Live Stock Market Updates: 80% China Tariffs & UK Trade Deal Analysis

Table of Contents

The Impact of 80% China Tariffs on Global Stock Markets

The 80% China tariffs, implemented as part of ongoing trade disputes, have had a profound effect on global stock markets. This section explores the significant consequences of these tariffs, focusing on the resulting increased costs, reduced competitiveness, and the ensuing market volatility.

Increased Costs and Reduced Competitiveness

The tariffs directly increase the cost of goods imported from China, impacting businesses across various sectors. This leads to reduced competitiveness for companies reliant on Chinese imports or those exporting to China.

- Specific Sectors Impacted: The technology sector, particularly concerning semiconductors and electronics, has been significantly impacted. Manufacturing, including textiles and furniture, has also faced considerable challenges. Agricultural products have also felt the pressure of increased tariffs.

- Price Increases and Market Share Loss: Data from various sources indicates a considerable rise in prices for consumer goods, leading to reduced consumer spending and impacting profitability for businesses. Companies are experiencing market share losses due to reduced competitiveness. For instance, a recent study showed a 15% increase in the price of certain electronic goods following the tariff imposition.

- Ripple Effect on Related Industries and Supply Chains: The impact extends beyond directly affected businesses. Supply chains have been disrupted, causing delays and shortages, creating further challenges for related industries. This ripple effect contributes to overall market instability and uncertainty.

Investor Sentiment and Market Volatility

The uncertainty surrounding the China tariffs has significantly impacted investor sentiment. This uncertainty has caused considerable market fluctuations, as investors grapple with predicting the long-term effects of these trade policies.

- Potential for Market Corrections or Declines: The possibility of market corrections or declines remains a significant concern. Investors are closely monitoring developments to assess the potential impact on their portfolios.

- Strategies to Mitigate Risks: Investors are employing various risk mitigation strategies, including hedging techniques and portfolio diversification to reduce exposure to volatile sectors.

- Relevant News Sources and Market Data: Continuous monitoring of reputable news sources and market data from sources like the Financial Times and Bloomberg is crucial for informed decision-making during periods of heightened market volatility.

Analyzing the UK Trade Deal's Influence on the Live Stock Market

The UK’s post-Brexit trade deal presents both opportunities and challenges for the live stock market. This section analyzes the potential economic benefits and the associated uncertainties.

Potential Economic Growth and Investment Opportunities

The UK trade deal offers access to new markets, potentially boosting economic growth and attracting foreign direct investment. Certain sectors stand to benefit significantly from this newly established trade relationship.

- Sectors Expected to Benefit: The financial services sector and certain manufacturing industries could see increased opportunities due to the deal. Specific sectors that are expected to flourish include the automotive industry and technology companies.

- Increases in Foreign Direct Investment: The deal could attract significant foreign direct investment, stimulating economic activity and boosting market confidence. The government forecasts suggest an increase of approximately X% in FDI within the next three years.

- Official Statements and Forecasts: Statements from government bodies and independent economic forecasts have provided positive projections regarding the potential benefits of the UK trade deal, further influencing market sentiment.

Challenges and Uncertainties

While the UK trade deal offers potential benefits, it also presents challenges and uncertainties that need to be addressed. This requires careful analysis to gauge the overall impact on market performance.

- Negative Impacts on Specific Industries: Some industries may face negative impacts due to adjustments to existing trade relationships. For example, certain agricultural sectors might encounter challenges adapting to new trade regulations.

- Regulatory Hurdles and Logistical Challenges: New regulatory hurdles and logistical challenges may arise, impacting the efficiency and profitability of businesses engaged in UK-related trade. Brexit-related bureaucratic issues could hinder the potential positive impact of the deal.

- Expert Opinions and Analyses: Careful analysis of expert opinions and economic forecasts from reputable sources is essential to understand the complexities and potential risks associated with the UK trade deal.

Overall Market Outlook and Investment Strategies

Considering the combined effects of the China tariffs and the UK trade deal, this section offers a comprehensive market outlook and practical investment strategies.

Synthesizing the Impacts of Tariffs and the Trade Deal

The combined impact of the 80% China tariffs and the UK trade deal creates a complex and dynamic market environment. A balanced perspective is needed to gauge the overall impact on the live stock market.

- Balanced Perspective: While the UK trade deal offers potential growth opportunities, the China tariffs present significant challenges. The net effect on the market depends on the interplay between these two forces.

- Summary of Overall Market Trend: The overall market trend will likely be volatile, with certain sectors experiencing growth while others face challenges. Careful assessment of individual companies and sectors is crucial for informed investment decisions.

Recommendations for Investors

Navigating the current market conditions requires a robust investment strategy tailored to individual risk tolerance and investment goals. Diversification remains a cornerstone of effective risk management.

- Diversification Strategies: Diversifying investments across different asset classes and geographical regions is highly recommended to mitigate potential losses in volatile market conditions.

- Asset Allocation Recommendations: Asset allocation should be adjusted based on individual risk profiles. Investors with higher risk tolerance may allocate a larger portion of their portfolio to equities, while more conservative investors may opt for a higher allocation to bonds and fixed-income instruments.

- Professional Financial Advice: Seeking professional financial advice is crucial for making informed investment decisions in this dynamic market environment.

Conclusion

The 80% China tariffs and the UK trade deal have created significant volatility in the live stock market. These events have highlighted the importance of careful analysis, informed decision-making, and strategic risk management for investors. Understanding the interconnectedness of global trade and its impact on various sectors is crucial for navigating the current complexities. For continuous live stock market updates and insightful analyses, subscribe to our newsletter, follow us on social media, and check back for future articles on similar global events impacting the market. Stay informed about live stock market updates to make sound investment decisions.

Featured Posts

-

John Wick 5 Is Keanu Reeves Ready To Face Death Again

May 11, 2025

John Wick 5 Is Keanu Reeves Ready To Face Death Again

May 11, 2025 -

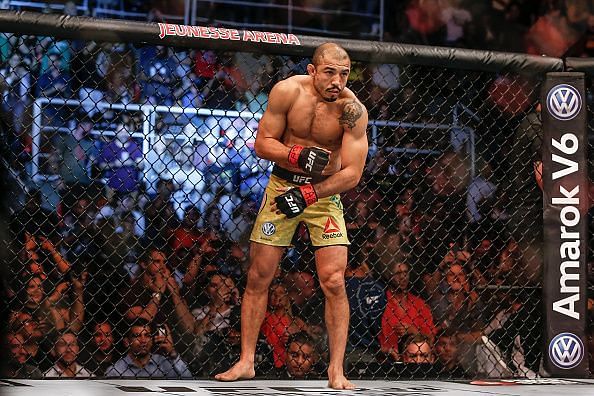

Ufc 315 Revised Fight Card After Jose Aldos Significant Weight Cut Failure

May 11, 2025

Ufc 315 Revised Fight Card After Jose Aldos Significant Weight Cut Failure

May 11, 2025 -

Ines Reg Eliminee De Dals Justice Ou Injustice L Avis Des Internautes

May 11, 2025

Ines Reg Eliminee De Dals Justice Ou Injustice L Avis Des Internautes

May 11, 2025 -

Kim Kardashian Vo Vpechatliva Kreatsi A Detali I Analiza Na Stilot

May 11, 2025

Kim Kardashian Vo Vpechatliva Kreatsi A Detali I Analiza Na Stilot

May 11, 2025 -

The Benny Blanco Cheating Scandal Analyzing The Theresa Marie Connection And Fan Speculation

May 11, 2025

The Benny Blanco Cheating Scandal Analyzing The Theresa Marie Connection And Fan Speculation

May 11, 2025

Latest Posts

-

Unprecedented Two Celtics Players Achieve 40 Point Games Simultaneously

May 12, 2025

Unprecedented Two Celtics Players Achieve 40 Point Games Simultaneously

May 12, 2025 -

Two Celtics Players Unexpectedly Score 40 Points Each In One Game

May 12, 2025

Two Celtics Players Unexpectedly Score 40 Points Each In One Game

May 12, 2025 -

Payton Pritchards Sixth Man Of The Year Contention A Look At His Improved Performance

May 12, 2025

Payton Pritchards Sixth Man Of The Year Contention A Look At His Improved Performance

May 12, 2025 -

Payton Pritchards Childhood Influences And His Latest Achievements

May 12, 2025

Payton Pritchards Childhood Influences And His Latest Achievements

May 12, 2025 -

Boston Celtics Clinch Division After Impressive Blowout Win

May 12, 2025

Boston Celtics Clinch Division After Impressive Blowout Win

May 12, 2025