Post-US-China Trade Talks: Market Analysis And Future Outlook

Table of Contents

Immediate Market Reactions to the Latest Trade Talks

The conclusion of the most recent trade talks between the US and China had a measurable impact on global markets. Analyzing these immediate reactions provides valuable insight into the short-term consequences and sets the stage for understanding the long-term implications.

Stock Market Performance

Following the announcement of the latest trade talks' outcome, major stock indices experienced mixed reactions. While the S&P 500 initially showed a slight increase, the Shanghai Composite exhibited more volatility, with a significant dip followed by a gradual recovery.

- Positive movements: Primarily seen in sectors perceived as less directly affected by trade tensions.

- Negative movements: More pronounced in sectors heavily reliant on trade with either the US or China, particularly technology and agriculture.

- Sector-specific impacts: The technology sector, sensitive to geopolitical risks and regulatory changes, showed considerable volatility. The agricultural sector, heavily impacted by trade tariffs, experienced a more nuanced response depending on the specific commodities involved.

- Volatility analysis: Market volatility increased significantly in the days following the announcement, reflecting investor uncertainty about the long-term implications of the talks. Further analysis revealed heightened volatility in sectors directly linked to US-China trade.

Currency Fluctuations

The USD and CNY experienced notable fluctuations in response to the trade talks. The USD showed a slight strengthening against the CNY initially, reflecting investor sentiment and speculation about future trade policies.

- Strength/weakness of currencies: The USD's strength was partly driven by a flight to safety, as investors sought refuge in the more stable US dollar during the period of uncertainty.

- Impact on international trade: Currency fluctuations directly influence the cost of imports and exports, impacting businesses involved in international trade with both countries. A stronger USD makes US goods more expensive for Chinese buyers.

- Speculation and forecasting: Market analysts are closely watching currency movements to predict future trade flows and potential shifts in global economic power.

Commodity Prices

Key commodities heavily impacted by US-China trade experienced significant price swings. Soybean prices, for example, initially dropped following the announcement, reflecting concerns about reduced demand from China. However, prices later stabilized as other factors, like global supply and demand, came into play.

- Price trends: Generally, commodity prices demonstrated volatility reflecting uncertainty about the future trade environment.

- Supply chain disruptions: Trade disputes often lead to supply chain disruptions, forcing businesses to seek alternative sources and potentially increasing costs.

- Impact on businesses and consumers: Price fluctuations directly impact businesses' profitability and consumer purchasing power.

Long-Term Implications for Global Trade

The Post-US-China Trade Talks have long-term implications that extend far beyond immediate market reactions. Understanding these broader consequences is crucial for navigating the evolving global economic landscape.

Restructuring of Global Supply Chains

The trade tensions between the US and China are accelerating the restructuring of global supply chains. Companies are increasingly exploring:

- Nearshoring: Bringing manufacturing closer to home markets to reduce reliance on distant suppliers.

- Friend-shoring: Focusing on partnerships with countries aligned with their geopolitical interests.

- Diversification of supply sources: Reducing dependence on a single supplier or country to mitigate risks.

- Increased costs: These restructuring efforts often lead to increased costs due to higher transportation expenses and potential loss of economies of scale.

Technological Competition and Innovation

The trade talks highlight the intense technological competition between the US and China, particularly in areas like 5G, AI, and semiconductors. This competition is driving:

- Investment in R&D: Both countries are significantly increasing investments in research and development to maintain technological leadership.

- Government policies: Governments are actively implementing policies to support domestic industries and limit reliance on foreign technologies.

- Potential for decoupling: The ongoing tension could lead to a further decoupling of the US and Chinese economies in sensitive technological sectors.

Geopolitical Implications

The evolving US-China trade relationship has significant geopolitical implications:

- Impact on alliances: The trade disputes influence the dynamics of global alliances and partnerships.

- Potential for increased tensions: Trade disputes often exacerbate existing geopolitical tensions.

- Role of international organizations: International organizations play a crucial role in mediating disputes and promoting a stable global trading environment.

Analyzing Key Sectors Affected by Post-US-China Trade Talks

Specific sectors felt the impact of the Post-US-China Trade Talks more acutely. Understanding their unique challenges and opportunities is essential for informed decision-making.

Technology Sector

The technology sector, particularly the semiconductor industry, faced significant headwinds due to trade restrictions and increased scrutiny of data privacy regulations.

- Impact on specific companies: Companies heavily reliant on either US or Chinese markets experienced varying degrees of success or challenges.

- Investment opportunities: The sector presents both risks and opportunities for investors, with potential for growth in areas less exposed to trade tensions.

- Regulatory changes: Increased regulatory scrutiny impacts investment decisions and business strategies within the sector.

Agricultural Sector

The agricultural sector experienced both positive and negative consequences. While some crops benefited from increased domestic demand, others faced reduced exports to China.

- Specific crop impacts: The impact varied depending on the specific crop, with some seeing price increases while others faced decreased exports.

- Trade volume changes: Trade volume between the two countries fluctuated significantly, reflecting changes in tariffs and other trade policies.

- Farmer responses: Farmers adapted by diversifying crops, exploring new markets, and seeking government support.

Manufacturing Sector

Manufacturing businesses experienced significant disruptions, with many forced to reconsider their reliance on either US or Chinese markets.

- Production shifts: Companies shifted production to other countries to mitigate risks associated with trade tensions.

- Relocation of factories: Some businesses relocated their manufacturing facilities to reduce dependence on either the US or China.

- Job creation/loss: These shifts resulted in job losses in some regions while creating new opportunities in others.

Conclusion

The Post-US-China Trade Talks have had a profound and multifaceted impact on global markets, affecting various sectors and the broader geopolitical landscape. From immediate stock market reactions and currency fluctuations to long-term implications for supply chains and technological competition, the consequences are far-reaching. Understanding both the short-term market responses and the long-term implications for global trade is crucial for navigating this complex and evolving economic environment. To stay informed about future developments in Post-US-China Trade Talks and their impact on the global market, subscribe to our newsletter, follow reputable news sources, and engage in further research on Understanding the Future of Post-US-China Trade Relations. Navigating the Shifting Landscape of Post-US-China Trade requires continuous vigilance and informed analysis.

Featured Posts

-

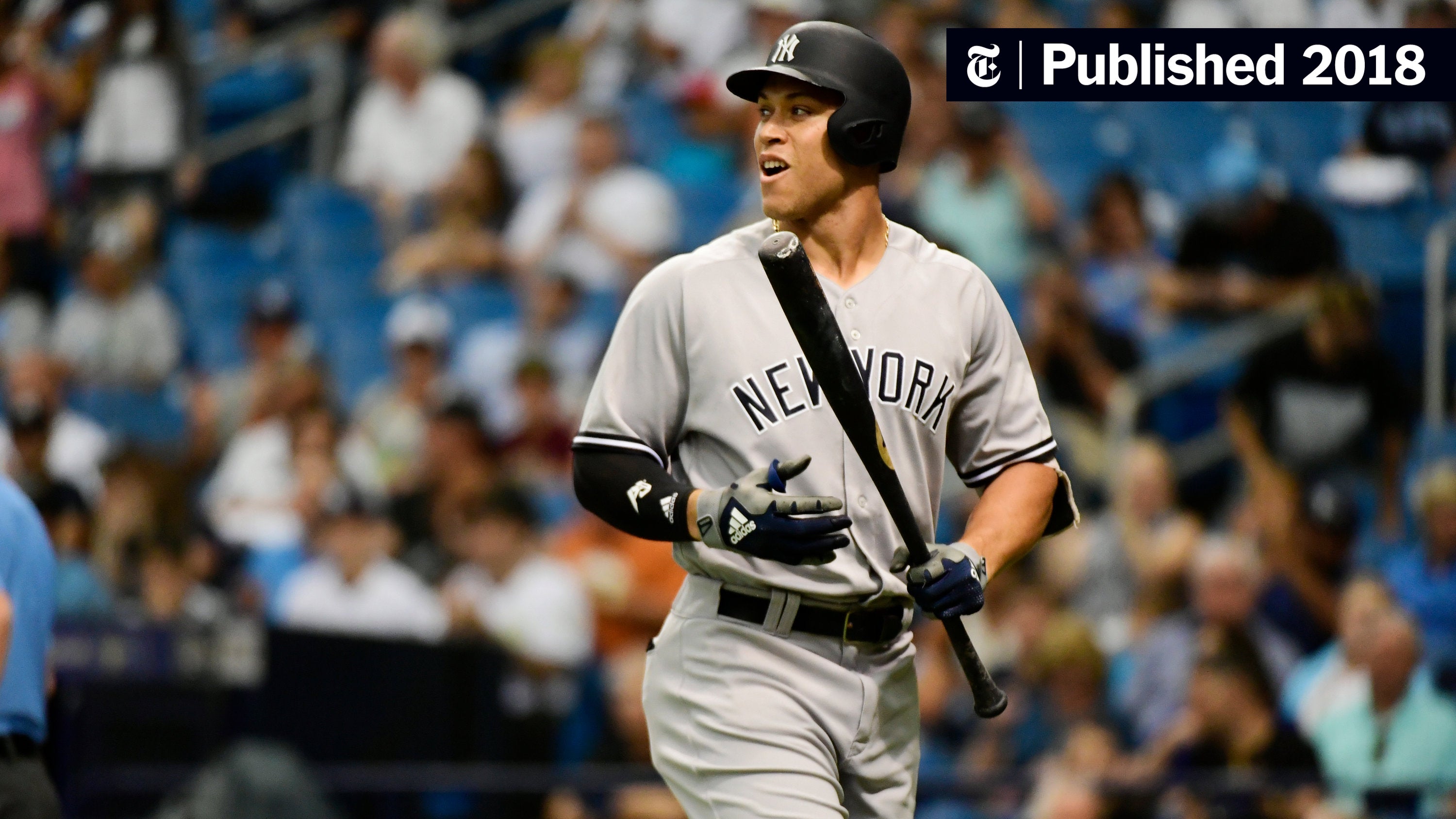

Bellinger To Bat Behind Judge In Yankees Offensive Strategy

May 12, 2025

Bellinger To Bat Behind Judge In Yankees Offensive Strategy

May 12, 2025 -

Eric Antoine Et La Roue De La Fortune Analyse Des Audiences Apres 3 Mois De Diffusion

May 12, 2025

Eric Antoine Et La Roue De La Fortune Analyse Des Audiences Apres 3 Mois De Diffusion

May 12, 2025 -

Cavaliers Vs Knicks Game Prediction Odds And Betting Picks February 21

May 12, 2025

Cavaliers Vs Knicks Game Prediction Odds And Betting Picks February 21

May 12, 2025 -

High End Homes An Mtv Cribs Retrospective

May 12, 2025

High End Homes An Mtv Cribs Retrospective

May 12, 2025 -

Chto Delali Boris I Kerri Dzhonson V Tekhase Foto

May 12, 2025

Chto Delali Boris I Kerri Dzhonson V Tekhase Foto

May 12, 2025