Is This Hot New Investment A Retirement Risk?

Table of Contents

Understanding the Appeal of Cryptocurrency

High Potential Returns

Cryptocurrency's popularity stems largely from its potential for incredibly high returns on investment (ROI). The astronomical gains witnessed by early adopters have fueled widespread interest, creating a narrative of overnight riches.

- Examples of Past Gains: Bitcoin, for example, experienced a price surge from under $1,000 in 2017 to nearly $70,000 in late 2021, representing a phenomenal increase in value. Other altcoins have also seen explosive growth periods.

- Potential Future Growth Scenarios: Some analysts predict continued growth in the cryptocurrency market, driven by factors like increasing adoption by businesses and institutions, technological advancements, and the potential for wider regulatory acceptance. However, these predictions are highly speculative.

- Early Adopter Success Stories: Numerous documented cases exist of individuals who achieved significant wealth through early investment in Bitcoin and other cryptocurrencies. However, these are exceptional cases and don't represent the typical investor experience.

Accessibility and Ease of Entry

One of cryptocurrency's key attractions is its accessibility. Unlike traditional investments, individuals can access and participate in the crypto market with relatively low barriers to entry.

- Low Minimum Investment Requirements: Many cryptocurrency exchanges allow users to invest with relatively small amounts of money.

- User-Friendly Platforms: Numerous user-friendly platforms and mobile apps make buying, selling, and trading cryptocurrencies relatively straightforward.

Assessing the Retirement Risks Associated with Cryptocurrency

Volatility and Market Fluctuations

Cryptocurrency markets are notoriously volatile, exhibiting significant price swings in short periods. This inherent instability presents a substantial retirement risk.

- Examples of Past Crashes: The cryptocurrency market has experienced several dramatic crashes, with prices plummeting by significant percentages in relatively short timeframes. These crashes can wipe out substantial portions of an investor's portfolio.

- Correlation with Other Market Indicators: While often touted as a hedge against traditional markets, cryptocurrency's price can be correlated with broader market trends, meaning a downturn in the stock market could negatively impact crypto values.

- Lack of Regulation: The lack of comprehensive regulation in many jurisdictions introduces additional uncertainty and risk.

Lack of Diversification

Concentrating a significant portion of your retirement savings in a single, high-risk asset class like cryptocurrency is exceptionally dangerous. Diversification is crucial for mitigating risk.

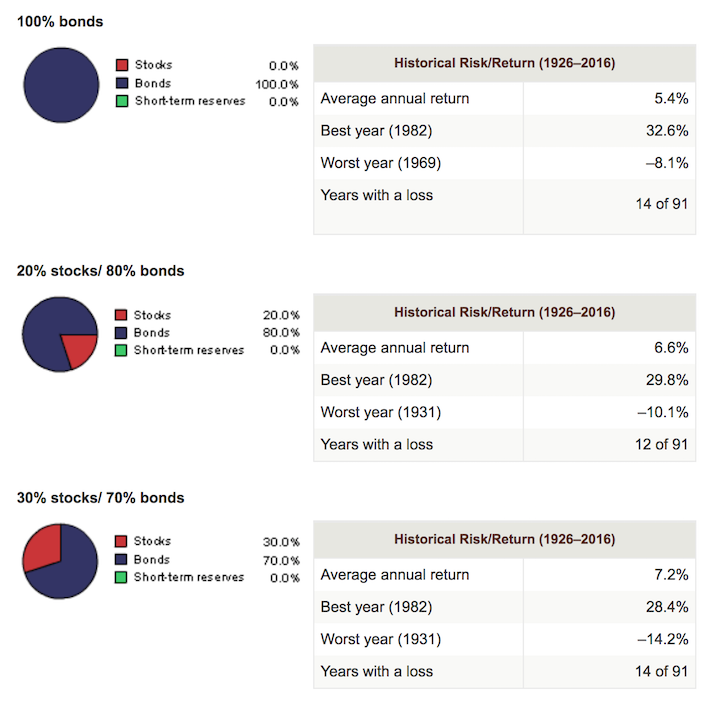

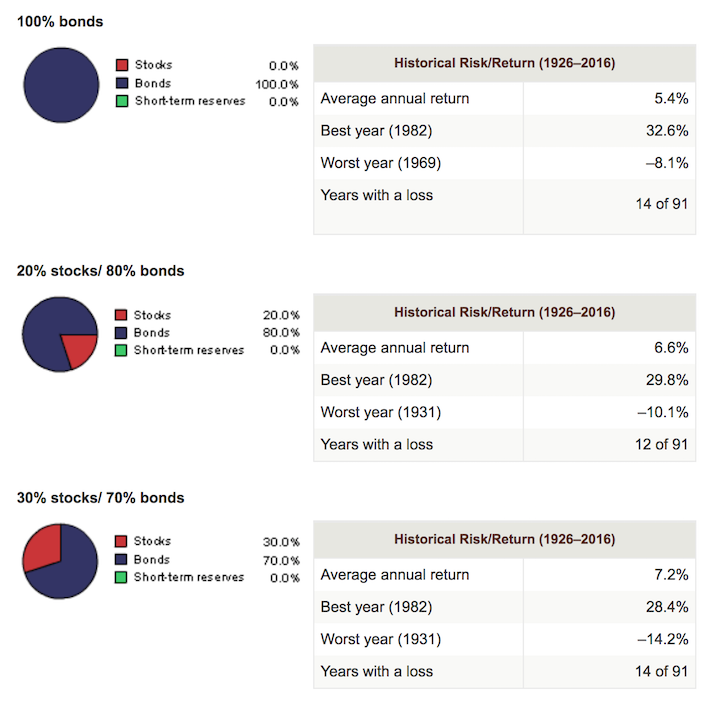

- Importance of Diversification: A well-diversified portfolio spreads risk across various asset classes, reducing the impact of losses in any single investment.

- Comparison with More Stable Investments: Bonds and real estate, for example, offer greater stability and lower volatility compared to cryptocurrencies.

- Risk Tolerance Assessment: Before investing in cryptocurrency, assess your risk tolerance honestly. Cryptocurrency is not suitable for risk-averse investors nearing retirement.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies is constantly evolving, and this uncertainty presents a considerable risk.

- Potential for Government Intervention: Governments worldwide are grappling with how best to regulate cryptocurrencies, and future regulations could significantly impact their value and accessibility.

- Tax Implications: The tax implications of cryptocurrency investments can be complex and vary across jurisdictions, potentially resulting in unexpected tax liabilities.

- Legal Loopholes: The relatively nascent nature of the cryptocurrency market means certain legal loopholes and grey areas exist, exposing investors to potential legal challenges.

Developing a Safe Retirement Investment Strategy

Diversification and Risk Management

A well-diversified investment portfolio is paramount for mitigating retirement risk. Don't put all your eggs in one basket.

- Examples of Asset Allocation Strategies: Consider a balanced portfolio incorporating a mix of stocks, bonds, real estate, and potentially a small allocation to alternative investments like cryptocurrencies (if your risk tolerance allows).

- Risk Tolerance Questionnaires: Online questionnaires can help you assess your risk tolerance, enabling you to make more informed investment decisions.

- Professional Financial Advice: Seeking advice from a qualified financial advisor is highly recommended.

Long-Term Investment Horizons

Different investment strategies are suitable for different timelines. Retirement planning necessitates a long-term perspective.

- Advantages of Long-Term Investing vs. Short-Term Gains: Long-term investing allows for weathering market fluctuations and benefiting from compounding returns. Chasing short-term gains in volatile markets is extremely risky.

- The Importance of Patience: Retirement investing requires patience and discipline. Don't panic-sell during market downturns.

Seeking Professional Financial Advice

Consult a financial advisor to create a personalized retirement plan.

- Benefits of Consulting a Financial Advisor: A financial advisor can help you develop a diversified investment strategy tailored to your individual needs, risk tolerance, and retirement goals.

- Importance of Personalized Investment Plans: Generic investment advice is insufficient. A personalized plan considers your unique circumstances, maximizing returns while minimizing risks.

Conclusion

While cryptocurrency offers the potential for high returns, its volatility and lack of regulation introduce significant retirement risk. The allure of quick riches shouldn't overshadow the importance of a diversified and carefully planned approach to retirement investing. Remember, responsible retirement planning requires a well-diversified strategy and a realistic assessment of your risk tolerance. Don't let the excitement of cryptocurrency jeopardize your retirement security. Consult a financial advisor to develop a strategy that aligns with your goals and risk tolerance and protects your future. Avoid unnecessary cryptocurrency retirement risk by making informed decisions today.

Featured Posts

-

Maneskins Damiano David Rocks Jimmy Kimmel Live Radio 94 5

May 18, 2025

Maneskins Damiano David Rocks Jimmy Kimmel Live Radio 94 5

May 18, 2025 -

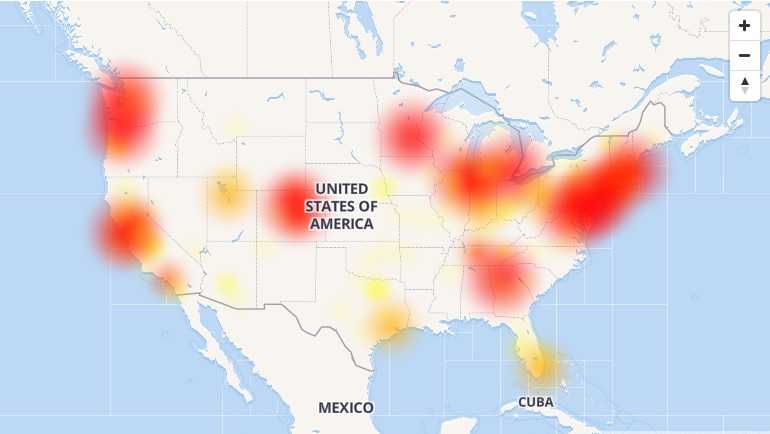

Global Reddit Outage Thousands Of Users Report Issues

May 18, 2025

Global Reddit Outage Thousands Of Users Report Issues

May 18, 2025 -

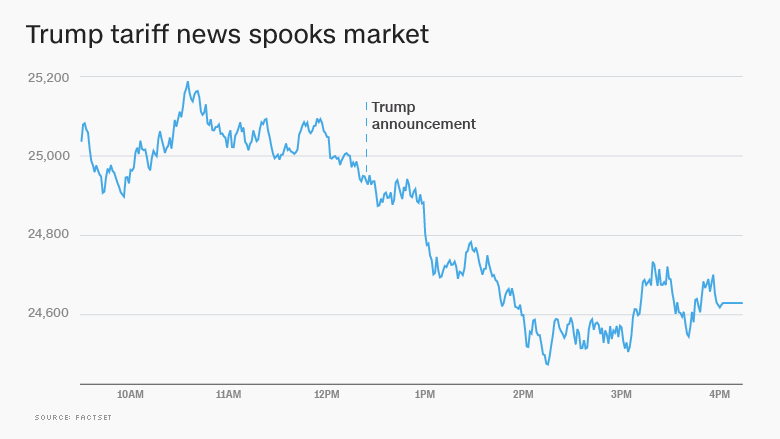

Indias Tariff Concessions Trumps Reaction And Next Steps

May 18, 2025

Indias Tariff Concessions Trumps Reaction And Next Steps

May 18, 2025 -

White Sox Fall To Angels 1 0 Sorianos Outstanding Performance

May 18, 2025

White Sox Fall To Angels 1 0 Sorianos Outstanding Performance

May 18, 2025 -

Damiano Davids Funny Little Fears An Album Review

May 18, 2025

Damiano Davids Funny Little Fears An Album Review

May 18, 2025

Latest Posts

-

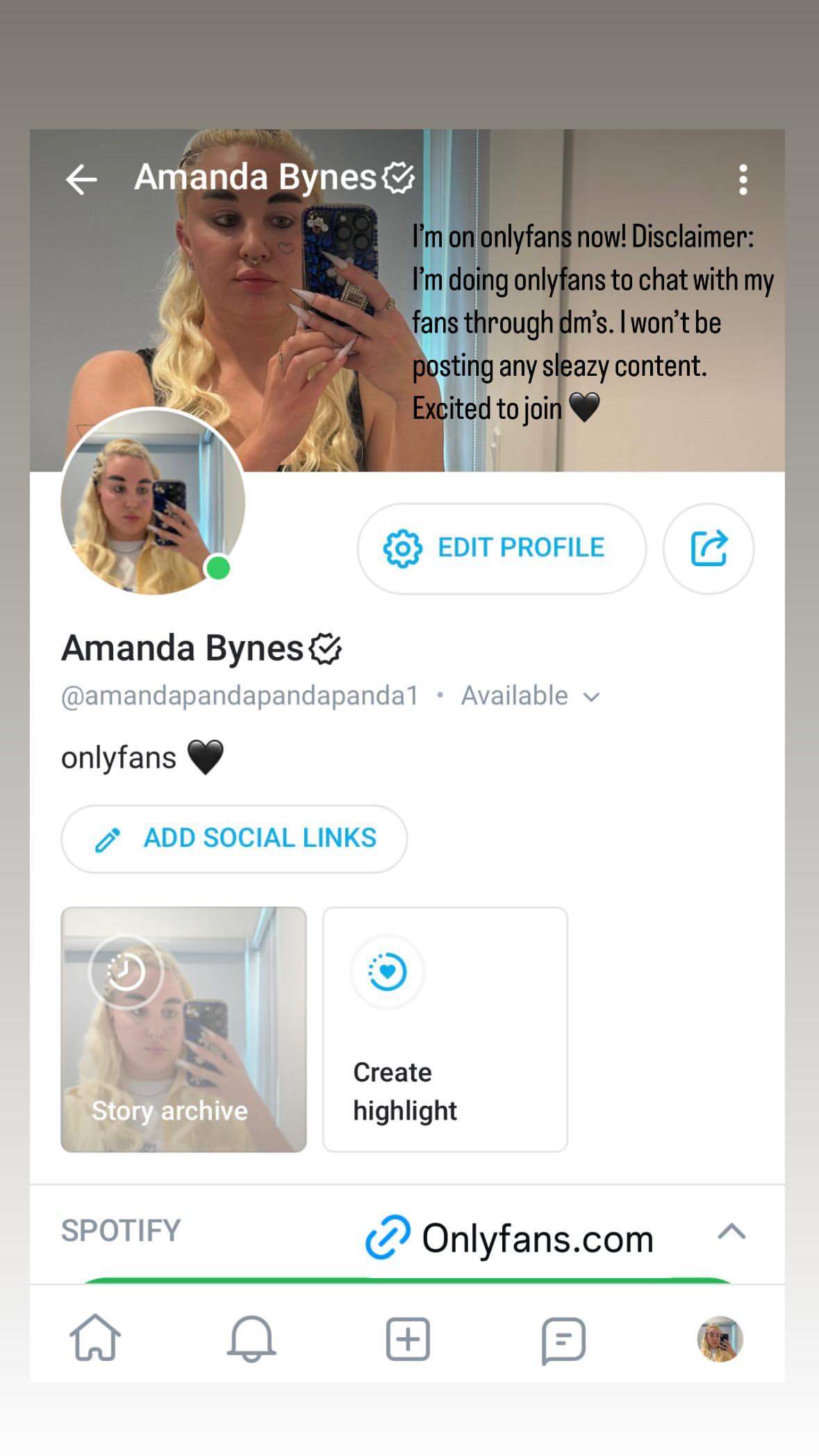

Amanda Bynes Only Fans Debut Seeking Stability After Hollywood

May 18, 2025

Amanda Bynes Only Fans Debut Seeking Stability After Hollywood

May 18, 2025 -

Amanda Bynes Only Fans What To Expect And Recent Sightings

May 18, 2025

Amanda Bynes Only Fans What To Expect And Recent Sightings

May 18, 2025 -

Amanda Bynes Seen With Friend After Only Fans Announcement

May 18, 2025

Amanda Bynes Seen With Friend After Only Fans Announcement

May 18, 2025 -

New Photos Amanda Bynes After Joining Only Fans

May 18, 2025

New Photos Amanda Bynes After Joining Only Fans

May 18, 2025 -

Amanda Bynes Only Fans Debut Photos And Details Revealed

May 18, 2025

Amanda Bynes Only Fans Debut Photos And Details Revealed

May 18, 2025