Investing In Uber Technologies (UBER): A Detailed Look

Table of Contents

Understanding Uber's Business Model and Revenue Streams

Uber's success hinges on its multifaceted business model, generating revenue from various interconnected services. Let's examine each segment in detail:

Ride-Sharing Services

Uber's core business, ride-sharing, remains a significant revenue driver. Its global reach and extensive network of drivers provide unparalleled convenience for users. However, profitability in this sector is influenced by several factors:

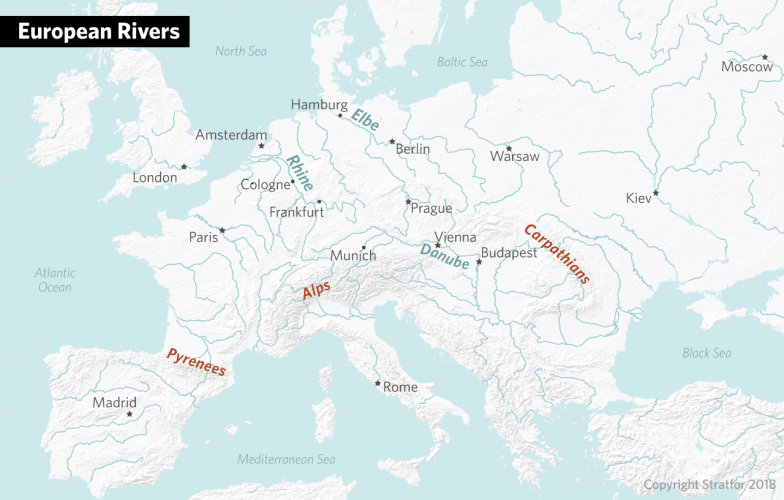

- Revenue breakdown by region: Uber's revenue is geographically diverse, with varying contributions from North America, Europe, and Asia. Understanding regional performance is crucial for assessing overall financial health.

- Competition from Lyft and other ride-sharing apps: Intense competition from Lyft and other ride-hailing services necessitates continuous innovation and strategic pricing to maintain market share. The ride-sharing investment landscape is highly competitive.

- Impact of autonomous vehicle development: Uber's investment in autonomous vehicle technology presents a long-term opportunity to reduce operational costs and improve efficiency, though the timeline for widespread adoption remains uncertain.

Uber Eats and Food Delivery

Uber Eats has rapidly emerged as a major player in the competitive online food delivery market. Its integration with Uber's existing platform provides a significant advantage:

- Market share comparisons: Uber Eats competes directly with giants like DoorDash and Grubhub, necessitating a close examination of market share trends and competitive dynamics.

- Expansion into new markets: Continued geographic expansion into underserved areas offers significant growth potential for Uber Eats. International expansion is key to future growth prospects for this segment.

- Profitability of the food delivery segment: The food delivery sector is known for its thin margins. Analyzing Uber Eats' profitability and its ability to navigate these challenges is essential.

- Technological advancements in delivery optimization: Investments in AI-powered route optimization and delivery technology are crucial for improving efficiency and profitability in this highly competitive segment.

Freight and Logistics

Uber Freight represents a significant expansion into the broader logistics industry, leveraging technology to connect shippers with carriers:

- Market size and opportunity: The freight logistics market is vast, presenting considerable growth potential for Uber Freight.

- Competitive advantages: Uber's existing technology infrastructure and driver network could provide a competitive edge in this sector.

- Technological innovations in freight logistics: Uber's investment in logistics technology, such as route optimization and real-time tracking, can significantly improve efficiency and service quality.

- Profitability and scaling challenges: Achieving profitability and scaling operations in the highly competitive freight industry presents unique challenges.

Analyzing Uber's Financial Performance and Future Growth Prospects

Understanding Uber's financial health and future growth prospects is vital for any potential investor.

Financial Statements Review

Analyzing Uber's financial statements provides crucial insights into its operational performance:

- Revenue growth year-over-year: Consistent revenue growth indicates strong market demand and effective business strategies.

- Profitability margins: Examining profit margins across different segments helps gauge the efficiency and profitability of Uber's operations.

- Debt-to-equity ratio: Assessing Uber's leverage reveals its financial risk profile and its ability to manage debt.

- Free cash flow generation: Strong free cash flow is essential for reinvestment, debt reduction, and shareholder returns.

Growth Strategies and Opportunities

Uber's future growth hinges on several strategic initiatives:

- International expansion plans: Expanding into new international markets offers significant growth potential.

- Strategic acquisitions: Acquiring complementary businesses can enhance Uber's capabilities and market position.

- Technological investments (e.g., autonomous vehicles): Investing in autonomous vehicle technology could revolutionize its operations and potentially disrupt the transportation sector.

- Partnerships and collaborations: Strategic partnerships can expand Uber's reach and access to new markets and technologies.

Risks and Challenges

Investing in UBER comes with inherent risks:

- Regulatory risks by region: Ride-sharing and food delivery regulations vary significantly across different regions, posing operational and financial challenges.

- Competitive pressures from established players and new entrants: The highly competitive nature of Uber's various market segments presents ongoing challenges.

- Economic sensitivity of the ride-sharing and food delivery markets: Demand for ride-sharing and food delivery services is sensitive to economic downturns.

- Potential for labor disputes: Ongoing labor disputes related to driver classification and compensation can significantly impact Uber's operational costs and reputation.

Evaluating Uber's Competitive Landscape and Market Position

Analyzing Uber's competitive landscape provides a clearer picture of its market position and potential for future success.

Key Competitors

Uber faces fierce competition across all its business segments:

- Lyft: A direct competitor in the ride-sharing market.

- DoorDash, Grubhub: Key players in the online food delivery market.

- Other ride-sharing and food delivery services: Numerous regional and national players further intensify the competitive pressure.

- Players in the freight logistics sector: Established logistics companies pose a significant challenge in the freight segment.

Market Share and Dominance

Uber's market share varies across different regions and business segments:

- Market share data by segment and region: Analyzing market share data reveals Uber's competitive strength and dominance in various geographic markets.

- Competitive advantages (e.g., brand recognition, technological superiority, network effects): Uber's brand recognition, technological investments, and large network effects provide some competitive advantages.

Strategic Partnerships and Acquisitions

Uber's strategic partnerships and acquisitions have significantly impacted its competitive standing:

- Examples of key partnerships: Analyzing successful partnerships reveals their contribution to Uber's growth and market expansion.

- Acquired companies and their contributions: Understanding the impact of acquired companies on Uber's overall business strategy is critical.

- Impact of these strategies on market share and growth: Assessing the overall effect of these strategies on market share and growth helps evaluate the effectiveness of Uber's competitive strategy.

Conclusion

Investing in Uber Technologies (UBER) presents both significant opportunities and substantial risks. While its diversified business model and technological leadership offer growth potential, the competitive landscape, regulatory uncertainties, and inherent volatility of the technology sector demand careful consideration. A thorough analysis of its financial performance, growth strategies, and competitive positioning is crucial before making any investment decisions.

Call to Action: This article provides an overview of Uber Technologies and potential considerations for investing in UBER stock. However, it is crucial to conduct your own thorough due diligence before making any investment decisions. Consult reliable financial news sources, analyze Uber's financial statements, and assess the company's future growth prospects and competitive landscape independently. Remember, this article is not financial advice. Always consult with a qualified financial advisor before making any investment in UBER stock or any other security.

Featured Posts

-

Ufc Vegas 106 Staff Picks Burns Vs Morales Belal Muhammad Predictions And More

May 19, 2025

Ufc Vegas 106 Staff Picks Burns Vs Morales Belal Muhammad Predictions And More

May 19, 2025 -

Union Starts Season With Victory Against Orlando City

May 19, 2025

Union Starts Season With Victory Against Orlando City

May 19, 2025 -

Orlando Bloom Heats Things Up With A Cold Plunge Workout

May 19, 2025

Orlando Bloom Heats Things Up With A Cold Plunge Workout

May 19, 2025 -

Analyzing The Relationship Between Eu Restrictions And European Outflows

May 19, 2025

Analyzing The Relationship Between Eu Restrictions And European Outflows

May 19, 2025 -

Could Driverless Uber Pay Off Investing In Autonomous Vehicle Etfs

May 19, 2025

Could Driverless Uber Pay Off Investing In Autonomous Vehicle Etfs

May 19, 2025

Latest Posts

-

Justice For Stolen Dreams A Restaurant Owners Plea For Accountability

May 19, 2025

Justice For Stolen Dreams A Restaurant Owners Plea For Accountability

May 19, 2025 -

Accountability Sought Restaurant Owners Fight After Business Theft

May 19, 2025

Accountability Sought Restaurant Owners Fight After Business Theft

May 19, 2025 -

Stolen Dreams Holding Perpetrators Accountable In The Restaurant Industry

May 19, 2025

Stolen Dreams Holding Perpetrators Accountable In The Restaurant Industry

May 19, 2025 -

Restaurant Owner Demands Accountability After Dream Business Stolen

May 19, 2025

Restaurant Owner Demands Accountability After Dream Business Stolen

May 19, 2025 -

Who Pays For My Stolen Dreams A Restaurant Owners Demand For Accountability

May 19, 2025

Who Pays For My Stolen Dreams A Restaurant Owners Demand For Accountability

May 19, 2025