Is Palantir Stock A Buy Before May 5th? Wall Street's Unexpected Opinion

Table of Contents

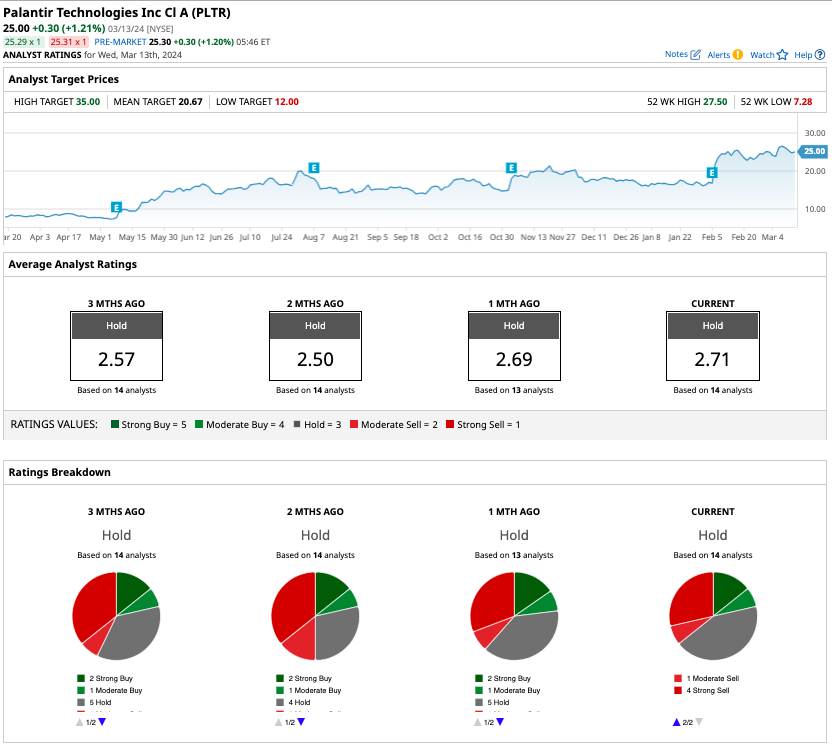

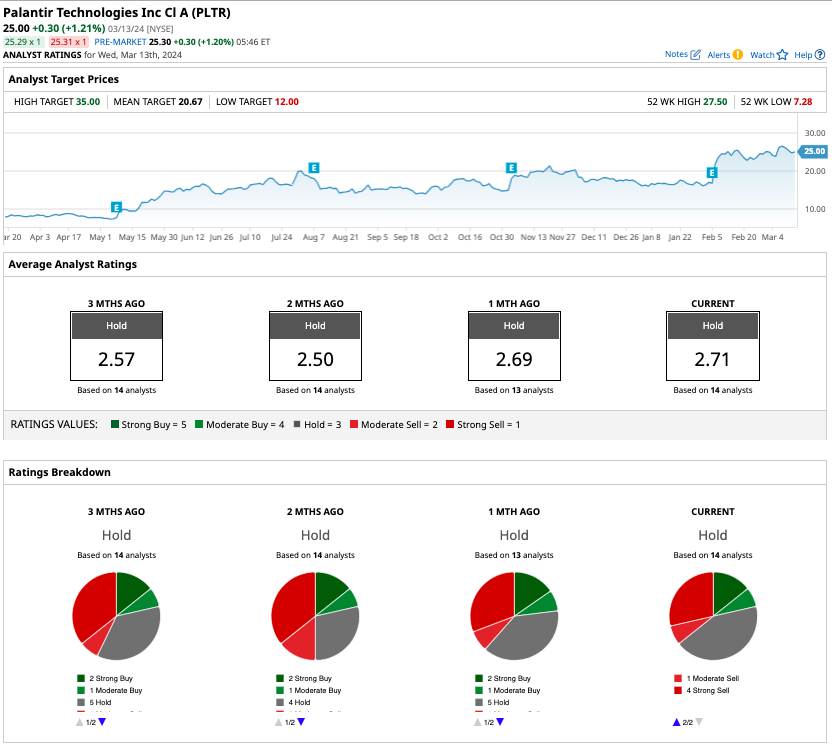

Wall Street's Current Sentiment on PLTR Stock

Wall Street's opinion on Palantir stock is currently mixed, with analysts offering a range of price targets and ratings. Understanding this diverse sentiment is crucial before deciding whether to buy PLTR stock before May 5th.

Analyst Ratings and Price Targets

As of [Insert Current Date], analyst ratings for Palantir stock vary considerably. Some firms maintain a "buy" rating, citing the company's strong growth potential and expanding government contracts. Others hold a more cautious "hold" rating, emphasizing the risks associated with the company's high valuation and dependence on government contracts. A few analysts even have a "sell" rating, concerned about the company's profitability and competition.

For example, [Analyst Firm A] has a price target of $[Price Target] for PLTR stock, while [Analyst Firm B] has a more conservative target of $[Price Target]. These differing perspectives highlight the uncertainty surrounding Palantir's future performance and the potential volatility of its stock price.

- Reasons for Bullish Predictions: Strong government contract pipeline, increasing commercial adoption, potential for disruptive technology in new markets.

- Reasons for Bearish Predictions: High valuation, dependence on government contracts, intense competition in the data analytics market, concerns about profitability.

- Recent Significant News: [Mention recent news affecting PLTR stock, e.g., new contract wins, earnings reports, partnerships, etc.]. This news has significantly influenced analyst opinions and contributed to the current mixed sentiment surrounding PLTR stock.

Analyzing Palantir's Financial Performance and Future Growth Potential

Understanding Palantir's financial health and growth prospects is essential for assessing the viability of a PLTR stock investment before May 5th.

Revenue Growth and Profitability

Palantir has demonstrated consistent revenue growth in recent years, driven largely by its government contracts. However, profitability remains a key concern for many investors. [Insert relevant financial data such as revenue growth percentage, profit margins, etc.]. Analyzing key financial ratios like the Price-to-Sales ratio and the debt-to-equity ratio can provide further insights into the company's financial stability.

- Key Revenue Streams: Government contracts (U.S. and international), commercial contracts across various sectors (healthcare, finance, etc.). Growth prospects are dependent on winning new contracts and expanding into new markets.

- Significant Investments/Acquisitions: [Mention any recent investments or acquisitions and their potential impact on future growth]. These strategic moves can influence the company's trajectory and impact the valuation of PLTR stock.

- Competitive Landscape: Palantir operates in a competitive market with established players and emerging startups. Its success depends on its ability to maintain its competitive edge through technological innovation and strong customer relationships.

Understanding the Significance of May 5th (if applicable)

If there are any significant events scheduled around May 5th, it is crucial to analyze their potential impact on PLTR stock.

Upcoming Events or Announcements

[If applicable, detail specific events scheduled around May 5th, such as earnings reports, product launches, or investor conferences. If no significant events are planned, remove this section or adjust it to focus on general market factors that might affect PLTR's price around that time.]

- Potential Market Reaction: Depending on the outcome of these events, the market's reaction could be significant. Positive news could lead to a surge in PLTR stock price, while negative news could trigger a sharp decline.

- Historical Impact: Analyzing Palantir's historical performance following similar events can provide insights into potential price movements.

- Preparing for Volatility: Investors should be prepared for potential volatility around May 5th, regardless of the specific events. Diversification and a long-term investment horizon can help mitigate risk.

Risks and Considerations Before Investing in PLTR Stock

Before investing in PLTR stock, it's crucial to assess the inherent risks.

Evaluating the Investment Risks

Investing in Palantir carries several risks, including market volatility, competition, and the company's dependence on government contracts. The speculative nature of the company's business model also contributes to stock price fluctuations.

- Speculative Business Model: Palantir's business model is inherently speculative, making its stock price susceptible to shifts in market sentiment and investor expectations.

- Potential Downside Risks: The potential for lower-than-expected revenue growth, increased competition, failure to secure new contracts, and changes in government policy could all negatively impact PLTR stock. Effective risk mitigation strategies include diversification and setting realistic expectations.

- Balanced Perspective: While Palantir presents significant growth opportunities, it's crucial to acknowledge the associated risks. A balanced assessment is vital before making any investment decisions.

Conclusion: Should You Buy Palantir Stock Before May 5th?

The decision of whether to buy Palantir stock before May 5th is complex, requiring careful consideration of Wall Street's mixed sentiment, Palantir's financial performance, and the potential risks involved. While the company shows promising growth potential, its high valuation and dependence on government contracts pose significant challenges. The potential impact of any events around May 5th should also be considered.

Ultimately, the decision of whether or not to buy Palantir stock before May 5th rests on your individual investment strategy. Conduct your own thorough due diligence, carefully evaluate your risk tolerance, and consider consulting with a financial advisor before making any investment in PLTR stock or pursuing a Palantir investment strategy. Remember that this analysis is for informational purposes only and not financial advice.

Featured Posts

-

Jeanine Pirros Past Did A Drunk Episode Jeopardize Her Dc Attorney Appointment

May 09, 2025

Jeanine Pirros Past Did A Drunk Episode Jeopardize Her Dc Attorney Appointment

May 09, 2025 -

Oboronnoe Soglashenie Frantsii I Polshi Chto Eto Znachit Dlya Geopolitiki

May 09, 2025

Oboronnoe Soglashenie Frantsii I Polshi Chto Eto Znachit Dlya Geopolitiki

May 09, 2025 -

Judge Who Jailed Becker To Chair Nottingham Attacks Investigation

May 09, 2025

Judge Who Jailed Becker To Chair Nottingham Attacks Investigation

May 09, 2025 -

Operation Sindoor And Its Fallout Analyzing The Kse 100 Crash

May 09, 2025

Operation Sindoor And Its Fallout Analyzing The Kse 100 Crash

May 09, 2025 -

Community In Shock Child Rapist Found Residing Close To Massachusetts Daycare

May 09, 2025

Community In Shock Child Rapist Found Residing Close To Massachusetts Daycare

May 09, 2025