Is Palantir Stock A Smart Investment For Your Portfolio?

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir operates primarily through two platforms: Gotham, catering to government agencies, and Foundry, focused on commercial clients. Its revenue model centers on providing software-as-a-service (SaaS) solutions and securing substantial government contracts. The growth potential is substantial, but challenges exist within each sector.

-

Palantir Gotham: This platform provides data analytics and intelligence solutions to government agencies worldwide, generating significant revenue through long-term contracts. However, this reliance on government contracts presents risks. Budget cycles, political changes, and shifting geopolitical landscapes can significantly impact revenue streams.

-

Palantir Foundry: Designed for commercial clients, Foundry aims to disrupt various industries with its advanced big data analytics capabilities. This platform holds massive growth potential, mirroring the broader SaaS market's expansion. However, intense competition from established players in the big data analytics market, like Databricks and Snowflake, presents a considerable challenge. Securing and retaining clients requires continuous innovation and strong sales efforts.

Key revenue drivers include the increasing demand for data-driven decision-making across both public and private sectors. Challenges include maintaining high-value government contracts and competing effectively in the increasingly crowded SaaS marketplace. Keywords: Palantir Foundry, Palantir Gotham, SaaS revenue, government contracts, big data analytics.

Financial Performance and Valuation of PLTR Stock

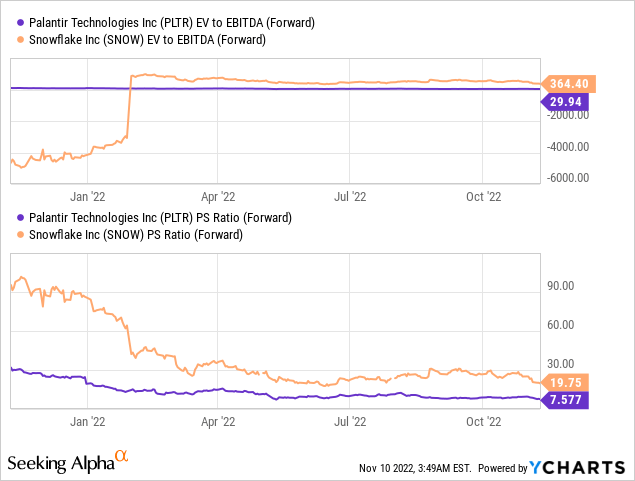

Palantir's financial statements reveal a company experiencing rapid revenue growth, though profitability remains elusive. Analyzing Palantir financials requires considering several key metrics. Its valuation, often measured by the P/E ratio and price-to-sales ratio, is high compared to some industry peers. This high valuation reflects investor optimism regarding its future growth potential. However, the lack of consistent profitability raises concerns for some investors.

-

Key Financial Highlights: High revenue growth rates, increasing customer base, expansion into new markets.

-

Potential Concerns: Currently unprofitable, high valuation relative to earnings, dependence on large contracts.

Keywords: Palantir financials, PLTR stock valuation, P/E ratio, price-to-sales ratio, market capitalization.

Risks and Challenges Associated with Investing in Palantir

Investing in Palantir stock, like any high-growth tech stock, carries inherent risks. Besides the financial uncertainties discussed above, several other factors pose challenges.

-

Competition: The big data analytics market is fiercely competitive. Established players and emerging startups continually challenge Palantir's market share.

-

Regulatory Hurdles: Palantir's work with government agencies brings regulatory scrutiny and potential legal challenges.

-

Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts, making it vulnerable to changes in government spending and policy.

-

Palantir Controversy: The company's work with government agencies has attracted controversy, potentially impacting its public image and future contracts.

Keywords: PLTR risk, high-growth stock risk, big data security, government regulation, Palantir controversy.

Palantir Stock: A Comparative Analysis with Competitors

To assess Palantir's investment potential fully, comparing it with key competitors is crucial. Companies like Databricks and Snowflake offer similar big data analytics solutions, presenting direct competition.

| Feature | Palantir | Databricks | Snowflake |

|---|---|---|---|

| Primary Focus | Government & Commercial | Primarily Commercial | Primarily Commercial |

| Revenue Model | SaaS, Government Contracts | SaaS | SaaS |

| Valuation | High | High | High |

| Strengths | Strong government relationships, Foundry | Open-source technology, strong community | Scalability, data warehousing expertise |

| Weaknesses | Profitability, Competition | Less mature ecosystem, enterprise focus | Pricing, dependence on cloud providers |

Keywords: Palantir competitors, Databricks, Snowflake, big data analytics comparison.

Conclusion: Is Palantir Stock a Good Investment for Your Portfolio?

Palantir stock presents a compelling investment opportunity but also carries significant risks. Its high growth potential and strong position in the big data analytics market are balanced by its high valuation, lack of consistent profitability, and competitive landscape. Whether Palantir stock is a good investment for your portfolio depends heavily on your risk tolerance, investment horizon, and overall investment strategy. Investors with a higher risk tolerance and a longer-term perspective might find Palantir's growth potential attractive. However, those seeking safer, more established investments should proceed with caution. Before investing in Palantir stock, conduct thorough due diligence, consider your personal financial goals, and explore diverse PLTR investment strategies. Remember, this analysis is for informational purposes only and not financial advice.

Featured Posts

-

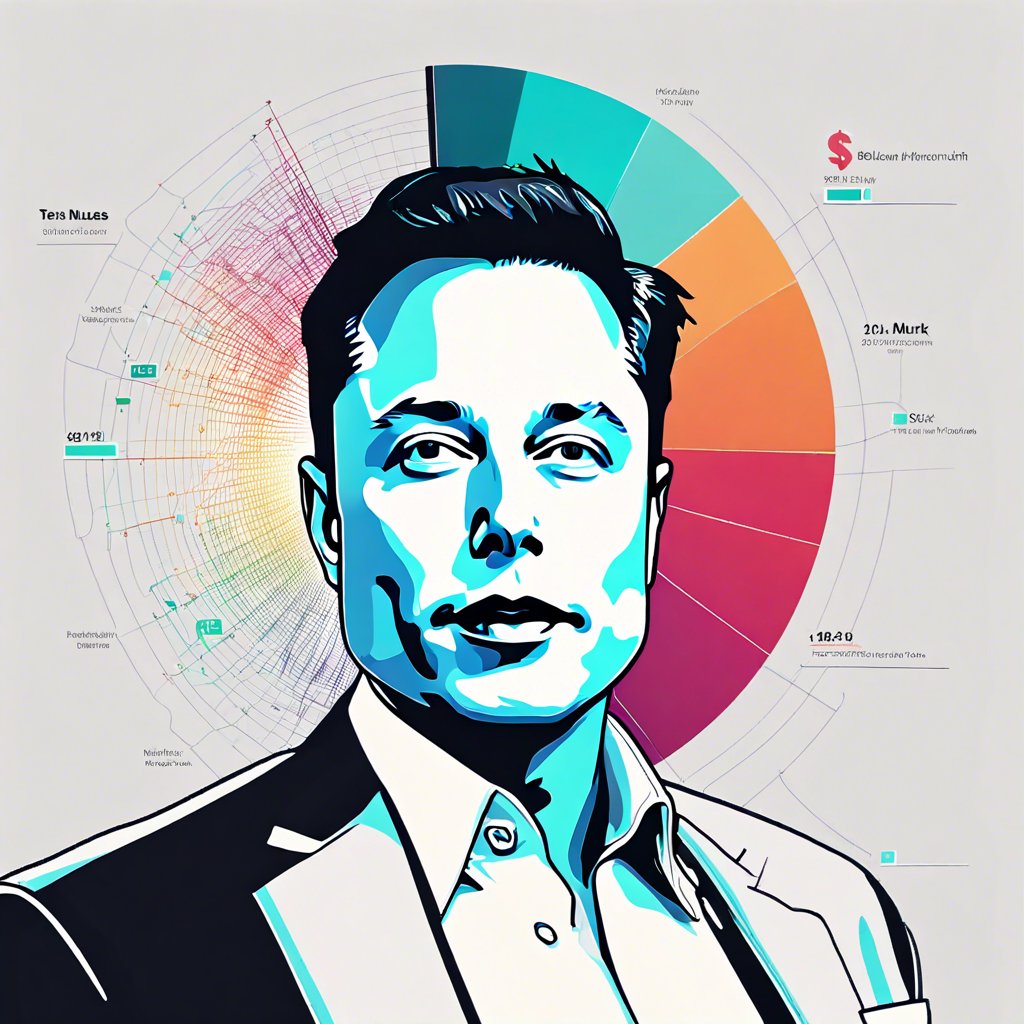

Boss Of Troubled Nhs Trust To Cooperate Fully With Nottingham Attack Inquiry

May 10, 2025

Boss Of Troubled Nhs Trust To Cooperate Fully With Nottingham Attack Inquiry

May 10, 2025 -

Teslas Success And Elon Musks Wealth The Role Of The Us Economy

May 10, 2025

Teslas Success And Elon Musks Wealth The Role Of The Us Economy

May 10, 2025 -

R5 1078

May 10, 2025

R5 1078

May 10, 2025 -

5 Famous Feuds Featuring Stephen King

May 10, 2025

5 Famous Feuds Featuring Stephen King

May 10, 2025 -

Zrada Vid Maska Ta Trampa Rizke Zvinuvachennya Vid Stivena Kinga

May 10, 2025

Zrada Vid Maska Ta Trampa Rizke Zvinuvachennya Vid Stivena Kinga

May 10, 2025

Latest Posts

-

Celebrity Stylist Elizabeth Stewart Designs Exclusive Line With Lilysilk

May 10, 2025

Celebrity Stylist Elizabeth Stewart Designs Exclusive Line With Lilysilk

May 10, 2025 -

Troubled Nhs Trust Leader Commits To Nottingham Attack Investigation

May 10, 2025

Troubled Nhs Trust Leader Commits To Nottingham Attack Investigation

May 10, 2025 -

Go Compare Pulls Wynne Evans Ads Following Mail On Sunday Report

May 10, 2025

Go Compare Pulls Wynne Evans Ads Following Mail On Sunday Report

May 10, 2025 -

Nottingham Attack Inquiry Nhs Trust Chief Pledges Cooperation

May 10, 2025

Nottingham Attack Inquiry Nhs Trust Chief Pledges Cooperation

May 10, 2025 -

Did Wynne Evanss Actions Lead To Katya Jones Leaving Strictly

May 10, 2025

Did Wynne Evanss Actions Lead To Katya Jones Leaving Strictly

May 10, 2025