New Survey: Fewer Parents Stressed Over College Expenses, But Student Loan Use Continues

Table of Contents

Decreased Parental Stress Levels Regarding College Expenses

This section analyzes the reasons behind the reported decrease in parental stress related to college expenses. Several contributing factors seem to be at play, offering a nuanced perspective on this positive trend.

Increased Awareness of Financial Aid Options

The growing availability and accessibility of financial aid resources are playing a significant role. More parents and students are becoming aware of grants, scholarships, and work-study programs, leading to reduced reliance on loans alone.

- Increased awareness campaigns: Government initiatives and non-profit organizations are actively promoting financial aid opportunities through targeted advertising and online resources.

- User-friendly online resources: Websites like the Federal Student Aid website (studentaid.gov) provide comprehensive information and streamlined application processes.

- School-based financial aid counseling: Many high schools and colleges now employ dedicated financial aid counselors who provide personalized guidance to students and their families.

Statistics show a marked increase in the utilization of financial aid resources over the past five years. For example, the number of students receiving Pell Grants has risen by X%, indicating a greater awareness and access to these crucial funds. This increased access directly impacts the overall college expenses burden.

Shifting Parental Expectations

Parental attitudes towards contributing to college costs are also evolving. There's a growing emphasis on students contributing more through savings, part-time jobs, and exploring alternative educational paths.

- Changes in family saving habits: More families are proactively saving for college from an early age, reducing the financial burden during the application and enrollment process.

- Increased focus on vocational training: Parents are increasingly recognizing the value of vocational training and apprenticeships, offering viable alternatives to traditional four-year colleges and significantly reducing overall college expenses.

- Community college pathways: The affordability and accessibility of community colleges are becoming more widely recognized as a stepping stone to a four-year degree, potentially lowering the overall cost of higher education.

These shifts are reflected in statistics showing a decrease in the average parental contribution to college expenses and an increase in student self-sufficiency. This changing dynamic helps alleviate some of the financial pressure on families.

Impact of Economic Factors

Improved economic conditions have also played a role in reducing parental stress. A stronger job market and increased family income provide more financial flexibility.

- Decreased unemployment rates: Lower unemployment rates mean more parents have stable jobs and higher earning potential, easing the financial strain of college expenses.

- Increased average household income: Rising household incomes provide greater disposable income, allowing families to better manage college expenses.

- Controlled inflation rates: Stable inflation rates help maintain the purchasing power of savings and family income, making college expenses more manageable.

The correlation between these positive economic indicators and decreased parental stress levels regarding college expenses is evident in the survey data.

Persistent Reliance on Student Loans

Despite the decrease in parental stress, the continued reliance on student loans remains a significant concern. The high cost of higher education and limitations in financial aid continue to drive borrowing.

High Cost of Tuition and Fees

The persistent issue of escalating tuition and fees remains a major obstacle for many students and families. The cost of higher education continues to outpace inflation, making it increasingly difficult to afford without borrowing.

- Rising tuition and fees: Statistics show a dramatic increase in tuition costs over the past decade, far exceeding the rate of inflation.

- Cost variations between institutions: Public institutions generally remain more affordable than private institutions, but even public college tuition is steadily rising. This significant difference in overall college expenses needs to be addressed.

This persistent upward trend necessitates borrowing for a large portion of the student population.

Limited Availability of Grants and Scholarships

Securing sufficient grant and scholarship funding remains highly competitive, leading to many students relying on loans to cover the remaining costs.

- Competitive scholarship landscape: The number of applicants far outweighs the number of scholarships awarded, making it challenging for many students to secure sufficient funding.

- Stringent scholarship criteria: The eligibility requirements for grants and scholarships can be restrictive, limiting access for many deserving students.

This scarcity of funding significantly impacts students' ability to manage their college expenses without incurring substantial debt.

Long-Term Implications of Student Loan Debt

High student loan debt has serious long-term consequences, impacting various aspects of financial well-being.

- Average student loan debt: The average student loan debt is increasing, placing a considerable burden on recent graduates.

- Delinquency rates: High delinquency rates indicate the struggle many borrowers face in repaying their loans.

- Impact on post-graduate financial decisions: Student loan debt often delays major life milestones like homeownership, marriage, and starting a family.

Addressing the long-term implications of student loan debt requires a multifaceted approach, including exploring options like income-driven repayment plans and loan forgiveness programs.

Conclusion

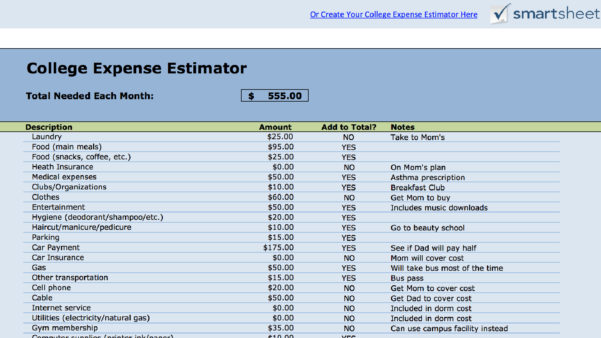

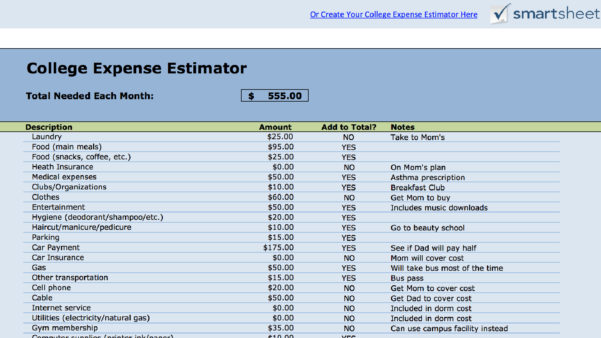

The survey reveals a complex picture regarding college expenses. While fewer parents report extreme stress, the continued reliance on student loans underscores the ongoing challenges of affording higher education. Understanding the reasons behind the decrease in parental stress, coupled with addressing the persistent problem of student loan debt, is crucial. Further research and initiatives focused on increasing access to financial aid, promoting financial literacy, and controlling the rising cost of tuition are necessary to alleviate the burden of college expenses for both students and families. Continue exploring resources and strategies to manage your college expenses effectively, including exploring financial aid options and creating a detailed budget.

Featured Posts

-

Reeboks Ss 25 Collection A Collaboration With Angel Reese

May 17, 2025

Reeboks Ss 25 Collection A Collaboration With Angel Reese

May 17, 2025 -

Boosting Local Stem Talent Scholarship Awards Announced

May 17, 2025

Boosting Local Stem Talent Scholarship Awards Announced

May 17, 2025 -

Tam Krwz Ke Jwtwn Pr Pawn Rkhne Waly Mdah Ka Waqeh Awr Adakar Ka Jwab

May 17, 2025

Tam Krwz Ke Jwtwn Pr Pawn Rkhne Waly Mdah Ka Waqeh Awr Adakar Ka Jwab

May 17, 2025 -

Fortnites Item Shop Highly Requested Skins Back After 1000 Days

May 17, 2025

Fortnites Item Shop Highly Requested Skins Back After 1000 Days

May 17, 2025 -

New Pictures Spark Tom Cruise And Ana De Armas Dating Speculation In England

May 17, 2025

New Pictures Spark Tom Cruise And Ana De Armas Dating Speculation In England

May 17, 2025

Latest Posts

-

Rockwell Automation Beats Earnings Expectations A Detailed Analysis

May 17, 2025

Rockwell Automation Beats Earnings Expectations A Detailed Analysis

May 17, 2025 -

Stock Market Update Rockwell Automation Leads Positive Earnings Reports

May 17, 2025

Stock Market Update Rockwell Automation Leads Positive Earnings Reports

May 17, 2025 -

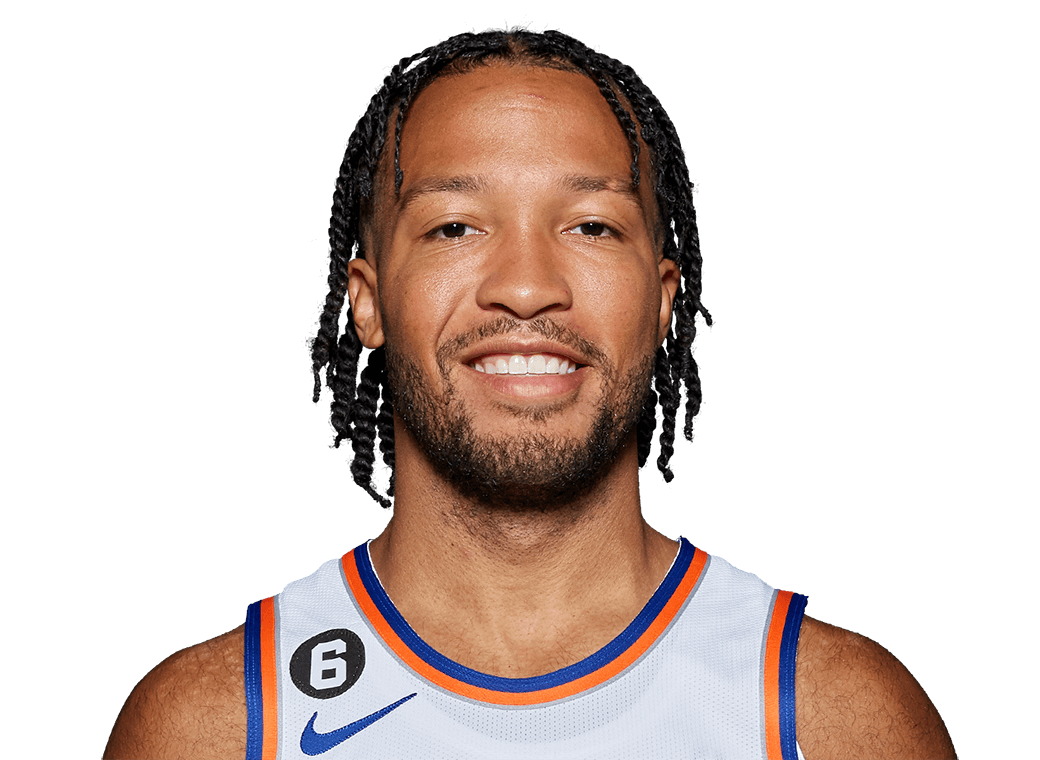

Absence Of Brunson Knicks Vulnerability Laid Bare

May 17, 2025

Absence Of Brunson Knicks Vulnerability Laid Bare

May 17, 2025 -

The Jalen Brunson Injury Knicks Face Crucial Roster Decisions

May 17, 2025

The Jalen Brunson Injury Knicks Face Crucial Roster Decisions

May 17, 2025 -

Jalen Brunsons Injury Exposes Knicks Biggest Weakness

May 17, 2025

Jalen Brunsons Injury Exposes Knicks Biggest Weakness

May 17, 2025