Investing In Apple: A $254 Prediction And $200 Buying Opportunity?

Table of Contents

Apple's Strong Financial Performance & Future Growth Potential

Apple's consistent financial success forms the bedrock of the optimistic $254 price target. Understanding this performance is crucial before considering investing in Apple.

Consistent Revenue Growth:

Apple has demonstrated remarkable revenue growth over the past decade. This consistent upward trend isn't just a fleeting phenomenon; it's a testament to the company's robust business model and loyal customer base.

- Fiscal Year 2023: Apple reported record revenue, exceeding analyst expectations across multiple product categories. (Source: Apple's official financial reports – Insert specific figures and links here).

- iPhone Dominance: The iPhone remains a significant revenue driver, maintaining a dominant market share in the premium smartphone segment. (Source: Cite market research data from reputable sources like Gartner or IDC).

- Services Growth: Apple's Services segment, encompassing Apple Music, iCloud, and the App Store, continues to exhibit exceptional growth, demonstrating a recurring revenue stream less susceptible to market fluctuations. (Source: Cite relevant financial reports and data).

- Wearables, Home, and Accessories: This segment consistently shows strong growth, driven by the popularity of the Apple Watch and AirPods. (Source: Cite relevant financial reports and data).

Innovation and New Product Launches:

Apple's commitment to innovation is a key driver of future growth. The company's consistent introduction of groundbreaking products and services ensures its continued relevance in a rapidly evolving technological landscape.

- Vision Pro Headset: The launch of the Apple Vision Pro marks a significant foray into the burgeoning augmented and virtual reality (AR/VR) market, promising a new revenue stream and market expansion.

- AI Integration: Apple is aggressively integrating artificial intelligence (AI) across its product ecosystem, enhancing user experience and creating new opportunities for growth.

- Automotive Ambitions: Rumors and reports suggest Apple is developing its own autonomous vehicle, which, if successful, could represent a game-changing addition to its portfolio.

- Continued Software and Services Updates: Regular updates to iOS, macOS, and other operating systems keep Apple devices current and attractive, fostering customer loyalty.

Analyzing the $254 Prediction & $200 Buying Opportunity

The $254 price target isn't arbitrary; it's based on a confluence of factors suggesting significant future growth for Apple. However, it's essential to weigh the potential rewards against the inherent risks.

Factors Contributing to the Price Target:

Analysts cite several factors justifying the ambitious $254 price target:

- Robust Services Revenue Growth: The continued expansion of Apple's services business provides a strong, recurring revenue stream, less sensitive to economic downturns than hardware sales.

- International Market Expansion: Further penetration into emerging markets presents significant growth opportunities.

- Customer Loyalty: Apple enjoys high customer loyalty, ensuring repeat purchases and a strong installed base.

- Successful New Product Launches: The success of new products like the Vision Pro could significantly boost revenue and drive stock price appreciation.

Assessing the Risk of Investing at $200:

While the potential upside is substantial, investing in Apple at any price carries inherent risks:

- Macroeconomic Factors: Inflation, recessionary pressures, and geopolitical instability could negatively impact consumer spending and Apple's stock performance.

- Competition: Intense competition in the smartphone, wearable, and other technology markets could affect Apple's market share and profitability.

- Disruptive Technologies: The emergence of disruptive technologies could challenge Apple's dominance in certain markets.

- Supply Chain Issues: Global supply chain disruptions could impact production and sales.

Diversification and Portfolio Management Strategies for Apple Investments

Investing in Apple, even with its strong fundamentals, should be part of a well-diversified investment strategy.

Determining Your Risk Tolerance:

Before investing in Apple or any stock, understand your personal risk tolerance.

- Long-Term vs. Short-Term Investments: Are you investing for long-term growth or short-term gains? This dictates your risk tolerance.

- Investment Goals: What are your financial goals? Are you saving for retirement, a down payment, or other objectives?

Dollar-Cost Averaging and Other Strategies:

Mitigating risk involves employing smart investment strategies:

- Dollar-Cost Averaging (DCA): Investing a fixed amount at regular intervals, regardless of price fluctuations, reduces the impact of market volatility.

- Stop-Loss Orders: Setting a stop-loss order protects your investment by automatically selling your shares if the price falls below a predetermined level.

- Consult a Financial Advisor: Seeking professional advice from a qualified financial advisor is crucial, especially for significant investments.

Conclusion

Investing in Apple presents a compelling opportunity, fueled by its strong financial performance, innovation, and ambitious future plans. The $254 price target is ambitious but supported by analysts' projections of continued growth. However, a $200 entry point still carries risk. Macroeconomic factors, competition, and disruptive technologies pose potential downsides.

Ready to explore the potential of investing in Apple? Conduct thorough due diligence, understand your risk tolerance, and consider consulting a financial advisor before making any investment decisions. Remember to diversify your portfolio to mitigate risk and to carefully research Apple's financial performance and future prospects using credible financial news sources. Don't treat this article as financial advice – it's for informational purposes only.

Featured Posts

-

Water Safety Focus Worlds Largest Rubber Duck Visits Myrtle Beach

May 25, 2025

Water Safety Focus Worlds Largest Rubber Duck Visits Myrtle Beach

May 25, 2025 -

Navigating Us Tariff Challenges Strengthening Canada Mexico Trade

May 25, 2025

Navigating Us Tariff Challenges Strengthening Canada Mexico Trade

May 25, 2025 -

Corporate Espionage Office365 Data Breach Nets Millions For Hacker

May 25, 2025

Corporate Espionage Office365 Data Breach Nets Millions For Hacker

May 25, 2025 -

Escape To The Country Top Locations For A Tranquil Lifestyle

May 25, 2025

Escape To The Country Top Locations For A Tranquil Lifestyle

May 25, 2025 -

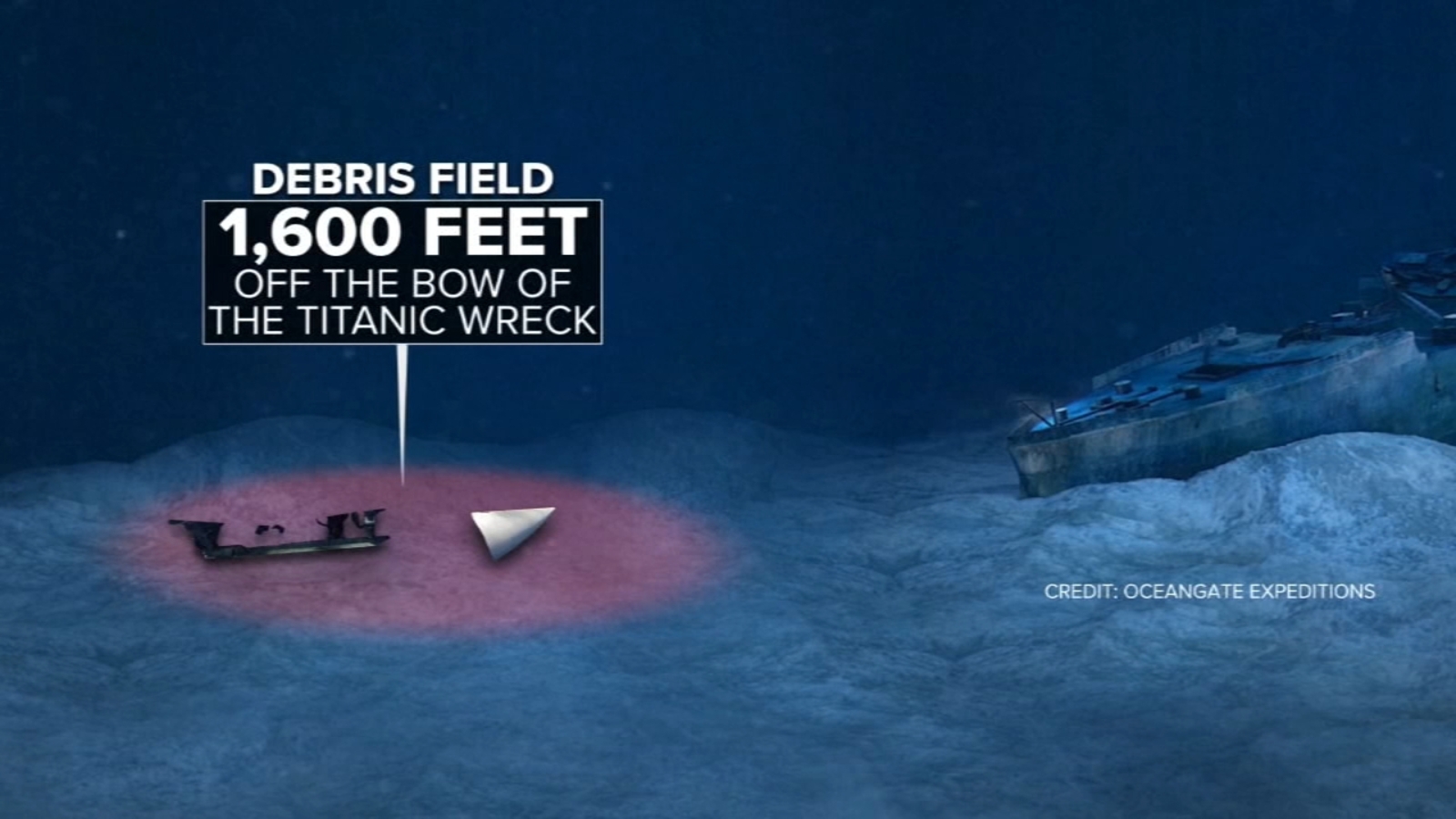

New Footage The Distinctive Sound Of The Titan Subs Implosion

May 25, 2025

New Footage The Distinctive Sound Of The Titan Subs Implosion

May 25, 2025