Investing In Apple (AAPL): Identifying Key Support And Resistance Levels

Table of Contents

Understanding Support and Resistance Levels in AAPL Stock

Understanding support and resistance is fundamental to successful AAPL stock trading. These levels act as price magnets, influencing the direction of the Apple stock price.

What are Support Levels?

Support levels represent price points where buying pressure is strong enough to prevent a further decline in the AAPL stock price. They act as a floor, often causing a price bounce. Historically, Apple has shown strong support at various levels, acting as reliable buying opportunities for savvy investors. For example, the $130-$140 range has previously acted as significant support.

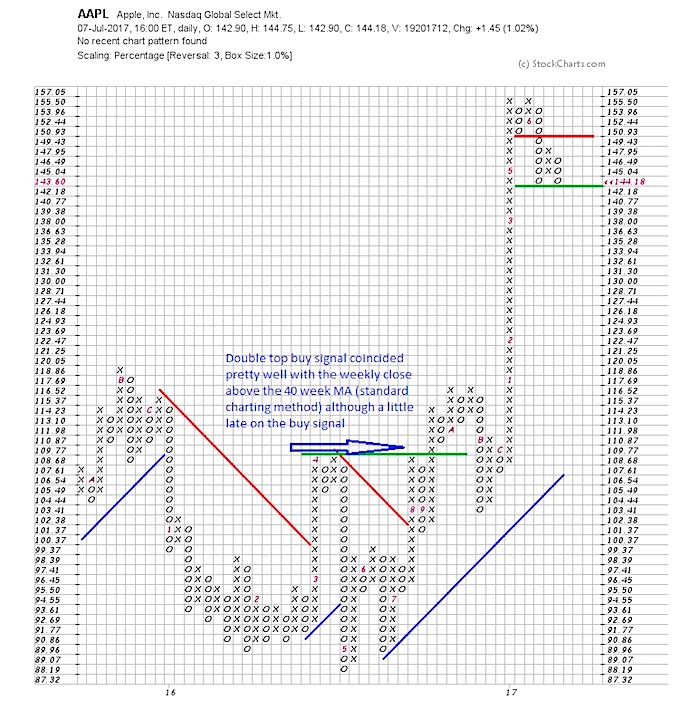

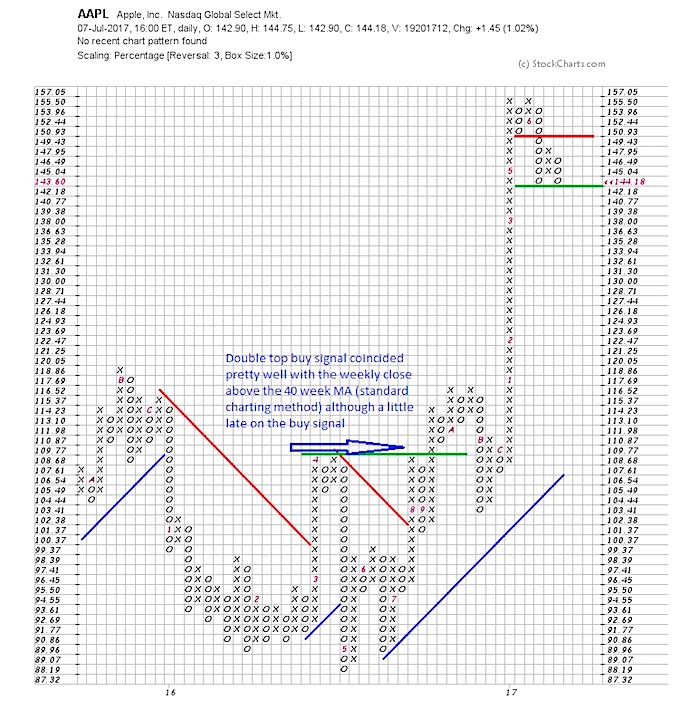

- Identify visually on charts: Look for areas where the price has bounced off multiple times.

- Confirm with volume analysis: Higher volume during support bounces confirms its strength.

- Consider psychological support levels: Round numbers ($150, $100) often act as significant psychological support levels for AAPL.

- Technical indicators: Moving averages (like the 50-day and 200-day MA) and Fibonacci retracements can help pinpoint potential support zones.

What are Resistance Levels?

Resistance levels are price points where selling pressure is strong enough to prevent a further price increase in AAPL. They act as a ceiling, often leading to price reversals or consolidations. Past resistance levels for AAPL can offer clues about future price movements. For instance, the $180-$190 range has acted as a significant resistance level in the past.

- Identify visually on charts: Look for areas where the price has repeatedly failed to break through.

- Confirm with volume analysis: High volume during failed attempts to break through resistance confirms its strength.

- Consider psychological resistance levels: Round numbers ($150, $200) often act as significant psychological resistance for AAPL.

- Technical indicators: Moving averages and Fibonacci retracements can also assist in identifying resistance zones.

Identifying Key Support and Resistance Levels for AAPL:

Pinpointing accurate support and resistance for AAPL requires a multi-faceted approach.

- Use multiple timeframes: Analyze daily, weekly, and monthly charts to identify both short-term and long-term support and resistance.

- Analyze trading volume: High volume confirms the significance of support and resistance levels.

- Consider market sentiment: News events, analyst ratings, and overall market trends can impact support and resistance levels.

- Charting Techniques: Employ candlestick charts to easily identify price patterns and reversals, or utilize line charts for a simpler representation of price movements.

Factors Influencing AAPL Support and Resistance Levels

Numerous factors influence the dynamics of AAPL's support and resistance levels. Understanding these factors is crucial for accurate prediction and strategic trading.

Company Fundamentals:

Apple's financial health significantly impacts its stock price.

- Earnings surprises: Positive or negative surprises can dramatically shift support and resistance.

- New product announcements: Successful product launches often boost the stock price, potentially creating new resistance levels.

- Economic forecasts: Predictions of slowing economic growth can negatively impact AAPL stock, potentially lowering support levels.

- Analyst ratings: Positive analyst ratings can increase investor confidence, potentially pushing the stock price towards resistance levels.

Market Sentiment and External Factors:

Broader market trends heavily influence AAPL's performance.

- Overall market volatility: Periods of high market volatility can significantly affect AAPL's support and resistance levels.

- Interest rate changes: Interest rate hikes generally negatively impact growth stocks like AAPL.

- Global economic events: Geopolitical events and global economic uncertainty can cause significant fluctuations in the AAPL stock price.

Strategies for Trading AAPL Based on Support and Resistance

Understanding support and resistance levels allows for strategic trading decisions.

Buying near Support Levels:

Buying near strong support offers a potentially favorable risk/reward ratio.

- Potential for price rebound: Support levels often mark buying opportunities, leading to price rebounds.

- Risk of further price decline: There's always a risk that the price may continue to fall below the support level.

- Importance of stop-loss orders: Always use stop-loss orders to limit potential losses.

Selling near Resistance Levels:

Selling near strong resistance can help secure profits and limit potential losses.

- Potential for price reversal: Resistance levels frequently cause price reversals or consolidations.

- Risk of missing further upside: There’s a risk the price may break through resistance and continue rising.

- Trailing stop-loss orders: Trailing stop-loss orders help to lock in profits while minimizing risk.

Conclusion

Mastering the art of investing in Apple (AAPL) involves a deep understanding of support and resistance levels. Identifying these key levels requires a comprehensive analysis of company fundamentals, market sentiment, and technical indicators. By employing the strategies discussed – analyzing charts, considering volume, and understanding market forces – you can enhance your AAPL trading decisions. Remember to always use risk management techniques such as stop-loss and trailing stop-loss orders. Start analyzing AAPL stock today, using the knowledge gained here to make informed investment choices. Further your education by exploring resources on technical analysis and charting techniques to become a more successful AAPL investor. Master the art of Investing in Apple (AAPL) by identifying key support and resistance levels.

Featured Posts

-

Auto Legendas F1 Es Motorral Szerelt Porsche Koezuti Verzioja

May 25, 2025

Auto Legendas F1 Es Motorral Szerelt Porsche Koezuti Verzioja

May 25, 2025 -

Naomi Kempbell 55 Foto S Yubileynoy Vecherinki

May 25, 2025

Naomi Kempbell 55 Foto S Yubileynoy Vecherinki

May 25, 2025 -

How To Interpret The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

How To Interpret The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Mia Farrow On Trump Deportation Of Venezuelan Gang Members Demands Accountability

May 25, 2025

Mia Farrow On Trump Deportation Of Venezuelan Gang Members Demands Accountability

May 25, 2025 -

Under 1m Country Homes Buyer Success Stories

May 25, 2025

Under 1m Country Homes Buyer Success Stories

May 25, 2025