Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily through two core platforms: Gotham and Foundry. Gotham is tailored for government agencies, providing advanced data analytics and intelligence solutions to combat terrorism, crime, and other national security threats. Foundry, on the other hand, is designed for commercial clients, offering a similar data integration and analysis platform to optimize various business operations.

Palantir's revenue streams are diverse, spanning both government and commercial sectors. While government contracts have historically been a significant portion of their revenue, the company is actively expanding its commercial footprint. This diversification is a key factor in assessing the long-term sustainability of Palantir's business model.

- Key Revenue Drivers:

- Government contracts for national security and intelligence purposes.

- Commercial contracts with Fortune 500 companies in diverse sectors like finance, healthcare, and manufacturing.

- Growing adoption of Palantir's platforms in cloud computing environments.

- Future Growth Areas:

- Expansion into new geographical markets.

- Leveraging artificial intelligence (AI) and machine learning (ML) capabilities within their platforms.

- Development of new products and services catering to emerging industry needs.

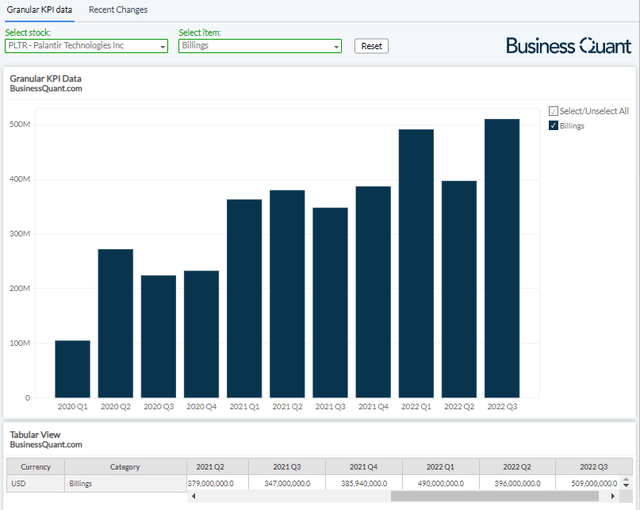

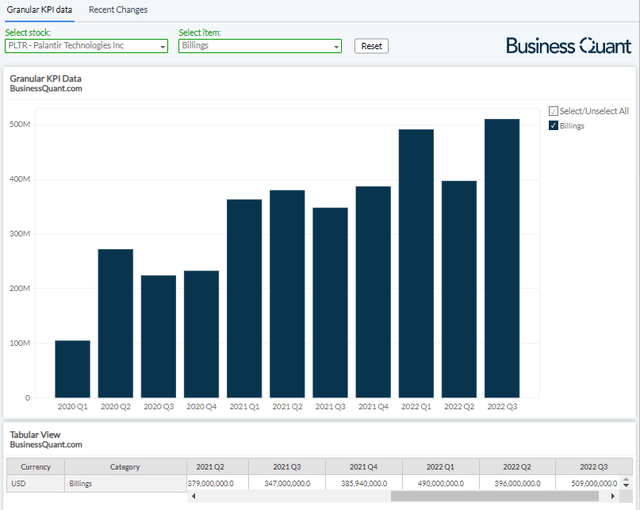

Palantir's Financial Performance and Valuation

Analyzing Palantir's financial performance requires careful consideration of several key metrics. While the company has demonstrated strong revenue growth, profitability remains a focus area. Examining earnings per share (EPS), free cash flow, and debt levels provides a comprehensive picture of Palantir's financial health. Further, comparing Palantir's valuation metrics (P/E ratio, Price-to-Sales ratio) to competitors within the data analytics sector is essential for determining if the stock is fairly valued.

- Key Financial Highlights:

- Consistent revenue growth, although profitability remains inconsistent.

- Significant investment in research and development to maintain a competitive edge.

- Increasing operating leverage as the company scales its operations.

- Potential Risks:

- High operating expenses impacting profitability in the short-term.

- Dependence on large government contracts could create volatility.

- High valuation compared to some competitors, potentially presenting a risk if growth slows.

Competitive Landscape and Market Position

Palantir operates in a competitive data analytics market, facing established players and emerging startups. Key competitors include companies like Databricks, Snowflake, and Tableau, each possessing unique strengths. Palantir's competitive advantages lie in its unique data integration capabilities, strong relationships with government clients, and the proprietary nature of its technology. However, increasing competition and technological advancements pose ongoing challenges.

- Palantir vs. Competitors:

- Strength: Unique platform capabilities for complex data integration. Strong government relationships.

- Weakness: High cost of implementation and ongoing maintenance. Dependence on large contracts.

- Opportunities: Expansion into new markets and development of innovative AI/ML solutions.

- Threats: Increased competition from larger, more established players and the emergence of disruptive technologies.

Future Growth Potential and Risks

Palantir's future growth hinges on its ability to execute its growth strategy, expand into new markets, and leverage technological advancements effectively. The company's expansion into the commercial sector and its growing focus on AI and cloud computing represent key growth opportunities. However, potential risks include dependence on large government contracts, increased competition, and the ever-evolving regulatory landscape for data analytics.

- Potential Growth Opportunities:

- Expansion into new commercial sectors (e.g., energy, logistics).

- Development of AI-powered analytics solutions.

- Strategic acquisitions to broaden product offerings and market reach.

- Associated Risks:

- Intense competition from established and emerging players.

- Changes in government spending priorities impacting revenue streams.

- Regulatory hurdles relating to data privacy and security.

Conclusion: Should You Buy Palantir Technologies Stock?

Our analysis reveals that Palantir Technologies presents a compelling yet risky investment opportunity. While the company boasts impressive technology and growing revenue, its profitability, high valuation, and dependence on large contracts necessitate careful consideration. The company's growth trajectory depends heavily on its ability to continue expanding its commercial business, successfully navigate competitive pressures, and maintain strong client relationships.

Based on this analysis, whether to buy, sell, or hold Palantir stock depends on your individual risk tolerance and investment horizon. Those seeking high-growth potential with a higher risk tolerance might find Palantir attractive. However, investors seeking stability and immediate profitability may want to exercise caution. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

What are your thoughts on Palantir Technologies stock? Is it a buy for you? Share your analysis in the comments below!

Featured Posts

-

F1 News Jeremy Clarkson Proposes Solution As Ferrari Faces Disqualification Threat

May 09, 2025

F1 News Jeremy Clarkson Proposes Solution As Ferrari Faces Disqualification Threat

May 09, 2025 -

Dijon Vs Concarneau 0 1 Compte Rendu De La 28eme Journee De National 2

May 09, 2025

Dijon Vs Concarneau 0 1 Compte Rendu De La 28eme Journee De National 2

May 09, 2025 -

Jayson Tatum Gets Roasted Tnts Hilarious Abc Promo For Lakers Vs Celtics

May 09, 2025

Jayson Tatum Gets Roasted Tnts Hilarious Abc Promo For Lakers Vs Celtics

May 09, 2025 -

Ozhidaemoe Pokholodanie I Snegopady V Permi I Permskom Krae V Kontse Aprelya 2025 Goda

May 09, 2025

Ozhidaemoe Pokholodanie I Snegopady V Permi I Permskom Krae V Kontse Aprelya 2025 Goda

May 09, 2025 -

Britannian Kuninkaallinen Perimysjaerjestys Ajankohtainen Lista

May 09, 2025

Britannian Kuninkaallinen Perimysjaerjestys Ajankohtainen Lista

May 09, 2025