Major BSE Stocks Up 10%+ Following Sensex Surge

Table of Contents

Top Performing BSE Stocks (10%+ Gains)

Understanding market capitalization is crucial when selecting stocks. Market capitalization, often shortened to market cap, represents the total value of a company's outstanding shares. Larger market cap stocks (large-cap) are generally considered less volatile than smaller companies (small-cap). Today's surge affected both large and mid-cap major BSE stocks.

Sector-Specific Analysis

Several sectors showed exceptional performance, indicating a broad-based market rally. Below are some of the top-performing major BSE stocks across key sectors:

-

IT Sector: Infosys (+12%), TCS (+11.5%), HCL Technologies (+10.8%). The strong performance in the IT sector can be attributed to positive quarterly earnings reports exceeding analyst expectations and a surge in global demand for IT services.

-

Banking Sector: HDFC Bank (+11%), ICICI Bank (+10.5%), SBI (+10.2%). The banking sector benefited from positive investor sentiment driven by expectations of robust credit growth and improving macroeconomic indicators. Government policies supporting the financial sector also played a role.

-

Pharma Sector: Sun Pharma (+10.5%), Cipla (+9.8%), Dr Reddy's Laboratories (+9%). Positive regulatory developments and strong export demand contributed to the impressive performance of pharmaceutical major BSE stocks.

Analyzing Stock Performance Drivers

Several factors contributed to this extraordinary surge in major BSE stocks:

-

Global Market Trends: Positive global market sentiment, driven by encouraging economic data from several major economies, created a ripple effect in the Indian market.

-

Positive Investor Sentiment: Increased investor confidence, fueled by positive corporate earnings and expectations of future growth, drove significant buying activity.

-

Rupee Appreciation: A strengthening Indian Rupee against the US dollar boosted the returns for investors holding foreign currency investments.

-

Specific Company Announcements: Several companies announced positive developments, such as new product launches or strategic partnerships, further bolstering investor confidence.

Key Performance Indicators (KPIs) for these top performers showed impressive numbers. For example, many companies reported higher-than-expected revenue growth and improved profit margins. (Insert relevant charts and graphs here visually representing stock price movements of the top performers. Label axes clearly and provide a concise title for each chart.)

Understanding the Sensex Surge

The Sensex, a benchmark index of the BSE, serves as a barometer for the overall market health. Its substantial increase directly impacted the performance of individual major BSE stocks. The Sensex surge was a result of a confluence of factors:

-

Foreign Institutional Investor (FII) inflows: Significant investments from FIIs injected liquidity into the market, boosting stock prices.

-

Domestic Institutional Investor (DII) participation: Robust participation from DIIs further amplified the positive market momentum.

-

Improved Economic Outlook: Positive economic indicators, such as lower inflation and stable interest rates, contributed to a more optimistic market outlook.

-

Government Initiatives: Positive government policies aimed at boosting economic growth fostered investor confidence.

Risks and Considerations for Investors

While today's gains are impressive, investors should exercise caution. Rapid growth in major BSE stocks can be followed by periods of correction.

-

Volatility: Stocks that experience rapid growth are often more volatile, meaning their prices can fluctuate significantly in short periods.

-

Overvaluation: Rapid price increases can lead to overvaluation, making the stock susceptible to sharp price corrections.

-

Market Corrections: Market downturns can significantly impact even the strongest performing stocks.

Diversification is key to mitigating risk. Don't put all your eggs in one basket. Spread your investments across different sectors and asset classes. Avoid impulsive decisions based solely on short-term gains. Conduct thorough research and understand the underlying fundamentals of a company before investing.

Conclusion

Today's market rally resulted in significant gains for several major BSE stocks, with many exceeding the 10% mark. This surge was driven by a combination of factors, including a strong Sensex performance and positive sector-specific news. While these gains are impressive, investors should approach such rapid growth with caution and consider the associated risks. Understanding the market dynamics affecting major BSE stocks is crucial for making informed investment decisions.

Call to Action: Stay informed about the performance of major BSE stocks and other market trends to make informed investment decisions. Continue to monitor these key stocks for further potential opportunities. Learn more about [link to relevant resource on BSE stocks/investing] to enhance your investment strategies.

Featured Posts

-

Bvg Strike Ends S Bahn Disruptions And Public Transport Updates

May 15, 2025

Bvg Strike Ends S Bahn Disruptions And Public Transport Updates

May 15, 2025 -

Investigating The Connection Between Aircraft And Political Favors Under Trump

May 15, 2025

Investigating The Connection Between Aircraft And Political Favors Under Trump

May 15, 2025 -

Angels Defeat Padres Wards 9th Inning Grand Slam Secures Victory

May 15, 2025

Angels Defeat Padres Wards 9th Inning Grand Slam Secures Victory

May 15, 2025 -

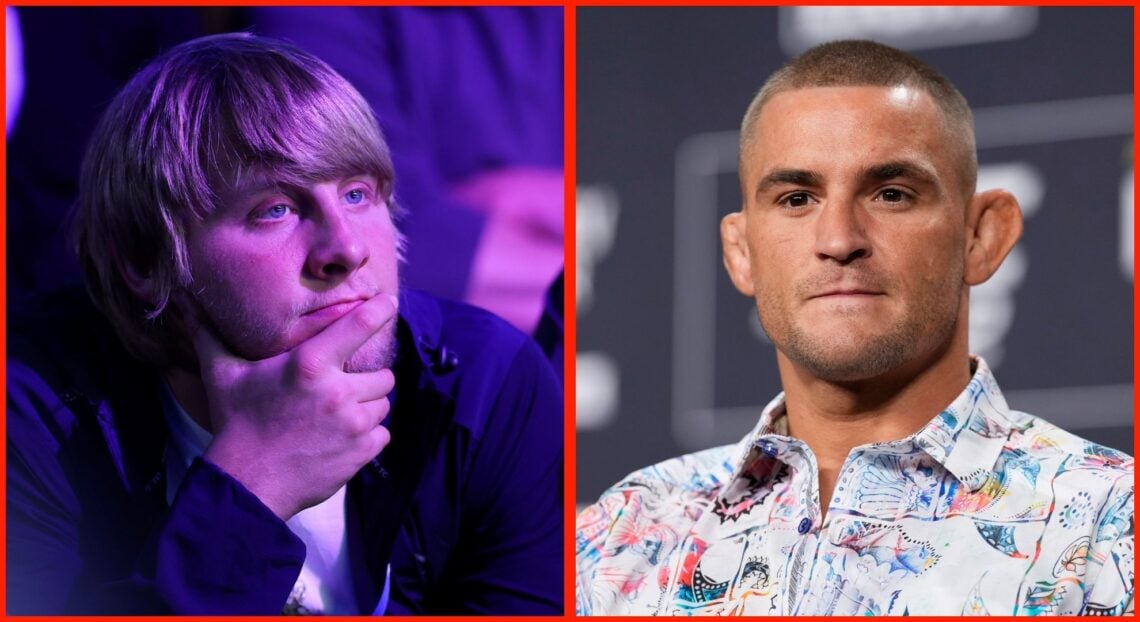

Is Dustin Poiriers Retirement Final Paddy Pimblett Thinks Not

May 15, 2025

Is Dustin Poiriers Retirement Final Paddy Pimblett Thinks Not

May 15, 2025 -

Ufc Legends U Turn Backing Paddy Pimblett For Championship Gold

May 15, 2025

Ufc Legends U Turn Backing Paddy Pimblett For Championship Gold

May 15, 2025