Liberation Day Tariffs: Impact On Donald Trump's Wealthy Associates

Table of Contents

Real Estate Investments and the Impact of Tariffs

The real estate sector, a significant area of investment for many of Trump's associates, felt the pinch of Liberation Day tariffs in several ways.

Increased Construction Costs

Tariffs on imported materials directly increased construction costs. This impacted projects across the board.

- Increased steel and lumber prices: Tariffs significantly raised the price of imported steel and lumber, key components in most construction projects. This led to higher overall project costs.

- Delayed projects: Some projects faced delays due to increased costs and material sourcing difficulties. Developers had to renegotiate contracts or seek alternative, often more expensive, materials.

- Reduced Profitability: The increased costs squeezed profit margins on real estate developments, potentially impacting the overall return on investment for Trump's associates involved in these ventures.

- Example: Reports suggested that the construction of a luxury condominium complex in [City, State] experienced significant cost overruns due to increased steel tariffs, potentially delaying its completion and impacting projected profits.

Diminished Demand Due to Economic Slowdown

The Liberation Day tariffs contributed to an overall economic slowdown, impacting demand for luxury real estate.

- Decreased consumer spending: Tariffs led to higher prices for consumer goods, reducing disposable income and impacting consumer confidence. This decreased demand for high-end properties.

- Economic uncertainty: The uncertainty created by the trade wars discouraged investment in luxury real estate, leading to a slowdown in sales and potentially lower rental yields.

- Example: Data from [Source, e.g., real estate market analysis firm] indicated a noticeable drop in sales of luxury properties in [Specific location] during the period following the imposition of the Liberation Day tariffs. This decline suggests a direct correlation between tariff implementation and decreased demand.

- Impact on Property Values: The decreased demand inevitably led to a potential decrease in property values, reducing the net worth of Trump's associates holding significant real estate portfolios.

Impact on Businesses Involved in International Trade

Many businesses owned by Trump's associates were heavily involved in international trade, making them particularly vulnerable to the Liberation Day tariffs.

Increased Import Costs for Goods and Materials

Businesses relying on imported goods and materials faced substantially higher costs.

- Increased import duties: The tariffs directly increased the cost of importing raw materials, components, and finished goods, impacting manufacturing and distribution businesses.

- Mitigation Strategies: Businesses attempted to mitigate these increased costs by exploring domestic sourcing alternatives, adjusting pricing strategies, or absorbing some of the increased costs to maintain competitiveness.

- Example: A clothing manufacturer owned by a Trump associate that relied on imported textiles saw its production costs increase by [Percentage]% due to the tariffs.

Retaliatory Tariffs and Reduced Export Opportunities

Retaliatory tariffs imposed by other countries negatively affected the export businesses of some of Trump's associates.

- Reduced export demand: Retaliatory tariffs reduced demand for American goods in foreign markets, hurting export-oriented businesses.

- Loss of market share: Businesses lost market share to competitors from countries not affected by retaliatory tariffs.

- Example: [Specific example of a business experiencing reduced exports due to retaliatory tariffs, including specifics like country and product.] This led to a significant drop in revenue and profitability.

Investment Portfolio Diversification and Tariff Resilience

The impact of Liberation Day tariffs varied significantly depending on the level of diversification in the investment portfolios of Trump's associates.

The Role of Diversification in Mitigating Risk

Diversification played a crucial role in minimizing the negative effects of tariffs.

- Reduced exposure: Investors with diversified portfolios, including holdings in sectors less susceptible to tariff impacts (such as technology or healthcare), experienced less significant losses.

- Asset allocation: A well-diversified portfolio mitigates risk by spreading investments across various asset classes, industries, and geographic regions.

Strategic Adjustments and Portfolio Rebalancing

Some associates likely responded to the tariffs by strategically adjusting their investment strategies.

- Portfolio rebalancing: Investors may have rebalanced their portfolios by shifting investments away from sectors heavily impacted by tariffs toward those less affected.

- Risk management: Sophisticated risk management techniques were crucial for navigating the economic uncertainty caused by the tariffs.

Conclusion

Liberation Day tariffs had a complex and multifaceted impact on Donald Trump's wealthy associates. While some experienced increased costs and reduced profitability in their real estate and import/export businesses, others, through strategic diversification and portfolio adjustments, may have been less affected. The overall economic climate created by the tariffs significantly influenced investment outcomes, highlighting the interconnectedness of global trade and domestic financial health. Understanding the effects of Liberation Day Tariffs on this influential group is crucial for analyzing the broader economic ramifications of such policies. Continue exploring the intricacies of tariff impacts and their effects on various sectors by researching further into the economic consequences of trade wars and their repercussions on high-net-worth individuals. Learn more about the complex relationship between Liberation Day Tariffs and the financial well-being of Donald Trump's wealthy associates.

Featured Posts

-

Empowering Transgenders In Punjab Through Technical Training

May 10, 2025

Empowering Transgenders In Punjab Through Technical Training

May 10, 2025 -

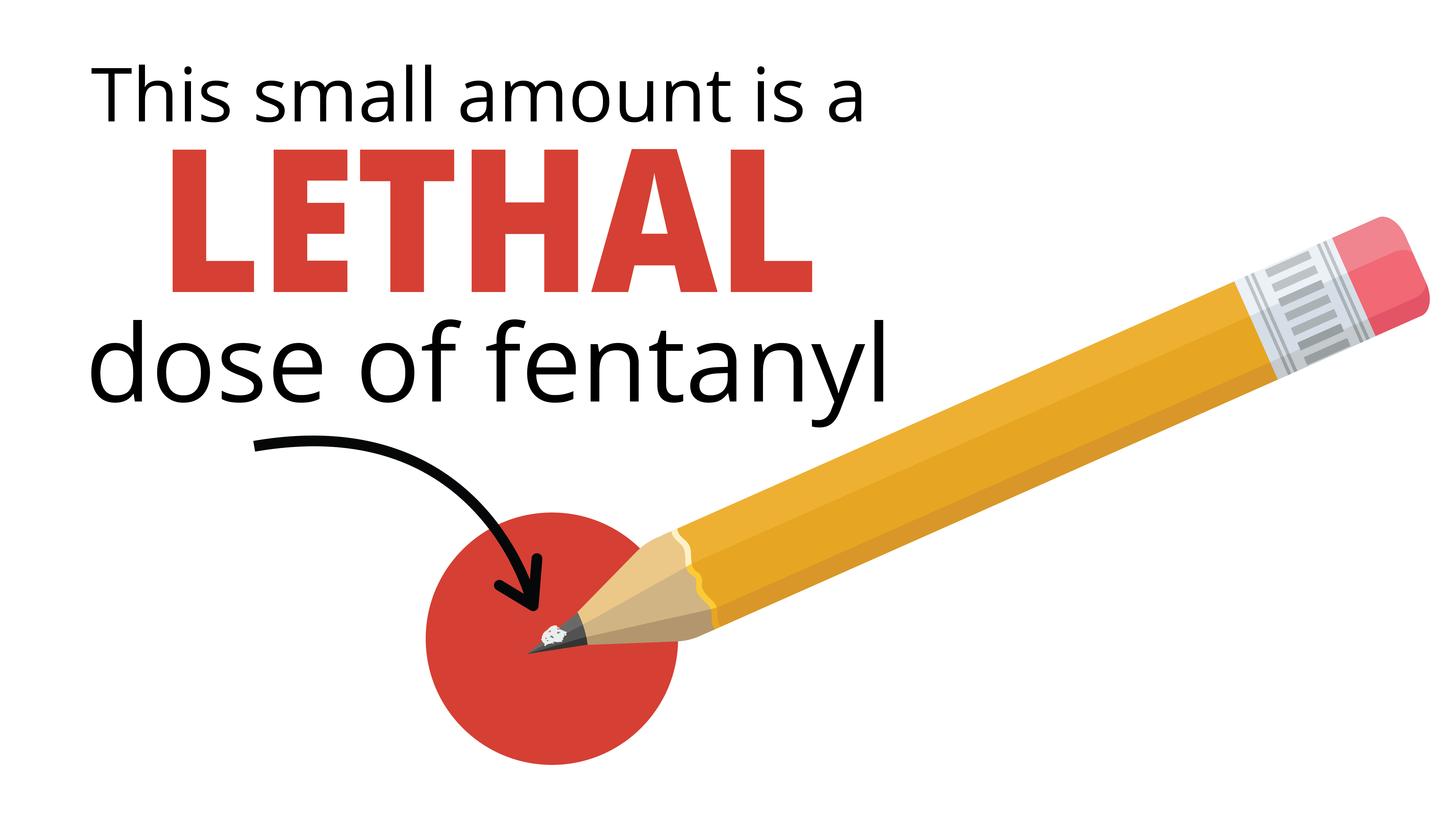

Record Fentanyl Seizure Announced Pam Bondis Update

May 10, 2025

Record Fentanyl Seizure Announced Pam Bondis Update

May 10, 2025 -

Feds Cautious Approach Reasons For Delaying Interest Rate Reductions

May 10, 2025

Feds Cautious Approach Reasons For Delaying Interest Rate Reductions

May 10, 2025 -

Addressing West Hams 25m Financial Gap Strategies And Implications

May 10, 2025

Addressing West Hams 25m Financial Gap Strategies And Implications

May 10, 2025 -

Investigating Us Funding Allocation For Transgender Mouse Research Studies

May 10, 2025

Investigating Us Funding Allocation For Transgender Mouse Research Studies

May 10, 2025

Latest Posts

-

Draisaitls Exceptional Year Edmonton Oilers Star A Hart Trophy Finalist

May 10, 2025

Draisaitls Exceptional Year Edmonton Oilers Star A Hart Trophy Finalist

May 10, 2025 -

Nhls Hart Trophy Finalists Draisaitl Hellebuyck And Kucherov In The Running

May 10, 2025

Nhls Hart Trophy Finalists Draisaitl Hellebuyck And Kucherov In The Running

May 10, 2025 -

Leon Draisaitls Hart Trophy Nomination A Stellar Season For The Edmonton Oilers

May 10, 2025

Leon Draisaitls Hart Trophy Nomination A Stellar Season For The Edmonton Oilers

May 10, 2025 -

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalists Banner Season

May 10, 2025

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalists Banner Season

May 10, 2025 -

Overtime Thriller Oilers Beat Kings Series Tied 1 1

May 10, 2025

Overtime Thriller Oilers Beat Kings Series Tied 1 1

May 10, 2025