Is "The Real Safe Bet" Your Next Investment? A Practical Guide

Table of Contents

Understanding "The Real Safe Bet" - Defining Low-Risk Investments

What constitutes a "safe bet" in the investment world? It's crucial to understand that while "no-risk" investments are rare, low-risk investments prioritize capital preservation over high-growth potential. This involves aligning your investments with your risk tolerance – your comfort level with potential losses. Your personal financial goals significantly influence your investment strategy; long-term goals might tolerate more risk than short-term needs.

-

Low-risk vs. No-risk: The difference is subtle but crucial. Low-risk investments aim to minimize potential losses, but still carry some degree of uncertainty. No-risk investments, like keeping cash under your mattress, offer no return beyond the initial investment's value, potentially losing purchasing power over time due to inflation.

-

Examples of Low-Risk Investments: Several options provide relatively safe harbors for your capital:

- Government Bonds: Issued by governments, these bonds generally offer lower returns but are considered very safe due to the backing of the issuing entity.

- High-Yield Savings Accounts: These accounts offer higher interest rates than standard savings accounts, providing a safe place to park your money and earn interest.

- Index Funds: These funds track a specific market index (like the S&P 500), offering diversification and relatively stable growth potential over the long term. They are generally considered lower risk than individual stocks.

-

Diversification: Don't put all your eggs in one basket! Diversifying your portfolio across different asset classes (bonds, stocks, real estate, etc.) reduces the impact of any single investment's poor performance. This is a cornerstone of effective risk management.

Analyzing the Potential Returns of "The Real Safe Bet"

The potential returns of "The Real Safe Bet" – a low-risk investment strategy – are naturally lower than higher-risk options. While the allure of quick riches is tempting, consistent, albeit slower, growth is often a more reliable path to long-term wealth.

-

Realistic Return Expectations: The returns on low-risk investments like government bonds and high-yield savings accounts are generally modest but predictable. Index funds offer the potential for moderate growth over time, but market fluctuations can impact returns.

-

Inflation's Impact: Inflation erodes the purchasing power of money over time. Therefore, the real return on any investment is its nominal return minus the inflation rate. It's vital to consider this when evaluating the potential returns of "The Real Safe Bet."

-

Comparison with Higher-Risk Options: While high-risk investments like individual stocks or speculative ventures could offer significantly higher returns, they also carry a greater chance of substantial losses. "The Real Safe Bet" prioritizes capital preservation, making it a less volatile but potentially slower-growing option.

The Real Safe Bet vs. Other Investment Strategies

Comparing "The Real Safe Bet" to other investment strategies is crucial for making informed decisions. Each approach presents a unique balance between risk and reward.

- Investment Comparison Table:

| Investment Strategy | Risk Level | Potential Return | Liquidity | Suitability |

|---|---|---|---|---|

| The Real Safe Bet (e.g., Government Bonds, Index Funds) | Low | Moderate | Moderate | Conservative investors, long-term goals |

| Stock Market | High | High | High | Aggressive investors, higher risk tolerance |

| Real Estate | Moderate | Moderate to High | Low | Moderate risk tolerance, long-term outlook |

| Mutual Funds | Varies | Varies | High | Depends on fund's investment strategy |

-

Investor Profiles: Aggressive investors comfortable with substantial risk might prefer stocks, while conservative investors prioritizing capital preservation might favor "The Real Safe Bet."

-

Long-Term Growth: While "The Real Safe Bet" may not offer the same explosive growth potential as some higher-risk strategies, its consistent, albeit slower, growth can be highly effective for building wealth over the long term.

Considering Fees and Expenses

Investment fees and expenses can significantly impact your overall returns. It's crucial to understand these costs before committing to any strategy.

-

Common Fees: Transaction fees, expense ratios (for mutual funds and ETFs), and management fees (for managed accounts) are all common charges.

-

Impact on Returns: These fees directly reduce your investment's returns. Even small fees can accumulate over time, eroding your profits considerably.

-

Minimizing Investment Costs: Choose low-cost investment vehicles (index funds, ETFs), negotiate fees with financial advisors, and understand all charges before investing.

Practical Steps to Implement "The Real Safe Bet"

Implementing "The Real Safe Bet" involves a structured approach to investment planning.

-

Define Your Investment Goal: What are you saving for? Retirement? A down payment? Clearly defining your goal helps determine your investment timeline and risk tolerance.

-

Diversified Portfolio: Create a portfolio combining different low-risk investment vehicles to mitigate risk and optimize returns.

-

Investment Timeline: A longer timeline allows for greater risk tolerance, potentially leading to higher returns. Short-term goals generally require lower-risk strategies.

-

Seek Professional Advice: Consider consulting a qualified financial advisor to create a personalized investment plan tailored to your specific needs and risk tolerance.

Conclusion

This guide explored "The Real Safe Bet" investment strategy, examining its potential for secure returns and comparing it to alternative investment options. We highlighted the importance of understanding risk tolerance, diversification, and the associated fees. A balanced approach, considering your financial goals and risk tolerance, is crucial for successful investing.

Call to Action: Ready to secure your financial future with a "safe bet"? Learn more about crafting a low-risk investment strategy that aligns with your goals. Start exploring "The Real Safe Bet" today and take control of your financial well-being!

Featured Posts

-

Is Young Thugs Back Outside Album Really Coming Soon A Look At The Evidence

May 10, 2025

Is Young Thugs Back Outside Album Really Coming Soon A Look At The Evidence

May 10, 2025 -

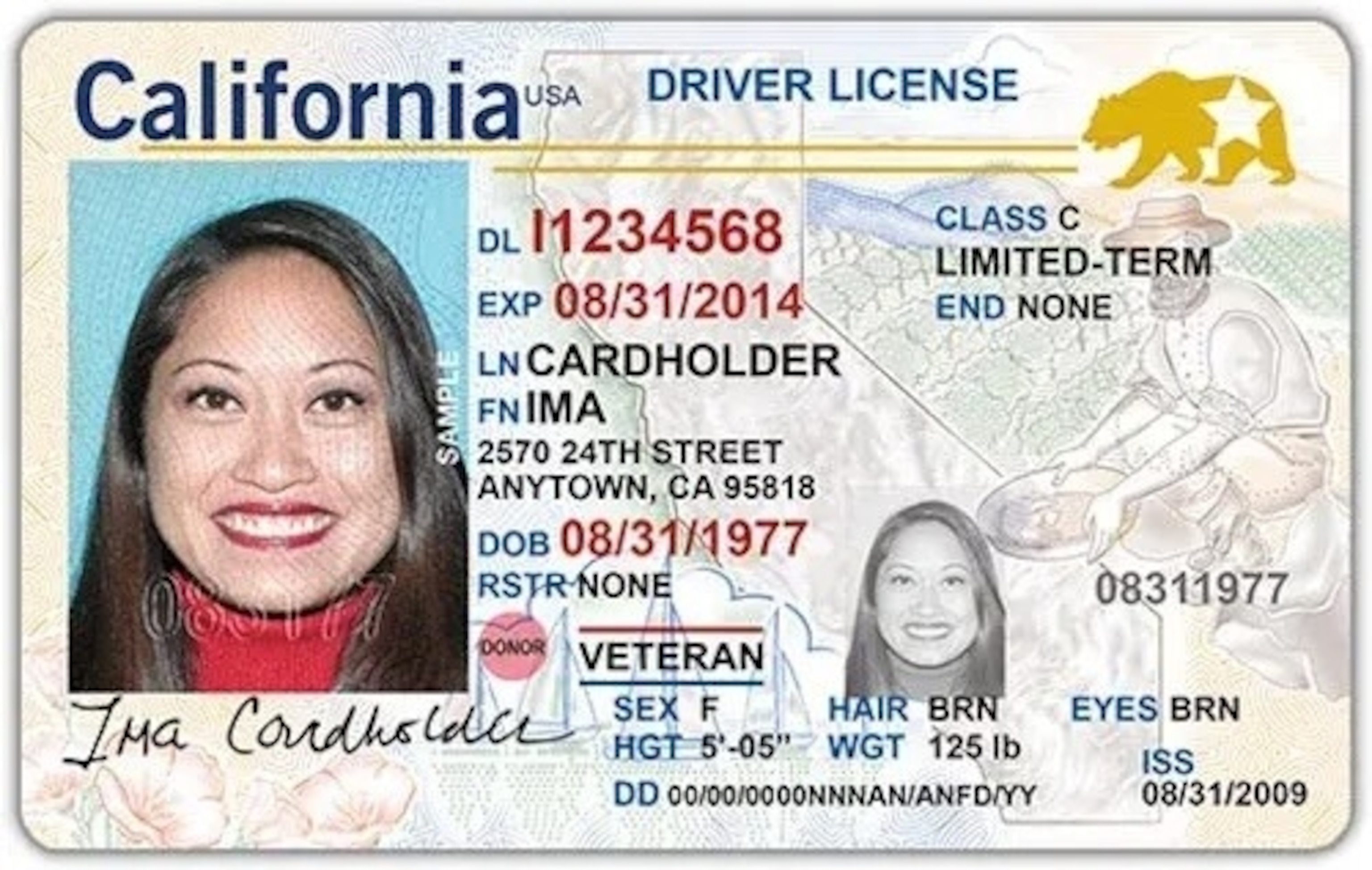

Summer Travel 2024 Navigating The New Real Id Requirements

May 10, 2025

Summer Travel 2024 Navigating The New Real Id Requirements

May 10, 2025 -

Elon Musks Net Worth A Reflection Of The Us Economic Landscape

May 10, 2025

Elon Musks Net Worth A Reflection Of The Us Economic Landscape

May 10, 2025 -

International Transgender Day Of Visibility 3 Ways To Show Allyship

May 10, 2025

International Transgender Day Of Visibility 3 Ways To Show Allyship

May 10, 2025 -

Hills Shutout Performance Leads Golden Knights To 4 0 Victory Over Blue Jackets

May 10, 2025

Hills Shutout Performance Leads Golden Knights To 4 0 Victory Over Blue Jackets

May 10, 2025

Latest Posts

-

5 Reasons For Todays Significant Increase In Sensex And Nifty 50

May 10, 2025

5 Reasons For Todays Significant Increase In Sensex And Nifty 50

May 10, 2025 -

Sensex And Nifty Today Key Highlights And Market Analysis

May 10, 2025

Sensex And Nifty Today Key Highlights And Market Analysis

May 10, 2025 -

Sensex And Nifty Surge Understanding The 1 400 And 23 800 Point Rise

May 10, 2025

Sensex And Nifty Surge Understanding The 1 400 And 23 800 Point Rise

May 10, 2025 -

Is Palantir Stock A Buy Before May 5th A Wall Street Analysis

May 10, 2025

Is Palantir Stock A Buy Before May 5th A Wall Street Analysis

May 10, 2025 -

Indian Stock Market Rally 5 Key Factors Behind Sensex And Niftys Sharp Gains

May 10, 2025

Indian Stock Market Rally 5 Key Factors Behind Sensex And Niftys Sharp Gains

May 10, 2025