Investor's Guide: Uber Stock And Economic Uncertainty

Table of Contents

Uber's Business Model and Resilience During Downturns

Uber's success hinges on its diversified business model, extending beyond just ride-sharing. It operates in several key areas: ride-hailing, food delivery (Uber Eats), and freight transportation. This diversification offers a degree of protection during economic downturns. While ride-sharing demand might soften during a recession, the demand for food delivery services often remains relatively stable, and even increases as consumers cut back on dining out.

- Impact of recession on ride-sharing demand: Historically, ride-sharing usage tends to decline slightly during recessions as consumers reduce discretionary spending. However, Uber's diverse offerings mitigate this impact.

- Effect of economic slowdown on food delivery orders: Food delivery often proves more resilient during economic downturns. Consumers may opt for less expensive home-cooked meals using delivery services instead of restaurants.

- Uber's ability to adapt its services to changing market conditions: Uber consistently adapts its services, pricing, and marketing strategies to meet evolving consumer needs and economic realities.

- Analysis of Uber's pricing strategies during periods of economic uncertainty: Uber employs dynamic pricing, adjusting fares based on demand. This can help maintain profitability even during periods of reduced demand.

- Discussion of Uber's cost-cutting measures and their effectiveness: Uber has proven adept at controlling costs, including streamlining operations and optimizing its driver network, enhancing profitability during challenging economic times.

Analyzing Uber's Financial Performance and Key Metrics

Understanding Uber's financial performance is crucial for any investment decision. Key metrics to consider include revenue, profitability (measured by net income or EBITDA), and debt levels. Analyzing trends in these metrics, particularly during previous economic downturns, provides valuable insights into the company's resilience.

- Review of Uber's recent financial reports: Regularly reviewing Uber's quarterly and annual reports provides up-to-date information on its financial health.

- Analysis of revenue growth and profitability margins: Consistent revenue growth and improving profitability margins are positive indicators of a healthy and growing business.

- Evaluation of Uber's debt levels and its impact on the company's financial health: High debt levels can increase financial risk, particularly during economic downturns.

- Comparison of Uber's performance to competitors in the ride-sharing and delivery market: Benchmarking Uber against its main competitors allows for a comprehensive assessment of its relative performance and market position.

External Factors Influencing Uber Stock: Macroeconomic Trends and Regulations

Macroeconomic factors and regulatory environments significantly influence Uber's stock performance. Inflation, interest rates, and consumer spending directly impact its operations and profitability. Government regulations concerning ride-sharing and delivery services also play a critical role.

- Impact of inflation on Uber's operating costs and pricing: Rising inflation increases Uber's operating costs, potentially squeezing profit margins. However, it also allows for price adjustments.

- Effect of interest rate hikes on Uber's borrowing costs: Higher interest rates increase Uber's borrowing costs, affecting its financial health.

- Analysis of government regulations concerning ride-sharing and delivery services: Varying regulations across different jurisdictions can impact Uber's operational efficiency and profitability.

- Potential impact of future legislation on Uber's business model: Changes in regulations could present both risks and opportunities for Uber.

Investment Strategies for Uber Stock During Economic Uncertainty

Investing in Uber stock during economic uncertainty requires a well-defined strategy. Consider a long-term holding strategy, diversifying your portfolio to mitigate risk, and potentially employing hedging techniques to protect against potential losses. Thorough due diligence is paramount before making any investment decisions.

- Strategies for mitigating risk associated with investing in Uber stock: Diversification is key; don't put all your eggs in one basket.

- Importance of diversification in an investment portfolio: Spreading your investments across different asset classes reduces overall portfolio risk.

- Guidance on long-term vs. short-term investment strategies for Uber stock: A long-term perspective often proves more beneficial when navigating market volatility.

- Recommended resources for conducting thorough due diligence: Consult financial news sources, analyst reports, and company filings.

Conclusion: Making Informed Decisions on Uber Stock in Uncertain Times

Understanding Uber's business model, financial performance, and the external factors impacting its stock price is crucial for making informed investment decisions. Remember that thorough research and diversification are essential for managing risk effectively. Invest wisely in Uber stock by carefully considering your risk tolerance and financial goals. Learn more about navigating economic uncertainty with Uber stock and develop a sound investment strategy for Uber stock that aligns with your individual circumstances.

Featured Posts

-

Damiano Davids Potential Eurovision 2025 Appearance A Speculative Look

May 18, 2025

Damiano Davids Potential Eurovision 2025 Appearance A Speculative Look

May 18, 2025 -

Gilbert Burns Vs Michael Morales Ufc Fight Night Live Blog And Analysis

May 18, 2025

Gilbert Burns Vs Michael Morales Ufc Fight Night Live Blog And Analysis

May 18, 2025 -

Fatal Shooting In Brooklyn Bridge Park Police Seek Information

May 18, 2025

Fatal Shooting In Brooklyn Bridge Park Police Seek Information

May 18, 2025 -

Nyc Bridge Safety Urgent Alert Lessons From Baltimore Collapse

May 18, 2025

Nyc Bridge Safety Urgent Alert Lessons From Baltimore Collapse

May 18, 2025 -

Get 50 Free Spins No Deposit In The Uk Not With Gam Stop

May 18, 2025

Get 50 Free Spins No Deposit In The Uk Not With Gam Stop

May 18, 2025

Latest Posts

-

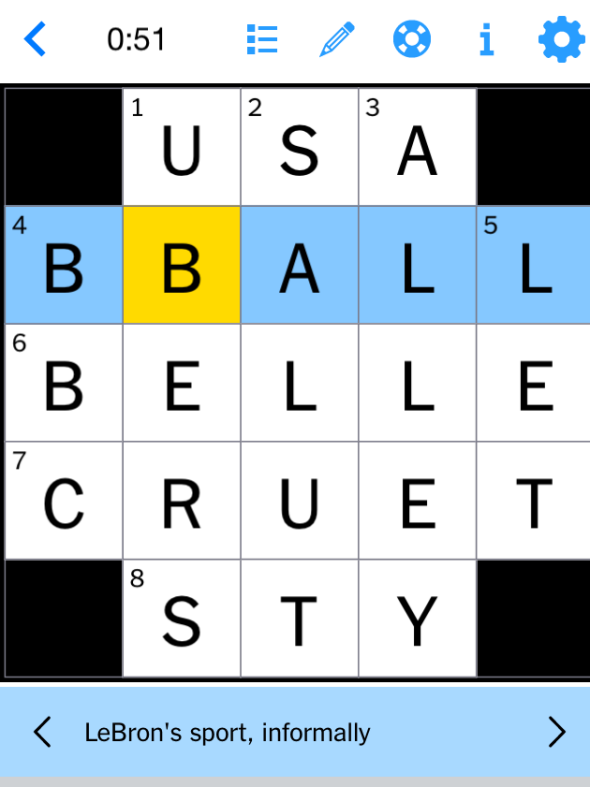

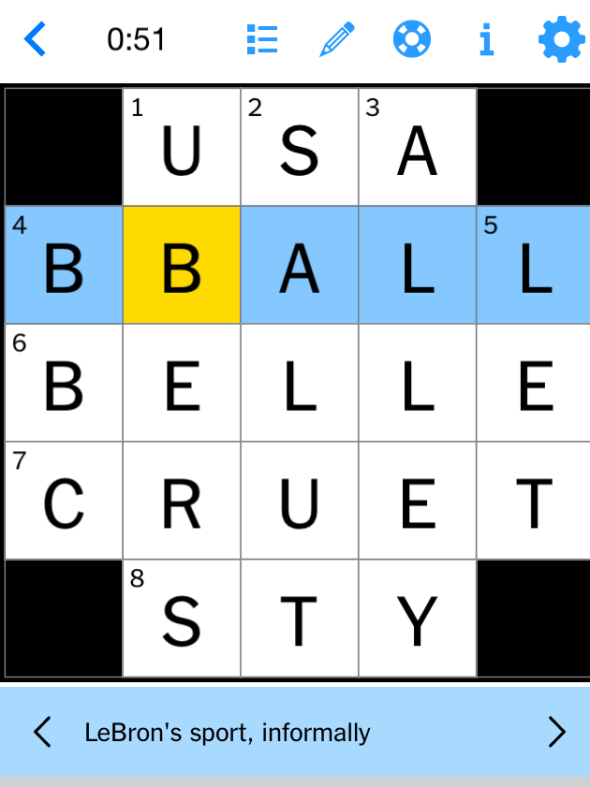

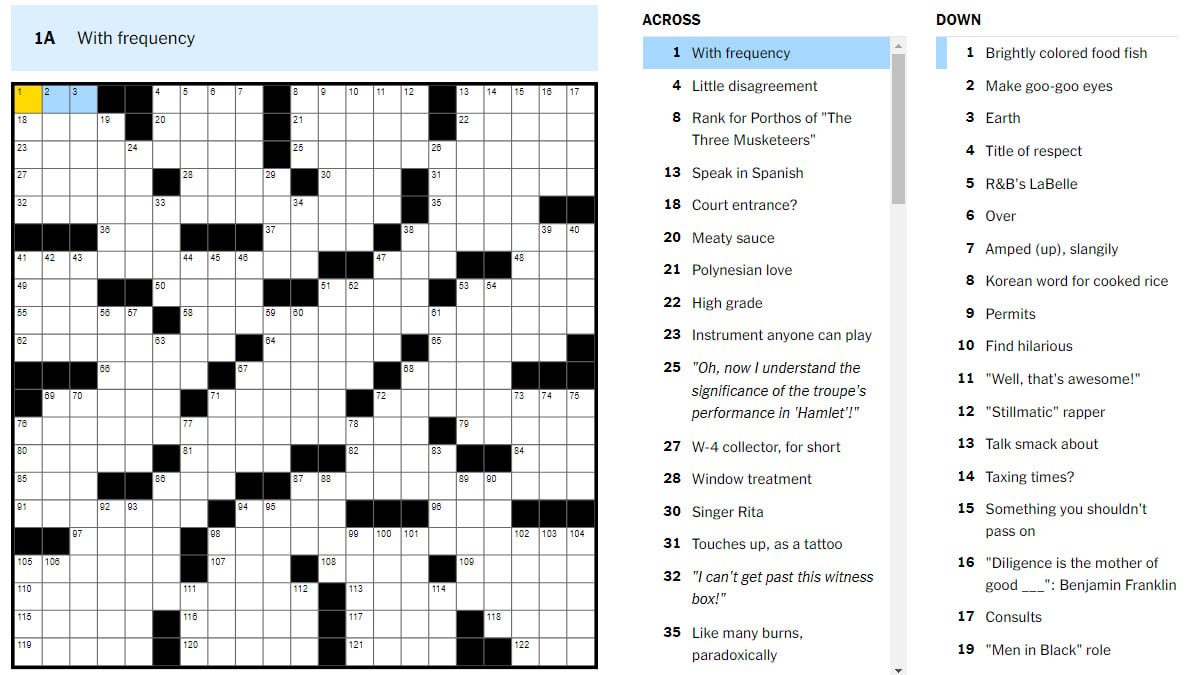

Nyt Mini Crossword April 8 2025 Tuesday Clues Answers And Solutions

May 19, 2025

Nyt Mini Crossword April 8 2025 Tuesday Clues Answers And Solutions

May 19, 2025 -

Nyt Mini Crossword March 5 2025 Solutions And Clues

May 19, 2025

Nyt Mini Crossword March 5 2025 Solutions And Clues

May 19, 2025 -

April 8 2025 Nyt Mini Crossword Complete Answers And Clues

May 19, 2025

April 8 2025 Nyt Mini Crossword Complete Answers And Clues

May 19, 2025 -

Nyt Mini Crossword Today Hints And Answer For March 5 2025

May 19, 2025

Nyt Mini Crossword Today Hints And Answer For March 5 2025

May 19, 2025 -

Nyt Mini Crossword Solutions April 8 2025 Tuesday

May 19, 2025

Nyt Mini Crossword Solutions April 8 2025 Tuesday

May 19, 2025