Oil Price Analysis And Market News For May 16, 2024

Table of Contents

Crude Oil Price Movement on May 16, 2024

May 16, 2024, saw considerable fluctuation in crude oil prices. Let's examine the daily oil price movements for both benchmark crudes: Brent and West Texas Intermediate (WTI).

-

Brent Crude: Opened at $75.50 per barrel, reached a high of $76.20, experienced a low of $74.80, and closed at $75.80. This represents a 0.4% increase compared to the previous day and a 1.2% increase compared to the previous week. The daily oil price chart showed a period of volatility mid-morning, likely linked to the news regarding OPEC+ production cuts (detailed below).

-

WTI Crude: Opened at $72.00 per barrel, saw a high of $72.75, a low of $71.50, and closed at $72.50. This indicates a 0.7% increase from the previous day and a 1.5% increase from the previous week. The price movement largely mirrored that of Brent crude, suggesting a synchronized global response to the news cycle.

-

Significant Price Spikes/Drops: A noticeable price spike occurred around midday, coinciding with the release of a statement from OPEC+ regarding potential production adjustments. This highlights the immediate impact of geopolitical factors on daily oil prices.

[Insert relevant chart or graph visualizing the price movement of Brent and WTI crude on May 16, 2024]

Factors Influencing Oil Prices on May 16, 2024

Several interconnected factors contributed to the oil price movements on May 16, 2024. Analyzing these drivers provides a clearer understanding of the market dynamics.

-

OPEC+ Production Decisions: OPEC+ (Organization of the Petroleum Exporting Countries and its allies) announced a surprise production cut, impacting global oil supply. This decision, driven by concerns about weakening global demand and the need to support prices, directly influenced the upward price trajectory.

-

Geopolitical Risks: Ongoing geopolitical tensions in [mention specific region/conflict], along with the ongoing sanctions on [mention country/entity], created uncertainty in the market, contributing to upward pressure on oil prices. Supply disruptions due to these geopolitical factors are always a concern for crude oil price analysis.

-

Economic Indicators: The release of weaker-than-expected economic data from major economies (e.g., a slowdown in manufacturing PMI) suggested a potential reduction in future oil demand. While this might usually put downward pressure on prices, the OPEC+ decision countered this effect.

-

Seasonal Factors: The approach of the peak summer driving season in the Northern Hemisphere typically boosts oil demand, leading to some price support.

-

Supply Chain Disruptions: Minor disruptions to oil supply chains due to [mention specific event, e.g., a pipeline maintenance schedule or a storm] added a further layer of complexity to the market dynamics.

Market Sentiment and Analyst Predictions for May 16, 2024

Market sentiment on May 16, 2024, was predominantly bullish, driven by the OPEC+ production cuts. While weaker economic data initially caused some concern, the perceived supply tightness ultimately overshadowed this negative factor.

-

Analyst Opinions: Most leading energy analysts held a cautiously optimistic outlook, anticipating continued price volatility in the short term. However, long-term predictions varied, with some suggesting further price increases due to supply constraints, and others expecting a more moderate trend depending on overall global economic growth.

-

Price Targets/Forecasts: Short-term price targets ranged from $76 to $80 per barrel for Brent crude, while long-term projections varied considerably, reflecting the uncertainty surrounding global economic growth and geopolitical developments.

-

Implications for Investors/Traders: The volatility presented both opportunities and risks. Investors needed to carefully consider their risk tolerance and trading strategies in light of this uncertainty. The ongoing oil price analysis is a necessary tool to properly evaluate these variables.

Trading Strategies and Investment Opportunities in Light of Oil Price Movements (Optional)

(Note: This section requires careful consideration and disclaimer about investment risks.)

Given the price movements and market sentiment, several trading strategies could have been considered on May 16, 2024. However, it is crucial to remember that trading commodities like crude oil involves substantial risk.

-

Long Positions: A long position (betting on rising prices) may have been considered by some investors given the OPEC+ production cuts and the bullish market sentiment.

-

Risk Management: Implementing stop-loss orders and diversifying investments are crucial for mitigating risk in the volatile oil market.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading in commodities markets involves significant risk, and losses can exceed initial investments.

Conclusion

The oil price analysis for May 16, 2024, reveals a complex interplay of factors influencing crude oil prices. The OPEC+ production cuts played a significant role, creating a sense of supply tightness that counteracted the impact of weaker economic data. Geopolitical risks and seasonal factors further contributed to the daily oil price fluctuations. To successfully navigate the energy markets, maintaining awareness of daily oil price analysis and market news is paramount.

Call to Action: Stay informed on daily oil price fluctuations with our regular oil price analysis and market news updates. For continuous updates on crude oil price movements, follow our daily oil price analysis.

Featured Posts

-

Rising Rents In La Price Gouging Following Recent Fires

May 17, 2025

Rising Rents In La Price Gouging Following Recent Fires

May 17, 2025 -

The Looming Cold War Over Scarce Rare Earth Minerals

May 17, 2025

The Looming Cold War Over Scarce Rare Earth Minerals

May 17, 2025 -

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6 Falsehoods Allegations

May 17, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6 Falsehoods Allegations

May 17, 2025 -

Belgica 0 1 Portugal Resumen Y Goles Del Crucial Encuentro

May 17, 2025

Belgica 0 1 Portugal Resumen Y Goles Del Crucial Encuentro

May 17, 2025 -

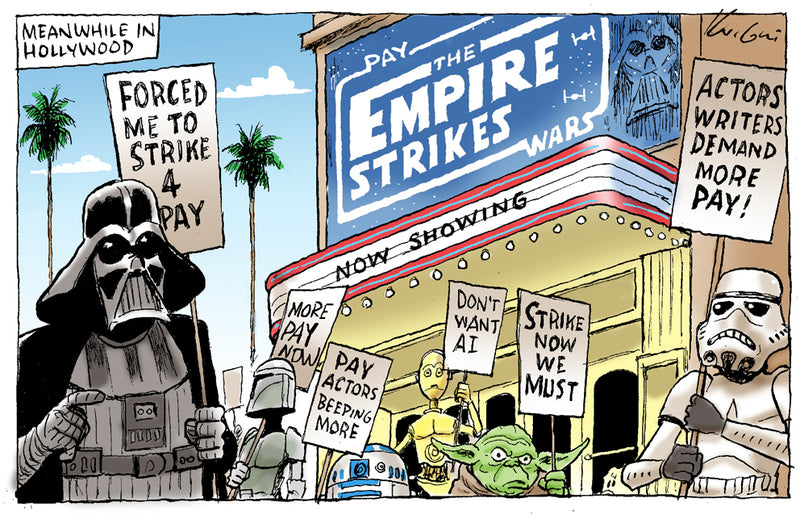

The Hollywood Strike Understanding The Impact Of The Double Walkout

May 17, 2025

The Hollywood Strike Understanding The Impact Of The Double Walkout

May 17, 2025

Latest Posts

-

Conference Track And Field A Roundup Of Award Winners

May 17, 2025

Conference Track And Field A Roundup Of Award Winners

May 17, 2025 -

Comparing Josh Hart And Draymond Green Similar Roles Different Teams

May 17, 2025

Comparing Josh Hart And Draymond Green Similar Roles Different Teams

May 17, 2025 -

Is Josh Hart The Knicks Version Of Draymond Green Analyzing His Contributions

May 17, 2025

Is Josh Hart The Knicks Version Of Draymond Green Analyzing His Contributions

May 17, 2025 -

Track Roundup Celebrating Student Athlete Success In Conference

May 17, 2025

Track Roundup Celebrating Student Athlete Success In Conference

May 17, 2025 -

Josh Hart The Knicks Draymond Green A Role Comparison

May 17, 2025

Josh Hart The Knicks Draymond Green A Role Comparison

May 17, 2025