Is Palantir's High Multiple Justified? A Deep Dive Into Its Performance

Table of Contents

Palantir Technologies (PLTR) has captivated investors since its IPO, largely due to its innovative data analytics platform and substantial government contracts. However, its high price-to-earnings (P/E) multiple has sparked intense debate: is Palantir's valuation truly justified by its performance? This article delves into Palantir's financial health, market position, and future prospects to offer a comprehensive analysis. We will examine key factors influencing the PLTR stock price and provide insights to help you make informed investment decisions.

Palantir's Revenue Growth and Profitability

Analyzing Revenue Streams

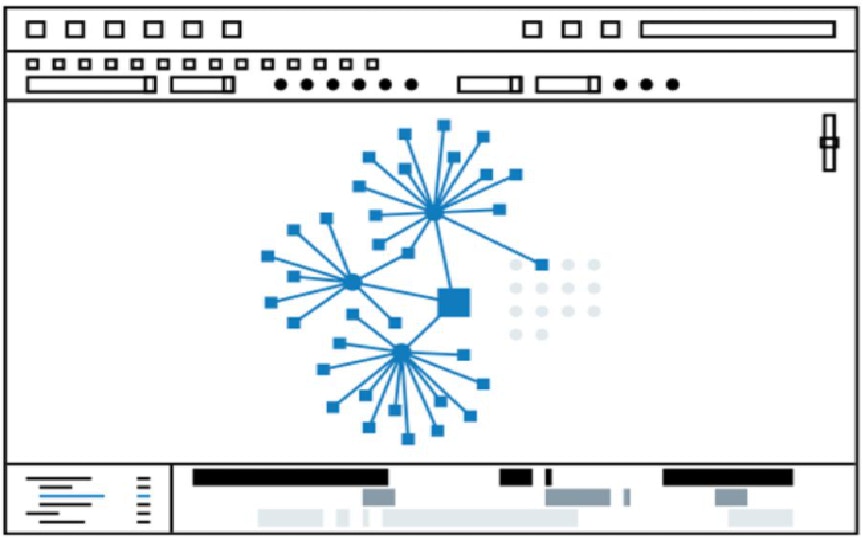

Palantir's revenue streams are primarily derived from government and commercial contracts. Understanding the breakdown and growth trajectory of each is crucial for evaluating the company's overall financial health.

- Government vs. Commercial Revenue: Historically, government contracts have formed a significant portion of Palantir's revenue. However, the company has been actively pursuing growth in the commercial sector, aiming for greater diversification. Analyzing the year-over-year growth in each segment reveals the success of this strategy.

- Year-over-Year Revenue Growth Analysis: Examining Palantir's financial reports reveals consistent revenue growth over the past few years. This growth needs to be evaluated in relation to the overall market growth in the data analytics space. A faster-than-market growth rate signifies strong market share gains and execution capabilities.

- Impact of Contract Wins: Securing major government and commercial contracts significantly impacts Palantir's future revenue projections. Analyzing the size and duration of these contracts provides insights into the predictability and sustainability of revenue streams. Large, long-term contracts bolster investor confidence, whereas reliance on short-term contracts increases risk.

- Sustainability of Revenue Growth: The crucial question is whether Palantir can maintain its impressive revenue growth. This requires an assessment of market competition, the company's innovation pipeline, and its ability to consistently win new contracts. A deep dive into its sales pipeline and customer retention rates is critical for determining the sustainability of this growth.

(Insert chart showing Palantir's revenue growth over time, broken down by government and commercial sectors.)

Profitability Metrics

While revenue growth is impressive, assessing profitability is equally important for understanding Palantir's long-term value.

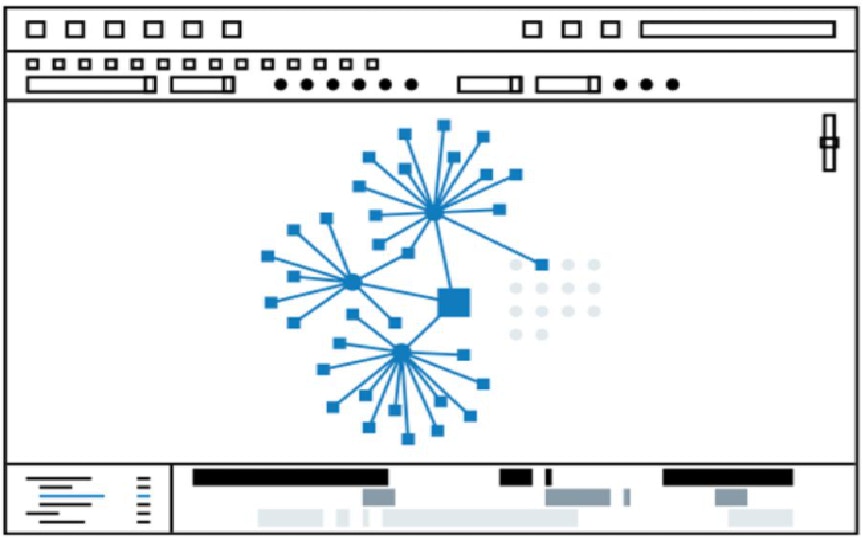

- Gross Margin, Operating Margin, and Net Income: Examining these key profitability metrics provides insights into Palantir's operational efficiency and cost structure. High gross margins suggest a strong pricing power and efficient production, while positive operating and net income indicate a healthy, profitable business model.

- Comparison to Competitors: Benchmarks against similar technology companies reveal Palantir's relative profitability. A higher-than-average profitability signifies a competitive advantage, potentially justifying the high valuation.

- Influencing Factors: Research and development (R&D) spending is crucial for innovation, but it also impacts profitability in the short term. Similarly, operational efficiency plays a vital role in lowering costs and boosting margins.

- Path to Profitability: Investors need to assess Palantir's strategy for achieving sustainable profitability. This may involve streamlining operations, increasing pricing, or focusing on higher-margin products/services.

(Insert chart comparing Palantir's key profitability metrics to those of its competitors.)

Market Position and Competitive Landscape

Market Dominance and Innovation

Palantir occupies a unique niche in the data analytics market, particularly in the government intelligence sector. Analyzing its market share and innovative capabilities is crucial.

- Market Share Analysis: Determining Palantir's market share in both government and commercial markets provides a clear picture of its dominance and competitive strength. A significant market share usually translates into higher revenue and pricing power.

- Technological Advantages: Palantir's proprietary software platforms offer unique capabilities for data integration, analysis, and visualization. Assessing these technological advantages reveals its competitive edge.

- Maintaining a Competitive Edge: The data analytics landscape is highly competitive. Palantir's ability to continuously innovate and adapt to market changes is essential for maintaining its leadership position. Analyzing its R&D spending and successful product launches is key here.

Government vs. Commercial Market Penetration

Palantir’s success hinges on its ability to effectively penetrate both government and commercial markets.

- Contract Comparisons: A direct comparison of Palantir's success rate in securing contracts from government agencies versus commercial clients highlights its strengths and weaknesses in each sector.

- Market Risks and Opportunities: Each market segment presents distinct risks and opportunities. Government contracts may offer stability but also involve bureaucratic processes and potential budget constraints. Commercial clients may offer higher growth potential but also involve more competitive bidding.

- Long-Term Growth Strategy: A diversified approach is usually preferred to reduce reliance on a single market. Palantir's long-term strategy regarding government and commercial market expansion provides a vital indicator of its long-term potential.

Valuation and Investment Considerations

Justifying the High P/E Multiple

The high P/E multiple assigned to Palantir necessitates a detailed valuation analysis.

- Comparison to Peers: Comparing Palantir's P/E ratio to that of similar technology companies allows for a relative valuation assessment. A higher multiple might be justified if Palantir demonstrates superior growth potential or technological leadership.

- Factors Justifying High Valuation: High growth potential, technological leadership, strong intellectual property, and a large addressable market can justify a higher P/E multiple. These factors must be carefully assessed.

- Risks of High-Growth Stocks: High-growth stocks, especially those with high P/E ratios, tend to be more volatile and carry higher risk. Investors need to accept the potential for significant price fluctuations.

Risks and Potential Downsides

Investing in Palantir involves inherent risks that need careful consideration.

- Key Risks: Competition from established players, dependence on large government contracts, macroeconomic factors (e.g., government budget cuts), and the potential for technological disruption all pose significant risks.

- Impact on Stock Price: Understanding how these risks might negatively impact the Palantir stock price is crucial for mitigating potential losses.

- Balanced Perspective: While Palantir presents exciting opportunities, investors should acknowledge and assess the inherent risks to make an informed investment decision.

Conclusion

This deep dive into Palantir's performance reveals a company with significant growth potential driven by its innovative data analytics platform and strong market position. However, its high valuation necessitates careful consideration of the inherent risks. The dependency on large government contracts and the competitive landscape pose challenges that could impact the PLTR stock price. Ultimately, whether Palantir's high multiple is justified depends on your individual risk tolerance and long-term outlook. Conduct thorough due diligence, considering all factors discussed, before investing in Palantir stock or any high-multiple technology company. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Who Wants To Be A Millionaire Celebrity Edition A Look At The Shows History And Evolution

May 07, 2025

Who Wants To Be A Millionaire Celebrity Edition A Look At The Shows History And Evolution

May 07, 2025 -

Magics Banchero Leads Team To Victory Ending Cavaliers Run

May 07, 2025

Magics Banchero Leads Team To Victory Ending Cavaliers Run

May 07, 2025 -

Lewis Capaldi Maintains Winning Streak With New Album

May 07, 2025

Lewis Capaldi Maintains Winning Streak With New Album

May 07, 2025 -

Multiple Teams Eyeing Pittsburgh Steelers Star Wide Receiver

May 07, 2025

Multiple Teams Eyeing Pittsburgh Steelers Star Wide Receiver

May 07, 2025 -

Julius Randles Playoff Redemption Can He Lead The Timberwolves To Success

May 07, 2025

Julius Randles Playoff Redemption Can He Lead The Timberwolves To Success

May 07, 2025

Latest Posts

-

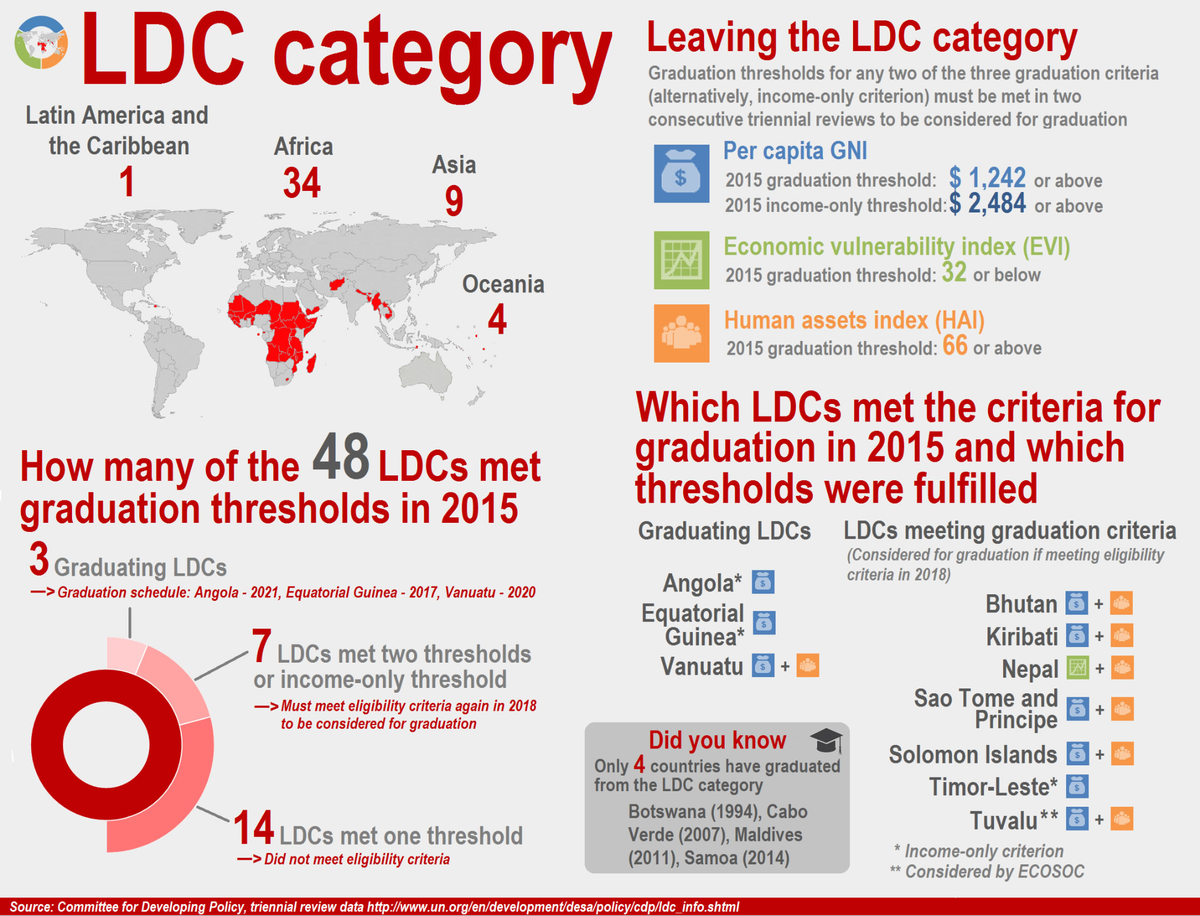

Press Release Sustainable Development At The Forefront The Ldcs Future Forum 2025 In Zambia

May 07, 2025

Press Release Sustainable Development At The Forefront The Ldcs Future Forum 2025 In Zambia

May 07, 2025 -

Cleveland Cavaliers Rout Knicks Mitchell And Mobleys Stellar Performance

May 07, 2025

Cleveland Cavaliers Rout Knicks Mitchell And Mobleys Stellar Performance

May 07, 2025 -

Zambia To Host Ldcs Future Forum 2025 Shaping A Sustainable Future For Least Developed Countries

May 07, 2025

Zambia To Host Ldcs Future Forum 2025 Shaping A Sustainable Future For Least Developed Countries

May 07, 2025 -

Cavaliers Mitchell And Mobley Power Blowout Win Against Knicks

May 07, 2025

Cavaliers Mitchell And Mobley Power Blowout Win Against Knicks

May 07, 2025 -

Mitchell And Mobley Lead Cavaliers To Dominant 142 105 Victory Over Knicks

May 07, 2025

Mitchell And Mobley Lead Cavaliers To Dominant 142 105 Victory Over Knicks

May 07, 2025