KRW/USD Forecast: Assessing The Effect Of Trump's Currency Manipulation Claims On The Won

Table of Contents

Trump's Currency Manipulation Accusations and their Initial Impact on the KRW/USD Exchange Rate

During his presidency, Donald Trump repeatedly accused South Korea of manipulating its currency to gain an unfair trade advantage, particularly during the height of the US-China trade war. These accusations, often made alongside threats of tariffs and trade sanctions, significantly impacted the KRW/USD exchange rate. The context was one of escalating global trade tensions, with the US seeking to reduce its trade deficit with several countries, including South Korea.

-

Sharp fluctuations in the KRW/USD exchange rate: The uncertainty created by Trump's rhetoric led to immediate and dramatic swings in the KRW/USD pair. Periods of heightened tension saw the Won depreciate significantly against the dollar.

-

Increased volatility and uncertainty in the foreign exchange market: The constant threat of retaliatory trade measures created a climate of fear and uncertainty, making it difficult for businesses to plan long-term strategies. This volatility impacted investment decisions, both domestic and foreign.

-

Potential flight of foreign investment from South Korea: Concerns about the stability of the South Korean economy and the potential for further trade disputes led some foreign investors to withdraw their capital.

-

Impact on South Korean exports and imports: A weaker Won initially boosted South Korean exports by making them cheaper for international buyers, but the overall uncertainty negatively affected long-term trade planning and investor confidence.

[Insert relevant chart/graph illustrating KRW/USD exchange rate movements during Trump's presidency]

Keywords: US-South Korea trade relations, trade deficit, currency wars, Trump administration economic policy.

Long-Term Effects of the Accusations on the KRW/USD Pair

While the immediate impact of Trump's accusations was substantial, their long-term effects on the KRW/USD exchange rate are still unfolding. Investor sentiment towards the Won remains sensitive to any hint of renewed trade friction between the US and South Korea.

-

Changes in foreign investment patterns in South Korea: While some foreign investment returned after the immediate shock, the uncertainty created by the accusations has likely led to a more cautious approach by investors.

-

Shifting global economic landscape and its influence on the KRW: Global macroeconomic factors, including interest rate changes in the US and the overall strength of the US dollar, continue to exert a strong influence on the KRW/USD exchange rate. The pandemic also played a significant role, impacting global supply chains and demand.

-

The role of Bank of Korea interventions in managing exchange rate volatility: The Bank of Korea has intervened in the foreign exchange market at times to manage the volatility of the Won, attempting to stabilize the currency and maintain confidence.

-

The influence of other global macroeconomic factors on the KRW/USD: Factors such as global inflation, economic growth in both the US and South Korea, and changes in global risk appetite all contribute to KRW/USD fluctuations.

Keywords: Investor confidence, macroeconomic factors, monetary policy, Bank of Korea, interest rates, inflation rates, economic growth.

Factors Influencing the Future KRW/USD Forecast Beyond Trump's Legacy

While Trump's accusations had a significant impact, numerous other factors now shape the KRW/USD forecast.

-

Global economic growth and its impact on demand for the Won: Strong global economic growth generally increases demand for the Won, as South Korea is a major exporter of goods and services.

-

The performance of the US dollar against other major currencies: The strength or weakness of the US dollar relative to other major currencies like the Euro or Yen will significantly influence the KRW/USD exchange rate.

-

Geopolitical risks in the region (e.g., North Korea): Geopolitical instability in the region, particularly concerning North Korea, can create uncertainty and lead to volatility in the KRW/USD pair.

-

Domestic economic policies in South Korea: South Korea's own economic policies, including its monetary policy and fiscal stimulus measures, will significantly influence the Won's performance.

-

Technological advancements and their effect on the South Korean economy: South Korea's technological prowess and its leading role in various high-tech sectors contribute to its economic strength and influence the KRW's value.

Keywords: Global economic outlook, US dollar strength, geopolitical uncertainty, South Korean economic growth, technology sector.

Potential Scenarios for the KRW/USD Exchange Rate

Several scenarios are possible for the KRW/USD exchange rate in the coming years. A scenario of continued global growth and stability could see a gradual appreciation of the Won against the dollar. Conversely, a global economic slowdown or heightened geopolitical risks could lead to a depreciation of the Won. The likelihood of each scenario depends on the interplay of the factors discussed above.

Conclusion

Predicting the precise future movement of the KRW/USD exchange rate remains a complex challenge. This analysis has highlighted the lingering effects of Trump's currency manipulation claims on investor sentiment and the KRW/USD pair, alongside other crucial macroeconomic and geopolitical factors. While the legacy of these accusations continues to influence the market, a broader range of economic indicators and global events now significantly shapes the future outlook. The inherent uncertainty underscores the need for continuous monitoring of these factors. While predicting the precise future movement of the KRW/USD exchange rate remains challenging, understanding the key factors influencing this pair is crucial for informed decision-making. Stay informed on the latest developments and continue monitoring this vital KRW/USD forecast for informed decision-making. Regularly check back for updates on our KRW/USD analysis.

Featured Posts

-

The Importance Of Legal Representation After A Car Accident

Apr 25, 2025

The Importance Of Legal Representation After A Car Accident

Apr 25, 2025 -

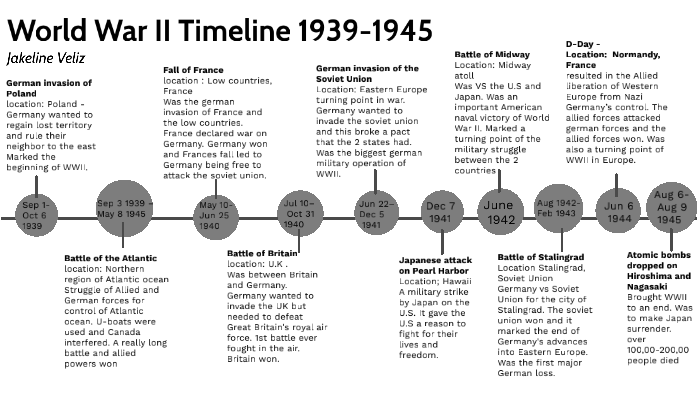

April 1945 A Turning Point In World War Ii

Apr 25, 2025

April 1945 A Turning Point In World War Ii

Apr 25, 2025 -

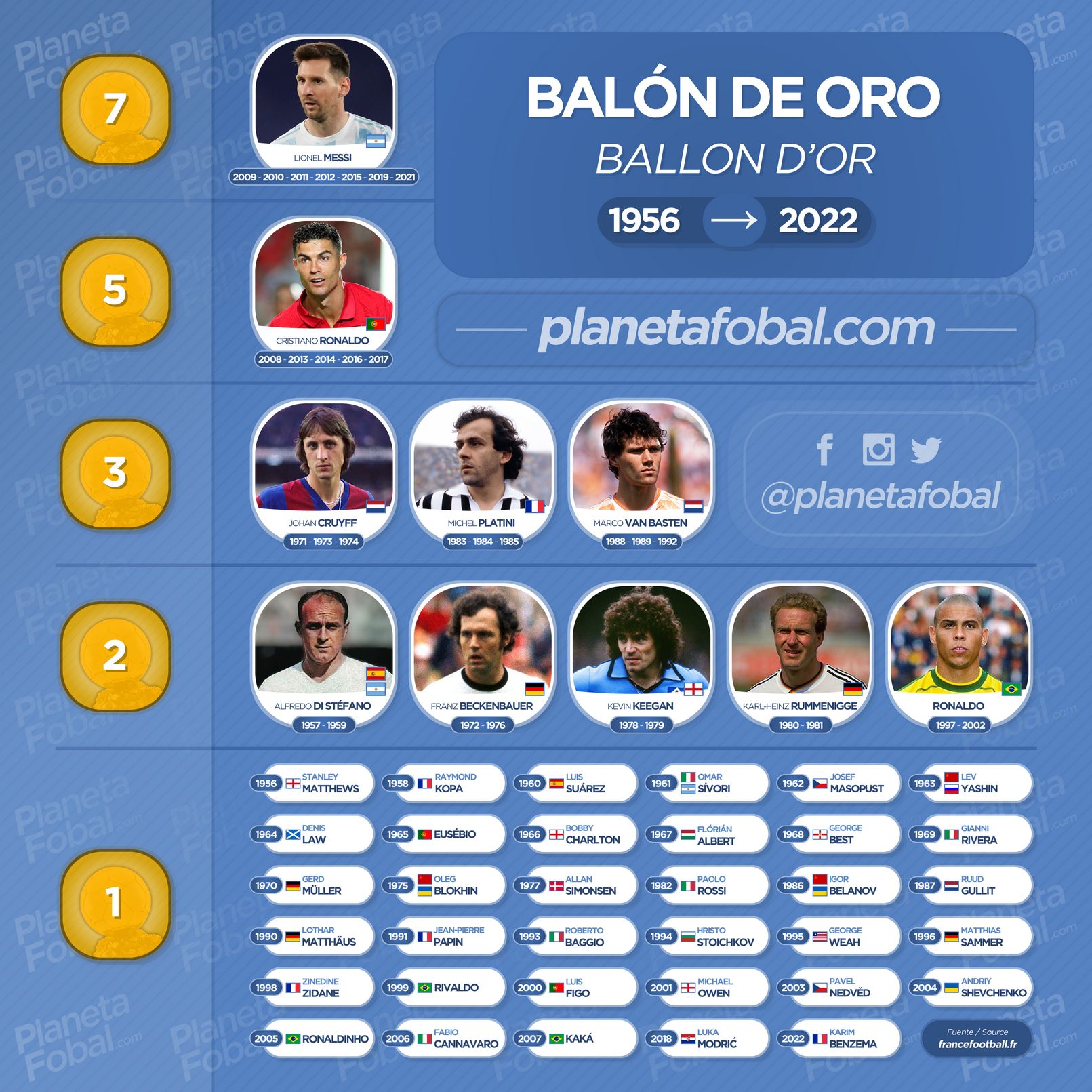

Bota De Oro 2024 25 Clasificacion Actual Y Aspirantes

Apr 25, 2025

Bota De Oro 2024 25 Clasificacion Actual Y Aspirantes

Apr 25, 2025 -

Chinas Prolonged Trade War Strategy Under Xi Jinping

Apr 25, 2025

Chinas Prolonged Trade War Strategy Under Xi Jinping

Apr 25, 2025 -

Ice Storm Causes School Closures In Oklahoma Wednesday

Apr 25, 2025

Ice Storm Causes School Closures In Oklahoma Wednesday

Apr 25, 2025

Latest Posts

-

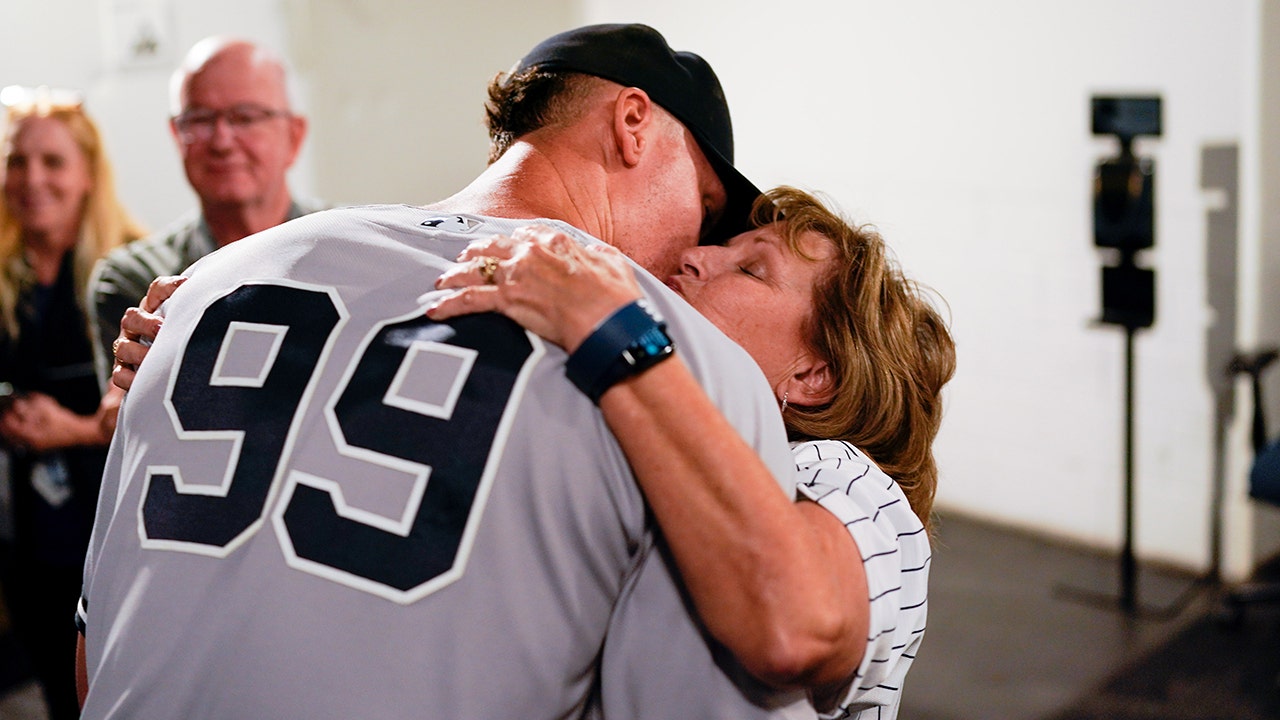

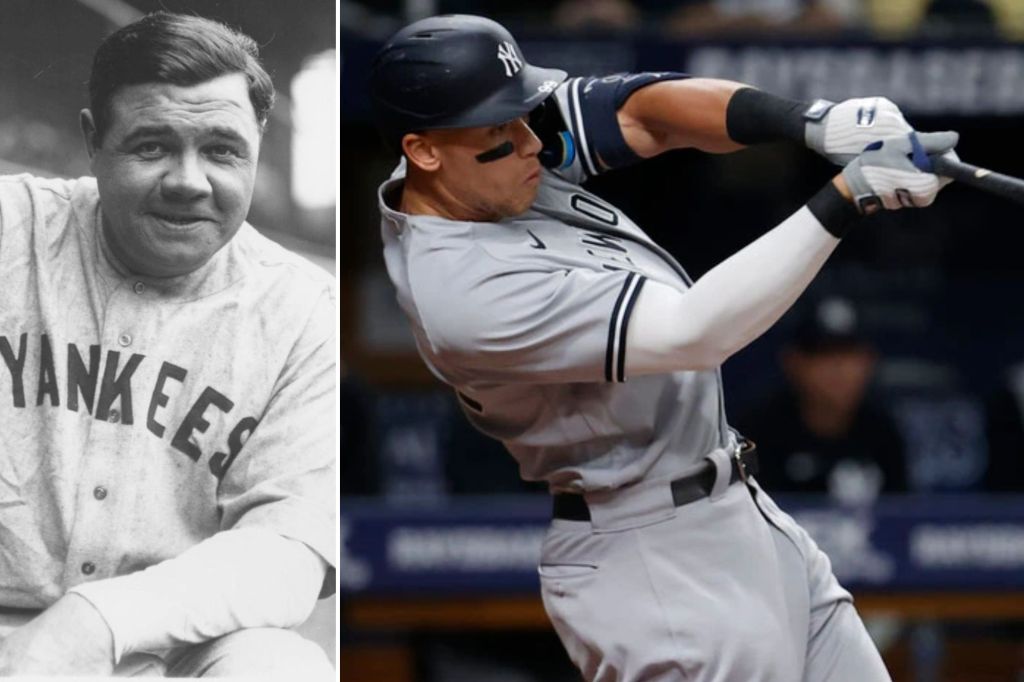

Babe Ruth And Aaron Judge A Yankees Record Tying Feat

Apr 28, 2025

Babe Ruth And Aaron Judge A Yankees Record Tying Feat

Apr 28, 2025 -

Aaron Judges Historic Home Run Matching Babe Ruths Yankees Mark

Apr 28, 2025

Aaron Judges Historic Home Run Matching Babe Ruths Yankees Mark

Apr 28, 2025 -

Yankees Star Aaron Judge Matches Babe Ruths Impressive Record

Apr 28, 2025

Yankees Star Aaron Judge Matches Babe Ruths Impressive Record

Apr 28, 2025 -

Aaron Judge Equals Babe Ruths Legendary Yankees Record

Apr 28, 2025

Aaron Judge Equals Babe Ruths Legendary Yankees Record

Apr 28, 2025 -

Yankees Star Aaron Judge Hints At 2025 With Unique Push Up Celebration

Apr 28, 2025

Yankees Star Aaron Judge Hints At 2025 With Unique Push Up Celebration

Apr 28, 2025