Market Volatility: Uncertainty Around US Finances Weighs On Stocks

Table of Contents

The Debt Ceiling Debate and its Impact on Market Volatility

The ongoing debate surrounding the US debt ceiling presents a significant source of market volatility. This political standoff creates considerable uncertainty, impacting investor sentiment and driving market fluctuations.

Increased Risk Perception

The debt ceiling debate introduces substantial risks to the US economy and the global financial system. Failure to raise the debt ceiling could lead to:

- Heightened risk of a US government default: A default would have catastrophic consequences, undermining the credibility of US Treasury bonds, the bedrock of the global financial system.

- Potential negative impact on credit ratings: A default or even a near-miss could trigger downgrades in US credit ratings, increasing borrowing costs for the government and potentially the entire economy.

- Uncertainty regarding future government spending: The protracted negotiations surrounding the debt ceiling introduce uncertainty about future government spending plans, impacting investor confidence and investment decisions.

- Increased volatility in Treasury yields: The uncertainty surrounding the debt ceiling leads to increased volatility in Treasury yields, reflecting the heightened risk perception in the market.

Investor Sentiment and Market Reactions

The debt ceiling debate significantly influences investor sentiment, triggering specific market reactions:

- Flight to safety: Investors often shift their funds towards safer assets like gold or government bonds of countries perceived as more stable, reducing investment in riskier assets.

- Sell-off in riskier assets like stocks: Uncertainty prompts many investors to sell off riskier assets like stocks, contributing to market downturns.

- Increased trading volume reflecting higher uncertainty: The heightened anxiety translates into increased trading volume as investors react swiftly to news and developments.

Inflation and Interest Rate Hikes Fueling Market Volatility

The current inflationary environment and the Federal Reserve's aggressive response through interest rate hikes are another major contributor to market volatility.

The Inflationary Environment

Persistent inflationary pressures are impacting the US economy and global markets:

- Persistent inflation pressures: High inflation erodes purchasing power and creates uncertainty about future economic growth.

- Impact on consumer spending and business investment: High inflation reduces consumer spending and discourages business investment, hindering economic growth.

- Fed's efforts to curb inflation through monetary policy: The Federal Reserve's interest rate hikes aim to cool down the economy and tame inflation, but this process itself introduces volatility.

Impact on Stock Valuations

Rising interest rates significantly affect company valuations and stock prices:

- Higher discount rates reducing present value of future earnings: Higher interest rates increase the discount rate used to calculate the present value of future earnings, reducing the perceived value of stocks.

- Increased borrowing costs for companies: Higher interest rates increase borrowing costs for companies, reducing profitability and impacting stock prices.

- Potential for reduced corporate profits: Higher interest rates can lead to reduced consumer and business spending, ultimately impacting corporate profits.

Geopolitical Factors Exacerbating Market Volatility

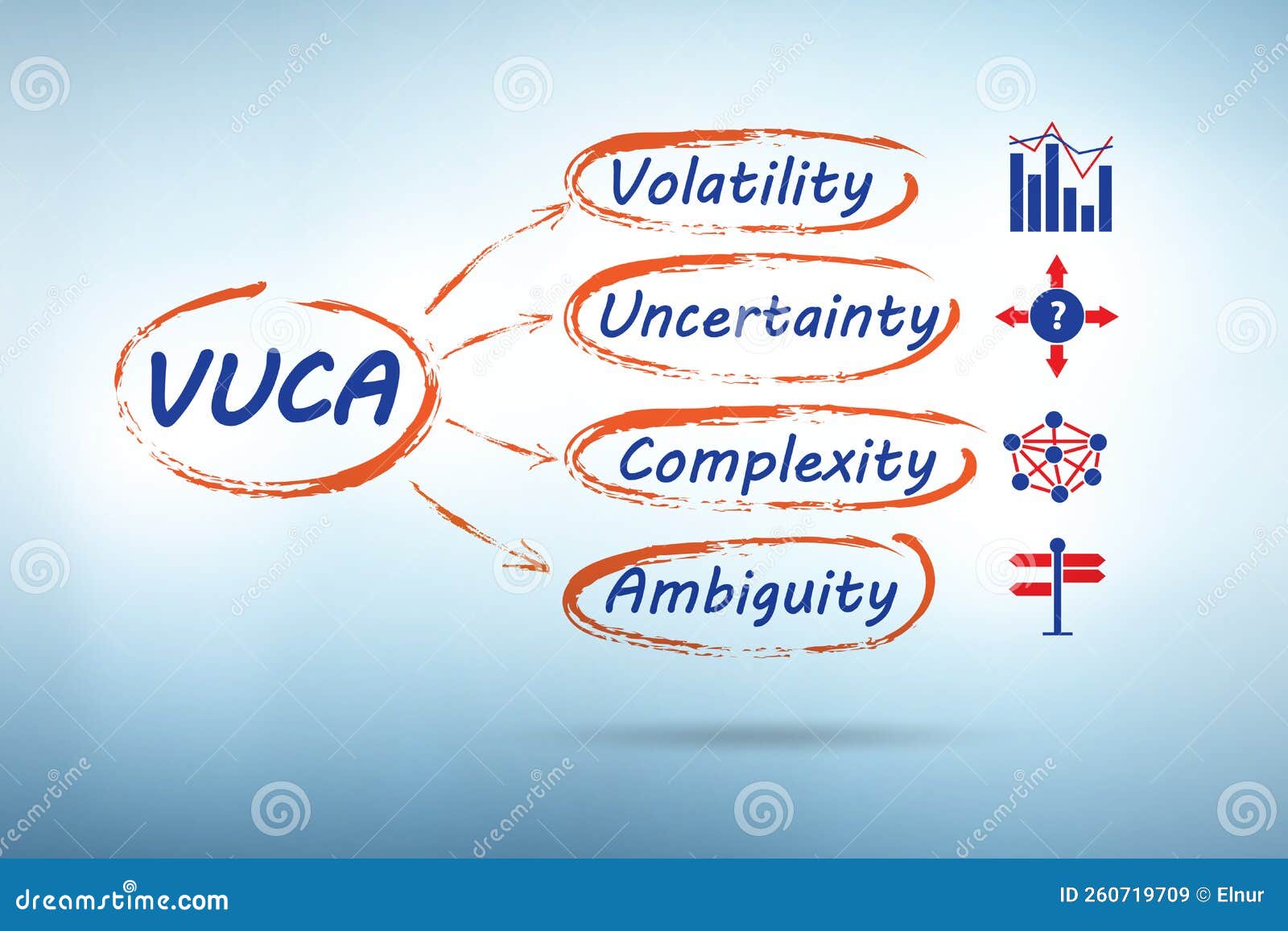

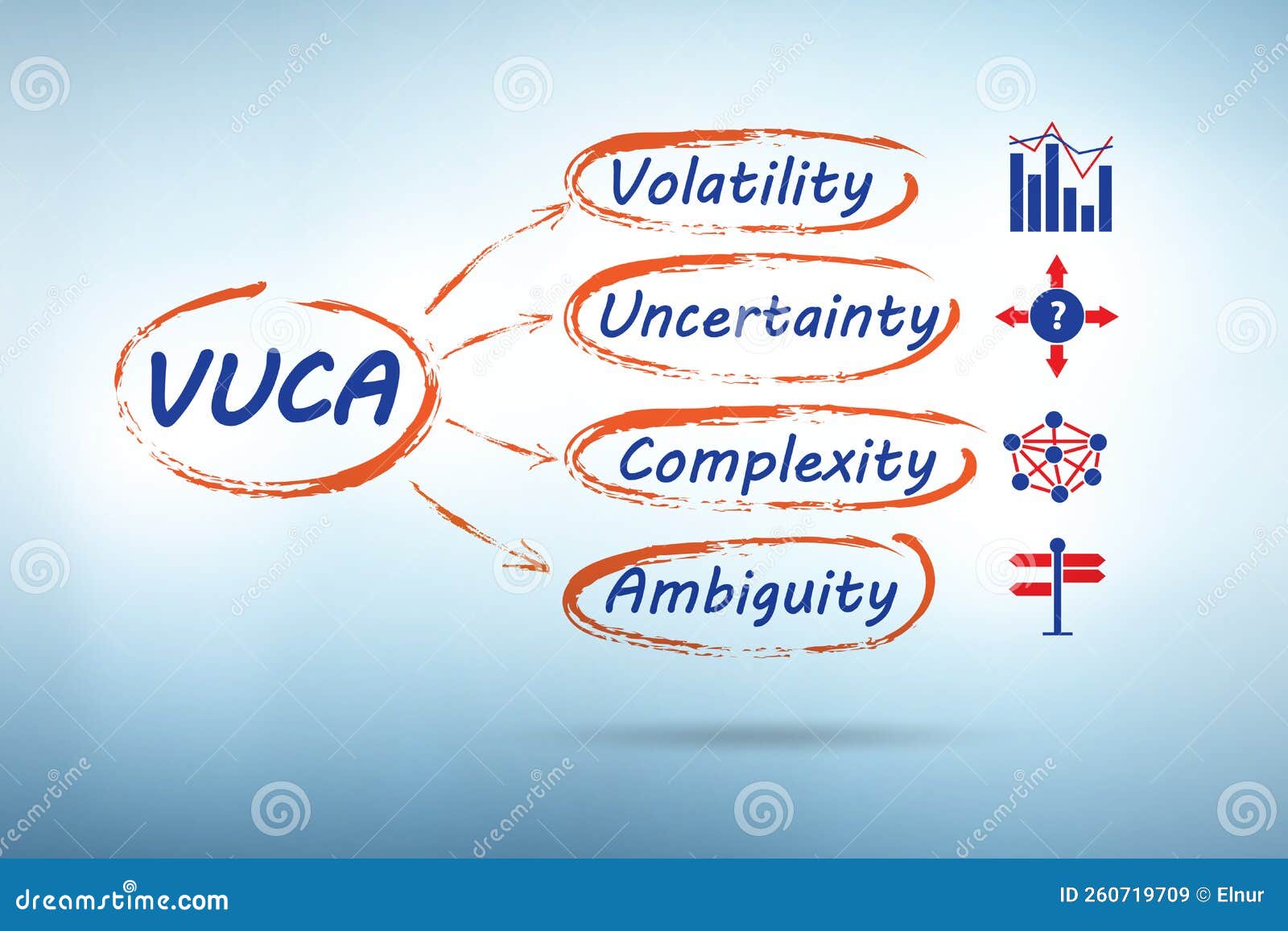

Global events and geopolitical tensions are further exacerbating market volatility, adding another layer of uncertainty.

Global Uncertainty

Several geopolitical factors contribute to market instability:

- The war in Ukraine and its impact on energy prices and supply chains: The war in Ukraine has created significant disruptions to energy markets and global supply chains, impacting inflation and economic growth worldwide.

- Tensions between the US and China: The ongoing trade war and geopolitical rivalry between the US and China inject significant uncertainty into global markets.

- Other significant geopolitical risks: Other global events, such as political instability in various regions, further contribute to market uncertainty.

Spillover Effects on US Markets

International events have a direct impact on US markets:

- Increased market uncertainty leading to sell-offs: Global uncertainty often spills over into US markets, triggering sell-offs as investors seek safer havens.

- Fluctuations in the value of the US dollar: Geopolitical events can impact the value of the US dollar, influencing both domestic and international investment flows.

- Impact on international trade and investment: Geopolitical risks disrupt international trade and investment, negatively impacting the US economy and its stock market.

Conclusion

In summary, the current market volatility is a confluence of factors: the debt ceiling debate, inflation and interest rate hikes, and significant geopolitical uncertainties. These interwoven elements create a challenging investment landscape. Understanding the drivers of market volatility is crucial for navigating the current challenging landscape. The significant impact of US financial uncertainty on stock market performance and investor confidence cannot be overstated.

Key Takeaways: US financial uncertainty, manifested through the debt ceiling debate and inflationary pressures, is a primary driver of the current market volatility. Geopolitical instability further amplifies these risks.

Call to Action: Stay informed about the latest developments concerning US finances and global events to make informed decisions about your investments and mitigate the risks associated with market volatility. Consult with a qualified financial advisor to develop a robust investment strategy tailored to your risk tolerance and financial goals.

Featured Posts

-

Just In Time Jonathan Groffs Shot At Tony Award Glory

May 23, 2025

Just In Time Jonathan Groffs Shot At Tony Award Glory

May 23, 2025 -

Hulu Movie Departures Dont Miss These Films Before They Go

May 23, 2025

Hulu Movie Departures Dont Miss These Films Before They Go

May 23, 2025 -

New Zealands 127 Million Kiwi Rail Investment Hillside Site Opens In Dunedin

May 23, 2025

New Zealands 127 Million Kiwi Rail Investment Hillside Site Opens In Dunedin

May 23, 2025 -

Instituto Novedades En La Citacion Y Posible Alineacion Vs Lanus

May 23, 2025

Instituto Novedades En La Citacion Y Posible Alineacion Vs Lanus

May 23, 2025 -

Honeywells 2 4 Billion Acquisition Of Johnson Mattheys Catalyst Technology A Deep Dive

May 23, 2025

Honeywells 2 4 Billion Acquisition Of Johnson Mattheys Catalyst Technology A Deep Dive

May 23, 2025