NCLH Stock: What Do Hedge Fund Holdings Reveal About Its Future?

Table of Contents

Analyzing Hedge Fund Ownership of NCLH Stock

Analyzing hedge fund ownership provides a unique perspective on market sentiment and potential future movements of NCLH stock. By examining the investment strategies and actions of these sophisticated investors, we can gain valuable insights.

Identifying Key Hedge Fund Investors

Several prominent hedge funds hold significant positions in NCLH stock. While specific holdings are often confidential and change frequently, publicly available data (such as 13F filings) allows us to identify some key players. [Insert links to relevant SEC databases or financial news articles here, if possible. Example: Link to a 13F filing database]. Identifying these investors helps us understand the collective wisdom and risk appetite surrounding NCLH.

Tracking Changes in NCLH Holdings

Monitoring changes in hedge fund holdings over time is critical. Recent buying trends suggest increased confidence in NCLH's future prospects, while selling could indicate concerns about the company’s performance. For example, a significant increase in holdings by a well-known value investor might be a bullish signal.

- Quantifying Hedge Fund Holdings: [Insert data here, if available. Example: "As of [Date], hedge funds collectively held X million shares of NCLH stock, representing Y% of the outstanding shares."]

- Significant Increases/Decreases: [Insert data and analysis here. Example: "Fund Z increased its NCLH holdings by 15% in Q3 2024, suggesting a positive outlook." ]

- Notable Entries/Exits: [Insert data and analysis here. Example: "The departure of Fund W from its NCLH position might indicate concerns about short-term profitability."]

Interpreting Hedge Fund Strategies and NCLH Stock Implications

Hedge fund strategies vary significantly, impacting their NCLH holdings and the resulting implications for the stock price.

Long-Term vs. Short-Term Investments

Some hedge funds may hold NCLH stock for long-term growth, betting on the company's recovery and expansion within the cruise industry. Others may take short-term positions, aiming to profit from short-term price fluctuations. Distinguishing between these strategies is vital for accurate interpretation.

Assessing Risk Tolerance

The risk tolerance of hedge funds invested in NCLH is directly related to the inherent risks in the cruise industry. The cruise industry is susceptible to economic downturns, geopolitical instability, and unforeseen events (like pandemics). Hedge funds with a higher risk tolerance might be more willing to hold NCLH stock through periods of volatility.

- Investment Strategies and NCLH: Value investors might see NCLH as undervalued, while growth investors might focus on its potential for future expansion.

- Catalysts for Hedge Fund Activity: Earnings reports, significant industry news (e.g., new regulations), and overall economic conditions can all influence hedge fund buying and selling activity.

- Limitations of Analyzing Hedge Fund Data: It's crucial to acknowledge that hedge fund data is not a perfect predictor. There can be conflicts of interest, and the data itself might be delayed or incomplete.

Considering Macroeconomic Factors and Industry Trends

Macroeconomic conditions and industry trends play a crucial role in influencing hedge fund decisions and the overall performance of NCLH stock.

The Impact of the Global Economy on NCLH Stock

Global economic factors, such as inflation, recession fears, and interest rates, significantly influence consumer spending and travel patterns. A strong economy generally leads to increased demand for leisure travel, benefiting NCLH. Conversely, economic downturns can reduce demand.

Cruise Industry Outlook and Its Effect on NCLH

The overall health of the cruise industry directly impacts NCLH. Factors like fuel prices, stricter regulations, and competition from other cruise lines all influence its performance. Technological advancements and sustainability initiatives also play a significant role.

- Relevant Economic Indicators: GDP growth, inflation rates, and consumer confidence indexes are key indicators to watch.

- Future Industry Trends: The adoption of sustainable cruising practices and the integration of new technologies are crucial for the long-term health of the industry.

- NCLH's Competitive Position: Analyzing NCLH's market share, pricing strategies, and brand image compared to competitors provides insights into its future performance.

Evaluating the Overall Picture and Potential Risks

Synthesizing the insights gleaned from hedge fund activity, macroeconomic conditions, and industry trends allows for a more comprehensive assessment of NCLH stock.

Synthesizing Insights from Hedge Fund Holdings

[Summarize the key findings here. Example: "Overall, the analysis suggests a mixed sentiment among hedge funds regarding NCLH, with some exhibiting optimism based on long-term growth potential, while others remain cautious due to short-term market volatility."]

Identifying Potential Risks and Opportunities

Investing in NCLH stock presents both significant opportunities and substantial risks.

- Overall Hedge Fund Sentiment: [Summarize the overall feeling - bullish, bearish, or neutral.]

- Potential Risks: Fluctuating fuel prices, unexpected geopolitical events, and changes in consumer spending can all negatively impact NCLH.

- Potential Opportunities: Increased passenger demand, successful cost-cutting measures, and strategic acquisitions can contribute to positive growth.

Conclusion: Making Informed Decisions about NCLH Stock

Analyzing hedge fund holdings provides valuable, albeit incomplete, information regarding the potential future of NCLH stock. However, it's crucial to consider macroeconomic factors and industry trends alongside this data. Remember that investing in any stock carries inherent risks. Before making any NCLH stock investment, conduct thorough due diligence, research the company's financial statements, and consider consulting a qualified financial advisor. Careful analysis of NCLH stock and the broader market context is crucial for making informed investment decisions.

Featured Posts

-

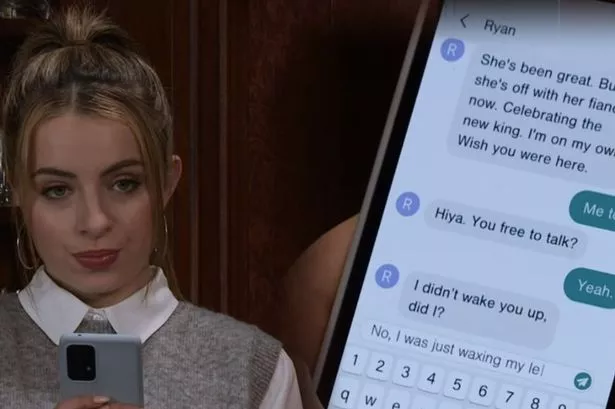

Coronation Street Fans React To Daisys Pre Soap Career

May 01, 2025

Coronation Street Fans React To Daisys Pre Soap Career

May 01, 2025 -

Xrp Etf Approvals Sec Developments And Ripples Future

May 01, 2025

Xrp Etf Approvals Sec Developments And Ripples Future

May 01, 2025 -

Planning Your 2025 Cruise Choosing The Right New Ship

May 01, 2025

Planning Your 2025 Cruise Choosing The Right New Ship

May 01, 2025 -

Blockchain Analytics Leader Chainalysis Integrates Ai Via Alterya Purchase

May 01, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai Via Alterya Purchase

May 01, 2025 -

Gillian Anderson And David Duchovnys Sag Awards Reunion A Look Back

May 01, 2025

Gillian Anderson And David Duchovnys Sag Awards Reunion A Look Back

May 01, 2025