Investing In XRP (Ripple) In 2024: A Price Point Analysis

Table of Contents

Current Market Conditions and XRP's Performance

The cryptocurrency market in 2024 presents a complex landscape. Bitcoin's price continues to influence the overall market sentiment, while regulatory scrutiny remains a significant factor. Understanding these broader trends is crucial before analyzing XRP's specific performance. XRP, in recent months, has exhibited [insert recent price data, e.g., volatility, percentage changes, key support/resistance levels]. Its trading volume and market capitalization currently stand at [insert current data], reflecting its position within the broader crypto market.

- Key Price Indicators: Technical analysis reveals key resistance levels around $[price] and support levels around $[price]. These levels are crucial to watch for potential price movements.

- Comparison to Other Major Cryptocurrencies: Compared to Bitcoin and Ethereum, XRP's performance has [insert comparative analysis, e.g., outperformed, underperformed, shown similar trends]. This comparative analysis provides context for XRP's price movements.

- Impact of Regulatory News: Regulatory announcements, both positive and negative, concerning cryptocurrencies directly impact XRP's price. For example, [cite a recent news event and its effect on XRP price].

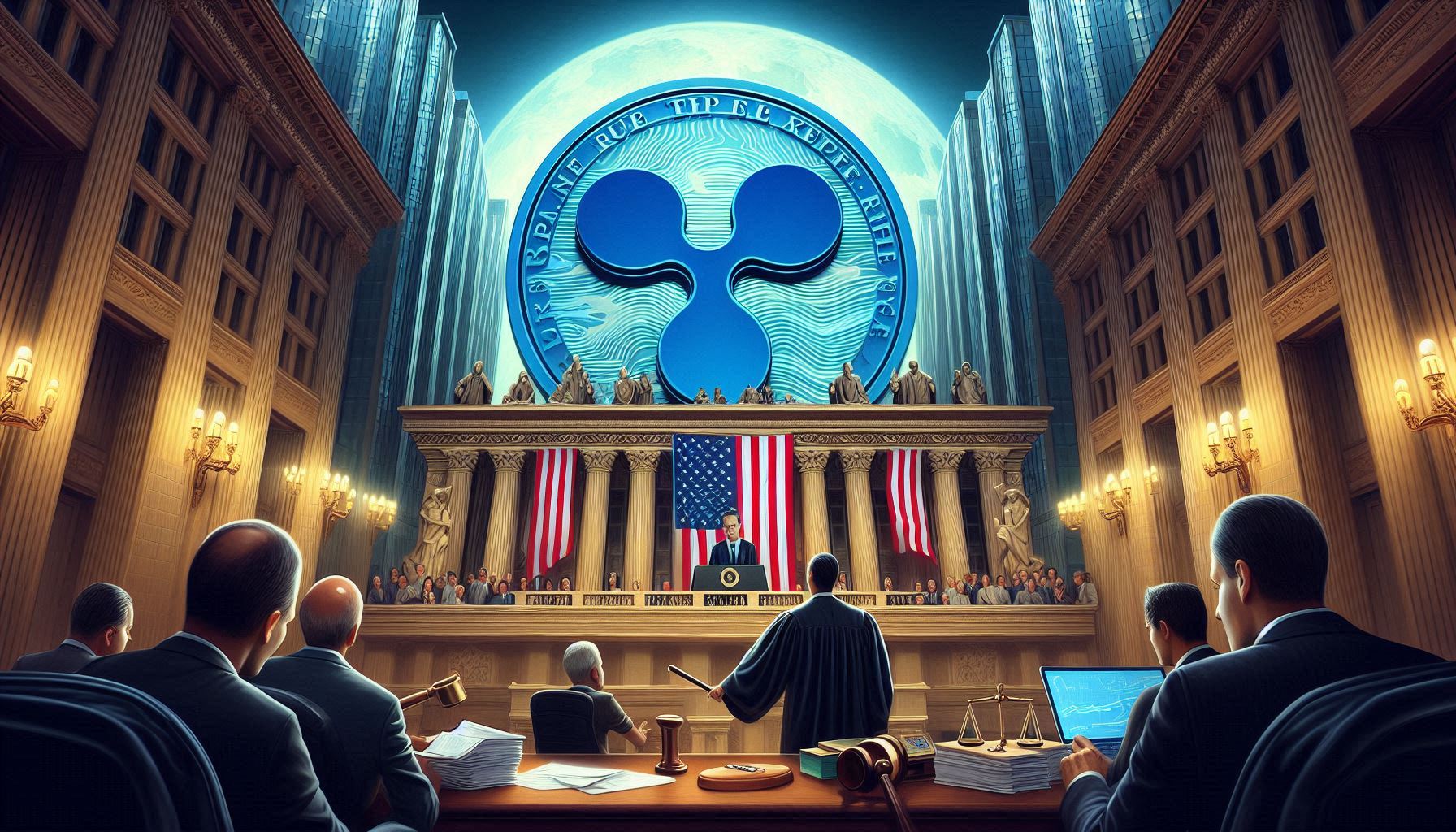

Ripple's Legal Battle and its Impact on XRP Price

The ongoing SEC lawsuit against Ripple Labs is undeniably the most significant factor influencing XRP's price. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The outcome of this lawsuit could drastically alter XRP's future. Various expert opinions range from predictions of significant price drops in a negative outcome to substantial price increases should Ripple prevail.

- Summary of the Legal Arguments: The core argument revolves around whether XRP is a currency or a security. [Briefly summarize the arguments from both sides].

- Potential Scenarios (Positive and Negative): A positive outcome could lead to a surge in XRP's price, driven by increased investor confidence and potential wider adoption. Conversely, an unfavorable ruling might cause a significant price decline and reduced market confidence.

- How the Legal Outcome Could Affect XRP Adoption: A favorable ruling could significantly accelerate XRP's adoption by financial institutions and payment processors, boosting its price. A negative outcome could hinder adoption and suppress price growth.

Technological Advancements and XRP's Future Potential

Despite the legal uncertainty, Ripple continues to invest in technological advancements and forge strategic partnerships. The XRP Ledger, Ripple's blockchain technology, is continually being improved, boasting faster transaction speeds and lower fees compared to some competitors. These improvements, combined with Ripple's efforts to expand its network of financial institutions, are crucial to XRP's long-term potential.

- New Features or Updates to the XRP Ledger: Recent updates include [mention specific updates and their impact].

- Strategic Partnerships and Collaborations: Ripple's collaborations with [mention key partners] broaden XRP's reach and enhance its potential for adoption.

- Potential for Increased Adoption by Financial Institutions: The success of Ripple's On-Demand Liquidity (ODL) product is a testament to the growing interest in XRP among financial institutions for cross-border payments.

Price Prediction Models and Future Price Points

Predicting the future price of any cryptocurrency is inherently speculative. However, analyzing various price prediction models can offer potential scenarios. Technical analysis based on historical price data and trading patterns suggests [mention potential price targets based on technical analysis]. Fundamental analysis, focusing on Ripple's technology, partnerships, and the outcome of the SEC lawsuit, points towards [mention potential price targets based on fundamental analysis].

- Different Price Targets Based on Various Models: Conservative estimates suggest a price range of $[price] – $[price] by the end of 2024. Moderate predictions point towards $[price] – $[price], while optimistic scenarios forecast prices as high as $[price].

- Factors Influencing Price: Adoption rate, overall market sentiment, regulatory developments, and the outcome of the SEC lawsuit are the primary factors influencing XRP's price.

- Risk Assessment of Investing in XRP: Investing in XRP carries significant risk. The ongoing lawsuit, market volatility, and the inherent risks associated with cryptocurrencies should be carefully considered.

Conclusion: Making Informed Decisions on Investing in XRP in 2024

Investing in XRP (Ripple) in 2024 presents both potential rewards and substantial risks. While technological advancements and partnerships point towards a promising future, the SEC lawsuit remains a significant hurdle. Our analysis reveals a range of potential price scenarios, highlighting the need for thorough due diligence. Before investing in XRP, conduct your own research, consider your risk tolerance, and possibly diversify your investment portfolio. Remember, consulting a financial advisor before making any significant investment decisions related to XRP (Ripple) in 2024 is always recommended.

Featured Posts

-

Play Station Beta Program Details And Sign Up Information

May 02, 2025

Play Station Beta Program Details And Sign Up Information

May 02, 2025 -

Waarom Nu Gratis The New York Times Lezen Met Uw Nrc Abonnement

May 02, 2025

Waarom Nu Gratis The New York Times Lezen Met Uw Nrc Abonnement

May 02, 2025 -

This Country A Comprehensive Guide

May 02, 2025

This Country A Comprehensive Guide

May 02, 2025 -

Ripple Vs Sec Xrp Price Analysis And Us Etf Potential

May 02, 2025

Ripple Vs Sec Xrp Price Analysis And Us Etf Potential

May 02, 2025 -

Fortnite Matchmaking Error 1 A Comprehensive Guide

May 02, 2025

Fortnite Matchmaking Error 1 A Comprehensive Guide

May 02, 2025