Is Investing In XRP (Ripple) Right For You? A Comprehensive Guide

Table of Contents

Understanding XRP and its Technology

XRP is a cryptocurrency designed to facilitate fast and low-cost international money transfers using the Ripple protocol. Unlike Bitcoin, which relies on a proof-of-work consensus mechanism, Ripple utilizes a unique consensus mechanism offering faster transaction speeds and lower energy consumption. The Ripple protocol acts as a bridge between different financial institutions, enabling seamless cross-border payments.

- Ripple's Functionality: The Ripple protocol allows banks and other financial institutions to send and receive payments in various currencies, including fiat currencies and cryptocurrencies like XRP. It streamlines the process, reducing the need for intermediaries and significantly lowering transaction costs.

- XRP's Role: XRP acts as a bridge currency, facilitating conversions between different fiat currencies and cryptocurrencies within the Ripple network. This minimizes the time and cost associated with traditional correspondent banking relationships.

- Advantages of XRP: XRP offers several key advantages over traditional payment systems:

- Speed: Transactions are significantly faster than traditional bank transfers.

- Cost: Transaction fees are considerably lower than traditional methods.

- Transparency: Transactions are recorded on a transparent, distributed ledger.

- Technology Behind XRP: XRP operates on a distributed ledger technology (DLT), a type of blockchain, ensuring security and transparency. Its unique consensus mechanism ensures efficient and rapid transaction processing.

XRP's Use Cases Beyond Cross-Border Payments

While cross-border payments are a primary focus, XRP's potential extends beyond this. It shows promise in several other areas:

- Microtransactions: The low transaction fees make XRP suitable for facilitating microtransactions, opening opportunities in various industries like gaming and digital content distribution.

- Decentralized Exchanges (DEXs): XRP can be used as a trading pair on DEXs, offering users a decentralized and more private trading experience.

- Other Blockchain Applications: XRP's technology can be integrated into other blockchain applications and systems, expanding its utility and adoption.

The SEC Lawsuit and its Impact on XRP Investment

The SEC's lawsuit against Ripple Labs alleging the unregistered sale of securities has significantly impacted XRP's price and investor sentiment. The outcome of this case remains uncertain, creating significant regulatory uncertainty for XRP investors.

- Summary of the Lawsuit: The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. The case involves complex legal arguments about whether XRP qualifies as a security or a currency.

- Potential Outcomes and Impact: A favorable ruling for Ripple could lead to a substantial increase in XRP's price, while an unfavorable ruling could result in a significant price drop. The uncertainty surrounding the outcome makes XRP a highly speculative investment.

- Regulatory Uncertainties: The SEC lawsuit highlights the regulatory challenges facing the cryptocurrency industry, and the outcome will have implications for other cryptocurrencies and blockchain projects.

Analyzing the Risks of Investing in XRP

Investing in XRP carries significant risks:

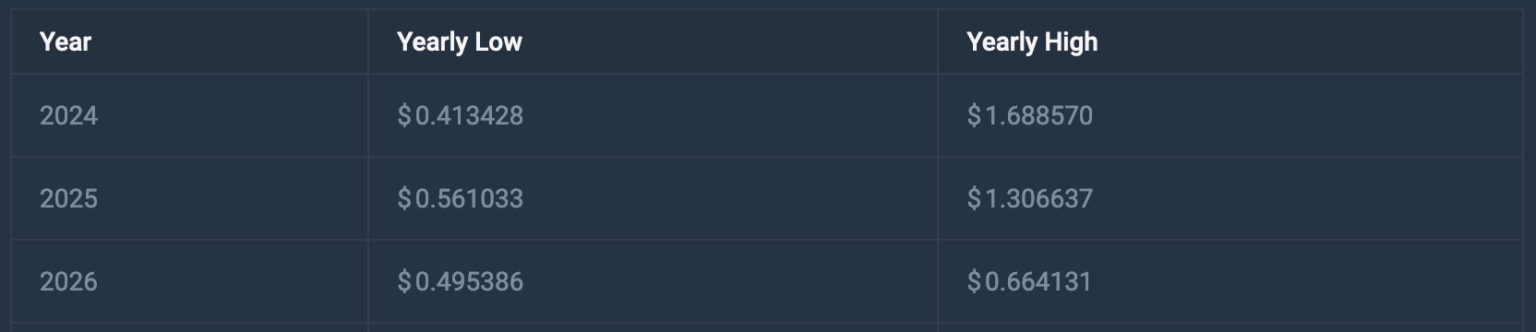

- Volatility: XRP's price is highly volatile and can experience dramatic swings in a short period.

- Regulatory Uncertainty: The outcome of the SEC lawsuit and future regulatory developments remain uncertain and pose significant risks.

- Market Manipulation: Like many cryptocurrencies, XRP is susceptible to market manipulation, which can lead to sudden price drops.

- Technological Risks: Technological vulnerabilities in the Ripple protocol could also impact XRP's value.

Analyzing the Potential Rewards of XRP Investment

Despite the risks, XRP also offers potential rewards:

- High Returns: Past performance indicates the potential for significant returns, although past performance does not guarantee future results.

- Early Adoption: Early investors could benefit significantly if XRP gains widespread adoption.

- Long-Term Holding: A long-term investment strategy could mitigate some of the risks associated with XRP's volatility.

- Increased Adoption: Increased adoption by financial institutions and businesses could drive XRP's price higher.

- Partnerships and Technological Advancements: Strategic partnerships and technological improvements in the Ripple protocol could also positively influence XRP's value.

Comparing XRP to Other Cryptocurrencies

| Cryptocurrency | Technology | Primary Use Case | Market Capitalization |

|---|---|---|---|

| Bitcoin | Proof-of-Work | Store of Value, Payment | High |

| Ethereum | Proof-of-Stake | Smart Contracts, DApps | High |

| XRP | Ripple Consensus | Cross-border Payments | Medium |

How to Invest in XRP

Investing in XRP involves several steps:

- Choosing an Exchange: Select a reputable cryptocurrency exchange that supports XRP trading. Carefully research and compare different exchanges before choosing one.

- Setting up a Wallet: Securely store your XRP in a digital wallet, prioritizing security and privacy. Consider hardware wallets for enhanced security.

- Diversification: Diversify your investment portfolio to minimize risk. Don't put all your eggs in one basket.

- Risk Management: Develop a risk management plan, including setting stop-loss orders to limit potential losses.

Understanding XRP Trading Fees and Associated Costs

Trading XRP involves various fees:

- Trading Fees: Exchanges charge fees for buying and selling XRP. These fees vary across platforms.

- Withdrawal Fees: Fees are also applied when withdrawing XRP from an exchange to your wallet.

- Storage Fees: While most wallets don't charge storage fees, some custodial services may. Compare fees across different platforms and providers before committing.

Conclusion: Is XRP the Right Investment for You?

Investing in XRP presents both significant risks and potential rewards. The ongoing SEC lawsuit introduces considerable regulatory uncertainty, while the potential for high returns remains attractive to some investors. This guide has highlighted the key factors to consider, emphasizing the importance of understanding the technology, the legal landscape, and your own risk tolerance before investing. Remember that past performance is not indicative of future results, and cryptocurrency investments are inherently volatile.

Ultimately, the decision of whether to invest in XRP (Ripple) is yours. Do your own research and make an informed decision based on your understanding of the risks and potential rewards. Remember to always diversify your investments and prioritize secure storage practices.

Featured Posts

-

Inter Milan Defeat Feyenoord Secure Europa League Quarter Final Spot

May 08, 2025

Inter Milan Defeat Feyenoord Secure Europa League Quarter Final Spot

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025 -

Will Xrp Hit 5 By 2025 Analyzing The Potential

May 08, 2025

Will Xrp Hit 5 By 2025 Analyzing The Potential

May 08, 2025 -

The Best Ps 5 Pro Enhanced Exclusives A Comprehensive Guide

May 08, 2025

The Best Ps 5 Pro Enhanced Exclusives A Comprehensive Guide

May 08, 2025 -

The Great Decoupling Economic Implications And Global Shifts

May 08, 2025

The Great Decoupling Economic Implications And Global Shifts

May 08, 2025

Latest Posts

-

Ptt Personel Alimi 2025 Kpss Li Ve Kpss Siz Alimlar Ne Zaman

May 08, 2025

Ptt Personel Alimi 2025 Kpss Li Ve Kpss Siz Alimlar Ne Zaman

May 08, 2025 -

Ptt 2025 Personel Alimi Basvuru Tarihleri Ve Kpss Sartlari

May 08, 2025

Ptt 2025 Personel Alimi Basvuru Tarihleri Ve Kpss Sartlari

May 08, 2025 -

How Breaking Bread With Scholars Can Advance Your Research And Career

May 08, 2025

How Breaking Bread With Scholars Can Advance Your Research And Career

May 08, 2025 -

Breaking Bread With Scholars Cultivating Intellectual Growth Through Dialogue

May 08, 2025

Breaking Bread With Scholars Cultivating Intellectual Growth Through Dialogue

May 08, 2025 -

The Importance Of Breaking Bread With Scholars Networking And Mentorship

May 08, 2025

The Importance Of Breaking Bread With Scholars Networking And Mentorship

May 08, 2025