Net Asset Value (NAV) Analysis: Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Factors Influencing the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is dynamic, influenced by a complex interplay of factors. Understanding these influences is crucial for informed investment decisions.

-

Underlying Assets: This ETF tracks the MSCI World Index, representing a broad range of large and mid-cap equities globally. The performance of these underlying companies directly impacts the ETF's NAV. Strong corporate earnings, positive economic indicators, and increased investor confidence generally lead to NAV growth. Conversely, poor corporate performance or negative economic news can cause NAV decline.

-

Currency Hedging (USD Hedged): The "USD Hedged" designation signifies that the ETF employs strategies to mitigate the impact of currency fluctuations between the base currency of the underlying assets and the US dollar. This hedging reduces the volatility stemming from exchange rate movements, providing a degree of stability to the NAV in USD terms, though it does not eliminate all currency risk completely. The effectiveness of the hedging strategy itself can influence NAV movements.

-

Market Conditions: Broad market trends significantly influence the ETF's NAV.

- Bull Markets: During periods of economic growth and rising stock prices (bull markets), the NAV of the Amundi MSCI World II ETF tends to increase.

- Bear Markets: Conversely, bear markets characterized by falling stock prices generally result in NAV decline.

- Geopolitical Events: Global events like wars, political instability, and trade disputes can create market uncertainty and impact the ETF's NAV.

- Sector-Specific Performance: The performance of individual sectors within the MSCI World Index (e.g., technology, energy, healthcare) will influence the overall NAV. Strong performance in one sector may offset weakness in another.

-

Expense Ratios and Management Fees: These fees, deducted from the fund's assets, directly impact the NAV. Higher expense ratios lead to a slightly lower NAV compared to funds with lower fees.

-

Dividends and Distributions: When the underlying companies pay dividends, the ETF receives these payments. After deducting expenses, these distributions are typically passed on to ETF investors, which can affect the NAV slightly. The NAV will typically decrease by the amount of the distribution on the ex-dividend date.

How to Interpret the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Accurately interpreting the NAV requires understanding where to find the data and how to analyze it effectively.

-

Finding NAV Data: You can find the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist on the ETF's official website, major financial news websites (like Bloomberg or Yahoo Finance), and through your brokerage account.

-

Interpreting NAV Changes: Analyzing daily, weekly, and monthly changes reveals trends. Consistent upward trends suggest positive performance, while downward trends indicate underperformance.

-

NAV vs. Market Price: The NAV represents the theoretical value of the ETF's assets, while the market price is the actual price at which the ETF trades on the exchange. These can differ slightly due to supply and demand.

-

Benchmarking: Comparing the NAV performance to the MSCI World Index benchmark is crucial to assess the ETF's tracking ability.

-

Comparing to Similar ETFs: Comparing the NAV performance with other globally diversified ETFs helps assess relative performance and identify potential better alternatives.

Analyzing Historical NAV Trends of Amundi MSCI World II UCITS ETF USD Hedged Dist

Analyzing historical NAV data provides insights into the ETF's long-term performance and potential future behavior. (Note: Specific historical data would need to be inserted here, ideally with charts and graphs visualizing NAV trends over time. This section would benefit from data visualization tools). By examining periods of growth and decline, investors can identify correlations between NAV movements and specific market events. Technical analysis tools can also be used (though with caution) to identify potential support and resistance levels in the NAV.

Using NAV Analysis for Investment Decisions in Amundi MSCI World II UCITS ETF USD Hedged Dist

NAV analysis is a valuable tool, but should not be the sole factor in investment decisions.

-

Buy/Sell Decisions: While rising NAV suggests potential for further growth, it's essential to consider overall market conditions, your risk tolerance, and other investment metrics.

-

Investment Metrics: NAV should be analyzed alongside other factors, such as expense ratio, volatility, and the ETF's historical performance relative to its benchmark.

-

Risk Tolerance: Your personal risk tolerance significantly influences your investment strategy. Aggressive investors might be less concerned with short-term NAV fluctuations, while conservative investors might prefer more stable investments.

-

Dollar-Cost Averaging: This strategy involves investing a fixed amount at regular intervals, regardless of the NAV. This mitigates the risk of investing a lump sum at a market peak.

-

Limitations: Relying solely on NAV for investment decisions is risky. Consider broader economic factors and geopolitical events that could influence future NAV.

Conclusion: The Importance of Consistent NAV Monitoring for Amundi MSCI World II UCITS ETF USD Hedged Dist

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is essential for informed investment decisions. Factors such as underlying asset performance, currency hedging, market conditions, and fees all contribute to its fluctuations. Regularly monitoring the NAV, alongside other key investment metrics and your personal risk profile, allows for a more informed approach to portfolio management. Remember to conduct thorough research and due diligence before making any investment decisions. Regularly monitor the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF USD Hedged Dist investment for optimal portfolio management.

Featured Posts

-

The Future Of Mia Farrows Career Ronan Farrows Influence

May 24, 2025

The Future Of Mia Farrows Career Ronan Farrows Influence

May 24, 2025 -

Planning Your Memorial Day Trip The Best And Worst Days To Fly In 2025

May 24, 2025

Planning Your Memorial Day Trip The Best And Worst Days To Fly In 2025

May 24, 2025 -

Gestaendnis Im Bestechungsskandal Neue Erkenntnisse Zur Uni Duisburg Essen

May 24, 2025

Gestaendnis Im Bestechungsskandal Neue Erkenntnisse Zur Uni Duisburg Essen

May 24, 2025 -

Skandal An Nrw Universitaeten Manipulation Von Noten Fuehrt Zu Gefaengnisstrafen

May 24, 2025

Skandal An Nrw Universitaeten Manipulation Von Noten Fuehrt Zu Gefaengnisstrafen

May 24, 2025 -

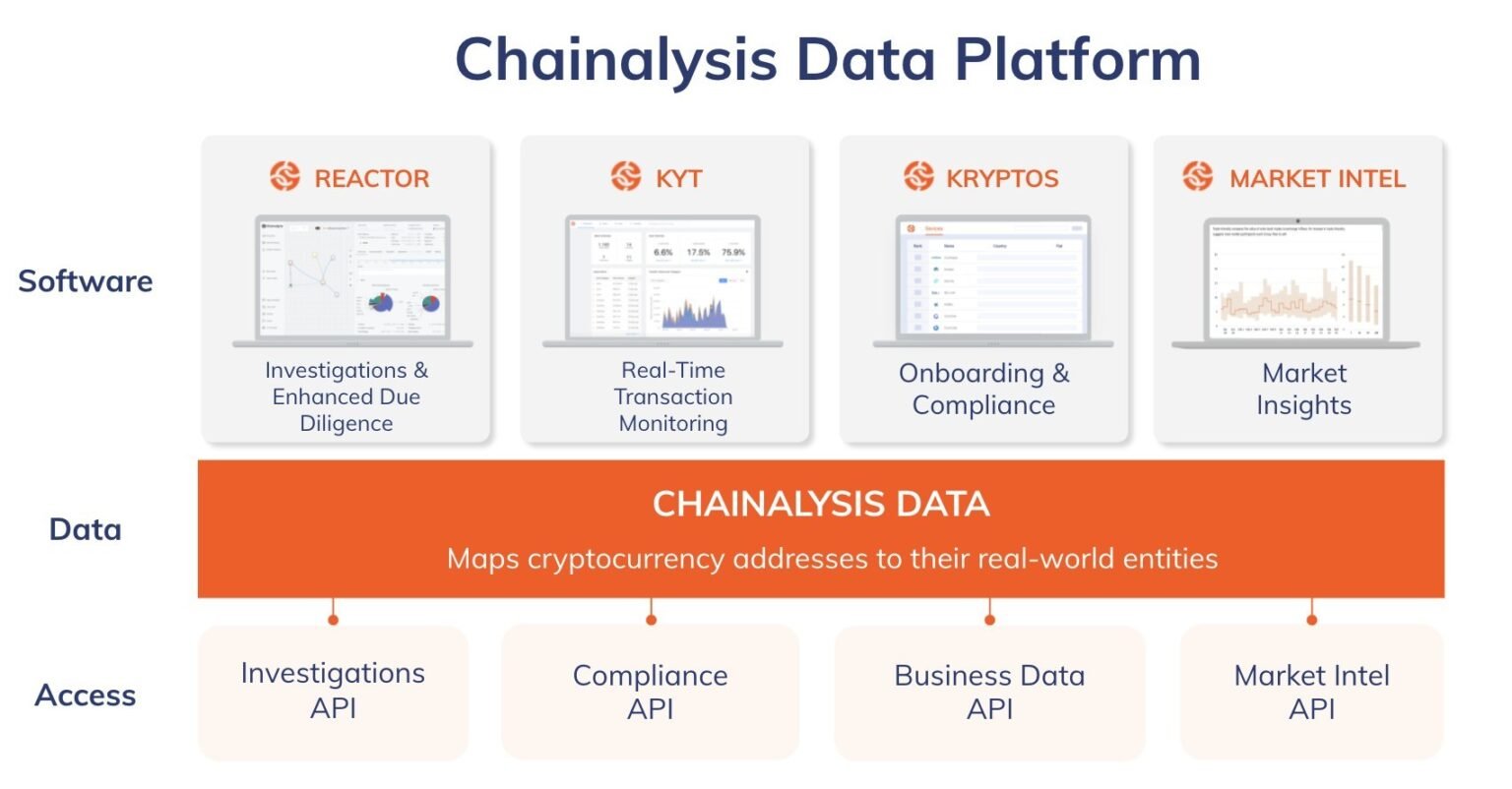

Blockchain Analytics Leader Chainalysis Integrates Ai With Alterya Purchase

May 24, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai With Alterya Purchase

May 24, 2025