Investor Concerns About High Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Market Valuations

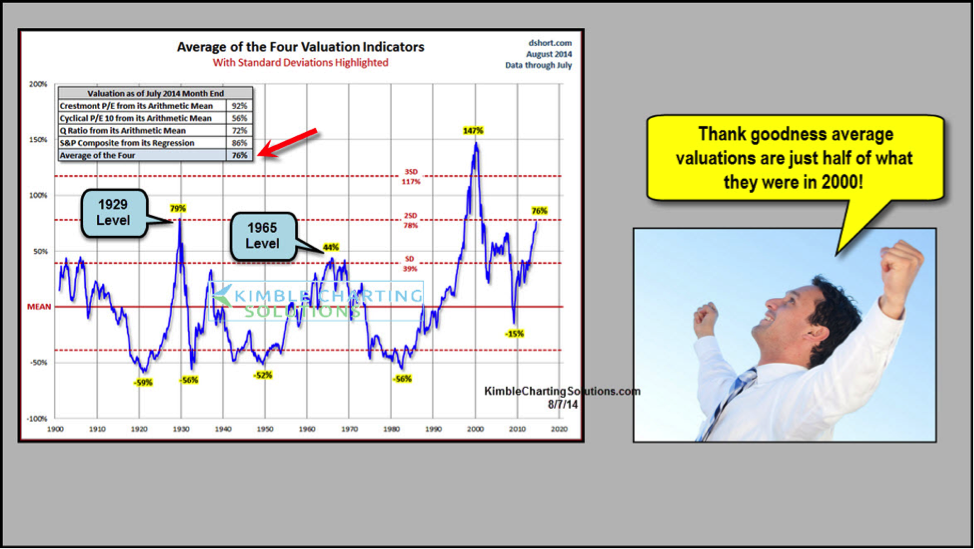

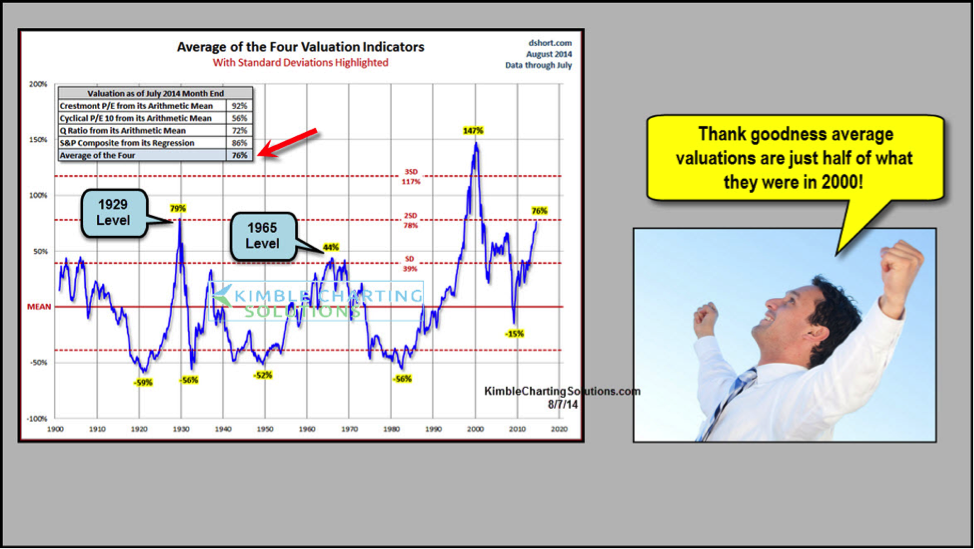

BofA's recent reports have carefully examined current stock market valuations, employing various metrics to determine whether the current levels are justified or indicative of a speculative bubble. Their analysis incorporates key indicators like Price-to-Earnings (P/E) ratios, including the cyclically adjusted price-to-earnings ratio (Shiller PE), to compare current valuations with historical averages.

-

Key findings from BofA's report: BofA acknowledges that valuations are elevated compared to historical norms. However, they also point to factors that may partially justify these higher valuations, such as low interest rates and strong corporate earnings growth in specific sectors.

-

Comparison of current valuations to historical averages: The analysis shows that while certain sectors are indeed overvalued, others remain within reasonable ranges, offering opportunities for discerning investors. The comparison against historical data helps contextualize the current situation, avoiding alarmist conclusions.

-

BofA's methodology for assessing market valuations: Their approach utilizes a multi-faceted analysis, combining quantitative data with qualitative factors like macroeconomic conditions, investor sentiment, and geopolitical risks to present a comprehensive view.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors have played a significant role in driving up stock market valuations. These include:

-

Low interest rates: Historically low interest rates have made borrowing cheaper for companies, fueling investment and increasing corporate profits. This, in turn, supports higher stock prices. This effect is amplified by quantitative easing policies implemented by central banks globally.

-

Quantitative easing (QE): QE programs have injected massive liquidity into financial markets, further supporting asset prices, including stocks. While stimulating economic growth, QE can also inflate asset bubbles if not managed carefully.

-

Strong corporate earnings (in specific sectors): While some sectors show signs of strain, robust earnings in technology, healthcare, and certain consumer goods sectors have propelled overall market valuations.

-

Investor sentiment and speculation: Positive investor sentiment and speculation, driven by factors like technological advancements and the belief in continued economic growth, have contributed significantly to higher valuations. This optimism can lead to inflated asset prices, potentially setting the stage for a correction.

-

Potential Risks: The reliance on low interest rates and QE to sustain growth carries inherent risks. A sudden shift in monetary policy or a weakening economy could trigger a significant market downturn. Overly optimistic investor sentiment can also be a leading indicator of a potential bubble burst.

BofA's Recommendations for Investors

Navigating this environment requires a cautious approach. BofA recommends investors adopt a diversified portfolio and consider employing the following strategies:

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors mitigates risk associated with any single investment underperforming.

-

Defensive investing: Shifting a portion of the portfolio towards less volatile assets, like high-quality bonds, during periods of uncertainty can cushion potential losses.

-

Value stocks: Focusing on undervalued companies with strong fundamentals, rather than chasing high-growth, high-valuation tech stocks, can offer better risk-adjusted returns over the long term. This approach focuses on intrinsic value rather than market speculation.

-

Long-term investment perspective: Maintaining a long-term outlook is crucial. Short-term market fluctuations are inevitable. A well-diversified portfolio, adjusted periodically based on market conditions, is a more effective strategy than attempting to time the market.

Addressing Investor Fears: Potential Market Corrections and Downturns

The possibility of a market correction or even a more significant downturn is a valid concern. BofA acknowledges this risk, although they don't predict an imminent crash.

-

BofA's assessment of market risks: They emphasize that elevated valuations increase the probability of a correction. However, the timing and severity of any potential downturn remain uncertain.

-

Potential scenarios for market corrections: BofA models various scenarios, including gradual corrections and more abrupt downturns, depending on factors like interest rate hikes, inflation, and geopolitical events.

-

Strategies for weathering market downturns: Maintaining a well-diversified portfolio, having a sufficient emergency fund, and avoiding panic selling are crucial strategies for navigating a market downturn. Rebalancing the portfolio as needed and potentially shifting to more defensive strategies can further mitigate losses.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis highlights the complexities of the current market environment. While acknowledging the elevated valuations, they also point to factors that partially justify these levels. Their recommendations emphasize the importance of diversification, risk management, and a long-term investment perspective. Understanding market dynamics and proactively managing investment risk are paramount for navigating the challenges posed by high stock market valuations. Learn more about BofA's analysis of high stock market valuations and their recommendations for investors by visiting [link to BofA's report/website]. Develop a sound investment strategy to manage concerns surrounding high stock market valuations.

Featured Posts

-

Watch All Episodes Of Gypsy Rose Blanchards Life After Lockup

May 06, 2025

Watch All Episodes Of Gypsy Rose Blanchards Life After Lockup

May 06, 2025 -

The Small Town Designer Behind Suki Waterhouses Look

May 06, 2025

The Small Town Designer Behind Suki Waterhouses Look

May 06, 2025 -

Is Kevin Costner Pursuing Demi Moore A Look At The Rumored Relationship

May 06, 2025

Is Kevin Costner Pursuing Demi Moore A Look At The Rumored Relationship

May 06, 2025 -

Mindy Kalings Shows A Deep Dive Into Fascinating Female Characters

May 06, 2025

Mindy Kalings Shows A Deep Dive Into Fascinating Female Characters

May 06, 2025 -

Line Of Duty Season 7 What Martin Compston Revealed

May 06, 2025

Line Of Duty Season 7 What Martin Compston Revealed

May 06, 2025