Palantir Stock: Analyzing Q1 2024 Government And Commercial Business Trends

Table of Contents

Palantir's Government Business in Q1 2024: A Deep Dive

Palantir's government business remains a cornerstone of its revenue stream. Understanding its performance in Q1 2024 is crucial for assessing the overall health of the Palantir stock.

Analyzing Government Contract Wins and Revenue Growth

Palantir's success in securing significant government contracts directly impacts its Q1 2024 earnings and the overall outlook for Palantir stock.

- Significant Contract Wins: While specific details may be limited due to confidentiality agreements, publicly available information suggests several substantial contract wins in Q1 2024, including a multi-year agreement with a major intelligence agency and an expansion of existing contracts with various branches of the US military and international defense forces.

- Year-over-Year Revenue Growth: Preliminary reports suggest a healthy year-over-year growth rate from government contracts, exceeding expectations in some analyst forecasts. This points towards a strong demand for Palantir's data analytics and integration capabilities within the government sector.

- Challenges and Headwinds: Budgetary constraints and increased competition from other technology companies are potential headwinds. However, Palantir's unique platform capabilities and long-standing relationships with key agencies seem to be mitigating these challenges.

- Key Partnerships and Collaborations: Palantir's continued collaboration with various government agencies, including joint development projects, strengthens its position within the government market, making it more resilient to external pressures on Palantir stock.

- (Insert relevant chart/graph visualizing government contract wins and revenue growth here)

Future Outlook for Palantir's Government Business

The pipeline of future government contracts looks promising, suggesting sustained growth for Palantir stock.

- Pipeline of Future Contracts: Palantir's strong relationship with numerous government bodies indicates a substantial pipeline of potential future contracts, indicating consistent demand for its platform in the years to come.

- Long-Term Growth Projections: Analysts project continued, albeit perhaps slower, growth in government revenue for the coming years. The long-term implications are positive for Palantir Stock's valuation.

- Geopolitical Factors: Global geopolitical events can influence government spending on defense and intelligence, creating both opportunities and risks for Palantir's government business and ultimately influencing Palantir stock price.

Palantir's Commercial Sector Performance in Q1 2024

The commercial sector is an increasingly important component of Palantir's overall revenue, representing significant growth potential for Palantir stock.

Examining Commercial Revenue Growth and Key Client Acquisitions

Expansion within the commercial sector is vital to Palantir's growth narrative and the valuation of Palantir stock.

- Commercial Revenue Growth: Q1 2024 saw robust growth in commercial revenue compared to the previous quarter and the same period last year. This signals the increasing adoption of Palantir's platform by businesses across various sectors.

- Significant New Commercial Clients: Palantir secured several key clients in Q1 2024, spanning industries like finance, healthcare, and energy. These acquisitions demonstrate market traction and validate the platform's applicability across multiple business domains.

- Expansion into New Commercial Markets: Palantir's strategic focus on expanding into new commercial markets indicates a proactive approach to diversifying its revenue streams, reducing dependence on the government sector and benefiting Palantir stock.

- Notable Success Stories: Positive client case studies showcasing the tangible benefits of using Palantir's platform can significantly boost investor confidence and the price of Palantir stock.

Analyzing the Commercial Market Landscape and Competitive Dynamics

The commercial market is fiercely competitive, presenting both challenges and opportunities for Palantir.

- Competitive Landscape: The commercial data analytics market is crowded with established players and innovative startups. Palantir faces significant competition, demanding continued innovation and strategic positioning.

- Competitive Advantages and Differentiators: Palantir's strengths lie in its powerful platform, its ability to integrate disparate data sources, and its focus on addressing complex business problems. These differentiators are crucial for maintaining a competitive edge.

- Potential for Future Growth: The commercial market offers vast untapped potential. Palantir's continued investment in R&D and strategic partnerships should facilitate robust future growth, influencing the valuation of Palantir stock positively.

Overall Financial Performance and Stock Implications

A comprehensive review of Palantir's Q1 2024 financial performance provides context for understanding its stock implications.

Key Financial Metrics and Performance Indicators

Analyzing key metrics helps gauge the overall financial health of Palantir.

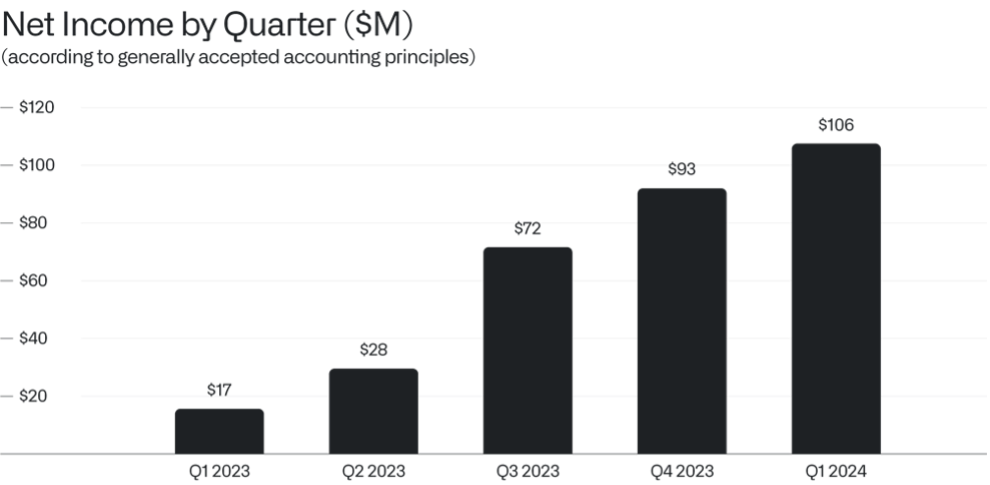

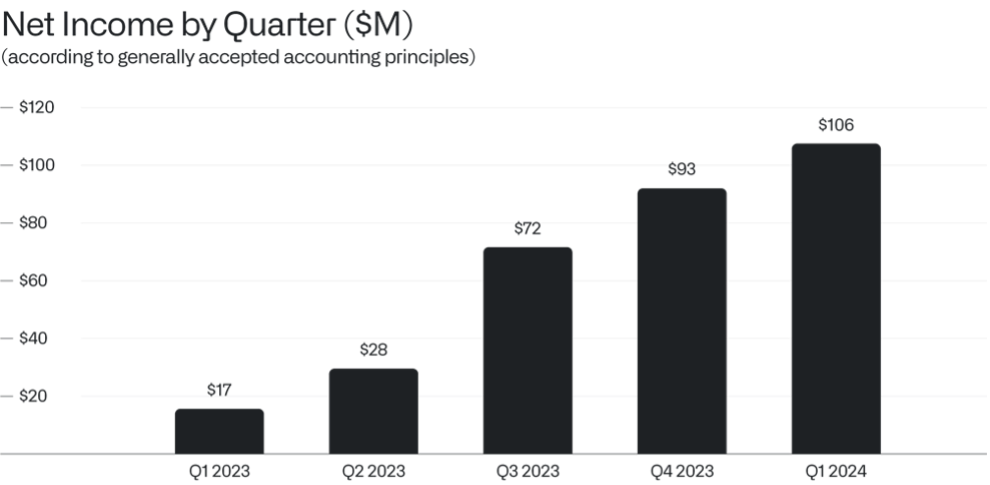

- Key Financial Metrics: Examining revenue, earnings per share (EPS), operating margin, and other crucial metrics provides a clear picture of Palantir's financial performance in Q1 2024.

- Comparison with Analyst Expectations: Comparing the reported results with analyst expectations helps determine whether the company exceeded or fell short of market projections, influencing the reaction of Palantir stock.

- Assessment of Overall Financial Health: A comprehensive assessment of all financial indicators allows for a thorough evaluation of Palantir's overall financial stability.

Impact on Palantir Stock Price and Future Valuation

The Q1 2024 results directly affect Palantir's stock price and its future valuation.

- Impact on Palantir Stock Price: The market's reaction to the Q1 2024 earnings report heavily influences the short-term price movements of Palantir stock.

- Potential Future Price Movements: Based on the Q1 performance and future growth projections, analysts offer forecasts for potential price movements, providing investors with insights to manage their Palantir stock holdings.

- Considerations for Investors: Investors should consider various factors, including risk tolerance and investment horizon, when making decisions about Palantir stock.

Conclusion: Investing in Palantir Stock – A Q1 2024 Perspective

Palantir's Q1 2024 performance showcased a mixed bag. While strong growth in both government and commercial sectors is encouraging, investors should carefully consider the competitive landscape and potential challenges. The sustained growth in government contracts and the expansion into the commercial sector highlight a promising future, but careful analysis of key financial metrics and future projections is crucial for making informed decisions regarding Palantir stock. Stay informed about Palantir Stock, and further your research into Palantir Stock's Q1 2024 performance to make well-informed investment choices. Consider Palantir Stock as part of your investment strategy after conducting thorough due diligence and, if necessary, seeking professional financial advice.

Featured Posts

-

Go Compare Axe Wynne Evans Following Strictly Controversy

May 10, 2025

Go Compare Axe Wynne Evans Following Strictly Controversy

May 10, 2025 -

9 Nhl Stars With The Potential To Eclipse Ovechkins Legacy

May 10, 2025

9 Nhl Stars With The Potential To Eclipse Ovechkins Legacy

May 10, 2025 -

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 10, 2025

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 10, 2025 -

Analyzing Morgans Strategic Weaknesses 5 High Potential Season 1 Examples

May 10, 2025

Analyzing Morgans Strategic Weaknesses 5 High Potential Season 1 Examples

May 10, 2025 -

New Spring Collection Elizabeth Stewart Designs For Lilysilk

May 10, 2025

New Spring Collection Elizabeth Stewart Designs For Lilysilk

May 10, 2025

Latest Posts

-

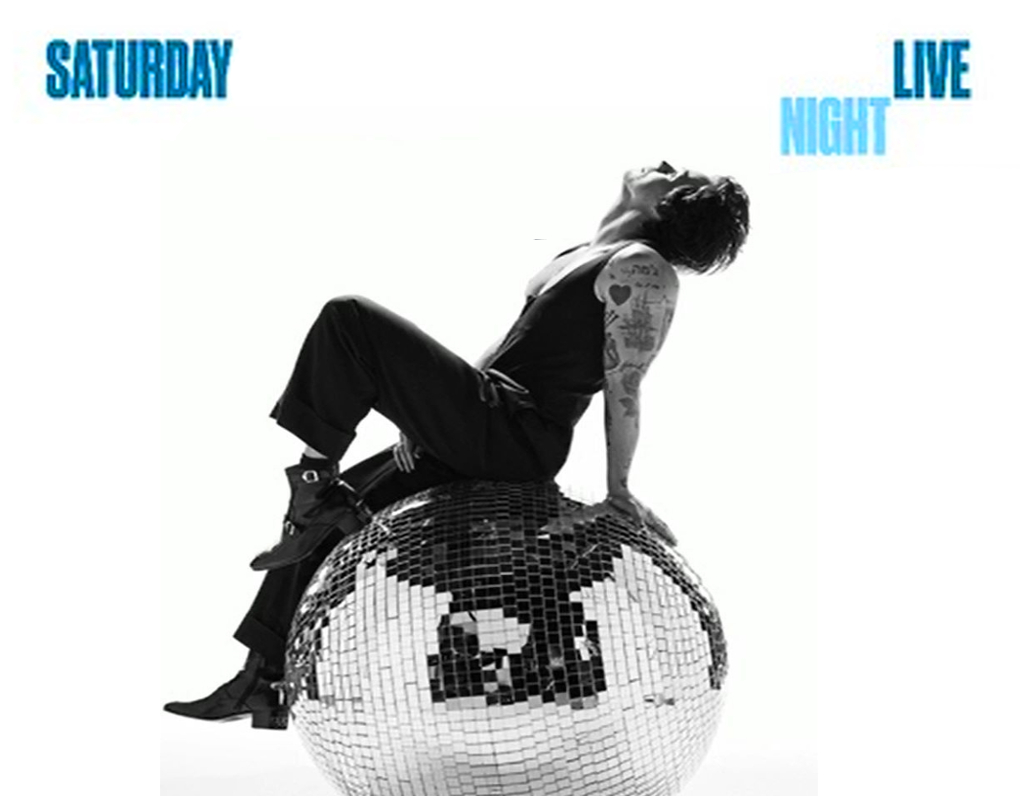

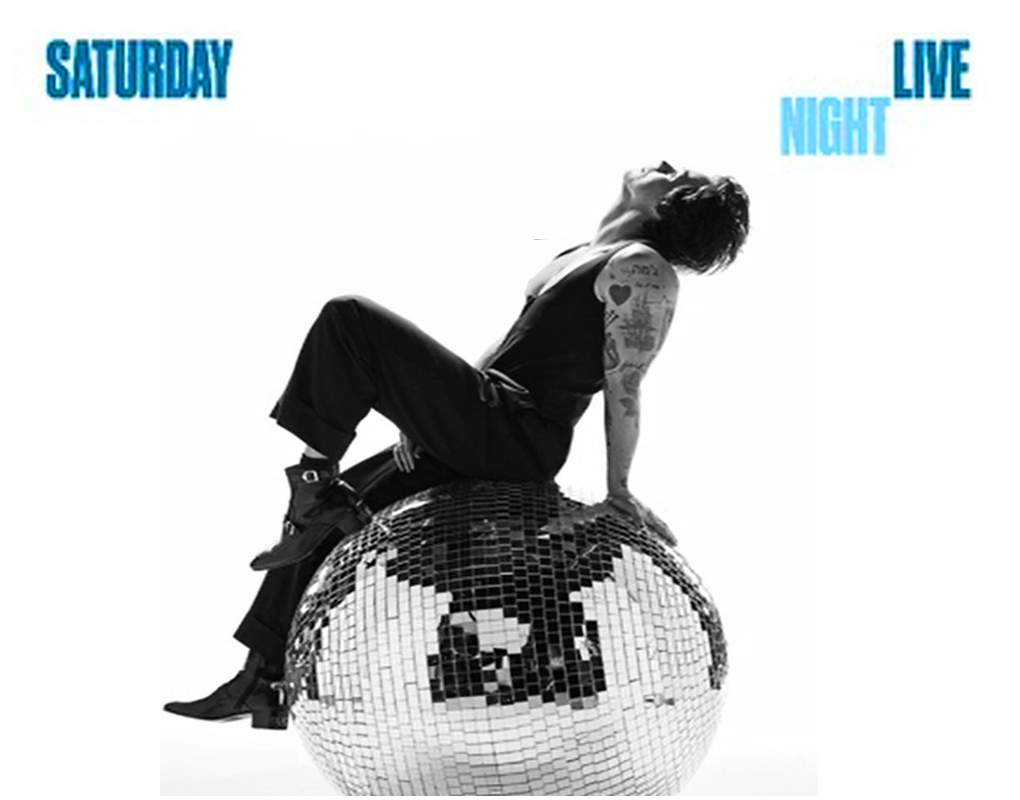

Harry Styles On That Snl Impression The Truth Behind His Disappointment

May 10, 2025

Harry Styles On That Snl Impression The Truth Behind His Disappointment

May 10, 2025 -

Harry Styles Addresses The Critically Panned Snl Impression Of Him

May 10, 2025

Harry Styles Addresses The Critically Panned Snl Impression Of Him

May 10, 2025 -

Snls Failed Harry Styles Impression His Honest Reaction

May 10, 2025

Snls Failed Harry Styles Impression His Honest Reaction

May 10, 2025 -

Did Snls Harry Styles Impression Miss The Mark The Star Reacts

May 10, 2025

Did Snls Harry Styles Impression Miss The Mark The Star Reacts

May 10, 2025 -

The Snl Impression That Left Harry Styles Devastated

May 10, 2025

The Snl Impression That Left Harry Styles Devastated

May 10, 2025