Market Value Meltdown: The Magnificent Seven's $2.5 Trillion Loss

Table of Contents

The Magnificent Seven: Identifying the Key Players

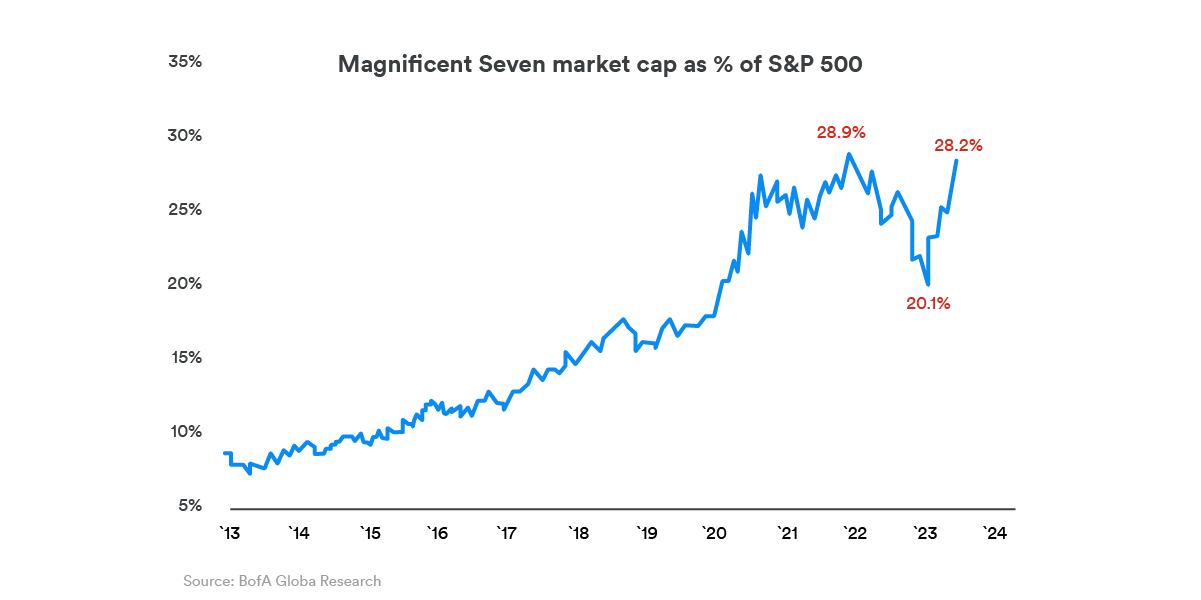

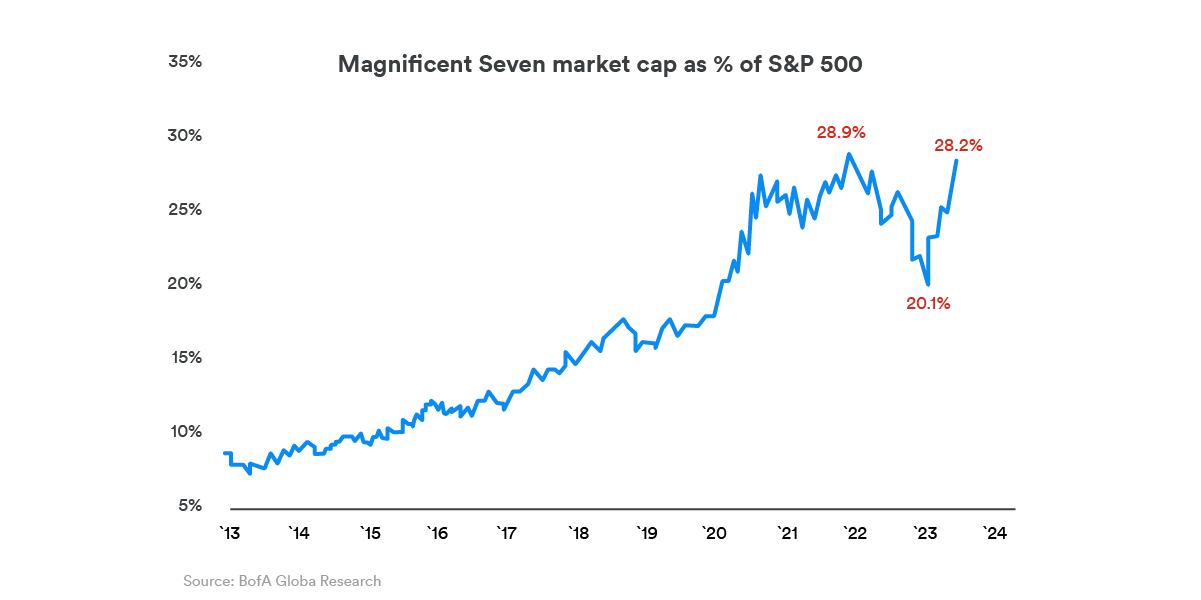

The "Magnificent Seven" – Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla – represent the pinnacle of technological innovation and market capitalization. Their combined market value decline of $2.5 trillion signifies a seismic shift in the tech landscape. Let's examine each company's contribution to this staggering loss:

-

Bullet points:

- Alphabet (Google): Before the decline, Alphabet boasted a market cap exceeding $1.5 trillion. Its Google stock experienced a significant drop, representing a substantial portion of the overall $2.5 trillion loss. Core business: Search engine, advertising, cloud computing. Approximate percentage loss: [Insert Percentage]

- Amazon: Amazon shares, once trading at record highs, plummeted, contributing significantly to the overall market value meltdown. Core business: E-commerce, cloud computing (AWS), advertising. Approximate percentage loss: [Insert Percentage]

- Apple: Apple's market cap, once the highest globally, experienced a considerable reduction. Its reliance on consumer spending makes it vulnerable to economic downturns. Core business: Consumer electronics, software, services. Approximate percentage loss: [Insert Percentage]

- Meta (Facebook): Meta faced challenges related to advertising revenue and competition, leading to a substantial decrease in its market value. Core business: Social media platforms, advertising. Approximate percentage loss: [Insert Percentage]

- Microsoft: Microsoft, a stalwart in the tech industry, also saw its stock price decline, adding to the overall market value meltdown. Core business: Software, cloud computing (Azure), gaming. Approximate percentage loss: [Insert Percentage]

- Nvidia: Nvidia, a key player in the semiconductor industry, experienced a market correction impacting its valuation. Core business: Graphics processing units (GPUs), artificial intelligence. Approximate percentage loss: [Insert Percentage]

- Tesla: Tesla's stock price, known for its volatility, also contributed to the overall decline, influenced by factors such as production challenges and CEO actions. Core business: Electric vehicles, energy storage. Approximate percentage loss: [Insert Percentage]

Factors Contributing to the Market Value Meltdown

Several interconnected factors fueled this dramatic market value meltdown. These include rising interest rates and inflation, geopolitical uncertainty, and increased regulation.

Rising Interest Rates and Inflation

Increased interest rates significantly impact tech valuations. Higher rates reduce investor appetite for growth stocks like those of the Magnificent Seven, as they make future earnings less valuable in present-day terms.

-

Bullet points:

- Higher interest rates increase the discount rate used to value future cash flows, lowering the present value of tech companies' projected growth.

- Inflation erodes the purchasing power of future earnings, further impacting the attractiveness of growth stocks.

- Rising borrowing costs make it more expensive for tech companies to finance expansion and innovation.

Geopolitical Uncertainty and Supply Chain Disruptions

Global instability and supply chain disruptions have created uncertainty in the market, impacting investor confidence and tech company performance.

-

Bullet points:

- The war in Ukraine disrupted global supply chains, impacting the availability of essential components for tech manufacturing.

- Trade tensions and geopolitical risks contribute to market volatility and investor hesitancy.

- Supply chain bottlenecks led to production delays and increased costs for tech companies.

Increased Regulation and Antitrust Scrutiny

Government regulation and antitrust concerns have played a role in influencing the market value of tech giants.

-

Bullet points:

- Increased scrutiny of data privacy, antitrust laws, and competition policies has led to uncertainty and potential legal costs for these companies.

- Antitrust lawsuits can lead to significant financial penalties and impact company valuations.

- Regulatory uncertainty can deter investment and stifle innovation within the tech sector.

The Implications of the Market Value Meltdown

The market value meltdown of the Magnificent Seven has far-reaching implications for the broader economy and the future of the tech sector.

Impact on the Broader Economy

The tech sector downturn can have a ripple effect throughout the economy.

-

Bullet points:

- Job losses in the tech sector and related industries can dampen consumer spending.

- Reduced investment in innovation can hinder long-term economic growth.

- Market volatility can impact investor confidence and overall economic stability.

Future Outlook for the Magnificent Seven

The future outlook for the Magnificent Seven is uncertain, but several factors will influence their recovery and growth prospects.

-

Bullet points:

- The tech sector's ability to adapt to changing market conditions and consumer demands will be critical.

- Successful navigation of regulatory hurdles and antitrust scrutiny will be essential.

- Innovative product development and strategic investments will be key to regaining investor confidence and driving future growth.

Conclusion

The $2.5 trillion loss experienced by the Magnificent Seven is a result of interconnected factors: rising interest rates, geopolitical uncertainty, and increased regulation. This market value meltdown has significant implications for the broader economy and the future of the tech sector. The impact on investor confidence, economic growth, and job markets is substantial. Staying informed about these ongoing developments is crucial. Follow [your website/publication] for the latest updates on the Magnificent Seven and the evolving market value meltdown, including analysis of tech stock outlook and market analysis. Keywords: Market Value Meltdown, Magnificent Seven, Tech Stock Outlook, Market Analysis.

Featured Posts

-

Cassidy Hutchinsons Memoir Key Jan 6 Witness Shares Her Story

Apr 29, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness Shares Her Story

Apr 29, 2025 -

Jeff Goldblum And Emilie Livingston A Look At Their Marriage And Family Life

Apr 29, 2025

Jeff Goldblum And Emilie Livingston A Look At Their Marriage And Family Life

Apr 29, 2025 -

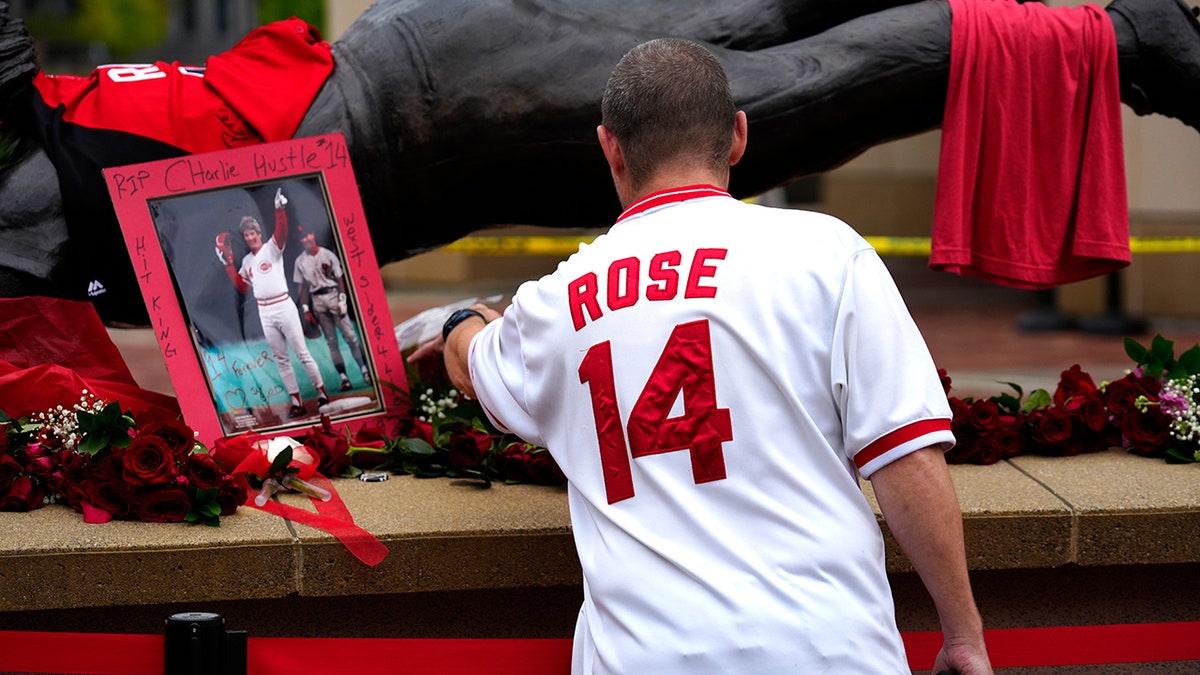

Will Pete Rose Receive A Posthumous Pardon From Trump

Apr 29, 2025

Will Pete Rose Receive A Posthumous Pardon From Trump

Apr 29, 2025 -

Underground Nightclub Raid Cnn Video Shows Detainment Of 100 Immigrants

Apr 29, 2025

Underground Nightclub Raid Cnn Video Shows Detainment Of 100 Immigrants

Apr 29, 2025 -

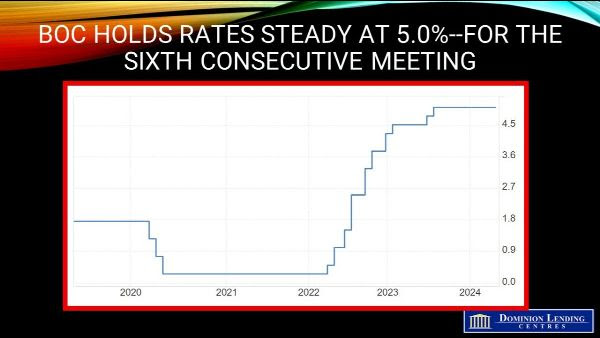

Rosenberg Critiques Bank Of Canadas Cautious Approach

Apr 29, 2025

Rosenberg Critiques Bank Of Canadas Cautious Approach

Apr 29, 2025