PBOC's Yuan Support Falls Short Of Expectations: Implications For The Chinese Currency

Table of Contents

Insufficient PBOC Intervention and Market Reaction

The PBOC has employed various tools to manage the Yuan's exchange rate, yet their effectiveness has been limited, resulting in continued depreciation against the US dollar and other major currencies.

Limited Effectiveness of PBOC's Tools

The PBOC's toolkit includes setting the daily fixing rate for the Yuan, conducting open market operations to influence liquidity, and utilizing foreign exchange reserves to intervene directly in the currency market. However, these measures haven't been sufficient to counter the downward pressure on the Yuan.

- Daily Fixing Rate: While the PBOC sets a daily reference rate for the Yuan, market forces often push the actual exchange rate beyond this range, indicating limitations in controlling the currency's trajectory.

- Open Market Operations: Adjusting liquidity through open market operations aims to influence interest rates and subsequently affect currency flows, but their impact has been muted in the face of larger global economic forces.

- Foreign Exchange Reserve Intervention: The PBOC has used its substantial foreign exchange reserves to buy Yuan and support its value, but these interventions haven't been enough to offset the considerable selling pressure.

The Yuan's depreciation against the US dollar, for example, has been significant in recent months, exceeding [Insert Data on Yuan Depreciation Percentage]. This demonstrates the limitations of these tools in the current global economic climate characterized by significant capital flight, US interest rate hikes, and persistent global trade tensions.

Market Response to PBOC Actions

The market's reaction to PBOC interventions has been mixed. While some temporary rebounds have been observed following specific interventions, the overall trend has been one of continued depreciation.

- Temporary Rebounds: Short-lived increases in the Yuan's value have followed certain PBOC actions, suggesting that interventions do have some short-term impact. However, these gains have often been quickly erased by renewed selling pressure.

- Continued Depreciation: The overall trend reflects the persistence of bearish sentiment and the dominance of larger global factors affecting the Yuan. [Insert Chart/Graph illustrating Yuan's movement against USD].

- Investor Sentiment: Investor sentiment remains cautious, with many expecting further depreciation in the Yuan. This has led to shifts in investment strategies, with some investors reducing their exposure to Yuan-denominated assets.

Underlying Factors Contributing to Yuan Weakness

Several underlying factors contribute to the Yuan's weakness, extending beyond the scope of the PBOC's interventions.

Economic Slowdown in China

China's economic growth has slowed considerably, impacting the demand for the Yuan.

- GDP Growth: Slower GDP growth indicates reduced economic activity and a decrease in demand for the Yuan both domestically and internationally. [Insert Data on GDP growth rate].

- Inflation and Unemployment: Rising inflation and unemployment further dampen economic prospects and exert downward pressure on the currency. [Insert relevant data].

- Reduced Demand: Diminished economic activity translates to lower demand for the Yuan, leading to its depreciation.

Geopolitical Risks and US-China Relations

Geopolitical risks, particularly strained US-China relations, significantly influence the Yuan's performance.

- Trade Disputes and Sanctions: Ongoing trade disputes and sanctions imposed by the US and other countries have eroded investor confidence and dampened foreign investment flows into China.

- Political Instability: Uncertainty surrounding political developments in China and its relations with other nations also adds to the negative sentiment surrounding the Yuan.

- Capital Flight: Concerns over geopolitical instability can trigger capital flight, leading to a sell-off in Yuan-denominated assets.

Global Monetary Policy Environment

The global monetary policy environment, particularly the US Federal Reserve's tightening monetary policy, has put significant pressure on the Yuan.

- Rising US Interest Rates: Higher US interest rates attract capital away from China, leading to capital flight and putting downward pressure on the Yuan.

- Stronger Dollar: A stronger US dollar makes US assets more attractive to foreign investors, further weakening the Yuan.

- Global Capital Flows: Changes in global capital flows significantly impact currency valuations, with the Yuan being particularly vulnerable to shifts in global investment preferences.

Implications for the Chinese Economy and Global Markets

The weakening Yuan has wide-ranging implications for both the Chinese economy and global markets.

Impact on Chinese Businesses and Consumers

A weaker Yuan presents challenges for Chinese businesses and consumers.

- Increased Import Costs: A weaker Yuan increases the cost of imported goods, potentially leading to inflation and squeezing profit margins for businesses reliant on imported inputs.

- Reduced Export Competitiveness: While a weaker Yuan can boost export competitiveness in theory, this effect is limited when global demand is weak.

- Consumer Spending: Higher prices for imported goods can impact consumer spending and overall economic growth.

Global Market Ripple Effects

Fluctuations in the Yuan's value have significant ripple effects across global markets.

- Global Trade Flows: A weaker Yuan can disrupt global trade flows, impacting businesses engaged in international trade with China.

- Commodity Prices: Changes in the Yuan's value affect the prices of commodities traded internationally, especially those heavily reliant on Chinese demand.

- Other Currencies: The Yuan's depreciation can trigger wider currency fluctuations, affecting global exchange rates.

Conclusion

The PBOC's recent attempts to support the Yuan have been inadequate in countering the multifaceted economic and geopolitical challenges. The resulting Yuan weakness carries significant implications for both China's economy and the global financial landscape. Understanding the limitations of PBOC interventions and the underlying factors driving the Yuan's depreciation is critical for navigating the current period of uncertainty. Continued monitoring of PBOC Yuan support measures and their efficacy is vital for investors and businesses interacting with the Chinese economy. Stay informed on future developments regarding PBOC Yuan support to effectively manage the associated risks and opportunities.

Featured Posts

-

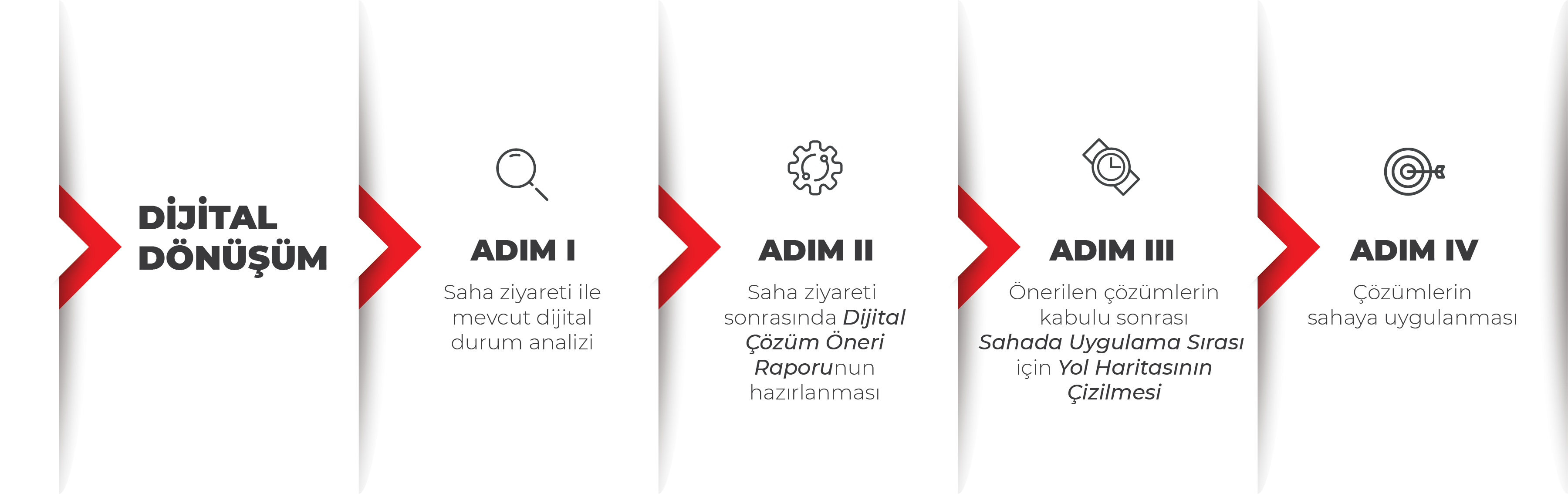

Carsamba Ledra Pal Da Isguecue Piyasasi Icin Dijital Veri Tabani Kullanimi

May 15, 2025

Carsamba Ledra Pal Da Isguecue Piyasasi Icin Dijital Veri Tabani Kullanimi

May 15, 2025 -

Nba Predictions Cavaliers Vs Celtics Who Will Win

May 15, 2025

Nba Predictions Cavaliers Vs Celtics Who Will Win

May 15, 2025 -

Padres Clinch Series Win Over Cubs

May 15, 2025

Padres Clinch Series Win Over Cubs

May 15, 2025 -

April 4 6 2025 Vont Weekend Photo Highlights 104 5 The Cat

May 15, 2025

April 4 6 2025 Vont Weekend Photo Highlights 104 5 The Cat

May 15, 2025 -

Braves Vs Padres Game Preview And Prediction

May 15, 2025

Braves Vs Padres Game Preview And Prediction

May 15, 2025