Klarna US IPO: 24% Revenue Increase Announced

Table of Contents

Klarna's 24% Revenue Increase: A Deep Dive

Klarna's 24% year-over-year revenue increase is a testament to the company's robust growth strategy and the increasing popularity of its BNPL services. This significant jump positions Klarna favorably ahead of its planned US IPO.

Breakdown of the Revenue Figures

While the exact figures may vary depending on the reporting period, let's assume Klarna reported a 24% increase on a previously stated revenue of $X billion, leading to a new revenue of approximately $X.24 billion. This substantial growth represents a considerable acceleration compared to previous years, indicating a strong upward trend. (Note: Replace 'X' with actual figures if available at the time of writing. Include a chart or graph visually representing this growth if data allows).

Geographic Breakdown of Revenue Growth

While Klarna operates globally, the US market plays a pivotal role in its overall success. A significant portion of the 24% revenue increase is likely attributable to robust growth within the US, reflecting the increasing adoption of BNPL solutions by American consumers. Further regional breakdowns, if released by Klarna, would provide a more detailed picture of the geographic drivers of this success.

- Specific revenue numbers and percentage changes for key regions (e.g., US, Europe, etc.) should be included here if available.

- Key factors contributing to the US growth could include successful marketing campaigns targeted at US consumers, strategic partnerships with major retailers, and a seamless user experience.

- Comparison of US growth to growth in other key markets should be included for context.

Impact of the Revenue Increase on the Klarna US IPO

The 24% revenue increase is undeniably positive news for Klarna's upcoming US IPO. This strong financial performance significantly enhances investor confidence and is likely to translate into a higher valuation for the company.

Investor Sentiment and Market Valuation

The impressive revenue growth significantly strengthens investor sentiment towards Klarna. Potential investors will view this as a clear indication of the company's strong market position and future growth potential. This is likely to lead to increased demand for Klarna shares during the IPO, potentially driving up the share price.

Potential IPO Timing and Pricing

While the exact timing and pricing of the Klarna US IPO remain uncertain, the revenue increase suggests a possible accelerated timeline and a higher-than-anticipated valuation. Market analysts are likely to revise their price targets upwards, reflecting the improved financial outlook.

- Expected IPO date (if available) and potential price range should be discussed here, referencing analyst predictions and market speculation.

- Analysis of investor interest based on pre-IPO activities (e.g., private investments, pre-orders) should be included.

- Potential risks and challenges associated with the IPO, such as market volatility and regulatory scrutiny, should be acknowledged.

Klarna's Competitive Landscape in the US BNPL Market

The US BNPL market is fiercely competitive, with major players like Affirm, Afterpay (now Square), and PayPal vying for market share. Klarna's 24% revenue increase demonstrates its ability to navigate this challenging environment effectively.

Key Competitors and Market Share

Klarna faces stiff competition from established players in the US BNPL market. While precise market share figures fluctuate, Affirm, Afterpay (Square), and PayPal's BNPL services represent significant competitors. Understanding Klarna's position relative to these competitors is crucial for evaluating its IPO prospects.

Klarna's Competitive Advantages

Despite intense competition, Klarna boasts several competitive advantages. Its strong brand recognition, sophisticated technology platform, and extensive partnerships with major retailers contribute to its market leadership.

- Market share data for key players should be included here, if available.

- A comparison of Klarna's features, services, and user experience with those of its main competitors should be provided.

- Analysis of Klarna's strengths, weaknesses, opportunities, and threats (SWOT analysis) would offer further insight.

Klarna US IPO: A Promising Outlook Fueled by Growth

In conclusion, Klarna's 24% revenue increase is a significant development, significantly boosting its prospects for a successful US IPO. This impressive growth demonstrates the company's strong market position and reinforces investor confidence. While uncertainties and challenges remain, the positive financial performance paints a promising picture for Klarna's future. The Klarna US IPO is poised to be a major event in the fintech world, potentially reshaping the landscape of the buy now, pay later market.

Stay tuned for further updates on the Klarna US IPO and its potential to reshape the financial technology landscape. Follow us for the latest news and analysis on Klarna’s progress in the buy now, pay later market. Keep an eye out for our next article covering potential challenges and risks associated with the Klarna IPO.

Featured Posts

-

The Snow White Debacle How Political Messaging Hurt Disneys Bottom Line

May 14, 2025

The Snow White Debacle How Political Messaging Hurt Disneys Bottom Line

May 14, 2025 -

Muere Jose Pepe Mujica Expresidente De Uruguay A Los 89 Anos

May 14, 2025

Muere Jose Pepe Mujica Expresidente De Uruguay A Los 89 Anos

May 14, 2025 -

Fitzgeralds Strong Performance Fuels Giants Win

May 14, 2025

Fitzgeralds Strong Performance Fuels Giants Win

May 14, 2025 -

Ramadan Taiwo Awoniyis Generous Iftar For Nottinghams Muslim Community

May 14, 2025

Ramadan Taiwo Awoniyis Generous Iftar For Nottinghams Muslim Community

May 14, 2025 -

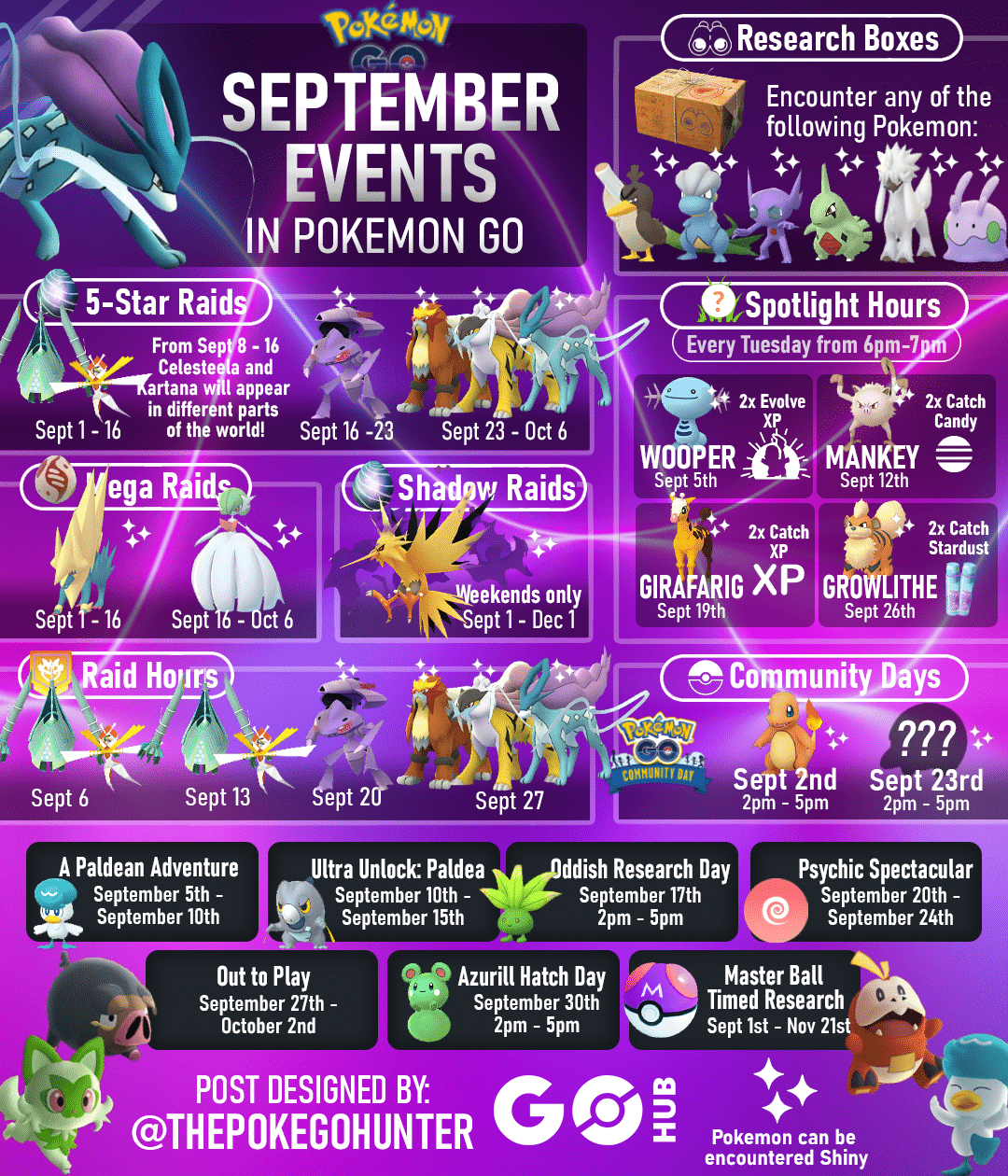

Pokemon Go May 2025 Raid Battles Spotlight Hours And Community Day Schedule

May 14, 2025

Pokemon Go May 2025 Raid Battles Spotlight Hours And Community Day Schedule

May 14, 2025