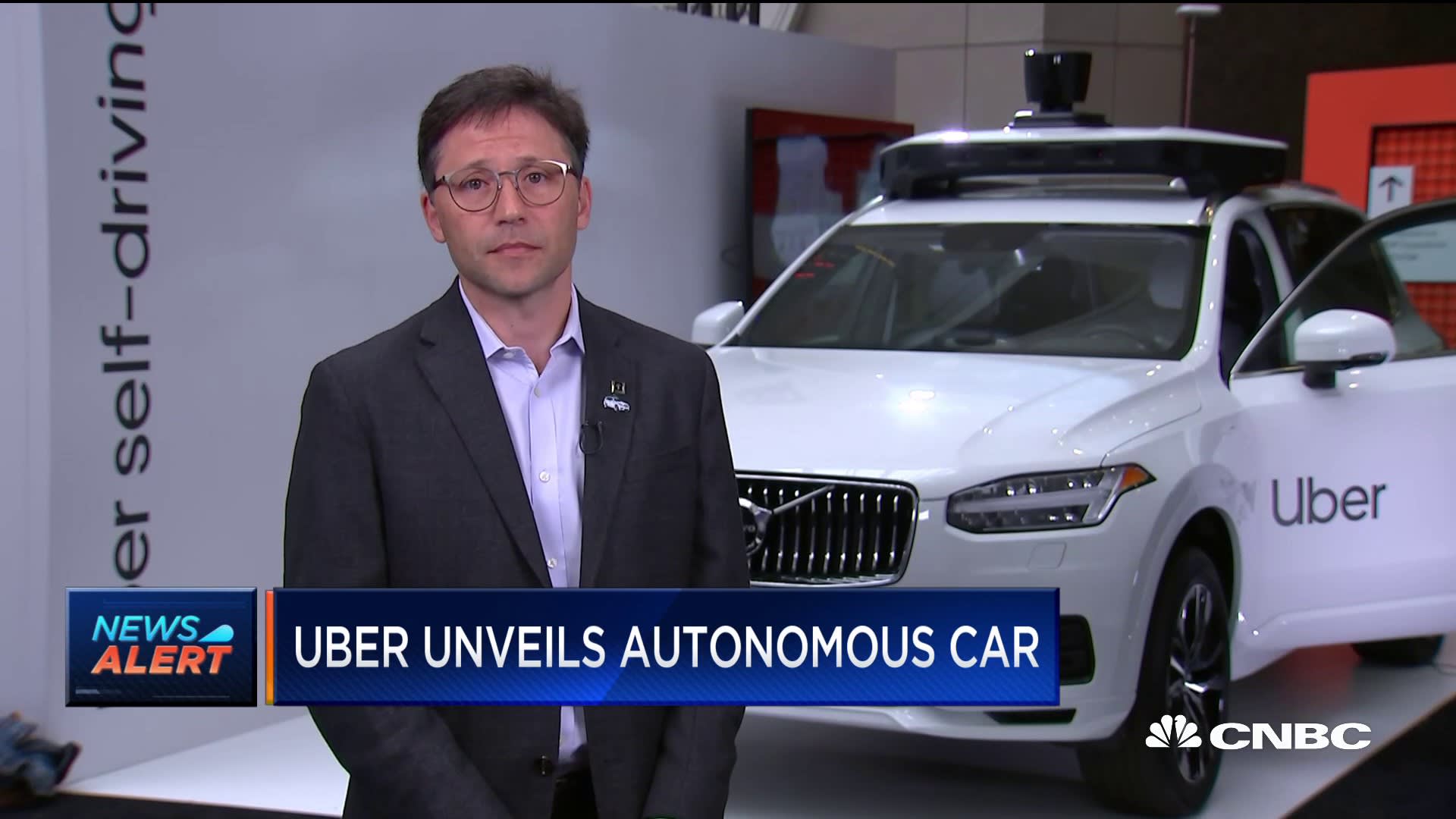

Is Uber's Autonomous Driving Technology A Smart ETF Investment?

Table of Contents

Uber's Autonomous Vehicle Technology: Current State and Future Potential

Uber's foray into autonomous driving represents a significant investment in its future. While not yet fully autonomous, their technology has made notable strides. They've invested heavily in research and development, collaborating with various tech companies and engineering firms to develop their self-driving systems.

- Level of autonomy achieved: Uber's technology is currently at a Level 4 autonomy stage in select areas, meaning it can operate without human intervention under specific conditions. Reaching Level 5, fully autonomous operation in all conditions, remains a significant technological hurdle.

- Geographic areas of testing and deployment: Uber's autonomous vehicles are currently undergoing testing and limited deployment in several cities across the United States, including Pittsburgh and San Francisco. Expansion to other regions is planned but dependent on technological advancements and regulatory approvals.

- Technological challenges: Significant challenges remain. Ensuring safety in unpredictable real-world conditions, refining software reliability to eliminate errors, and adapting to diverse infrastructure needs are key hurdles. Addressing concerns about cybersecurity and data privacy are also crucial.

- Recent breakthroughs and setbacks: While Uber has experienced setbacks, including accidents and regulatory scrutiny, they continue to invest in research, aiming to overcome these challenges and improve the safety and reliability of their self-driving systems.

Successful deployment of autonomous vehicles, including robotaxis operated by companies like Uber, could drastically reshape urban transportation, creating a potentially massive market for self-driving car technology and autonomous transportation services.

ETF Investment Opportunities in Autonomous Driving

Accessing the potentially lucrative autonomous driving market doesn't require direct investment in individual companies. Exchange-Traded Funds (ETFs) offer a diversified approach to investing in this rapidly evolving sector.

- Specific ETFs: Several ETFs offer exposure to companies involved in autonomous vehicle technology. While specific tickers can change, look for ETFs that focus on technology, robotics, and artificial intelligence. Research ETFs carefully to understand their holdings and weightings.

- Advantages of ETF investing: ETFs provide diversification, allowing you to spread risk across multiple companies involved in various aspects of the autonomous driving ecosystem. They are also highly liquid, making it easy to buy and sell shares.

- Types of ETFs to consider: Thematic ETFs focused specifically on autonomous vehicles or broader technology ETFs with significant holdings in related companies are options.

- Factors to consider: Pay attention to the ETF's expense ratio (fees), its holdings (which companies it invests in), and its past performance. Always carefully review the prospectus before investing.

- Potential risks: Investing in this sector through ETFs still carries risks. Market volatility in the technology sector can lead to significant price swings, and regulatory uncertainty could negatively impact the industry's growth.

Keywords like "autonomous vehicle ETF," "robotaxi ETF," "self-driving car ETF," and "technology ETF" are crucial for finding suitable investment vehicles.

Competitive Landscape and Regulatory Hurdles

Uber faces stiff competition in the autonomous vehicle space. Companies like Waymo (Alphabet's self-driving car project) and Tesla, with their Autopilot system, are major players. The competitive landscape is dynamic, with companies vying for market share and technological dominance.

- Competitive advantages and disadvantages: Uber's existing ride-hailing network gives it a potential advantage in deploying robotaxis, but its technology might lag behind some competitors in certain areas.

- Impact of regulatory changes: Government regulations regarding safety, liability, and data privacy significantly impact the autonomous driving industry. Changes in legislation can create both opportunities and challenges.

- Potential for legislative delays or setbacks: The regulatory landscape is complex and constantly evolving. Delays or setbacks in obtaining necessary approvals can hinder the growth and profitability of companies in this sector.

Navigating the complexities of "autonomous vehicle competition," "robotaxi regulation," and "self-driving car legislation" is crucial for informed investment decisions.

Financial Performance and Investment Risks

Analyzing Uber's financial performance related to its autonomous driving division is challenging due to the limited public disclosure of specific financial data related to this segment. However, it’s important to understand the inherent risks:

- Potential for high growth, but also significant losses: The autonomous vehicle market holds immense potential for growth, but considerable investment is required, leading to potential significant losses in the short term.

- Long-term vs. short-term investment horizons: Investing in autonomous driving technology is generally considered a long-term strategy. Short-term returns may be volatile and unpredictable.

- Impact of technological breakthroughs and failures: Technological advancements can drive substantial growth, while setbacks and failures can significantly impact investment returns.

Understanding "autonomous vehicle investment risk" and "robotaxi market valuation" is essential for assessing the potential ROI.

Conclusion

Investing in Uber's autonomous driving technology through ETFs presents both exciting opportunities and significant risks. While the potential for long-term growth in the autonomous vehicle market is substantial, investors should carefully weigh the competitive landscape, regulatory uncertainties, and inherent financial risks. Thorough research, a diversified investment strategy, and a long-term perspective are crucial when evaluating whether an autonomous vehicle ETF aligns with your investment goals. Make informed decisions about your autonomous driving ETF investments.

Featured Posts

-

Nba Referee Error Knicks Victory Overshadowed By Missed Foul Call

May 17, 2025

Nba Referee Error Knicks Victory Overshadowed By Missed Foul Call

May 17, 2025 -

Jalen Brunsons Return A Game Changer For Knicks Pistons Playoff Matchup

May 17, 2025

Jalen Brunsons Return A Game Changer For Knicks Pistons Playoff Matchup

May 17, 2025 -

Vercel And La Liga Clash Over Piracy Blocking And Censorship

May 17, 2025

Vercel And La Liga Clash Over Piracy Blocking And Censorship

May 17, 2025 -

Everton Vina 0 0 Coquimbo Unido Resultado Resumen Y Goles Del Partido

May 17, 2025

Everton Vina 0 0 Coquimbo Unido Resultado Resumen Y Goles Del Partido

May 17, 2025 -

New Pictures Spark Tom Cruise And Ana De Armas Dating Speculation In England

May 17, 2025

New Pictures Spark Tom Cruise And Ana De Armas Dating Speculation In England

May 17, 2025

Latest Posts

-

Brutal Clippers Loss Ends Knicks Playoff Bid

May 17, 2025

Brutal Clippers Loss Ends Knicks Playoff Bid

May 17, 2025 -

Crystal Palace Vs Nottingham Forest En Directo

May 17, 2025

Crystal Palace Vs Nottingham Forest En Directo

May 17, 2025 -

Knicks Collapse Last Minute Playoff Hopes Dashed By Clippers

May 17, 2025

Knicks Collapse Last Minute Playoff Hopes Dashed By Clippers

May 17, 2025 -

Compliance And Disclosure Within Proxy Statements Form Def 14 A

May 17, 2025

Compliance And Disclosure Within Proxy Statements Form Def 14 A

May 17, 2025 -

Interpreting Proxy Statements Form Def 14 A Tips And Best Practices

May 17, 2025

Interpreting Proxy Statements Form Def 14 A Tips And Best Practices

May 17, 2025