Point72's Departure Signals Shift In Emerging Markets Investment

Table of Contents

Analyzing Point72's Decision: Reasons Behind the Shift

Point72's reduced investment in emerging markets is a significant development that requires careful analysis. While the firm hasn't publicly released a detailed explanation, several factors likely contributed to this strategic shift. Understanding these factors is crucial for interpreting the broader implications for the emerging market investment landscape.

-

Increased Volatility in Emerging Markets: Emerging markets are inherently more volatile than developed markets. Fluctuations in currency exchange rates, commodity prices, and political stability can significantly impact investment returns. Increased volatility presents heightened risk, prompting investors like Point72 to reassess their exposure.

-

Geopolitical Risks: Geopolitical instability, including conflicts, trade wars, and sanctions, presents a significant challenge for investors in emerging markets. These events can trigger sudden market downturns and capital flight, making risk management a paramount concern. Point72's decision might reflect a heightened awareness of these escalating geopolitical risks.

-

Changes in Macroeconomic Conditions: Global macroeconomic factors, such as rising interest rates, inflation, and potential recessions, can significantly impact emerging economies. These conditions can lead to currency devaluations, decreased consumer spending, and reduced corporate profitability, impacting investment attractiveness.

-

Internal Portfolio Rebalancing and Risk Management: Point72's move could also be a part of a broader portfolio rebalancing strategy. The firm may be adjusting its asset allocation to reduce overall risk and improve diversification across different asset classes and geographies. This is a common practice among large hedge funds to optimize returns and minimize potential losses.

Impact on Emerging Market Investment Landscape

Point72's decision will likely have a multifaceted impact on the emerging market investment landscape. The ramifications extend beyond the specific markets affected by their divestment, influencing investor sentiment and capital flows globally.

-

Investor Sentiment: Point72's withdrawal could negatively impact investor sentiment, potentially leading other institutional investors to reconsider their emerging market holdings. This could trigger a domino effect, leading to further capital outflows and increased market volatility.

-

Market Volatility: The reduction in investment from a major player like Point72 could exacerbate existing market volatility in affected regions. This increased volatility can make it more challenging for investors to accurately assess risks and make informed investment decisions.

-

Investment Opportunities: Ironically, Point72's departure could create new investment opportunities for other investors willing to take on increased risk. The potential for undervalued assets and contrarian investment strategies might emerge in the wake of this shift.

-

Capital Flows: The reduced investment from Point72 and potentially other investors following suit could lead to decreased capital flows into emerging markets. This can impact economic growth and development in these regions, creating a ripple effect across various sectors.

Re-evaluating Emerging Market Investment Strategies

Point72's decision underscores the need for a more cautious and sophisticated approach to emerging market investment. Investors must adapt their strategies to address the increased risks and uncertainties in this evolving landscape.

-

Enhanced Due Diligence and Risk Assessment: Given the heightened volatility and geopolitical risks, investors need to conduct significantly more thorough due diligence before committing capital. A robust risk assessment framework is critical to understanding and managing potential losses.

-

Diversification Strategies: Diversification is key to mitigating risk in emerging markets. Investors should spread their investments across different countries, sectors, and asset classes to reduce exposure to any single risk factor.

-

Long-Term Investment Outlook: While short-term volatility is expected, many analysts maintain a positive long-term outlook for emerging markets. Investors with a long-term horizon can potentially benefit from these markets' significant growth potential, despite current challenges.

-

Alternative Investment Strategies: Exploring alternative investment strategies, such as private equity in emerging markets or emerging market debt, might offer attractive returns while diversifying away from traditional equity investments.

The Search for Alpha in a Changing Landscape

The shift in the emerging markets landscape presents a challenge, but also an opportunity for investors seeking alpha. While traditional approaches might need re-evaluation, alternative investment strategies can yield substantial returns.

-

Alternative Investments: Emerging market debt, for example, can offer higher yields than developed market counterparts. Careful selection and risk management are critical in this space. Private equity investments in emerging markets can provide access to high-growth companies not readily available on public exchanges.

-

Identifying Undervalued Opportunities: Point72's exit may have left behind undervalued opportunities for investors with the expertise and risk appetite to identify and capitalize on them. Thorough research and a contrarian approach could be rewarding in this context.

Conclusion

Point72's withdrawal from significant emerging market holdings underscores the evolving risks and opportunities within these dynamic economies. Increased volatility and geopolitical uncertainties necessitate a thorough reassessment of investment strategies. While the move may cause short-term market fluctuations, it also presents a chance for astute investors to identify and capitalize on new opportunities.

Call to Action: Understanding the implications of Point72's decision is crucial for navigating the shifting landscape of emerging market investment. Conduct thorough research, diversify your portfolio, and carefully assess risks before making investment decisions in these dynamic markets. Learn more about effective emerging market investment strategies and stay informed on the latest market trends to make well-informed decisions in this evolving space.

Featured Posts

-

Dam Safety Risk During Ajaxs 125th Anniversary Festivities

Apr 26, 2025

Dam Safety Risk During Ajaxs 125th Anniversary Festivities

Apr 26, 2025 -

Solicitare Catre Ambasada Olandei Criza De La Santierul Naval Mangalia

Apr 26, 2025

Solicitare Catre Ambasada Olandei Criza De La Santierul Naval Mangalia

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two Behind The Scenes Svalbard Filming

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Behind The Scenes Svalbard Filming

Apr 26, 2025 -

Construction Of Worlds Tallest Abandoned Skyscraper To Resume After A Decade

Apr 26, 2025

Construction Of Worlds Tallest Abandoned Skyscraper To Resume After A Decade

Apr 26, 2025 -

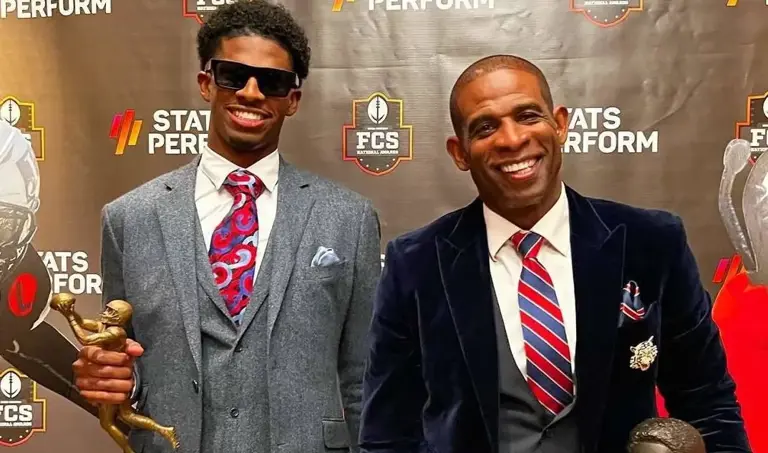

Deion Sanders On Shedeurs Nfl Future Team Conversations And Concerns

Apr 26, 2025

Deion Sanders On Shedeurs Nfl Future Team Conversations And Concerns

Apr 26, 2025

Latest Posts

-

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025 -

Robert Pattinson A Horror Movies Unexpected Aftermath

Apr 27, 2025

Robert Pattinson A Horror Movies Unexpected Aftermath

Apr 27, 2025 -

Robert Pattinsons Night Terror Knives Horror Movies And A Sleepless Night

Apr 27, 2025

Robert Pattinsons Night Terror Knives Horror Movies And A Sleepless Night

Apr 27, 2025 -

Binoche Named President Of The 2025 Cannes Film Festival Jury

Apr 27, 2025

Binoche Named President Of The 2025 Cannes Film Festival Jury

Apr 27, 2025 -

Cannes Film Festival 2025 Juliette Binoche To Head Jury

Apr 27, 2025

Cannes Film Festival 2025 Juliette Binoche To Head Jury

Apr 27, 2025