Navigating Economic Uncertainty: The Challenge Of Rising Inflation And Unemployment

Table of Contents

Understanding the Interplay of Inflation and Unemployment

Inflation and unemployment are not isolated phenomena; they often exhibit a complex relationship. The concept of stagflation, characterized by simultaneous high inflation and high unemployment, highlights this interdependence. Understanding this dynamic is crucial for effectively navigating economic uncertainty.

Let's define some key economic terms:

- Inflation: A general increase in the prices of goods and services in an economy over a period of time. It's measured using indices like the Consumer Price Index (CPI).

- Unemployment: The percentage of the labor force that is actively seeking employment but unable to find it.

- Consumer Price Index (CPI): A measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care.

- Interest Rates: The cost of borrowing money. Central banks often manipulate interest rates to influence inflation and economic growth.

Here's a breakdown of their interconnectedness:

- Rising inflation impacts purchasing power: As prices rise, the same amount of money buys fewer goods and services, reducing consumers' real income.

- Different types of unemployment exist: Frictional unemployment is temporary unemployment between jobs. Structural unemployment arises from mismatches between job skills and available positions. Cyclical unemployment is linked to economic downturns.

- Interest rate hikes combat inflation but can curb employment: Raising interest rates makes borrowing more expensive, potentially slowing down economic activity and leading to job losses. Conversely, lower interest rates stimulate economic growth but could fuel inflation.

For example, the recent surge in energy prices has contributed significantly to inflation globally, impacting household budgets and impacting employment in energy-intensive industries.

The Impact of Rising Inflation on Households and Businesses

Rising inflation significantly impacts both households and businesses. For households, the increased cost of living erodes purchasing power, squeezing budgets and impacting financial wellbeing.

Consequences for Households:

- Increased cost of essential goods: Food, energy, and housing costs are rising sharply, reducing disposable income.

- Reduced savings and investment potential: Inflation eats away at the value of savings, making it harder to save for the future or invest.

- Increased debt burdens: Rising interest rates make existing debt more expensive to service.

Consequences for Businesses:

- Rising production costs: Businesses face higher costs for raw materials, energy, and labor, squeezing profit margins.

- Decreased consumer spending: Consumers cut back on spending due to reduced purchasing power, leading to lower sales for businesses.

- Difficulty in business planning and investment decisions: Uncertainty about future economic conditions makes planning and investment challenging.

- Potential for business closures and job losses: Businesses struggling with rising costs and falling demand may be forced to close, leading to job losses.

For instance, many small restaurants are struggling to absorb rising food and energy costs, potentially leading to price increases that further strain consumer budgets and even closure.

Strategies for Navigating Economic Uncertainty

Effectively navigating economic uncertainty requires proactive strategies for both individuals and businesses.

For Individuals:

- Create a detailed budget: Track income and expenses to identify areas for savings.

- Reduce unnecessary expenses: Cut back on non-essential spending.

- Diversify income streams: Explore additional income sources to buffer against financial shocks.

- Consider inflation-protected investments: Explore investments that can help maintain purchasing power during periods of high inflation.

- Seek professional financial advice: A financial advisor can provide personalized guidance on managing finances during uncertain economic times. [Link to a reputable financial planning website]

For Businesses:

- Implement cost-cutting measures: Review operating expenses and identify areas for efficiency improvements.

- Explore new revenue streams: Find innovative ways to generate revenue and diversify offerings.

- Negotiate with suppliers: Secure better pricing and payment terms with suppliers.

- Invest in employee training and development: A skilled workforce is crucial for navigating economic challenges.

- Develop a robust contingency plan: Prepare for different economic scenarios.

Government Policies and Their Effectiveness

Governments employ various policies to address inflation and unemployment. Navigating economic uncertainty often depends on the effectiveness of these interventions.

- Monetary Policy: Central banks use tools like interest rate adjustments to control inflation and stimulate economic growth. Raising interest rates combats inflation but can slow economic growth, potentially leading to higher unemployment.

- Fiscal Policy: Governments use government spending and taxation policies to influence the economy. Increased government spending can stimulate demand, but it may also exacerbate inflation if not managed carefully.

However, government interventions are not without limitations:

- Time lags: The effects of government policies are often not immediate.

- Unintended consequences: Policies may have unintended negative side effects.

- Political considerations: Political pressures can influence policy decisions, potentially hindering effectiveness.

Central banks play a crucial role in managing the economy by monitoring economic indicators and adjusting monetary policy accordingly.

Mastering the Challenge of Economic Uncertainty

Rising inflation and unemployment present significant challenges for individuals and businesses. Successfully navigating economic uncertainty requires a proactive approach, including careful budgeting, cost management, and diversification strategies. Understanding the interplay between inflation and unemployment, and the role of government policies, is also crucial.

Take control of your finances, develop a robust plan for managing inflation, and learn effective strategies for coping with unemployment. Don't hesitate to seek professional financial advice and utilize the numerous online resources available to assist you in navigating economic uncertainty. By taking proactive steps, you can build resilience and navigate these economic headwinds successfully. Start planning your financial strategy today – your future self will thank you.

Featured Posts

-

San Diego Airport Crash Preliminary Report On Runway Light Failure And Weather System Malfunction

May 30, 2025

San Diego Airport Crash Preliminary Report On Runway Light Failure And Weather System Malfunction

May 30, 2025 -

Illegal Vehicle Registrations Maryland Drivers Costing Virginia Millions

May 30, 2025

Illegal Vehicle Registrations Maryland Drivers Costing Virginia Millions

May 30, 2025 -

Programma Tileoptikon Metadoseon Savvatoy 10 5

May 30, 2025

Programma Tileoptikon Metadoseon Savvatoy 10 5

May 30, 2025 -

Herbie Hancock Institute Of Jazz World Class Music Education In Des Moines

May 30, 2025

Herbie Hancock Institute Of Jazz World Class Music Education In Des Moines

May 30, 2025 -

Analisis Harga Kawasaki Ninja 500 Series Modifikasi Rp 100 Juta Ke Atas

May 30, 2025

Analisis Harga Kawasaki Ninja 500 Series Modifikasi Rp 100 Juta Ke Atas

May 30, 2025

Latest Posts

-

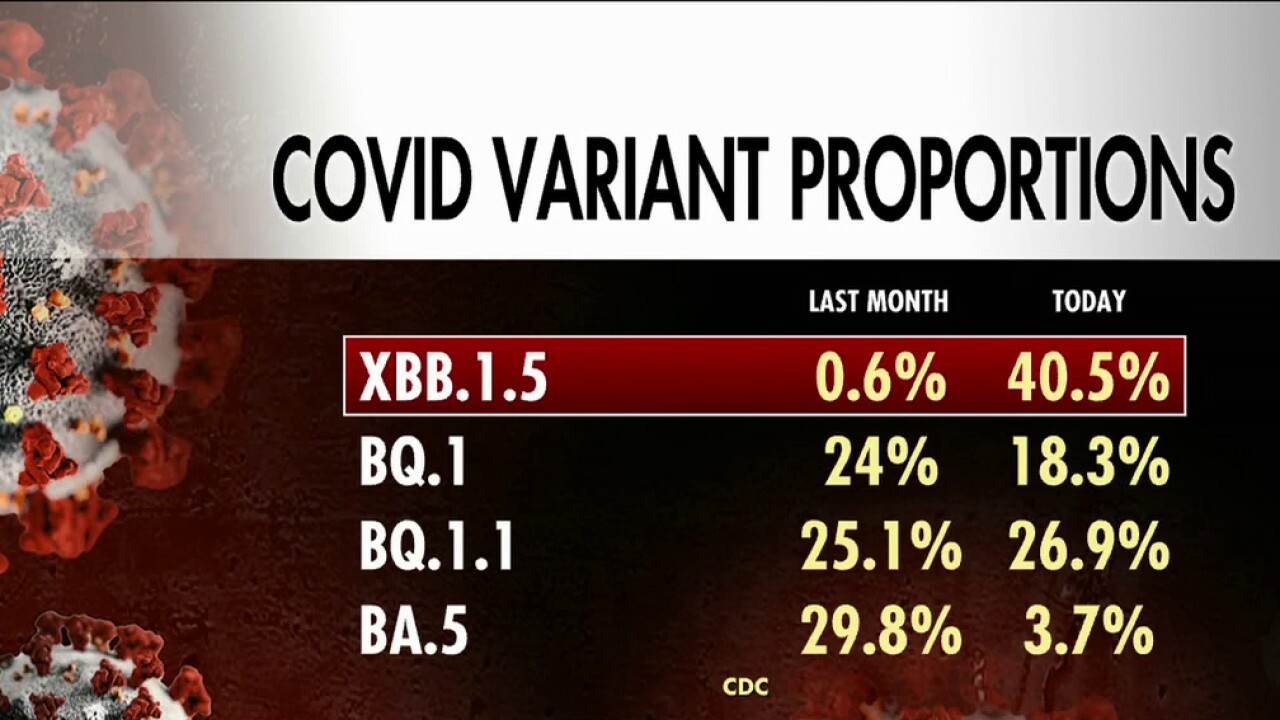

New Covid 19 Variant What You Need To Know About The Latest Surge

May 31, 2025

New Covid 19 Variant What You Need To Know About The Latest Surge

May 31, 2025 -

Swiateks Dominant Win Propels Her To Us Open Fourth Round

May 31, 2025

Swiateks Dominant Win Propels Her To Us Open Fourth Round

May 31, 2025 -

Understanding The Potential Impact Of A New Covid 19 Variant

May 31, 2025

Understanding The Potential Impact Of A New Covid 19 Variant

May 31, 2025 -

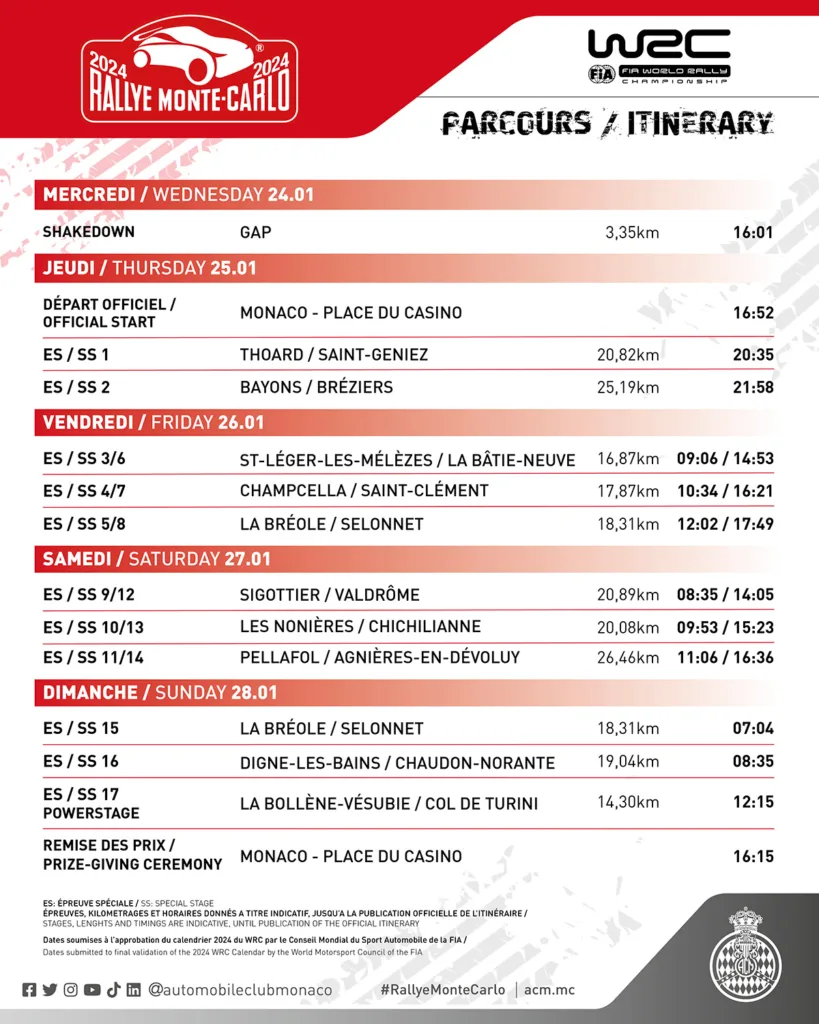

Monte Carlo Thompsons Challenging Race Experience

May 31, 2025

Monte Carlo Thompsons Challenging Race Experience

May 31, 2025 -

Thompsons Monte Carlo Misfortune A Race To Forget

May 31, 2025

Thompsons Monte Carlo Misfortune A Race To Forget

May 31, 2025