Is Investing In Uber (UBER) Right For You?

Table of Contents

Uber's Financial Performance and Growth Potential

Analyzing Uber's financial health is crucial for any potential investor. Recent financial reports reveal a complex picture. While Uber has demonstrated substantial revenue growth, driven by its ride-sharing and Uber Eats delivery services, profitability remains a challenge. Examining key financial metrics like revenue growth, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), and free cash flow provides a clearer picture of Uber's financial strength and potential for future growth. Investors should also compare Uber's performance to its main competitor, Lyft, to gauge its relative market position.

-

Positive Aspects: Uber's massive user base and global reach contribute to significant revenue streams. Continued expansion into new markets and services presents opportunities for future growth. The company is actively investing in technological advancements to improve efficiency and user experience.

-

Potential Challenges: Competition from established players and new entrants in the ride-sharing and food delivery sectors poses a significant threat. Regulatory changes and increasing driver costs can impact profitability. Economic downturns can also significantly impact demand for Uber's services.

-

Comparison to Competitors: While Uber holds a larger market share than Lyft, analyzing Lyft's financial performance and strategies helps to understand the competitive landscape and potential risks for Uber.

Uber's Market Position and Competitive Landscape

Uber's dominance in the ride-sharing and food delivery markets is undeniable. Its global reach and brand recognition give it a substantial competitive advantage. However, the market is far from static.

-

Global Reach and Market Penetration: Uber operates in numerous countries worldwide, demonstrating significant market penetration and diversification.

-

Innovation and Technological Advancements: Uber's continuous investment in technology, such as its app development and driver management systems, strengthens its competitive edge.

-

Threats from Existing and Emerging Competitors: Lyft, along with regional players and new entrants, constantly challenge Uber's market share. The emergence of alternative transportation options also poses a long-term threat.

-

Regulatory Hurdles: Government regulations concerning driver classification, pricing, and safety standards significantly impact Uber's operational costs and profitability.

Risks and Considerations for Investing in UBER Stock

Investing in the stock market, especially in a tech company like Uber, involves inherent risks. Understanding these risks is paramount before investing in UBER stock.

-

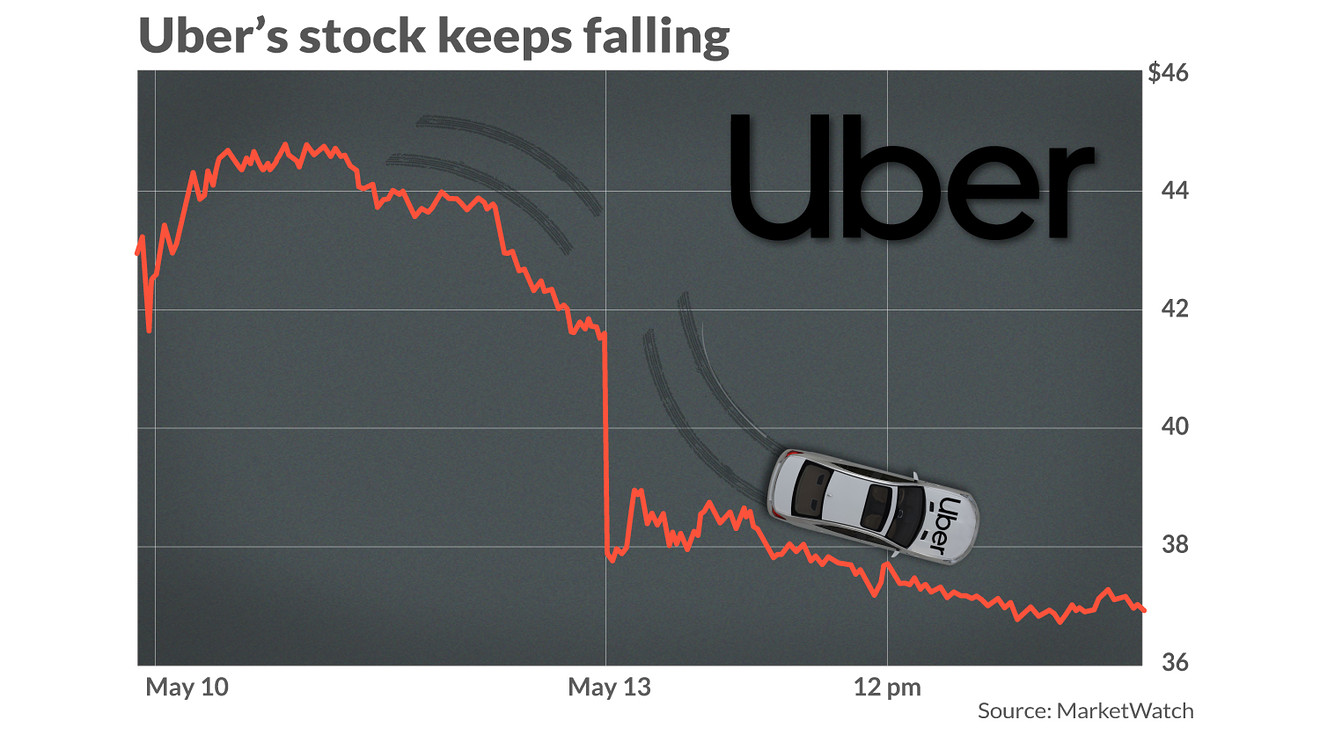

Potential for Significant Losses: The stock market is volatile, and Uber's stock price is no exception. Negative news or unforeseen events can cause substantial losses.

-

Impact of Negative News or Events: Negative publicity regarding driver relations, safety concerns, or regulatory challenges can significantly impact Uber's stock price.

-

Importance of Diversification: Diversifying your investment portfolio is crucial to mitigate the risk associated with investing in a single stock like UBER.

-

Long-term versus Short-term Investment Strategies: Investing in UBER requires a long-term perspective to weather short-term market fluctuations. Short-term trading of UBER stock is highly speculative and carries increased risk.

Analyzing UBER Stock: What to Look For

Before investing in UBER stock, thorough research is essential. This involves both fundamental and technical analysis.

-

Reviewing Financial Statements: Carefully examine Uber's financial statements, including income statements, balance sheets, and cash flow statements, to assess its financial health.

-

Understanding Key Financial Ratios: Analyze key financial ratios such as the price-to-earnings ratio (P/E), debt-to-equity ratio, and return on equity (ROE) to understand the company's financial performance and valuation.

-

Following Industry News and Analyst Reports: Stay informed about industry trends, competitive developments, and analyst reports on Uber to gain valuable insights.

-

Using Charting Tools to Analyze Price Trends: Utilize charting tools to analyze price trends, identify support and resistance levels, and assess the stock's momentum.

Conclusion: Is Investing in Uber (UBER) the Right Choice for You?

Investing in Uber (UBER) presents both opportunities and risks. While its strong market position and growth potential are attractive, the company faces significant challenges, including intense competition and regulatory uncertainty. Ultimately, the decision of whether to invest in Uber (UBER) is a personal one. After carefully considering the information in this article and conducting your own thorough research, you can make an informed decision about whether investing in Uber is right for your portfolio. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

How Ubers New Subscription Plans Impact Driver Earnings And Commissions

May 08, 2025

How Ubers New Subscription Plans Impact Driver Earnings And Commissions

May 08, 2025 -

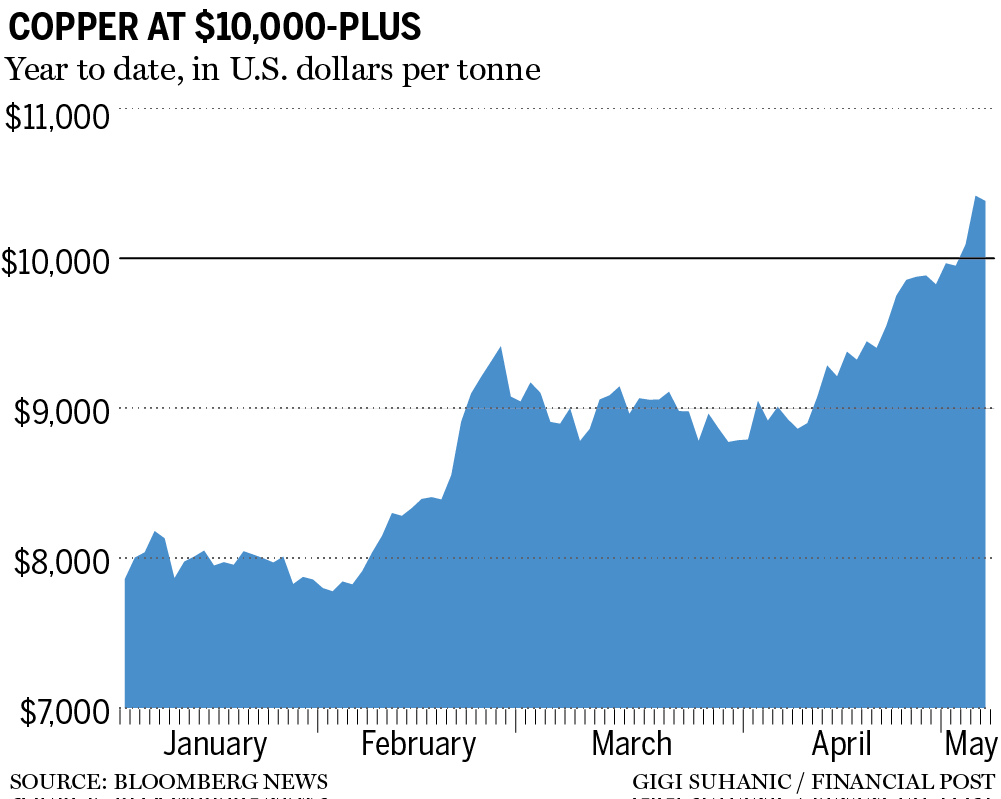

Canadas Trade Balance Improves Deficit Now 506 Million

May 08, 2025

Canadas Trade Balance Improves Deficit Now 506 Million

May 08, 2025 -

The Pritzker Dynasty And Harvard Penny Pritzkers Role In The Universitys Future

May 08, 2025

The Pritzker Dynasty And Harvard Penny Pritzkers Role In The Universitys Future

May 08, 2025 -

Canadian Dollar Economists Concerns And The Need For Rapid Response

May 08, 2025

Canadian Dollar Economists Concerns And The Need For Rapid Response

May 08, 2025 -

360

May 08, 2025

360

May 08, 2025

Latest Posts

-

Tesla Stock Plunge How Elon Musks Actions Affected Dogecoin

May 09, 2025

Tesla Stock Plunge How Elon Musks Actions Affected Dogecoin

May 09, 2025 -

Retrospective Trump Administrations Day 109 May 8th 2025

May 09, 2025

Retrospective Trump Administrations Day 109 May 8th 2025

May 09, 2025 -

Analyzing The Trump Administration On Day 109 May 8th 2025

May 09, 2025

Analyzing The Trump Administration On Day 109 May 8th 2025

May 09, 2025 -

Trump Administration Day 109 May 8th 2025 Key Events And Analysis

May 09, 2025

Trump Administration Day 109 May 8th 2025 Key Events And Analysis

May 09, 2025 -

May 8th 2025 A Look Back At The Trump Administrations Day 109

May 09, 2025

May 8th 2025 A Look Back At The Trump Administrations Day 109

May 09, 2025