Investor Concerns About Stock Market Valuations: BofA's Take

Table of Contents

BofA's Key Valuation Concerns

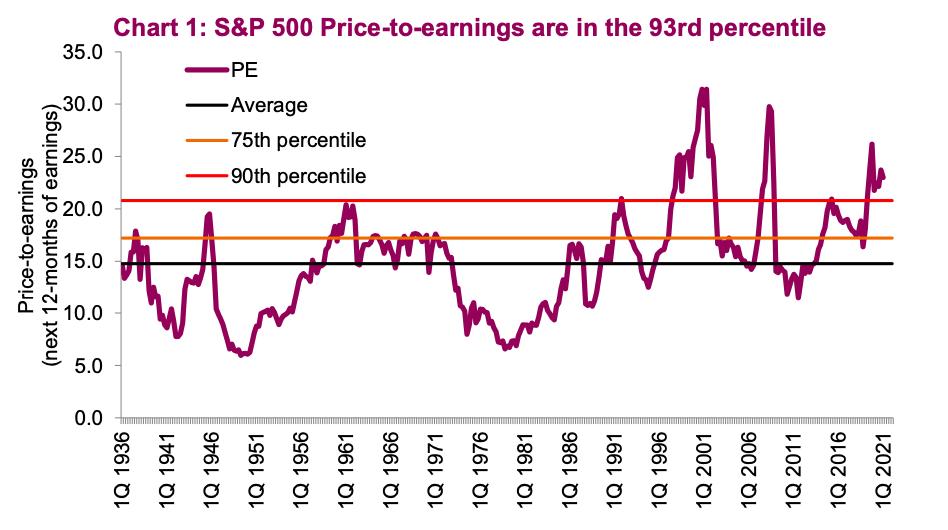

BofA's analysis reveals significant concerns about current stock market valuations. While the bull market has delivered impressive returns, key valuation metrics raise red flags. BofA's experts aren't solely focused on the overall market capitalization; their assessment delves into specific sectors and individual companies, utilizing a range of tools to gauge potential overvaluation. The core of their concern centers around traditional valuation metrics, particularly the price-to-earnings ratio (P/E) and the price-to-sales ratio (P/S).

- Analysis of specific sectors showing high valuations according to BofA: BofA's research highlights several sectors, such as technology and consumer discretionary, showing significantly elevated P/E and P/S ratios compared to historical averages. This suggests that these sectors may be susceptible to a greater correction if market sentiment shifts.

- Comparison of current valuations to historical averages: By comparing current valuation multiples to long-term averages, BofA identifies significant deviations, highlighting potential overvaluation in certain market segments. This historical context is critical in assessing the sustainability of current stock prices.

- Discussion of BofA's methodology for assessing valuation: BofA utilizes a multi-faceted approach to valuation analysis, incorporating discounted cash flow models, comparable company analysis, and macroeconomic forecasts to arrive at a comprehensive assessment of market conditions. Transparency in methodology builds trust and credibility.

- Mention of any specific companies cited as examples of overvaluation: While BofA's reports typically avoid naming specific companies publicly, their sector-specific analyses provide enough information to identify potential candidates for overvaluation based on their valuation metrics and the broader market context.

The equity risk premium, the extra return investors demand for holding stocks instead of risk-free assets, is also a key focus for BofA. A compressed equity risk premium signals potentially higher risk and lower future returns.

Macroeconomic Factors Influencing BofA's View

BofA's valuation assessment isn't conducted in a vacuum. Several significant macroeconomic factors heavily influence their outlook and significantly contribute to their concerns about stock market valuations.

- BofA's outlook for inflation and its impact on stock valuations: Persistent inflation erodes corporate profits and increases the cost of capital, potentially impacting future earnings growth and thus stock prices. BofA's assessment of inflation's trajectory is crucial to their valuation analysis.

- The potential impact of rising interest rates on corporate earnings and stock prices: Higher interest rates increase borrowing costs for companies, reducing profitability and making investments less attractive. This dampens earnings growth and can lead to lower stock prices. BofA's analysis considers the implications of rising interest rate environments.

- BofA's assessment of recession probabilities and their implications for the market: The possibility of an economic recession significantly impacts stock market valuations. BofA's assessment of recession probabilities plays a vital role in informing their overall outlook and recommendations.

- Analysis of how geopolitical events affect investor confidence: Geopolitical instability, such as wars or trade disputes, introduces uncertainty and can trigger risk aversion among investors, impacting stock prices. BofA accounts for these unpredictable events in their market forecasts.

BofA's Recommendations for Investors

Given their concerns about stock market valuations and the prevailing macroeconomic environment, BofA offers investors valuable recommendations for navigating these uncertain times.

- Specific sectors or asset classes BofA recommends for investors: BofA might suggest shifting towards more defensive sectors like consumer staples or healthcare, which are often less sensitive to economic downturns.

- Strategies for mitigating potential market downturns: Diversification across asset classes and geographies is crucial to mitigate risk. BofA likely emphasizes the importance of a well-diversified portfolio.

- Advice on adjusting investment timelines given the current valuation concerns: Investors might consider extending their investment horizon to allow for potential market fluctuations. BofA's recommendations might advocate for patience and long-term strategies.

- Discussion of the potential benefits of value investing versus growth investing in this climate: In a market with potentially high valuations, BofA might favor value investing strategies, focusing on undervalued companies with strong fundamentals.

Conclusion:

BofA's analysis highlights significant concerns regarding current stock market valuations, driven by elevated valuation metrics and the influence of macroeconomic factors like inflation and interest rate hikes. Their recommendations emphasize the importance of a cautious approach, incorporating portfolio diversification, risk management strategies, and a thorough understanding of the potential for market corrections. Understand your exposure to stock market valuation risks. Consult BofA's analysis on stock market valuations to inform your investment decisions. Learn more about BofA's insights on managing risk in today's market environment to develop a robust investment strategy that addresses these crucial concerns.

Featured Posts

-

Odigos Tileorasis Metadoseis M Savvatoy 19 4

May 30, 2025

Odigos Tileorasis Metadoseis M Savvatoy 19 4

May 30, 2025 -

Alexander Gustafsson Jon Jones Aware Of Aspinall Danger Not Scared

May 30, 2025

Alexander Gustafsson Jon Jones Aware Of Aspinall Danger Not Scared

May 30, 2025 -

Update Des Moines Public Schools Decision On The Central Campus Agriscience Program

May 30, 2025

Update Des Moines Public Schools Decision On The Central Campus Agriscience Program

May 30, 2025 -

The Looming Threat To Canadas Measles Free Status A Fall 2024 Concern

May 30, 2025

The Looming Threat To Canadas Measles Free Status A Fall 2024 Concern

May 30, 2025 -

Preduprezhdenie Politsii Izrailya Ostavaytes Doma

May 30, 2025

Preduprezhdenie Politsii Izrailya Ostavaytes Doma

May 30, 2025

Latest Posts

-

Tallon Griekspoors Upset Victory Over Alexander Zverev In Indian Wells

May 31, 2025

Tallon Griekspoors Upset Victory Over Alexander Zverev In Indian Wells

May 31, 2025 -

Covid 19 Case Increase Who Links Surge To Emerging Variant

May 31, 2025

Covid 19 Case Increase Who Links Surge To Emerging Variant

May 31, 2025 -

Who Warns New Covid 19 Variant Fueling Case Surge

May 31, 2025

Who Warns New Covid 19 Variant Fueling Case Surge

May 31, 2025 -

Rising Covid 19 Infections Is A New Variant To Blame Who Investigation Underway

May 31, 2025

Rising Covid 19 Infections Is A New Variant To Blame Who Investigation Underway

May 31, 2025 -

Who Reports A Novel Covid 19 Variant May Be Behind Recent Case Spikes

May 31, 2025

Who Reports A Novel Covid 19 Variant May Be Behind Recent Case Spikes

May 31, 2025