Palantir Stock: A Pre-May 5th Investment Analysis

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Analyzing Palantir's recent financial performance is crucial for any Palantir investment strategy. Recent quarterly earnings reports reveal important trends in revenue growth, profitability, and key performance indicators (KPIs). While Palantir has demonstrated consistent revenue growth, profitability remains a key focus for the company. Analyst predictions vary, but the consensus generally points towards continued revenue growth, though the pace might fluctuate.

-

Revenue Growth Rate: Comparing Palantir's revenue growth rate to previous quarters and industry benchmarks reveals its competitive position. While specific figures require referencing recent financial statements, a year-over-year comparison provides context for assessing the company's trajectory.

-

Profit Margin Analysis: Analyzing Palantir's profit margins and projecting future profitability is essential. Factors such as operating expenses and the impact of large contracts on profitability need careful consideration.

-

Key Contract Wins: The impact of key contract wins, particularly government contracts, significantly influences Palantir's financial performance and future projections. These contracts offer substantial revenue streams but also introduce dependencies that investors should acknowledge.

-

Valuation Comparison: Comparing Palantir's valuation to competitors in the big data and analytics market provides context. This helps determine if the current PLTR stock price reflects its potential for future growth.

Assessing Palantir's Competitive Landscape and Market Share

Palantir operates in a competitive landscape dominated by established players and emerging startups. Understanding Palantir's competitive position within the big data and analytics market is essential for a robust Palantir analysis.

-

Key Competitors: Companies like Databricks and Snowflake are significant competitors, each offering distinct strengths and weaknesses. Analyzing their offerings, relative market share, and potential for disruptive innovation is critical.

-

Technology and Offerings: A comparative analysis of Palantir's technology, including its data integration capabilities and platform features, compared to competitors' offerings, sheds light on its competitive advantages and disadvantages.

-

Market Share: Assessing Palantir's market share in both government and commercial sectors provides insights into its penetration and potential for further expansion. The company’s success in securing and retaining government contracts is a major factor in its overall performance.

-

Competitive Advantages: Palantir's competitive advantages, such as its strong relationships with government agencies and its sophisticated data integration capabilities, are crucial factors in its ability to maintain market share and attract new clients.

Evaluating the Risks and Opportunities Associated with Investing in Palantir Stock

Any Palantir investment carries inherent risks and opportunities. A thorough risk assessment is crucial before investing in PLTR stock.

-

High Valuation Risks: Palantir's stock valuation has been subject to significant fluctuations. Understanding the potential for market corrections and the impact on the PLTR stock price is vital.

-

Government Contract Dependency: Palantir's reliance on government contracts introduces risk. The loss of major contracts or changes in government spending could significantly affect the company's financial performance.

-

Commercial Market Opportunities: Palantir's expansion into the commercial market presents opportunities for growth. Success in this sector could significantly reduce its dependence on government contracts.

-

Economic Downturn Impact: Economic downturns can negatively impact technology spending, potentially affecting Palantir's revenue and stock price. Analyzing the potential impact of economic fluctuations is vital for any Palantir stock investment strategy.

Technical Analysis of Palantir Stock (Pre-May 5th)

Technical analysis of PLTR stock leading up to May 5th provides valuable insights. Examining support and resistance levels, trading volume, and price patterns helps predict potential price movements. (Note: Interactive charts would be inserted here to visually represent the technical analysis.)

-

Support and Resistance Levels: Identifying key support and resistance levels helps in determining potential price reversals or breakouts.

-

Trading Volume Analysis: Analyzing trading volume reveals the strength of price movements and potential shifts in market sentiment.

-

Chart Patterns: Identifying chart patterns, such as head and shoulders or triangles, can signal potential future price movements.

-

Technical Indicators: Using technical indicators like RSI and MACD can provide further insights into market momentum and potential price reversals.

Conclusion: Should You Invest in Palantir Stock Before May 5th?

This pre-May 5th Palantir stock analysis highlights both the significant opportunities and risks associated with investing in PLTR. While Palantir shows strong revenue growth and possesses technological advantages, its high valuation and dependence on government contracts remain concerns. The upcoming period before May 5th could significantly impact the PLTR stock price. Therefore, a careful consideration of all factors presented here is crucial before making any investment decisions. Remember, this analysis is for informational purposes only and does not constitute financial advice. Conduct your own thorough research and consider this Palantir stock analysis as one factor in your pre-May 5th investment strategy. Remember to always perform your own due diligence before making any decisions regarding your Palantir investment.

Featured Posts

-

The Unexpected High Potential Season 2 Victim A Case For The Season 1 Underdog

May 09, 2025

The Unexpected High Potential Season 2 Victim A Case For The Season 1 Underdog

May 09, 2025 -

Palantir Stock Weighing The Risks And Rewards Of A Potential 40 Increase By 2025

May 09, 2025

Palantir Stock Weighing The Risks And Rewards Of A Potential 40 Increase By 2025

May 09, 2025 -

Celebrity Antiques Road Trip Locations Experts And Notable Finds

May 09, 2025

Celebrity Antiques Road Trip Locations Experts And Notable Finds

May 09, 2025 -

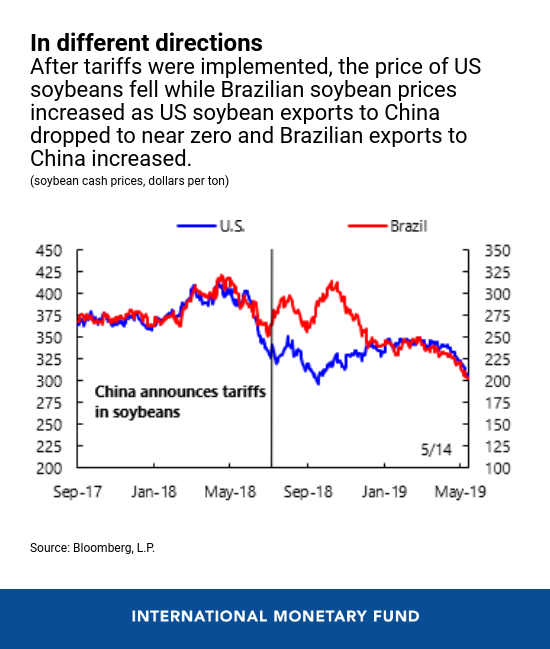

Chinese Goods And Trade Wars The Impact On Bubble Blasters And Beyond

May 09, 2025

Chinese Goods And Trade Wars The Impact On Bubble Blasters And Beyond

May 09, 2025 -

F1 News Montoya Reveals Predetermined Doohan Decision

May 09, 2025

F1 News Montoya Reveals Predetermined Doohan Decision

May 09, 2025