19,400 and a low of 19,250, finally closing at 19,350, a 0.2% gain.

- Opening Price and Time: Sensex: 65,000 (9:15 AM IST); Nifty: 19,300 (9:15 AM IST)

- Closing Price and Time: Sensex: 65,100 (3:30 PM IST); Nifty: 19,350 (3:30 PM IST)

- Day's High and Low: Sensex: High 65,300, Low 64,700; Nifty: High 19,400, Low 19,250

- Percentage Change from Previous Close: Sensex: +0.15%; Nifty: +0.2%

- Trading Volume: High trading volume observed across both indices, suggesting increased investor activity.

Overall market sentiment appears cautiously optimistic, leaning towards bullish, driven by positive global cues and sectoral performance in specific areas. However, some concerns remain due to lingering geopolitical uncertainty. This positive movement can be partly attributed to the recent positive RBI monetary policy announcement which boosted investor confidence.

Key Sectors Driving Market Movement

Sectoral performance played a significant role in shaping today's market movement. A divergence in performance across sectors indicates a mixed bag of opportunities and challenges.

-

Top 3 Performing Sectors:

- IT (+2%): Strong Q3 earnings reports and positive global tech outlook fueled gains in the IT sector.

- Financials (+1.5%): Increased lending activity and positive credit growth contributed to the sector's rise.

- FMCG (+1%): Steady consumer demand and increased disposable income supported this sector's performance.

-

Top 3 Underperforming Sectors:

- Energy (-0.5%): Concerns about fluctuating global oil prices led to a slight dip in this sector.

- Metals (-0.75%): Weakening global demand for steel and other metals impacted performance.

- Real Estate (-1%): Concerns about rising interest rates and tighter credit conditions weighed on this sector.

This sectoral performance highlights the importance of understanding the individual dynamics within the Indian Stock Market. Analyzing market breadth, through the performance of different sectors and index weights, gives a comprehensive view of the overall market health.

Impact of Global Market Trends

Global market trends significantly influenced the Indian stock market today. Positive cues from overseas markets, and particularly developments in the US, had a ripple effect on investor sentiment.

-

Specific Global Events Impacting Indian Markets: The relatively stable performance of US indices and positive sentiment following the latest US Federal Reserve announcements provided a boost to investor confidence.

-

Explanation of the Causal Relationship: Positive global sentiment often leads to increased Foreign Institutional Investment (FII) flows into the Indian stock market, pushing up prices.

-

Examples of Specific Stocks Affected: IT stocks, heavily reliant on global demand, showed a strong positive correlation with the upward movement of US tech giants.

The global economic outlook, including the performance of global indices and FII activity, continues to be a major driver for the Indian Stock Market.

Technical Analysis & Future Outlook

A brief technical analysis suggests a positive short-term outlook for both Sensex and Nifty.

-

Key Technical Indicators: The Relative Strength Index (RSI) suggests the market is not overbought, indicating potential for further upside.

-

Short-term and Mid-term Outlook: The current trend indicates a bullish short-term outlook, with potential for further gains in the coming days. The mid-term outlook remains positive, contingent on sustained positive global cues and continued domestic economic growth.

-

Potential Support and Resistance Levels: The 64,500 level could serve as crucial support for the Sensex, while the 19,200 level acts as support for the Nifty. Resistance levels are observed around 65,500 for the Sensex and 19,450 for the Nifty.

Conclusion

Today's Indian Stock Market witnessed a mixed performance, with the Sensex and Nifty closing slightly higher, driven by positive sectoral performance in IT and Financials, alongside supportive global cues. However, some sectors underperformed due to specific industry headwinds and global uncertainties. Understanding the interplay between global indices, FII activity, and domestic economic factors is crucial for informed investing in the Indian Stock Market. Monitoring key technical indicators and remaining aware of potential support and resistance levels will help investors navigate the market effectively. Stay updated on the latest developments in the Indian Stock Market by checking back regularly for our daily updates on Sensex and Nifty performance and key trends. Learn more about investing in the Indian Stock Market and making informed decisions.

Featured Posts

-

Pam Bondis Plan To Kill American Citizens A Closer Look

May 09, 2025

Pam Bondis Plan To Kill American Citizens A Closer Look

May 09, 2025 -

Ai Generated Poop Podcast Transforming Repetitive Documents Into Engaging Content

May 09, 2025

Ai Generated Poop Podcast Transforming Repetitive Documents Into Engaging Content

May 09, 2025 -

Nyt Strands Saturday Puzzle April 12 Game 405 Answers And Clues

May 09, 2025

Nyt Strands Saturday Puzzle April 12 Game 405 Answers And Clues

May 09, 2025 -

Harry Styles Reacts To A Bad Snl Impression The Full Story

May 09, 2025

Harry Styles Reacts To A Bad Snl Impression The Full Story

May 09, 2025 -

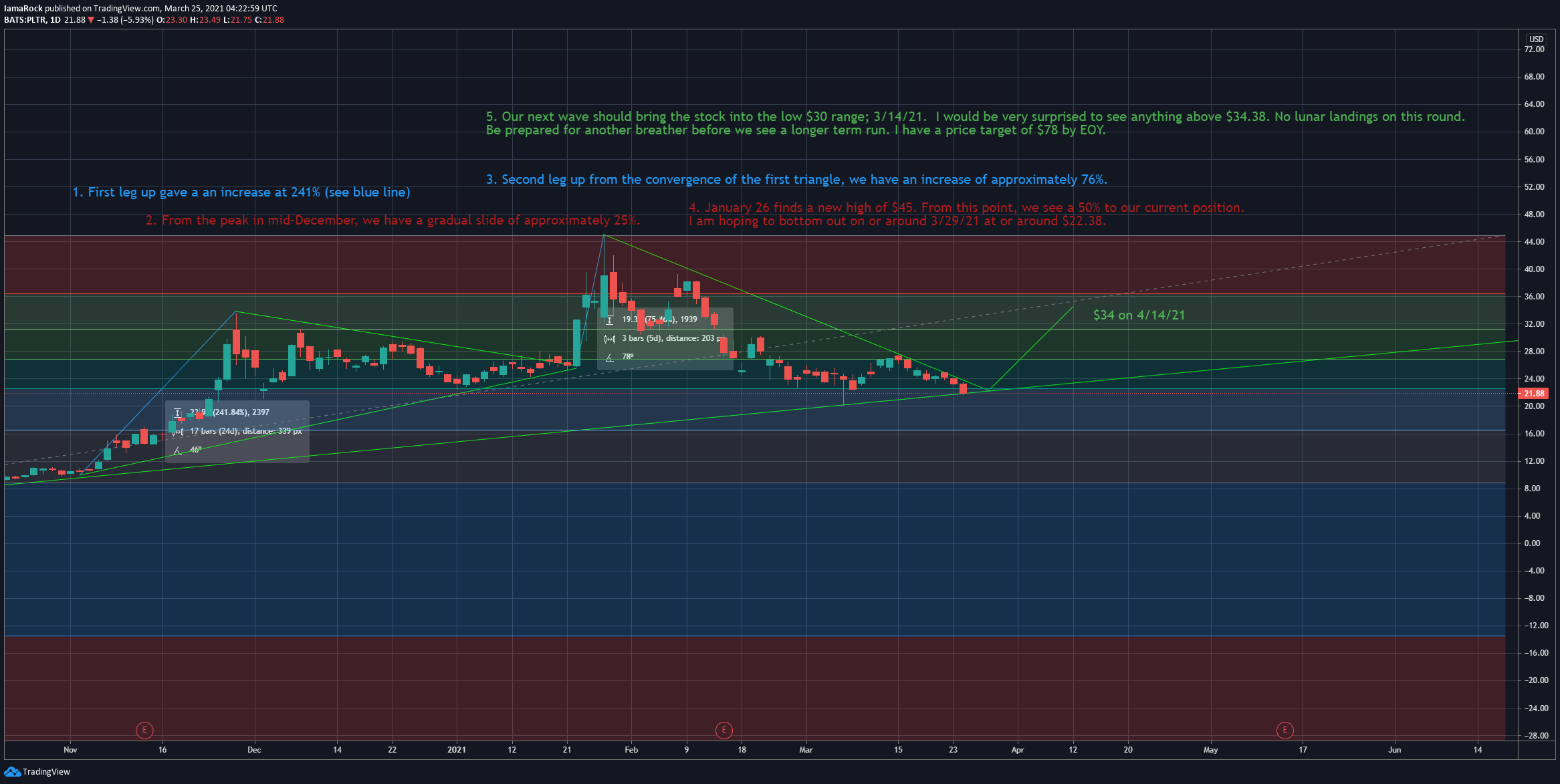

Is Palantir A Buy After Its 30 Drop

May 09, 2025

Is Palantir A Buy After Its 30 Drop

May 09, 2025