Lutnick-Built FMX Challenges CME: Treasury Futures Trading Commences

Table of Contents

FMX's Key Features and Advantages

FMX is entering a market dominated by the CME Group, but it's doing so armed with several key features designed to attract traders. These advantages center around superior technology, competitive pricing, and innovative trading tools.

Enhanced Technology and Speed

FMX boasts a cutting-edge technological infrastructure designed for speed and efficiency. This translates to significant advantages for traders engaged in high-frequency trading and algorithmic trading strategies.

- Low-latency trading infrastructure: FMX leverages state-of-the-art technology to minimize latency, ensuring orders are executed with minimal delay. This is crucial for traders seeking to capitalize on fleeting market opportunities.

- Advanced order management systems: Sophisticated order management systems allow for complex order types and advanced trading strategies, giving traders greater control and flexibility.

- High-speed data feeds: Real-time market data feeds provide traders with the most up-to-date information, enabling faster and more informed decision-making. This reduces the risk of missed opportunities due to delayed information.

Competitive Pricing and Fee Structure

One of FMX's key selling points is its competitive pricing structure. While specific details may vary, the platform aims to undercut CME's fees, offering cost-effectiveness for traders of all sizes.

- Transparent fee schedules: FMX emphasizes transparency in its fee structure, making it easier for traders to understand and budget for their trading costs.

- Potential for significant cost savings: By offering lower commission rates than its competitors, FMX aims to attract traders seeking to maximize their profits. This could lead to a significant reduction in overall trading expenses.

- Volume-based discounts: The platform may implement volume-based discounts, further incentivizing high-volume traders to choose FMX.

Innovative Trading Tools and Resources

FMX is not just about speed and cost; it also offers a range of innovative trading tools and resources designed to enhance the trader experience.

- Advanced analytics platform: Access to robust analytics tools empowers traders to better understand market trends and make data-driven decisions.

- Customized dashboards: Traders can personalize their dashboards to display the specific information most relevant to their trading strategies.

- Comprehensive educational resources: FMX may offer educational resources, such as webinars and tutorials, to help traders learn how to best utilize the platform's features. This support could be particularly beneficial for less experienced traders.

The CME Group's Response and Market Dynamics

The CME Group, the established leader in treasury futures trading, is unlikely to cede its market share without a fight. The entry of FMX will undoubtedly trigger a period of intense competitive rivalry.

CME's Market Position and Strengths

CME's long-standing presence in the market gives it several inherent advantages.

- Established market liquidity: CME boasts substantial market liquidity, meaning there's a high volume of buy and sell orders available at any given time. This ease of execution is a significant draw for many traders.

- Deep market depth: CME's established market depth provides price stability and minimizes slippage, which is particularly important for large trades.

- Strong brand reputation and trust: Decades of operation have built a strong reputation for reliability and trust among traders.

Anticipated Competitive Rivalry and Market Impact

The rivalry between FMX and CME will likely lead to several significant changes in the market.

- Increased market innovation: The pressure of competition should push both platforms to further enhance their technology and offerings, ultimately benefiting traders with improved tools and services.

- Potential price wars: Competition may lead to price wars, further reducing trading fees and enhancing cost-effectiveness for traders.

- Improved market efficiency: Increased competition fosters efficiency, leading to faster execution speeds and better price discovery.

The Role of Gary Lutnick and Cantor Fitzgerald

Gary Lutnick, the CEO of Cantor Fitzgerald, is a prominent figure in the financial world. His decision to launch FMX represents a significant strategic move.

Lutnick's Vision and Strategic Goals

Lutnick's vision for FMX is to disrupt the existing market structure and offer a superior trading experience.

- Disrupting the status quo: Lutnick aims to challenge the CME Group's dominance, fostering innovation and competition within the treasury futures market.

- Leveraging Cantor Fitzgerald's expertise: Cantor Fitzgerald's long history in financial markets provides FMX with valuable experience and market knowledge.

- Strategic investment in fintech: The creation of FMX demonstrates Cantor Fitzgerald's commitment to investing in and developing innovative financial technologies.

Potential for Future Expansion and Innovation

FMX's future prospects are promising, with potential for growth and innovation.

- Expansion into other markets: FMX may expand its offerings to include other financial instruments beyond treasury futures.

- Continuous technological advancements: The platform is likely to continue investing in technological improvements to maintain its competitive edge.

- Strategic partnerships: FMX may form strategic partnerships with other fintech companies to expand its capabilities and reach.

Conclusion

The launch of FMX, spearheaded by Gary Lutnick, presents a significant challenge to the CME Group's dominance in the treasury futures market. FMX's focus on advanced technology, competitive pricing, and innovative tools has the potential to reshape the trading landscape. The resulting competition will likely benefit traders through increased efficiency, lower costs, and enhanced market innovation.

Call to Action: Learn more about the exciting developments in treasury futures trading by exploring FMX and CME offerings and evaluating how this competition impacts your trading strategies. Stay informed on the evolving dynamics between FMX and CME in the treasury futures market. Understanding the nuances of this new competitive landscape is crucial for optimizing your treasury futures trading strategy.

Featured Posts

-

Wilders Faces Growing Internal Opposition Within Pvv

May 18, 2025

Wilders Faces Growing Internal Opposition Within Pvv

May 18, 2025 -

How Russias Call For Peace Talks Backfired Putins Diplomatic Defeat

May 18, 2025

How Russias Call For Peace Talks Backfired Putins Diplomatic Defeat

May 18, 2025 -

Netflix And The Osama Bin Laden Documentary A Streaming Availability Guide

May 18, 2025

Netflix And The Osama Bin Laden Documentary A Streaming Availability Guide

May 18, 2025 -

Dutch Public Favors De Escalation Over Retaliation On Us Import Tariffs

May 18, 2025

Dutch Public Favors De Escalation Over Retaliation On Us Import Tariffs

May 18, 2025 -

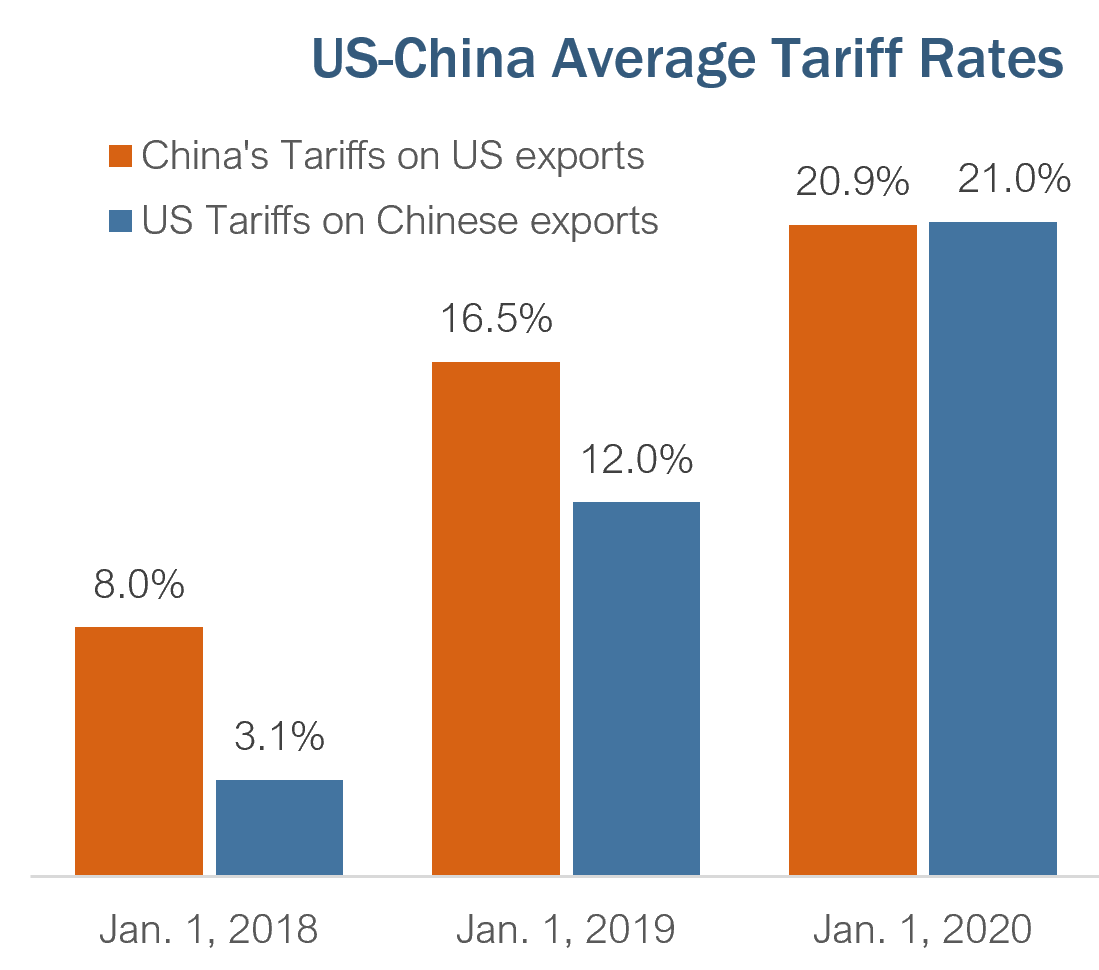

Trumps China Tariffs Analysts See Extended Implementation Until 2025

May 18, 2025

Trumps China Tariffs Analysts See Extended Implementation Until 2025

May 18, 2025

Latest Posts

-

Kanye Vest Ta Byanka Tsenzori Podrobnosti O Rasstavanii

May 18, 2025

Kanye Vest Ta Byanka Tsenzori Podrobnosti O Rasstavanii

May 18, 2025 -

Moncada Soriano Power Angels To 1 0 Win Against White Sox

May 18, 2025

Moncada Soriano Power Angels To 1 0 Win Against White Sox

May 18, 2025 -

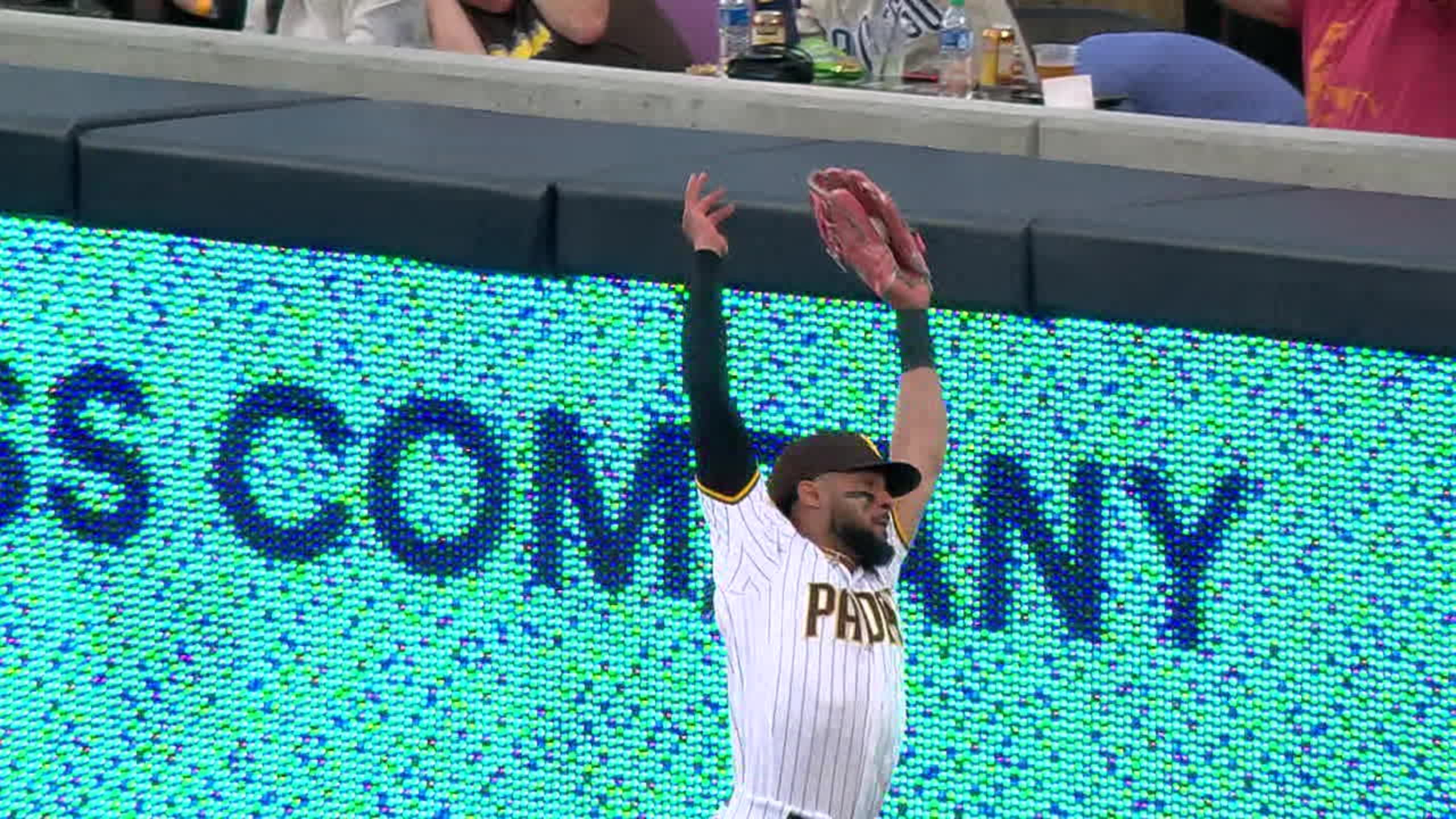

Angels Suffer Walk Off Defeat Against Padres Tatis Jr The Hero

May 18, 2025

Angels Suffer Walk Off Defeat Against Padres Tatis Jr The Hero

May 18, 2025 -

Close 1 0 Win For Angels Moncada And Soriano Shine Against White Sox

May 18, 2025

Close 1 0 Win For Angels Moncada And Soriano Shine Against White Sox

May 18, 2025 -

Tatis Jr S Walk Off Ends Angels Comeback Bid

May 18, 2025

Tatis Jr S Walk Off Ends Angels Comeback Bid

May 18, 2025