Palantir Stock: A Pre-Earnings Report Investment Decision For May 5th

Table of Contents

Palantir's Recent Performance and Key Metrics

Analyzing Palantir's recent financial performance is crucial for assessing its current health and predicting future trajectory. Examining key performance indicators (KPIs) provides valuable insights into the company's operational efficiency and growth potential. Let's review some key metrics:

- Revenue Growth: Comparing year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth rates reveals the pace of Palantir's expansion. Strong and consistent growth indicates a healthy business model. Investors should look for sustained momentum in revenue generation.

- Profitability Margins: Analyzing gross, operating, and net profit margins helps determine Palantir's profitability. Improving margins demonstrate increasing efficiency and cost management. This is a critical aspect for long-term sustainability.

- Customer Acquisition and Retention: High customer acquisition and retention rates are crucial indicators of the strength of Palantir's product offerings and customer relationships. This reveals the stickiness of their platform and the value proposition offered to clients.

- Government vs. Commercial Revenue: Understanding the breakdown and growth trends of revenue from government and commercial sectors highlights Palantir's diversification strategy and resilience to potential shifts in either market segment.

- Significant Contract Wins/Losses: Major contract wins or losses significantly impact Palantir's revenue projections and investor sentiment. Tracking these events provides a real-time pulse on the company's performance and future prospects.

Growth Prospects and Future Outlook for Palantir

Palantir operates in the rapidly expanding big data analytics market, presenting significant growth opportunities. However, understanding the company's long-term potential requires a multifaceted approach:

- Addressable Market Size: The size of the market Palantir targets dictates its potential for scaling its operations. A large, expanding market provides room for significant growth.

- Competitive Landscape: Palantir faces competition from established players. Analyzing its competitive advantages, such as its advanced technology and strong customer relationships, is crucial to assess its long-term viability.

- New Product Launches/Advancements: Innovation is key to sustaining growth. New product releases and technological advancements strengthen Palantir's competitive position and unlock new market segments.

- Strategic Partnerships and Alliances: Collaborations with other companies enhance Palantir's reach and capabilities. Strategic partnerships can significantly accelerate growth and expand market penetration.

- Projected Revenue Growth and Profitability: Analyzing analyst forecasts for future revenue growth and profitability provides a valuable indication of market expectations and potential returns on investment.

Risks and Challenges Facing Palantir Stock

While Palantir offers exciting growth prospects, several risks could negatively impact its stock price:

- Competition: Intense competition from established players in the big data analytics market could limit Palantir's market share and growth potential.

- Government Contract Dependence: A substantial portion of Palantir's revenue comes from government contracts. Changes in government spending or policy could significantly affect its financial performance.

- Data Privacy and Security: Operating in the data analytics space necessitates stringent data privacy and security measures. Breaches or regulatory changes in this area could harm Palantir's reputation and business.

- Valuation Concerns: Palantir's stock valuation is a crucial factor for investors. Overvaluation could lead to a significant price correction.

- Macroeconomic Factors: Economic downturns or geopolitical instability can negatively impact Palantir's business, especially its government contracts.

Analyzing the Sentiment Surrounding Palantir Stock

Gauging investor sentiment is crucial for understanding market expectations and potential price movements:

- Analyst Ratings and Price Targets: Analyzing analyst ratings and price targets provides insights into the overall market perception of Palantir's value.

- News Articles and Press Releases: Monitoring news and press releases helps track significant events and their impact on investor sentiment.

- Social Media Sentiment: Social media platforms provide a glimpse into public opinion towards Palantir, albeit with inherent biases.

- Significant Events Impacting Sentiment: Major announcements, such as new contracts, product launches, or regulatory changes, can significantly influence investor sentiment.

Conclusion

This pre-earnings report analysis of Palantir stock (PLTR) has explored key factors influencing its value, including recent performance, growth prospects, and associated risks. Considering the factors discussed, investors should carefully weigh the potential for substantial growth against the inherent volatility of the stock. The upcoming earnings report on May 5th will be a crucial data point in assessing the company’s progress and validating or refuting current market expectations.

Call to Action: Before making an investment decision on Palantir stock before the May 5th earnings report, conduct thorough due diligence and consider consulting with a financial advisor. Understanding the intricacies of Palantir's business model and the market conditions is crucial for making a sound investment decision regarding Palantir stock and navigating the complexities of the PLTR stock price. Remember, investing in Palantir, or any stock, involves risk.

Featured Posts

-

Us Fentanyl Seizure Pam Bondis Press Conference Highlights Record Bust

May 10, 2025

Us Fentanyl Seizure Pam Bondis Press Conference Highlights Record Bust

May 10, 2025 -

Updated Palantir Stock Predictions Market Rally Impacts Analysis

May 10, 2025

Updated Palantir Stock Predictions Market Rally Impacts Analysis

May 10, 2025 -

From Scatological Documents To Engaging Podcast The Power Of Ai

May 10, 2025

From Scatological Documents To Engaging Podcast The Power Of Ai

May 10, 2025 -

Investing In Palantir Technologies A Practical Assessment Of Its Stock

May 10, 2025

Investing In Palantir Technologies A Practical Assessment Of Its Stock

May 10, 2025 -

Edmonton Oilers Leon Draisaitls Lower Body Injury Expected Return Before Playoffs

May 10, 2025

Edmonton Oilers Leon Draisaitls Lower Body Injury Expected Return Before Playoffs

May 10, 2025

Latest Posts

-

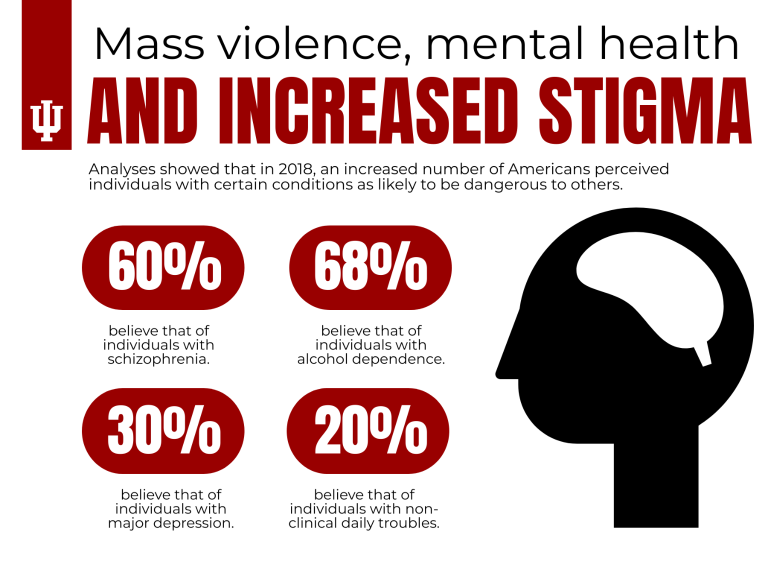

Reframing The Narrative Mental Illness Violence And The Medias Role

May 10, 2025

Reframing The Narrative Mental Illness Violence And The Medias Role

May 10, 2025 -

Academic Failure In Understanding Mental Illness And Violent Crime

May 10, 2025

Academic Failure In Understanding Mental Illness And Violent Crime

May 10, 2025 -

Severe Mental Illness And Violence Challenging The Monster Myth

May 10, 2025

Severe Mental Illness And Violence Challenging The Monster Myth

May 10, 2025 -

London Outing Harry Styles Sports A 70s Mustache

May 10, 2025

London Outing Harry Styles Sports A 70s Mustache

May 10, 2025 -

The Misrepresentation Of Mentally Ill Killers Why We Need A Better Understanding

May 10, 2025

The Misrepresentation Of Mentally Ill Killers Why We Need A Better Understanding

May 10, 2025