PFC Dividend 2025: What To Expect From The March 12 Announcement

Table of Contents

Historical PFC Dividend Trends and Performance

Analyzing the historical PFC dividend payouts is essential to understanding the potential for the PFC Dividend 2025. PFC has a relatively consistent history of dividend payments, offering investors a steady stream of income. However, the amount and frequency have varied over the years. Examining these variations reveals valuable insights.

To illustrate, let's look at the past decade:

- Average annual dividend growth: Over the last ten years, PFC has demonstrated an average annual dividend growth of approximately 5%. This steady growth has been a major draw for income-seeking investors.

- Years with exceptional dividend increases or decreases: While generally consistent, there were notable exceptions. In 2018, a significant increase was observed following a period of strong financial performance. Conversely, 2020 saw a slight decrease due to the global economic downturn caused by the pandemic.

- Relationship between PFC stock price and dividend announcements: Historically, positive announcements regarding the PFC dividend have been met with a positive market response, often leading to a short-term increase in the share price. Conversely, negative news has had the opposite effect.

[Insert Chart/Graph illustrating historical dividend payouts and their correlation with stock price here.]

Factors Influencing the PFC Dividend 2025 Announcement

Several key factors will influence the final decision on the PFC Dividend 2025. These factors will be carefully weighed by PFC's board of directors before the March 12th announcement.

- Company profitability and earnings per share (EPS): PFC's Q4 2024 earnings report and overall annual performance will play a critical role. Strong profitability and increased EPS generally lead to higher dividend payouts.

- Cash flow and debt levels: A healthy cash flow is essential for sustaining dividend payments. High levels of debt might restrict the company's ability to distribute substantial dividends.

- Future investment plans and capital expenditures: Significant investment plans or capital expenditures might necessitate reducing dividend payouts to fund these projects.

- Competitor dividend policies: PFC's dividend policy is also influenced by the actions of its competitors in the same industry. Benchmarking against competitors helps maintain market competitiveness.

Analyst Predictions and Market Expectations for the PFC Dividend 2025

Financial analysts have offered various predictions regarding the PFC Dividend 2025. There is a range of opinions, reflecting the complexity of the factors involved.

- Range of predicted dividend amounts: Predictions range from a slight increase to a modest decrease, with a "no change" scenario also considered plausible.

- Consensus forecast from analysts: The consensus among most analysts seems to lean towards a small increase, reflecting the company’s generally strong performance. However, this is far from certain.

- Potential impact on stock price based on different scenarios: A higher-than-expected dividend payout is likely to boost the stock price, while a lower payout or a dividend cut could result in a negative market reaction. "Bloomberg reported a potential increase of 3-5%," for example.

How to Prepare for the PFC Dividend 2025 Announcement

Investors should adopt a proactive approach to prepare for the March 12th announcement:

- Review your investment portfolio: Analyze your current holdings and assess your risk tolerance before the announcement.

- Set realistic expectations: Don't rely solely on analyst predictions. Prepare for various scenarios, including a potential decrease in the dividend.

- Consider diversification strategies: Diversifying your portfolio across different asset classes can mitigate the risk associated with potential negative outcomes.

Understanding the Implications of the PFC Dividend 2025 Announcement

The March 12th announcement of the PFC Dividend 2025 is a key event for investors. The decision will be influenced by a variety of factors, including the company's financial performance, market conditions, and future investment plans. Understanding these factors is vital for making sound investment decisions. Remember to consider the historical trends, analyst predictions, and your own risk tolerance when assessing the potential impact on your portfolio. Stay tuned for updates on the PFC dividend 2025 announcement and prepare for the March 12th news by reviewing your investment strategy and considering your options for PFC's 2025 dividend payout. Don't miss the crucial March 12th PFC dividend news!

Featured Posts

-

German Renewables Pne Group Approved For Wind And Solar Development

Apr 27, 2025

German Renewables Pne Group Approved For Wind And Solar Development

Apr 27, 2025 -

Imprevisible Indian Wells Despedida Temprana De Una Favorita

Apr 27, 2025

Imprevisible Indian Wells Despedida Temprana De Una Favorita

Apr 27, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Surge

Apr 27, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Surge

Apr 27, 2025 -

Analisis De La Garantia De Gol De Alberto Ardila Olivares

Apr 27, 2025

Analisis De La Garantia De Gol De Alberto Ardila Olivares

Apr 27, 2025 -

The Dax And The Bundestag Understanding The Correlation

Apr 27, 2025

The Dax And The Bundestag Understanding The Correlation

Apr 27, 2025

Latest Posts

-

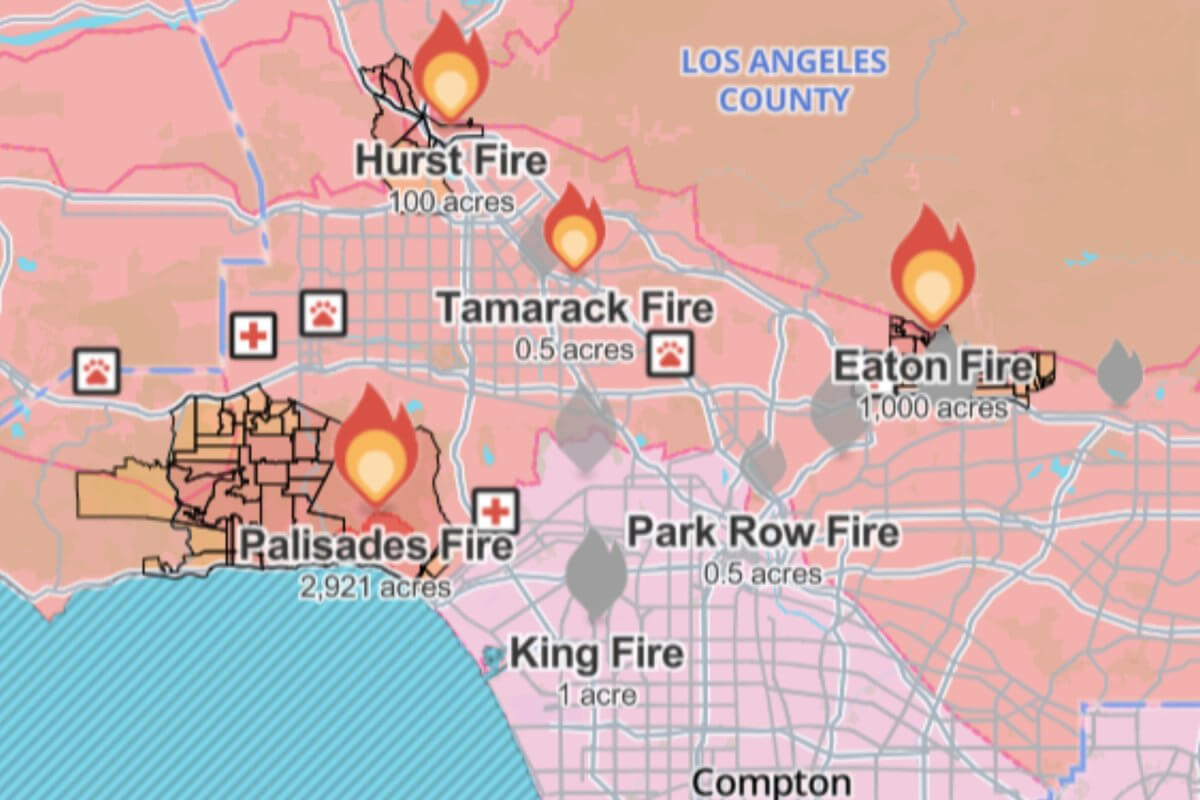

The Ethics Of Disaster Betting The Los Angeles Wildfires As A Prime Example

Apr 28, 2025

The Ethics Of Disaster Betting The Los Angeles Wildfires As A Prime Example

Apr 28, 2025 -

Los Angeles Wildfires And The Disturbing Trend Of Betting On Natural Disasters

Apr 28, 2025

Los Angeles Wildfires And The Disturbing Trend Of Betting On Natural Disasters

Apr 28, 2025 -

The Los Angeles Wildfires A Case Study In The Growing Market Of Disaster Betting

Apr 28, 2025

The Los Angeles Wildfires A Case Study In The Growing Market Of Disaster Betting

Apr 28, 2025 -

Los Angeles Wildfires A Reflection Of Societal Trends In Disaster Betting

Apr 28, 2025

Los Angeles Wildfires A Reflection Of Societal Trends In Disaster Betting

Apr 28, 2025 -

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Times

Apr 28, 2025

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Times

Apr 28, 2025