Palantir Stock Down 30%: Buy The Dip?

Table of Contents

Analyzing the 30% Drop in Palantir Stock

Understanding the Reasons Behind the Decline

Several factors contributed to the significant drop in Palantir stock price. Understanding these reasons is crucial before considering any Palantir investment.

-

Market Correction: The broader tech sector has experienced a recent correction, impacting even strong performers like Palantir. Increased interest rates and inflation concerns have led to a general sell-off in the stock market, dragging down many growth stocks, including PLTR.

-

Disappointing Earnings (if applicable): Recent earnings reports may have fallen short of analysts' expectations, leading to a sell-off by investors. Analyzing the specifics of the earnings report, particularly the revenue growth and guidance, is critical for understanding the impact on Palantir valuation.

-

Investor Sentiment: Negative investor sentiment, fueled by market volatility and news cycles, can contribute to significant stock price drops. Fear often outweighs logic in these situations, driving down prices regardless of the company's underlying fundamentals.

-

Competitor Activity: Increased competition in the data analytics market could also play a role. Analyzing the competitive landscape and Palantir's positioning within it is essential.

-

Macroeconomic Factors: Global economic uncertainty and geopolitical events can also significantly impact investor confidence and stock valuations. Factors like rising inflation and potential recessions influence investor behavior.

Assessing Palantir's Long-Term Potential

Despite the recent downturn, Palantir's long-term potential remains a key factor to consider in any Palantir investment decision.

-

Government Contracts: Palantir holds significant contracts with government agencies, providing a stable revenue stream. This reduces reliance on fluctuating commercial markets to some extent.

-

Commercial Partnerships: The company is expanding its commercial partnerships, diversifying its revenue sources and opening up new growth avenues. This is key to long-term growth and sustainability.

-

Innovative Data Analytics Technology: Palantir's cutting-edge data analytics technology is a significant asset, giving it a competitive edge in a rapidly expanding market. The ongoing evolution of this technology and its application to various sectors is a key driver of potential.

-

Strategic Partnerships and Acquisitions: Future strategic partnerships or acquisitions could significantly boost Palantir's growth and market share. Monitoring news and announcements related to this is crucial.

Evaluating the "Buy the Dip" Strategy for Palantir Stock

Risk Assessment and Due Diligence

Before considering a "buy the dip" strategy for Palantir stock, a thorough risk assessment is paramount.

-

High Volatility: PLTR stock is known for its high volatility. This inherent risk should be factored into any investment decision.

-

Dependence on Government Contracts: While stable, over-reliance on government contracts exposes Palantir to potential risks associated with government budget changes or policy shifts.

-

Competition: The competitive landscape in the data analytics market is intense, and Palantir faces competition from established players and emerging startups.

Comparing Palantir's Valuation to Competitors

A comparative analysis of Palantir's valuation against competitors in the data analytics sector is essential. This includes examining key metrics such as:

-

Market Capitalization: Comparing Palantir's market cap to its peers offers valuable insights into its relative valuation.

-

Price-to-Earnings Ratio (P/E Ratio): Analyzing the P/E ratio provides context to Palantir's valuation compared to industry benchmarks.

Considering Diversification and Investment Strategy

Diversification is key to mitigating risk in any investment portfolio.

-

Portfolio Diversification: Palantir should be considered within the context of a well-diversified portfolio to mitigate risk.

-

Investment Strategy: A defined investment strategy that aligns with your risk tolerance and financial goals is essential.

Alternative Investment Options and Strategies

Exploring other tech stocks

Several other technology stocks might offer comparable growth potential with potentially reduced risk compared to Palantir. Researching these alternatives is prudent.

Considering different investment approaches

Strategies like dollar-cost averaging can mitigate the risk associated with investing in volatile stocks like PLTR.

Conclusion

The 30% drop in Palantir stock presents a potential buying opportunity for some investors, but it's not without significant risk. While Palantir boasts innovative technology and a strong government presence, its high volatility and dependence on specific sectors demand careful consideration. Before jumping in with a "buy the dip" approach to Palantir investment, thorough due diligence, a comprehensive risk assessment, and a well-defined investment strategy are absolutely crucial. Make informed decisions based on your risk tolerance and long-term financial objectives. Remember to conduct your own research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Photos From Arctic Comic Con 2025 Characters Ectomobile And More

May 09, 2025

Photos From Arctic Comic Con 2025 Characters Ectomobile And More

May 09, 2025 -

David In High Potential Episode 13 Casting Choice And Its Ironic Significance

May 09, 2025

David In High Potential Episode 13 Casting Choice And Its Ironic Significance

May 09, 2025 -

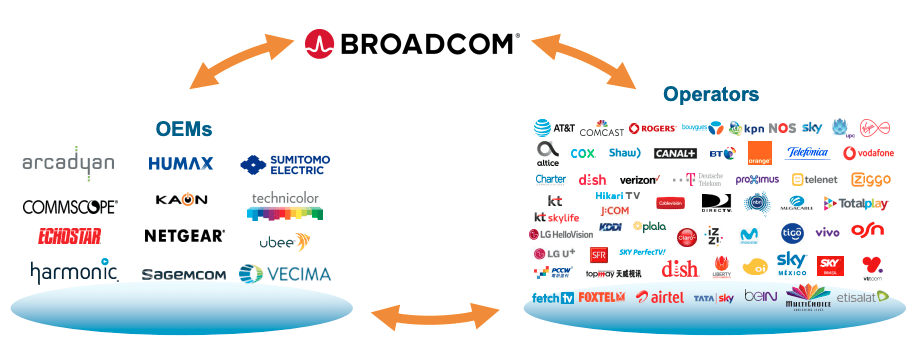

1 050 V Mware Price Increase At And Ts Concerns Over Broadcoms Acquisition

May 09, 2025

1 050 V Mware Price Increase At And Ts Concerns Over Broadcoms Acquisition

May 09, 2025 -

Rakesh Sharma Indias First Astronaut His Journey And Current Life

May 09, 2025

Rakesh Sharma Indias First Astronaut His Journey And Current Life

May 09, 2025 -

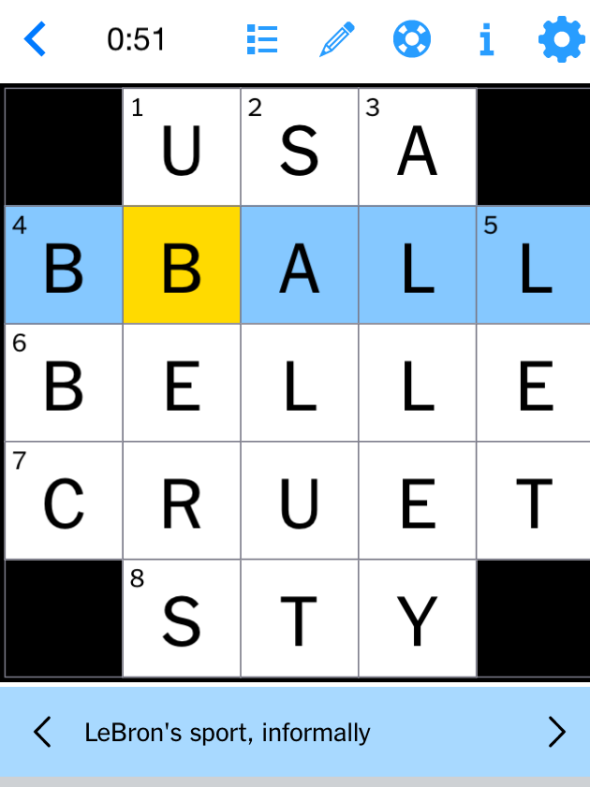

Solve The Nyt Strands Crossword April 12 2025 Hints And Solutions

May 09, 2025

Solve The Nyt Strands Crossword April 12 2025 Hints And Solutions

May 09, 2025