Parkland's US$9 Billion Acquisition: Key Details And The Upcoming Vote

Table of Contents

Understanding the Target Company and its Assets

While the specific target company hasn't been publicly disclosed in full detail, information suggests the acquisition involves a major player in the energy distribution and retail sectors. This deal is expected to significantly bolster Parkland's existing infrastructure and market share. The strategic assets being acquired are likely to include:

- Extensive Retail Network: A large number of gas stations and convenience stores, expanding Parkland's retail footprint across key markets.

- Significant Distribution Infrastructure: Pipelines, terminals, and other logistics assets vital for efficient fuel distribution.

- Refining Capacity (potentially): Depending on the target, this acquisition could also include refining assets, allowing Parkland greater control over its supply chain.

The target company's key strengths likely include a strong brand reputation, established customer base, and efficient operational capabilities within its geographic market, contributing to a robust market position. The acquisition aims to leverage these strengths to enhance Parkland's overall performance and competitiveness.

Financial Implications of the US$9 Billion Deal

The financial structure of the US$9 billion deal is likely a complex mix of cash, debt, and potentially equity financing. Securing this financing will be crucial for the deal's success. Post-acquisition, Parkland anticipates significant synergies and cost savings through:

- Economies of Scale: Combining operations should lead to substantial reductions in operating costs.

- Optimized Supply Chain: Integration of distribution networks will improve efficiency and reduce transportation expenses.

- Elimination of Redundancies: Streamlining overlapping functions within the merged entity will lead to further cost savings.

Projected financial benefits include substantial revenue growth, increased market share, and improved profitability. The deal is expected to deliver significant returns for Parkland shareholders in the long term. Detailed financial projections, including key metrics like EBITDA and EPS, will likely be unveiled closer to the shareholder vote.

Regulatory Approvals and Antitrust Concerns

The US$9 billion acquisition faces significant regulatory hurdles, including securing approvals from various competition authorities. Antitrust concerns are likely to be a major focus, particularly concerning potential impacts on competition within specific geographic markets. Relevant regulatory bodies, both in the target company's country and potentially others, will thoroughly scrutinize the deal to ensure it doesn't lead to monopolistic practices. Potential regulatory challenges include:

- Overlapping Market Presence: Authorities will examine the extent of market overlap between Parkland and the target company.

- Impact on Consumers: The impact on fuel prices and consumer choice will be closely evaluated.

- Conditions for Approval: Regulatory bodies may impose conditions, such as divestitures of certain assets, to mitigate competition concerns.

Addressing these concerns proactively will be vital for Parkland to secure the necessary approvals and finalize the acquisition.

The Upcoming Shareholder Vote: What to Expect

The shareholder vote represents a pivotal moment for Parkland. Shareholders will be presented with the full details of the deal, including financial projections, risk assessments, and the rationale behind the acquisition. The potential outcomes are a clear approval or rejection of the US$9 billion acquisition. Rejection would signify a significant setback for Parkland's strategic plans, while approval would pave the way for integration and the realization of the projected benefits. Key factors influencing the vote will include:

- Independent Analyst Opinions: Reports from financial analysts will provide valuable insight.

- Management Presentation: Parkland's management team will need to persuasively present the deal's merits.

- Shareholder Sentiment: Gauging shareholder opinions prior to the vote is crucial.

Long-Term Strategy and Future Outlook for Parkland

The successful completion of this US$9 billion acquisition is a central component of Parkland's long-term strategy. The acquisition is expected to significantly enhance Parkland's market position, leading to substantial future growth. Post-acquisition, Parkland may pursue various strategies, including:

- Market Expansion: Leveraging the acquired assets to expand into new geographic markets.

- Product Diversification: Offering a wider range of products and services to existing and new customers.

- Technological Upgrades: Investing in advanced technologies to improve efficiency and sustainability.

The long-term benefits are significant but will also present challenges relating to integration, cost management, and navigating a dynamic energy market.

Conclusion: The Future of Parkland Hinges on the US$9 Billion Acquisition Vote

Parkland's US$9 billion acquisition represents a bold and strategic move with the potential to reshape the company's future. The financial implications are substantial, regulatory hurdles need careful navigation, and the outcome of the upcoming shareholder vote will be decisive. Understanding these factors is crucial for anyone interested in the future direction of Parkland Fuel Corporation. Stay updated on the acquisition and the results of the shareholder vote by following Parkland’s official channels or subscribing to reputable financial news sources. The success of this significant acquisition will determine the next chapter for Parkland and its impact on the energy sector.

Featured Posts

-

Zendaya Unveils Cloudzones Spring 2025 Zone Dreamer Collection

May 07, 2025

Zendaya Unveils Cloudzones Spring 2025 Zone Dreamer Collection

May 07, 2025 -

A Baba Yaga Adventure The John Wick Experience Las Vegas

May 07, 2025

A Baba Yaga Adventure The John Wick Experience Las Vegas

May 07, 2025 -

Cavaliers Dominant Performance Leads To Knicks Blowout Newsradio Wtam 1100

May 07, 2025

Cavaliers Dominant Performance Leads To Knicks Blowout Newsradio Wtam 1100

May 07, 2025 -

Ripple Xrp Whales 20 Million Token Acquisition Implications For Investors

May 07, 2025

Ripple Xrp Whales 20 Million Token Acquisition Implications For Investors

May 07, 2025 -

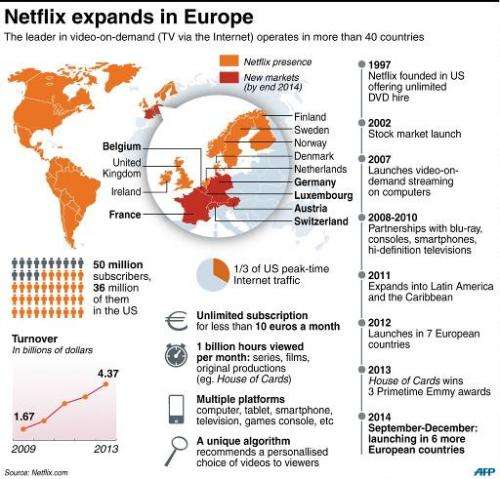

Is Macrons Vision For A European Netflix Becoming Reality

May 07, 2025

Is Macrons Vision For A European Netflix Becoming Reality

May 07, 2025

Latest Posts

-

La Victoire Des Cavaliers Sur Le Heat Une Demonstration De Force Et D Humilite

May 07, 2025

La Victoire Des Cavaliers Sur Le Heat Une Demonstration De Force Et D Humilite

May 07, 2025 -

Clippers Late Game Push Not Enough In Loss To Cavaliers

May 07, 2025

Clippers Late Game Push Not Enough In Loss To Cavaliers

May 07, 2025 -

Fox Sports 1340 Wnco Cavaliers Vs Grizzlies Injury Report March 14th

May 07, 2025

Fox Sports 1340 Wnco Cavaliers Vs Grizzlies Injury Report March 14th

May 07, 2025 -

Humilite Face A La Victoire Les Cavaliers Dominent Le Heat Et Entrent Dans L Histoire De La Nba

May 07, 2025

Humilite Face A La Victoire Les Cavaliers Dominent Le Heat Et Entrent Dans L Histoire De La Nba

May 07, 2025 -

55 Points D Ecart La Demonstration De Force Des Cavaliers Face Au Heat

May 07, 2025

55 Points D Ecart La Demonstration De Force Des Cavaliers Face Au Heat

May 07, 2025