Palantir Technologies Stock: Buy, Sell, Or Hold?

Table of Contents

Palantir's Financial Performance and Valuation

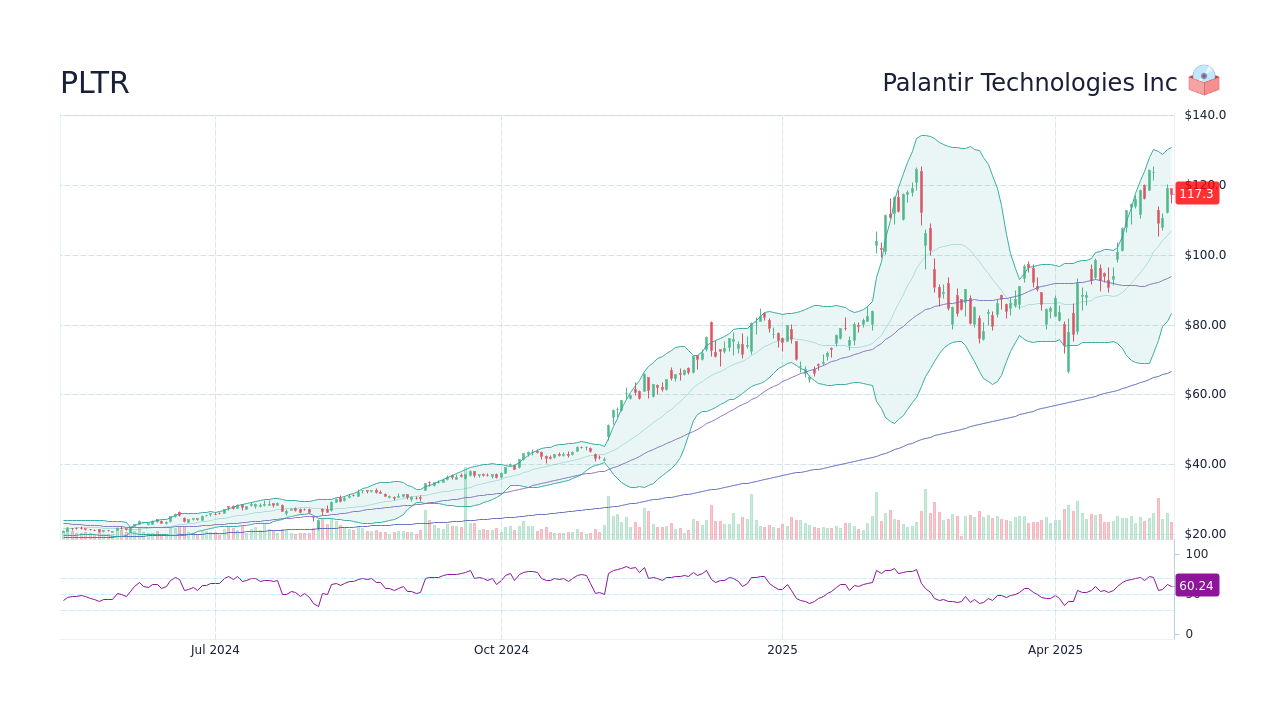

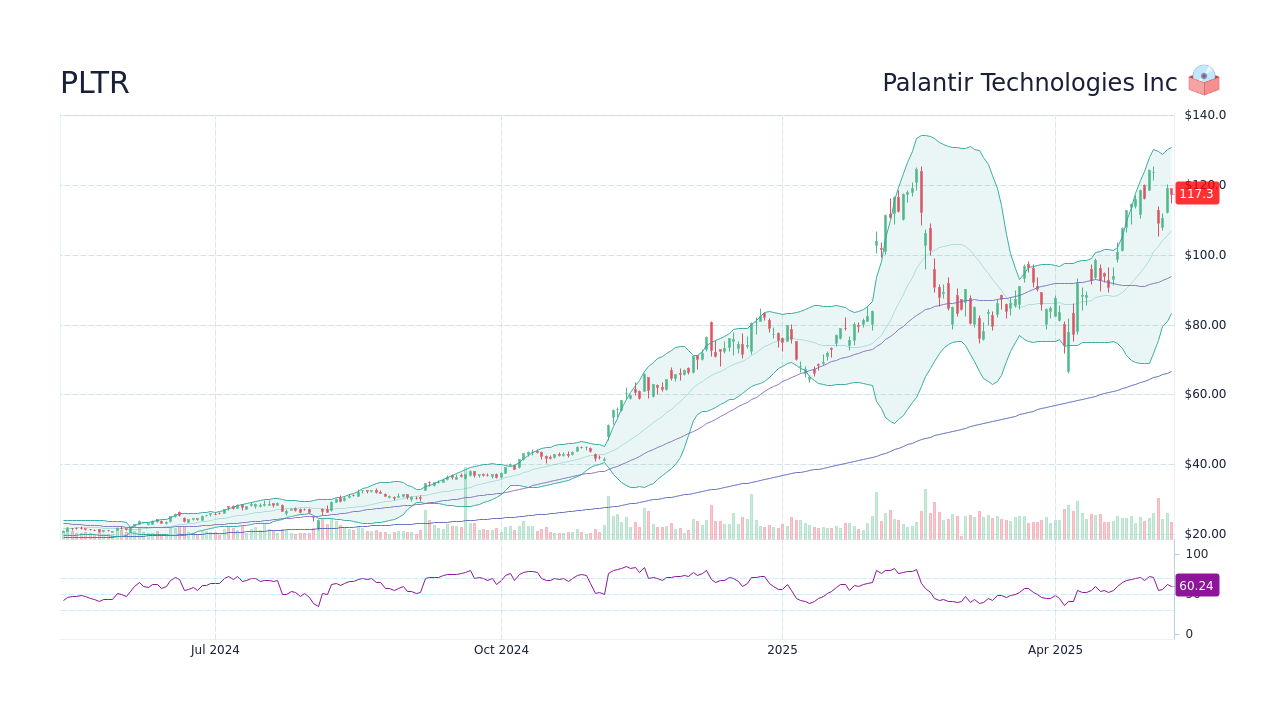

Understanding Palantir's financial health is crucial for any investment decision. Analyzing recent quarterly and annual reports reveals a mixed bag. While revenue growth has been impressive, consistent profitability remains a challenge. Let's look at the numbers:

- Revenue Growth Rate: Palantir has demonstrated strong year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth, indicating increasing demand for its data analytics platforms. However, the rate of growth needs to be considered in the context of the overall market growth and compared to its competitors.

- Profitability Margins: Gross margins are generally healthy, reflecting the high value proposition of Palantir's offerings. However, operating and net profit margins have been inconsistent, highlighting the company's ongoing investments in research and development (R&D) and sales & marketing.

- Debt-to-Equity Ratio: This metric provides insights into Palantir's financial leverage and its ability to manage debt. A high ratio can indicate higher risk.

- Free Cash Flow Generation: Positive free cash flow is a positive indicator of financial strength and sustainability. Analyzing the trend in free cash flow is critical for assessing Palantir's long-term financial health.

Comparing these key financial metrics to industry competitors like Databricks and Snowflake is essential to gauge Palantir's relative performance and valuation. Currently, Palantir’s valuation, as measured by metrics such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, needs to be carefully evaluated against its growth prospects and compared to industry benchmarks to determine if it is overvalued or undervalued.

Palantir's Market Position and Competitive Landscape

Palantir occupies a unique niche in the big data analytics and government contracting sectors. Its proprietary technology and strong relationships with government agencies provide significant competitive advantages. However, the competitive landscape is evolving rapidly.

- Key Market Segments: Palantir serves government agencies, financial institutions, and other large enterprises. Understanding the growth potential within each segment is crucial.

- Market Size and Growth Potential: The market for big data analytics and AI-powered solutions is massive and growing exponentially, presenting significant opportunities for Palantir.

- Competitive Strengths and Weaknesses: Palantir's strengths lie in its advanced technology, strong customer relationships, and data security capabilities. However, it faces competition from established players with broader product portfolios and potentially lower pricing strategies.

- Barriers to Entry: The high cost of developing and deploying sophisticated data analytics platforms creates significant barriers to entry, protecting Palantir's position to some extent.

Key competitors include Databricks, Snowflake, and other established players in the cloud computing and data analytics spaces. Analyzing their strategies and market shares is vital to assessing Palantir's long-term competitive positioning.

Palantir's Future Growth Potential and Strategic Initiatives

Palantir's future growth hinges on its ability to execute its strategic initiatives and capitalize on emerging market opportunities.

- New Product Development Pipeline: Continuous innovation and the development of new products and services are critical for maintaining a competitive edge.

- Strategic Partnerships and Collaborations: Strategic alliances can expand Palantir's reach and access new markets.

- Expansion into New Geographic Markets: International expansion can drive substantial revenue growth.

- Potential Regulatory Hurdles: Navigating regulatory environments and addressing potential compliance challenges is crucial for continued success.

The success of these initiatives will significantly impact Palantir's future growth trajectory. Investors should carefully assess the potential risks and rewards associated with each strategy.

Risks and Considerations for Investing in Palantir Technologies Stock

Investing in Palantir carries inherent risks that investors must carefully consider.

- Government Contract Dependency: A significant portion of Palantir's revenue comes from government contracts, making it vulnerable to changes in government spending and policy.

- Competition from Established Players: Intense competition from established players with larger resources and broader product portfolios poses a significant challenge.

- High Valuation Relative to Earnings: Palantir's current valuation may be considered high relative to its earnings, making it vulnerable to market corrections.

- Geopolitical Risks: Global events and geopolitical instability can impact Palantir's operations and financial performance.

Conclusion: Palantir Technologies Stock: The Verdict

Based on our analysis of Palantir's financial performance, market position, and future growth prospects, we recommend a cautious "Hold" strategy for Palantir Technologies stock at the current valuation. While the company demonstrates significant potential, the inherent risks, particularly its dependence on government contracts and its high valuation, warrant a cautious approach. Further research into the company's financial statements and an assessment of the competitive landscape are highly recommended before making any investment decision.

What are your thoughts on the future of Palantir Technologies stock? Share your insights in the comments below! Remember to always conduct thorough research before investing in Palantir Technologies or any other stock.

Featured Posts

-

Dakota Johnson With Family At Materialist Premiere Photos

May 10, 2025

Dakota Johnson With Family At Materialist Premiere Photos

May 10, 2025 -

The 5 Most Notable Stephen King Celebrity Conflicts

May 10, 2025

The 5 Most Notable Stephen King Celebrity Conflicts

May 10, 2025 -

The Beyonce Effect Cowboy Carter Streams Double After Tour Begins

May 10, 2025

The Beyonce Effect Cowboy Carter Streams Double After Tour Begins

May 10, 2025 -

Bondis Unprecedented Fentanyl Seizure A Major Blow To Drug Trafficking

May 10, 2025

Bondis Unprecedented Fentanyl Seizure A Major Blow To Drug Trafficking

May 10, 2025 -

Bodycam Captures Police Officers Quick Action Saving Choking Toddler

May 10, 2025

Bodycam Captures Police Officers Quick Action Saving Choking Toddler

May 10, 2025

Latest Posts

-

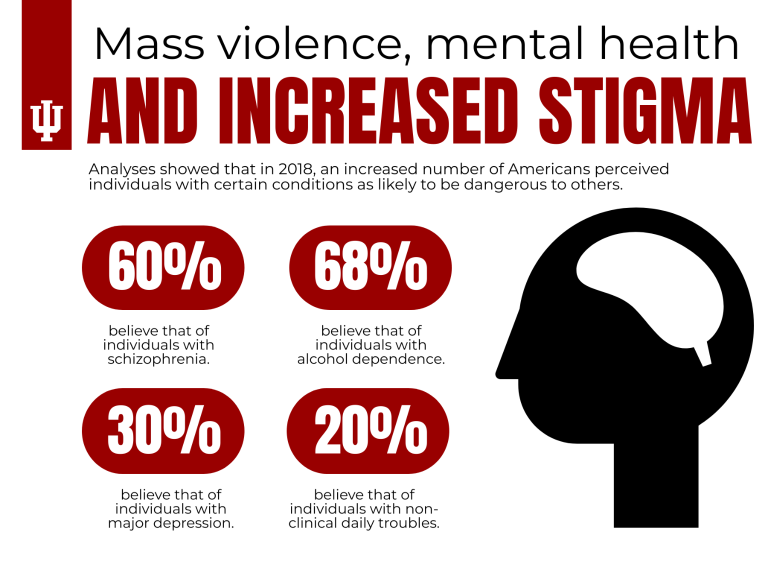

Reframing The Narrative Mental Illness Violence And The Medias Role

May 10, 2025

Reframing The Narrative Mental Illness Violence And The Medias Role

May 10, 2025 -

Academic Failure In Understanding Mental Illness And Violent Crime

May 10, 2025

Academic Failure In Understanding Mental Illness And Violent Crime

May 10, 2025 -

Severe Mental Illness And Violence Challenging The Monster Myth

May 10, 2025

Severe Mental Illness And Violence Challenging The Monster Myth

May 10, 2025 -

London Outing Harry Styles Sports A 70s Mustache

May 10, 2025

London Outing Harry Styles Sports A 70s Mustache

May 10, 2025 -

The Misrepresentation Of Mentally Ill Killers Why We Need A Better Understanding

May 10, 2025

The Misrepresentation Of Mentally Ill Killers Why We Need A Better Understanding

May 10, 2025