Market Reaction: Gold Rises On Trump's Less Confrontational Stance

Table of Contents

The Unexpected Gold Price Surge

The shift in Trump's rhetoric led to a noticeable increase in the gold price. Between [Start Date] and [End Date], the price of gold rose by approximately [Percentage]% — from roughly $[Price per ounce] to $[Price per ounce]. This unexpected surge caught many market analysts off guard, given the typical inverse relationship between geopolitical stability and gold prices.

- Specific Dates and Times: The most significant price jumps occurred on [Date 1] at [Time 1], following [Specific event or statement], and again on [Date 2] at [Time 2], after [Specific event or statement]. (Source: [Reputable Financial News Source])

- Geopolitical Uncertainty and Gold: Gold is traditionally viewed as a "safe-haven" asset. During periods of heightened geopolitical uncertainty or economic instability, investors often flock to gold as a store of value, driving up demand and consequently, the price. The initial expectation, therefore, was a decrease in gold prices with a less confrontational Trump.

Trump's Less Confrontational Stance: A Detailed Look

The market's reaction was triggered by a perceptible change in Trump's political approach. Previously characterized by aggressive rhetoric and protectionist policies, his recent statements and actions indicated a move towards greater international cooperation and less confrontational diplomacy.

- Policy Changes/Statements: Examples include [Specific policy shift 1, cite source], [Specific policy shift 2, cite source], and [Specific statement indicating de-escalation, cite source].

- Improved International Relations: The shift was also marked by improved relations with [Specific country or region], evidenced by [Specific example, cite source]. This reduction in apparent global tensions contributed to the alteration in market sentiment.

Analysis of Market Sentiment and Investor Behavior

The change in Trump's stance directly impacted investor sentiment towards gold. The reduced perception of geopolitical risk led to a decrease in demand for the traditionally "safe-haven" asset. Investors, feeling less need for a protective investment, shifted their focus to potentially higher-yielding assets.

- Safe-Haven Asset: Gold's traditional role as a safe-haven asset during times of uncertainty is well-established. Reduced anxiety and a perception of greater stability lessened the demand for this protective measure.

- Reduced Risk Aversion: With decreased geopolitical risk, investor risk aversion fell. This meant that investors were more willing to invest in higher-risk, higher-reward assets, reducing the appeal of the relatively low-yield gold.

- Economic Indicators: [Mention relevant economic indicators, e.g., interest rates, inflation expectations] also played a role in shaping investor behavior and gold market dynamics.

The Role of the US Dollar

The relationship between the gold price and the US dollar is inversely correlated. A stronger US dollar typically puts downward pressure on gold prices, as it becomes more expensive for investors holding other currencies to buy gold.

- USD Exchange Rate Changes: During the period in question, the US dollar experienced [Describe changes in the USD exchange rate, cite source], impacting the gold price accordingly.

- US Monetary Policy: [Discuss any potential changes in US monetary policy and their impact on both the USD and gold prices].

- Investor Confidence: A stronger dollar often reflects greater investor confidence in the US economy, lessening the need for the safety of gold.

Conclusion

The unexpected rise in the gold price following President Trump's less confrontational stance highlights the complex interplay between geopolitical events, investor sentiment, and precious metal markets. The reduction in perceived geopolitical risk led to decreased demand for the "safe-haven" asset, gold, resulting in a price increase. The US dollar's performance also played a significant role. Understanding the market reaction to Trump's stance and similar events is crucial for making informed investment decisions. Stay informed about shifts in political climates and their impact on the gold price. For comprehensive market analysis and gold price predictions, visit [link to relevant resource].

Featured Posts

-

Chiefs Run Game Upgrade The Potential Impact Of Ashton Jeanty

Apr 25, 2025

Chiefs Run Game Upgrade The Potential Impact Of Ashton Jeanty

Apr 25, 2025 -

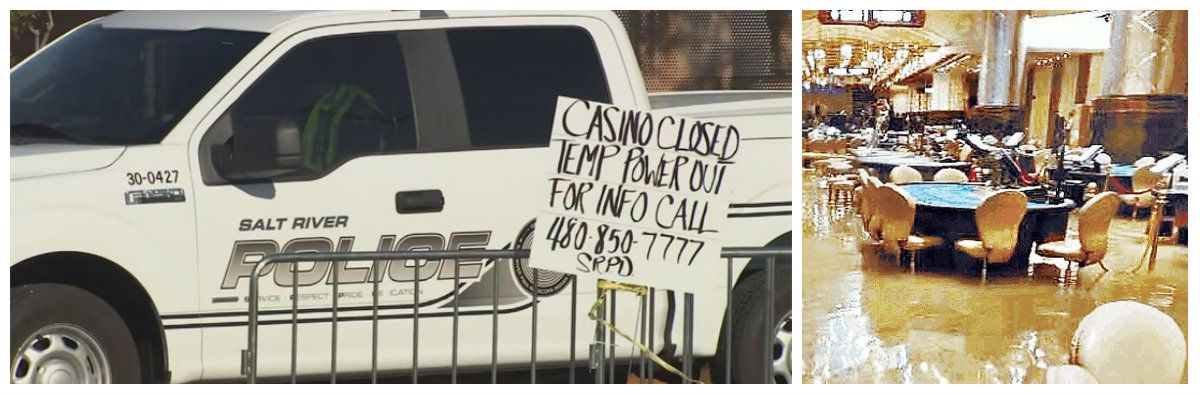

Japans 9 Billion Mgm Casino Construction Begins After Lengthy Delays

Apr 25, 2025

Japans 9 Billion Mgm Casino Construction Begins After Lengthy Delays

Apr 25, 2025 -

Maquiagem Em Aquarela Tutorial Passo A Passo E Inspiracoes

Apr 25, 2025

Maquiagem Em Aquarela Tutorial Passo A Passo E Inspiracoes

Apr 25, 2025 -

Against All Odds Bochum Triumphs Over Bayern Munich

Apr 25, 2025

Against All Odds Bochum Triumphs Over Bayern Munich

Apr 25, 2025 -

Chinas Invitation A Partnership With Canada To Counter Us Policies

Apr 25, 2025

Chinas Invitation A Partnership With Canada To Counter Us Policies

Apr 25, 2025

Latest Posts

-

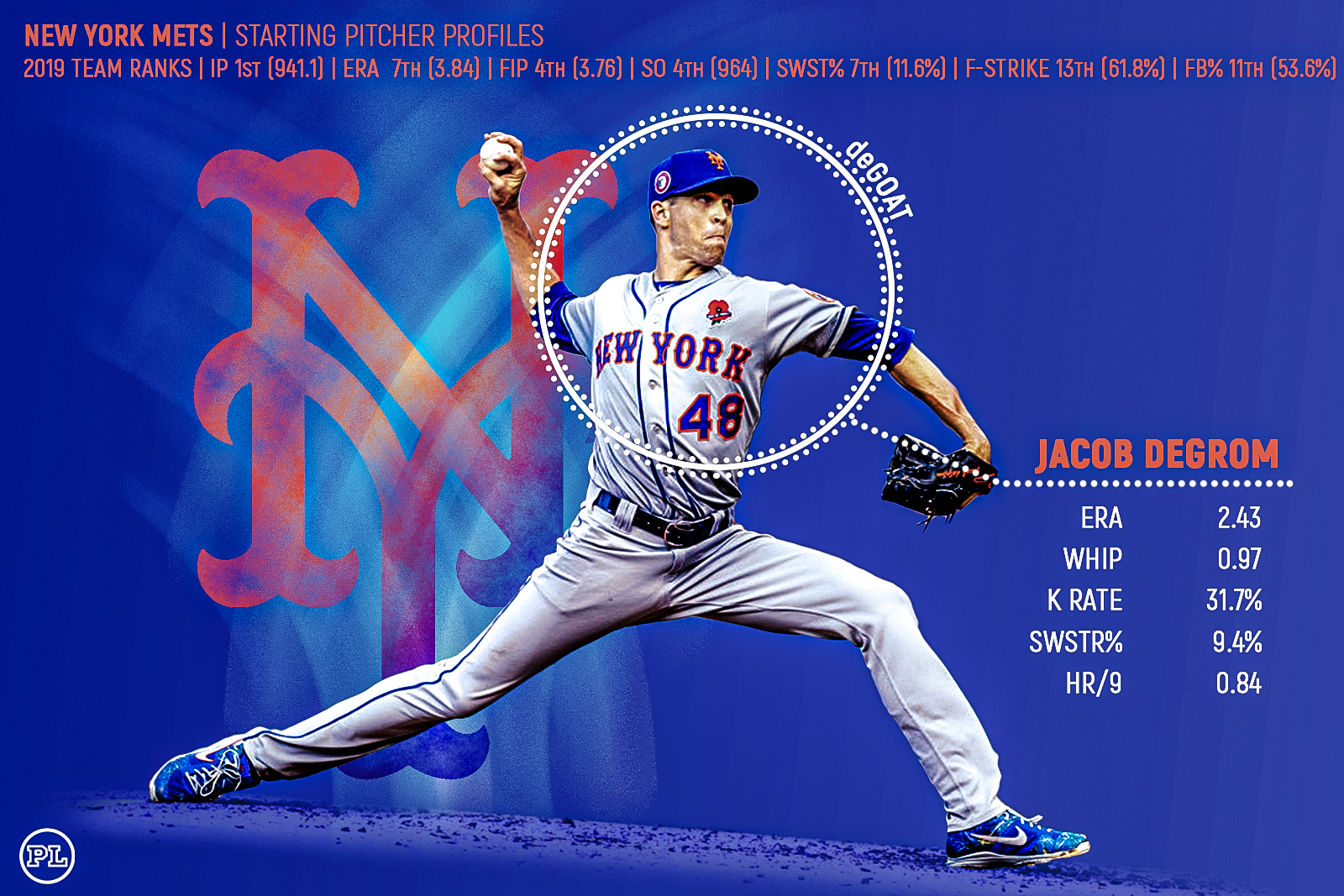

Mets Rivals Ace A Career Defining Season

Apr 28, 2025

Mets Rivals Ace A Career Defining Season

Apr 28, 2025 -

Unstoppable A Mets Rivals Starting Pitcher

Apr 28, 2025

Unstoppable A Mets Rivals Starting Pitcher

Apr 28, 2025 -

Mets Biggest Rival Their Starting Pitchers Dominance

Apr 28, 2025

Mets Biggest Rival Their Starting Pitchers Dominance

Apr 28, 2025 -

Mets Rival A Pitchers Unbeatable Season

Apr 28, 2025

Mets Rival A Pitchers Unbeatable Season

Apr 28, 2025 -

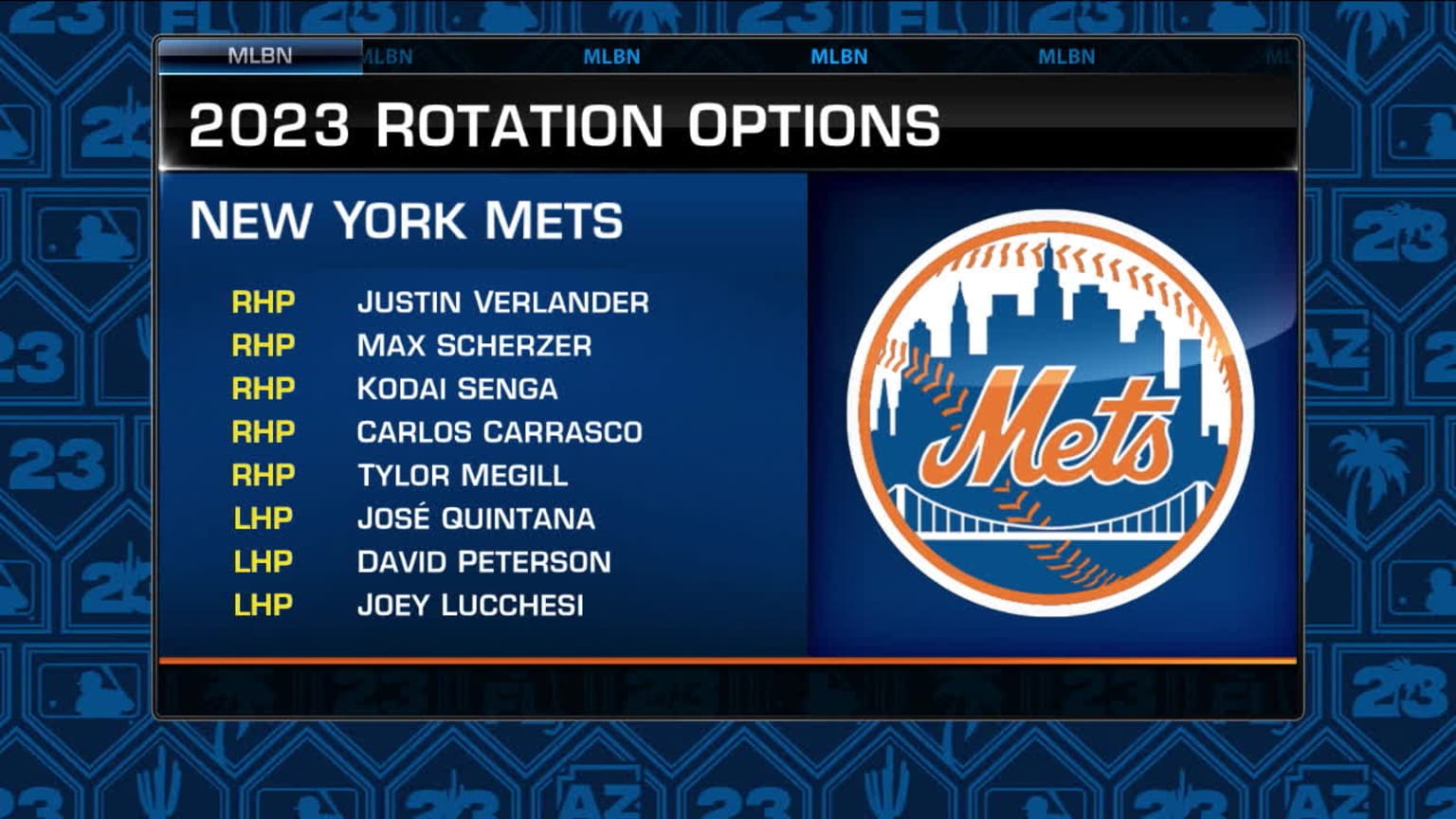

Mets Rotation Battle Significant Change Elevates One Starter

Apr 28, 2025

Mets Rotation Battle Significant Change Elevates One Starter

Apr 28, 2025