Investing In Quantum Computing: Is D-Wave (QBTS) The Right Choice?

Table of Contents

Understanding D-Wave Systems (QBTS) and its Technology

D-Wave Systems, trading under the ticker symbol QBTS, is a Canadian company pioneering a unique approach to quantum computing: quantum annealing. Unlike gate-based quantum computers pursued by competitors like IBM and Google, which manipulate qubits to perform computations sequentially, D-Wave's technology focuses on finding the lowest energy state of a system to solve optimization problems.

Advantages: D-Wave excels in tackling complex optimization problems across various sectors. Its systems find applications in logistics, finance, materials science, and artificial intelligence, where finding optimal solutions is crucial. The company boasts several successful partnerships and collaborations, further solidifying its position in the market. Recent technological advancements, including increased qubit counts and improved performance, demonstrate ongoing progress.

Disadvantages: D-Wave's quantum annealing approach has limitations compared to the more versatile gate-based quantum computers. While effective for specific problem types, it doesn't offer the same broad computational capabilities. Furthermore, the current technological maturity of quantum annealing is still relatively early in comparison to other approaches.

- Type of quantum computing: Quantum annealing

- Target market: Optimization problems in logistics, finance, materials science, AI

- Key partnerships and collaborations: (Insert specific examples here – research D-Wave's partnerships)

- Recent technological advancements and milestones: (Insert specific examples here – research D-Wave's recent progress)

Analyzing D-Wave's (QBTS) Financial Performance and Investment Potential

Assessing D-Wave's investment potential requires a thorough examination of its financial health and stock performance. Analyzing revenue, profitability, and growth trajectory is vital. While D-Wave is currently not profitable, its revenue growth and expansion into new markets offer insights into its future potential.

Examining the QBTS stock performance – historical trends, volatility, and market capitalization – helps gauge investor sentiment and risk assessment. Comparing its valuation to other players in the quantum computing sector provides a benchmark for understanding its relative position and potential for growth.

- Stock ticker symbol: QBTS (listed on [Exchange Name])

- Key financial ratios: (Include data on P/E ratio, revenue growth, etc., if available. Cite sources)

- Investor sentiment and analyst ratings: (Summarize analyst opinions and investor sentiment. Cite sources)

- Potential risks and rewards of investing in QBTS: (Discuss risks associated with early-stage technology and potential high returns)

Comparing D-Wave (QBTS) to Competitors in the Quantum Computing Market

The quantum computing landscape is highly competitive. Major players include IBM, Google, IonQ, Rigetti, and others, each pursuing different approaches. IBM and Google focus heavily on gate-based quantum computing, offering a more general-purpose approach than D-Wave's annealing method. IonQ and Rigetti also operate in the gate-based quantum computing space.

Comparing D-Wave's strengths and weaknesses against these competitors reveals its competitive advantages and disadvantages. While D-Wave may lag in certain areas, its specialization in quantum annealing provides a unique niche within the market. The overall quantum computing market shows significant future growth potential, but the allocation of that growth among different technologies remains uncertain.

- List of key competitors and their technologies: (List key competitors and their specific quantum computing technologies)

- Comparison table highlighting key differences: (Create a table comparing D-Wave with competitors, covering technology, market focus, financial performance, and other relevant aspects)

- Analysis of market share and future growth projections for quantum computing: (Include market research data and projections for the overall quantum computing market. Cite sources)

Assessing the Risks and Rewards of Investing in Quantum Computing through D-Wave (QBTS)

Investing in quantum computing, particularly in a company like D-Wave, involves inherent risks. Technological hurdles, intense competition, and the relatively nascent stage of the technology all contribute to uncertainty. Market risks include the rate of market adoption and potential regulatory changes. Financial risks stem from the company's current financial situation and the challenges of achieving sustained profitability.

However, the potential rewards are significant. If D-Wave's technology gains widespread adoption and the company achieves commercial success, the returns on investment could be substantial. The long-term growth potential of quantum computing is undeniable, with far-reaching implications across various industries.

- Technological risks: (List specific technological risks, such as competition from gate-based systems, challenges in scaling up qubit counts, etc.)

- Market risks: (List potential market risks, such as slow adoption rate, regulatory obstacles, etc.)

- Financial risks: (List potential financial risks, such as profitability challenges, cash flow issues, etc.)

- Potential for high returns: (Highlight the potential for significant returns if the technology and company are successful)

Conclusion: Is D-Wave (QBTS) the Right Quantum Computing Investment for You?

D-Wave (QBTS) occupies a unique position in the burgeoning quantum computing market. Its specialization in quantum annealing offers advantages for specific applications, but faces competition from more versatile gate-based approaches. While its financial performance shows potential for growth, it's crucial to acknowledge the inherent risks associated with investing in early-stage technology.

Ultimately, whether D-Wave is the right quantum computing investment for you depends on your risk tolerance, investment horizon, and understanding of the technology and market landscape. This analysis offers insights, but it is not financial advice. Before making any investment decisions related to quantum computing and D-Wave (QBTS), conduct thorough due diligence and consider consulting with a qualified financial advisor. Remember to research and understand the inherent risks before investing in any quantum computing stocks. Learn more about responsible investing in quantum technologies through [link to relevant resources].

Featured Posts

-

Tory Councillors Wife Loses Appeal After Migrant Rant

May 21, 2025

Tory Councillors Wife Loses Appeal After Migrant Rant

May 21, 2025 -

Gumballs World A Peek At The Upcoming Weirdness

May 21, 2025

Gumballs World A Peek At The Upcoming Weirdness

May 21, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Mia Moysiki Bradia

May 21, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Mia Moysiki Bradia

May 21, 2025 -

Vybz Kartels Exclusive Interview Life In Prison And Beyond

May 21, 2025

Vybz Kartels Exclusive Interview Life In Prison And Beyond

May 21, 2025 -

Bps Ceo Pay 31 Fall Sparks Discussion

May 21, 2025

Bps Ceo Pay 31 Fall Sparks Discussion

May 21, 2025

Latest Posts

-

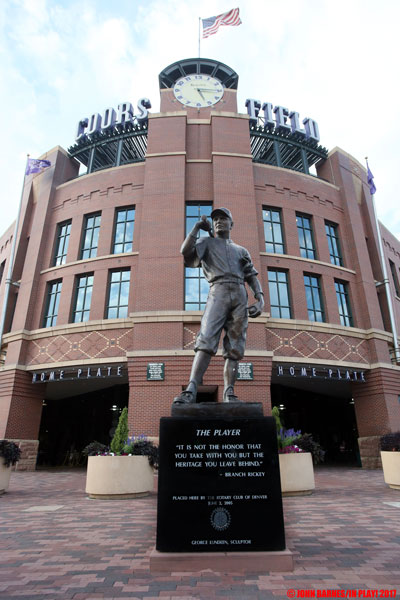

Tigers 8 Rockies 6 A Closer Look At The Upset

May 22, 2025

Tigers 8 Rockies 6 A Closer Look At The Upset

May 22, 2025 -

Rockies Vs Tigers An 8 6 Surprise

May 22, 2025

Rockies Vs Tigers An 8 6 Surprise

May 22, 2025 -

Unexpected Victory Tigers Triumph Over Rockies 8 6

May 22, 2025

Unexpected Victory Tigers Triumph Over Rockies 8 6

May 22, 2025 -

United Kingdom Tory Wifes Imprisonment Stands Following Migrant Incident

May 22, 2025

United Kingdom Tory Wifes Imprisonment Stands Following Migrant Incident

May 22, 2025 -

Former Tory Councillors Wife Fights Racial Hatred Conviction

May 22, 2025

Former Tory Councillors Wife Fights Racial Hatred Conviction

May 22, 2025