Is Riot Platforms Stock A Buy At 52-Week Lows? A Detailed Analysis

Table of Contents

Riot Platforms' Financial Performance and Recent Developments

Revenue and Profitability

Analyzing Riot Platforms' recent financial reports is crucial to understanding its current state. Key metrics like revenue growth, profitability margins, and net income paint a picture of the company's financial health. Several factors influence RIOT's revenue, primarily the price of Bitcoin and the efficiency of its mining operations.

- Bitcoin Price Correlation: The price of Bitcoin directly impacts Riot Platforms' revenue, as the value of mined Bitcoin fluctuates accordingly. A rising Bitcoin price translates to higher revenue, while a decline has the opposite effect.

- Mining Efficiency: Riot Platforms' operational efficiency, measured by its hash rate and energy consumption, significantly impacts profitability. Improvements in mining efficiency lead to lower operating costs and higher profit margins.

- Operating Expenses: These include electricity costs (a major expense for Bitcoin mining), equipment maintenance, and personnel costs. Analyzing the trend in operating expenses is vital for assessing profitability.

- Net Income: The bottom line – net income – reveals the overall profitability of Riot Platforms after accounting for all revenues and expenses. Consistent net income growth indicates a healthy financial position. (Note: Specific data and charts would be included here from Riot Platforms' financial statements.) Keywords: RIOT financials, revenue growth, profitability, operating margin, net income, Bitcoin price correlation.

Mining Capacity and Efficiency

Riot Platforms' success hinges on its mining capacity and efficiency. A higher hash rate indicates a greater ability to mine Bitcoin, and improved efficiency translates to lower costs per Bitcoin mined.

- Hash Rate Growth: Monitoring the company's hash rate growth is essential to understanding its ability to compete in the Bitcoin mining landscape. Expansion plans and new equipment acquisitions directly influence this metric.

- Energy Sourcing and Consumption: The cost of electricity is a substantial expense for Bitcoin mining. Riot Platforms' strategy for securing cost-effective and sustainable energy sources is crucial for its long-term profitability.

- ASIC Miner Upgrades: Investing in newer, more efficient ASIC miners is vital for maintaining a competitive edge. Upgrades can significantly improve the hash rate and reduce energy consumption.

- Capacity Additions: Expansion plans, including the addition of new mining facilities and equipment, will have a direct impact on the company’s overall hash rate and mining capacity. (Note: Specific data on hash rate, energy consumption, and capacity additions would be included here.) Keywords: Hash rate, mining efficiency, mining capacity expansion, energy consumption, ASIC miners.

Bitcoin Holdings and Strategy

Riot Platforms holds a significant amount of Bitcoin, impacting its overall valuation and financial flexibility.

- Bitcoin Treasury Strategy: Understanding how Riot Platforms manages its Bitcoin holdings is crucial. Do they hold for long-term appreciation, or do they plan to sell a portion to fund operations?

- Impact of Bitcoin Price Fluctuations: The value of Riot Platforms' Bitcoin treasury directly correlates with the price of Bitcoin. Significant price swings can significantly impact the company's balance sheet.

- Potential Future Sales: The potential sale of Bitcoin holdings could provide significant liquidity, but it also reduces the long-term value proposition of the company. The company’s strategy around these sales must be considered.

- Transparency and Reporting: Clear and transparent reporting on Bitcoin holdings is vital for investor confidence. Keywords: Bitcoin treasury, Bitcoin holdings, Bitcoin price volatility, cryptocurrency reserves.

Market Analysis and Industry Trends

Cryptocurrency Market Outlook

The overall health of the cryptocurrency market significantly impacts Riot Platforms.

- Bitcoin Price Prediction: While predicting Bitcoin's price is inherently challenging, analyzing market trends and factors influencing its price is crucial.

- Regulatory Developments: Government regulations around cryptocurrencies can have a profound impact on the industry. Changes in regulatory environments can significantly affect Bitcoin mining profitability.

- Market Sentiment: Investor sentiment, both bullish and bearish, directly impacts the price of Bitcoin and, consequently, Riot Platforms' stock price.

- Bitcoin Adoption: Increased adoption of Bitcoin and cryptocurrencies globally contributes to the growth of the entire market, benefiting mining companies like Riot Platforms. Keywords: Bitcoin price prediction, cryptocurrency market outlook, regulatory environment, Bitcoin adoption, market sentiment.

Competition and Industry Landscape

Riot Platforms operates in a competitive landscape.

- Key Competitors: Identifying Riot Platforms' main competitors and their market share is important for assessing the company’s competitive position.

- Competitive Advantages: Analyzing Riot Platforms' competitive advantages, such as its mining efficiency, energy costs, or strategic partnerships, is vital for understanding its long-term prospects.

- Market Share: Riot Platforms’ market share within the Bitcoin mining industry is a key indicator of its success and future growth potential.

- Industry Consolidation: The potential for industry consolidation through mergers and acquisitions needs to be considered in the competitive analysis. Keywords: Bitcoin mining competition, market share, competitive landscape, industry rivals.

Risk Assessment and Valuation

Key Risks and Challenges

Investing in Riot Platforms stock carries inherent risks.

- Bitcoin Price Volatility: The highly volatile nature of Bitcoin presents a significant risk. Price drops can severely impact the company's revenue and valuation.

- Regulatory Risks: Changes in regulatory frameworks concerning cryptocurrency mining can significantly affect operations and profitability.

- Operational Risks: Malfunctions of mining equipment, power outages, and other operational issues can negatively affect mining output and profitability.

- Energy Costs: Fluctuations in energy prices significantly impact the profitability of Bitcoin mining operations.

- Technological Obsolescence: The rapid pace of technological advancement in the mining industry could render existing equipment obsolete, requiring costly upgrades. Keywords: Investment risk, regulatory risk, Bitcoin price risk, operational risk, financial risk.

Valuation and Investment Thesis

Determining Riot Platforms' intrinsic value is crucial for making an informed investment decision.

- Discounted Cash Flow Analysis: A discounted cash flow (DCF) analysis can provide an estimate of the company's intrinsic value based on projected future cash flows.

- Comparable Company Analysis: Comparing Riot Platforms' valuation metrics to those of its competitors can offer insights into whether the current stock price is undervalued or overvalued.

- Investment Thesis: Based on the analysis of financials, market conditions, and risks, a clear investment thesis should be formulated justifying a buy, sell, or hold recommendation. (Note: Specific valuation calculations and justifications would be included here.) Keywords: Stock valuation, discounted cash flow, intrinsic value, investment opportunity, buy rating, sell rating, hold rating.

Conclusion: Should You Buy Riot Platforms Stock at 52-Week Lows?

This analysis has examined Riot Platforms' financial performance, market position, and inherent risks. While the company benefits from the potential growth of the cryptocurrency market and its established position in Bitcoin mining, significant risks remain, primarily related to Bitcoin price volatility and regulatory uncertainty. The current 52-week low price presents a potential opportunity for long-term investors with a high-risk tolerance. However, a thorough understanding of these risks is crucial before investing. Based on the analysis, a [Buy/Sell/Hold] recommendation is warranted at this time. (Note: This should be replaced with a specific recommendation justified by the analysis presented above.) Remember to conduct your own thorough research and consider your personal risk tolerance before making any investment decisions regarding Riot Platforms stock. For further information, please visit the Riot Platforms investor relations page and consult reputable financial news sources.

Featured Posts

-

Emission Matinale Mathieu Spinosi Joue Du Violon

May 03, 2025

Emission Matinale Mathieu Spinosi Joue Du Violon

May 03, 2025 -

Middle Managers The Unsung Heroes Of Business Growth And Employee Development

May 03, 2025

Middle Managers The Unsung Heroes Of Business Growth And Employee Development

May 03, 2025 -

Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Kyries Diatakseis Kai Stoxoi

May 03, 2025

Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Kyries Diatakseis Kai Stoxoi

May 03, 2025 -

Rupert Lowe On X Analyzing The Reach And Impact Of His Message On Uk Reform

May 03, 2025

Rupert Lowe On X Analyzing The Reach And Impact Of His Message On Uk Reform

May 03, 2025 -

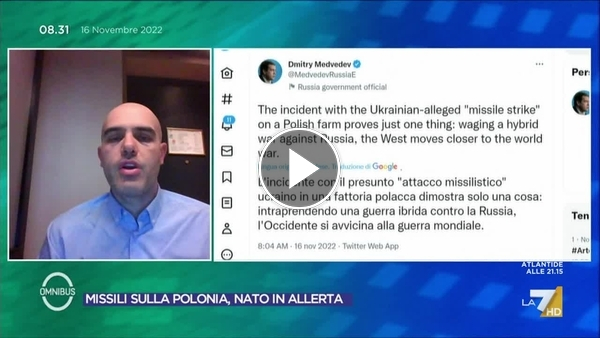

La Strategia Di Medvedev Russofobia Missili E La Risposta Dell Unione Europea

May 03, 2025

La Strategia Di Medvedev Russofobia Missili E La Risposta Dell Unione Europea

May 03, 2025

Latest Posts

-

A New Direction For Reform The Case For Rupert Lowe

May 04, 2025

A New Direction For Reform The Case For Rupert Lowe

May 04, 2025 -

Reform Party Leadership Debate Farage Vs Lowe

May 04, 2025

Reform Party Leadership Debate Farage Vs Lowe

May 04, 2025 -

Replacing Farage Arguments For Rupert Lowe Leading Reform

May 04, 2025

Replacing Farage Arguments For Rupert Lowe Leading Reform

May 04, 2025 -

Affordable Housing Progress In Tomatin Schoolchildren Participate In Groundbreaking Ceremony

May 04, 2025

Affordable Housing Progress In Tomatin Schoolchildren Participate In Groundbreaking Ceremony

May 04, 2025 -

Tomatin Pupils Celebrate Groundbreaking Of New Affordable Housing In Strathdearn

May 04, 2025

Tomatin Pupils Celebrate Groundbreaking Of New Affordable Housing In Strathdearn

May 04, 2025