Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

H2: Palantir's Current Financial Performance and Growth Prospects

Palantir Technologies, a leading provider of data analytics and software platforms, has experienced a period of both growth and challenges. Analyzing Palantir's current financial health and future growth trajectory is crucial for determining if Palantir stock is a sound investment.

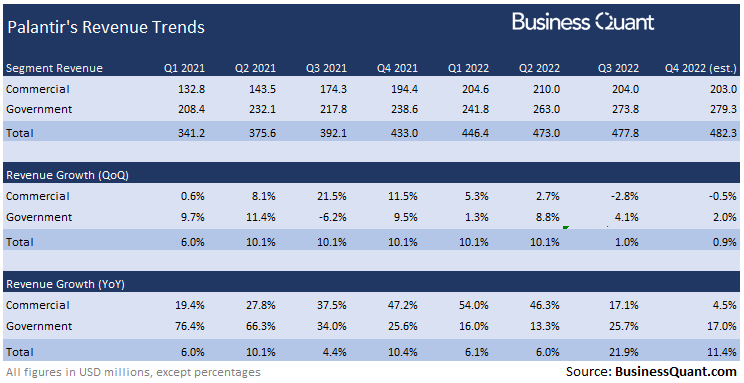

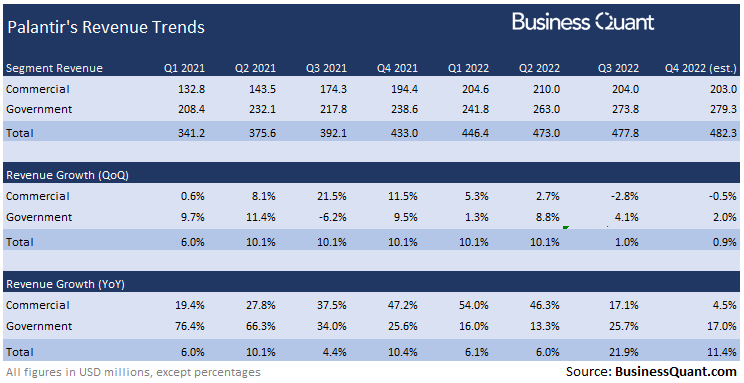

H3: Revenue Growth and Profitability

Recent financial reports paint a mixed picture for Palantir. While the company has demonstrated consistent revenue growth, profitability remains a key focus.

- Q2 2024 Revenue: (Insert actual Q2 2024 revenue data here, citing the source). This represents a (Insert percentage)% increase year-over-year.

- Operating Margin: (Insert data and source here).

- Net Income: (Insert data and source here).

This growth is largely driven by increasing demand for Palantir's government contracts and a gradual increase in commercial adoption of its platforms. However, reaching sustained profitability remains a challenge, a factor investors in PLTR stock should consider carefully.

H3: Future Growth Drivers

Several factors could fuel Palantir's future growth and impact the price of PLTR stock positively.

- Expansion into the Healthcare Sector: Palantir is actively pursuing opportunities within the healthcare industry, leveraging its data analytics capabilities to improve efficiency and patient outcomes.

- Strategic Partnerships: Collaborations with key players in various industries can unlock new markets and expand Palantir's reach. (Mention specific partnerships if available, and cite sources).

- Artificial Intelligence (AI) Integration: Integrating advanced AI capabilities into its platforms could significantly enhance Palantir's offerings and attract new clients.

H2: Valuation and Stock Price Analysis

Understanding Palantir's valuation is essential for determining if the current price of PLTR stock reflects its intrinsic value.

H3: Price-to-Sales Ratio (P/S) and Other Key Metrics

As of [Date], Palantir's P/S ratio stands at [Insert data and source here]. Compared to competitors in the data analytics sector, (mention specific competitors and their P/S ratios for comparison). This comparison provides a context for assessing whether Palantir stock is overvalued or undervalued. Other key metrics such as the Price-to-Earnings ratio (P/E) if applicable and relevant should also be considered.

H3: Technical Analysis

(Disclaimer: Technical analysis is not foolproof and should be used in conjunction with fundamental analysis). While we won't delve deeply into technical indicators, a brief look at [Mention relevant chart patterns or indicators, if any, with proper disclaimers] might offer short-term insights. However, the long-term success of Palantir investment hinges more strongly on fundamental analysis and its underlying business performance.

H2: Risks and Challenges Facing Palantir

While Palantir offers significant potential, several risks and challenges could impact the price of PLTR stock.

H3: Competition and Market Saturation

The data analytics market is highly competitive, with established players like Microsoft, Google, and Amazon offering similar solutions. New entrants are also continuously emerging, creating a dynamic and challenging landscape.

- Competitor Analysis: (List key competitors and briefly discuss their strengths and weaknesses).

H3: Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This dependence creates vulnerabilities, as changes in government spending or policy could negatively affect the company's financial performance.

- Potential Impacts: (Explain potential risks associated with fluctuating government contracts).

H3: Geopolitical Risks

Palantir operates globally, making it susceptible to geopolitical risks. Changes in international relations or political instability in key markets could disrupt its operations and affect its financial performance.

- Geopolitical Risk Factors: (List and explain specific geopolitical risks affecting Palantir).

H2: Alternative Investment Opportunities (Optional)

Investors interested in the data analytics sector should consider other players like [Mention alternative companies in the sector] before committing solely to Palantir stock. Each company presents a unique set of risks and rewards.

3. Conclusion

Our analysis of Palantir stock (PLTR) reveals a company with significant growth potential driven by increasing demand for its data analytics platforms and expansion into new markets. However, challenges remain, including sustained profitability, intense competition, and dependence on government contracts. The valuation of PLTR stock needs careful consideration against its growth prospects and risks.

Based on our comprehensive analysis, Palantir stock presents both opportunity and risk at its current valuation. Investors should carefully weigh these factors before making an investment decision. While the long-term prospects for Palantir are promising, the current market volatility and competitive landscape necessitate caution.

While this analysis provides valuable insights, remember to conduct your own due diligence before investing in Palantir stock (PLTR). Understanding the risks associated with Palantir Technologies stock is crucial for informed investment decisions.

Featured Posts

-

Is Trumps Transgender Military Ban Fair Examining The Arguments

May 10, 2025

Is Trumps Transgender Military Ban Fair Examining The Arguments

May 10, 2025 -

Analysis Trump Tariffs And The 174 Billion Drop In Billionaire Net Worth

May 10, 2025

Analysis Trump Tariffs And The 174 Billion Drop In Billionaire Net Worth

May 10, 2025 -

Trumps Surgeon General Nominee Examining The Background Of Casey Means And The Maha Movement

May 10, 2025

Trumps Surgeon General Nominee Examining The Background Of Casey Means And The Maha Movement

May 10, 2025 -

Nigerias Fuel Market Examining The Dynamics Between Dangote And Nnpc

May 10, 2025

Nigerias Fuel Market Examining The Dynamics Between Dangote And Nnpc

May 10, 2025 -

Understanding Pam Bondis Position On The Lives Of American Citizens

May 10, 2025

Understanding Pam Bondis Position On The Lives Of American Citizens

May 10, 2025

Latest Posts

-

Go Compare Responds To Wynne Evans Controversy

May 10, 2025

Go Compare Responds To Wynne Evans Controversy

May 10, 2025 -

Singer Wynne Evans Faces Backlash Over Alleged Sex Slur

May 10, 2025

Singer Wynne Evans Faces Backlash Over Alleged Sex Slur

May 10, 2025 -

Celebrity Stylist Elizabeth Stewart Designs Exclusive Line With Lilysilk

May 10, 2025

Celebrity Stylist Elizabeth Stewart Designs Exclusive Line With Lilysilk

May 10, 2025 -

Troubled Nhs Trust Leader Commits To Nottingham Attack Investigation

May 10, 2025

Troubled Nhs Trust Leader Commits To Nottingham Attack Investigation

May 10, 2025 -

Go Compare Pulls Wynne Evans Ads Following Mail On Sunday Report

May 10, 2025

Go Compare Pulls Wynne Evans Ads Following Mail On Sunday Report

May 10, 2025