Posthaste: The Looming Crisis In The World's Largest Bond Market

Table of Contents

Rising Interest Rates and Their Impact on the Bond Market

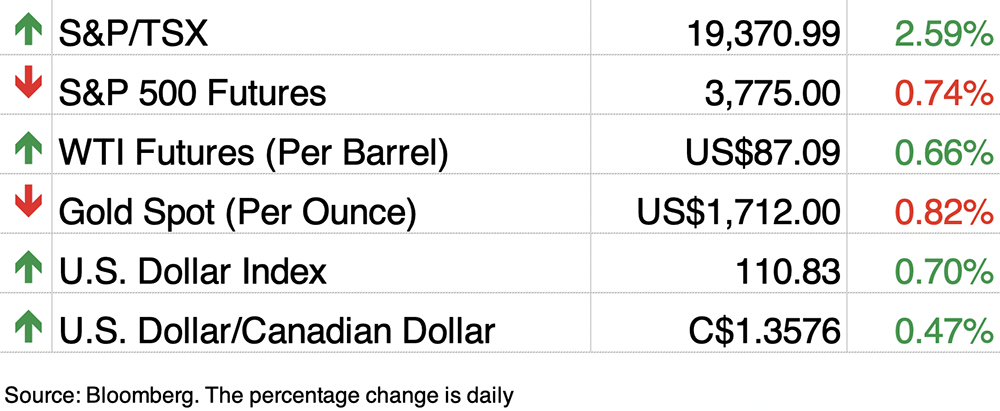

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. As interest rates rise, the yields on newly issued bonds increase, making existing bonds with lower yields less attractive. The Federal Reserve's recent aggressive monetary policy tightening, aimed at curbing inflation, has directly impacted bond yields. This has led to a significant decline in the value of many existing bond portfolios.

- Impact on existing bond portfolios: Holders of long-term bonds, particularly those with fixed interest rates, are experiencing capital losses as bond prices fall.

- Attractiveness of new bond issuances: While new bonds offer higher yields, the risk of further rate hikes makes investors hesitant.

- Risk of capital losses for bondholders: The potential for further interest rate increases poses a significant risk of substantial capital losses for bond investors.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of borrowing for governments and corporations, potentially hindering economic growth.

Inflationary Pressures and Bond Market Volatility

Persistent inflation erodes the purchasing power of fixed-income investments like bonds. When inflation is high, investors demand higher yields to compensate for the loss of purchasing power, pushing bond yields up and prices down. This creates a vicious cycle, leading to increased market volatility and uncertainty.

- Erosion of purchasing power: High inflation diminishes the real return on bond investments, making them less attractive to investors.

- Demand for higher yields to compensate for inflation: Investors demand higher yields to offset the effects of inflation, putting upward pressure on bond yields.

- Increased uncertainty and market volatility: The unpredictable nature of inflation adds to market uncertainty, increasing volatility in the bond market.

- Potential for a bond market sell-off: If inflation remains persistently high, investors may trigger a large-scale sell-off in the bond market.

Geopolitical Risks and their Influence on Global Bond Markets

Geopolitical events significantly influence investor sentiment and bond prices. Periods of heightened global uncertainty often lead to a "flight to safety," where investors seek refuge in perceived safe-haven assets like US Treasuries. This increased demand for safe-haven assets can temporarily suppress yields, but it can also distort market signals and create imbalances.

- Impact of specific geopolitical events: The ongoing war in Ukraine, for example, has significantly impacted global bond markets, causing increased volatility and uncertainty.

- Increased risk aversion among investors: Geopolitical instability increases risk aversion, leading investors to seek lower-risk investments.

- Potential for capital flight from emerging markets: Investors may pull capital out of emerging markets perceived as riskier during times of geopolitical turmoil.

- Increased demand for safe-haven assets like US Treasuries: Investors flock to perceived safe havens like US Treasuries, driving up demand and potentially suppressing yields in the short term.

Potential Consequences of a Bond Market Crisis

A major crisis in the bond market could have devastating ripple effects on the global economy. Increased borrowing costs could stifle business investment and economic growth, potentially leading to a global recession. The impact could extend to other asset classes as well.

- Increased borrowing costs for businesses: Higher interest rates make it more expensive for businesses to borrow money, hindering investment and expansion.

- Slowdown in economic growth: Reduced investment and increased borrowing costs can significantly slow economic growth.

- Potential for a global recession: A severe bond market crisis could trigger a global recession, with widespread economic hardship.

- Impact on stock markets and other financial assets: A bond market crisis could trigger a sell-off in other asset classes, impacting stock markets and other investments.

- Increased risk of defaults: Higher interest rates increase the risk of defaults on corporate and sovereign bonds, potentially leading to financial instability.

Navigating the Posthaste Crisis in the Global Bond Market

The risks and challenges facing the global bond market are significant and demand urgent attention. The "Posthaste" nature of the situation underscores the need for proactive risk management. Investors need to carefully assess their portfolios, diversify their holdings, and consider risk mitigation strategies. Understanding the complexities of the global bond market is crucial in these posthaste times. Don't delay; consult with a financial advisor to develop a robust investment strategy that mitigates the risks associated with this potential crisis and explore alternative investment options to reduce your exposure. Staying informed about market developments is critical to navigating this challenging period.

Featured Posts

-

Mbarat Qtr Walkhwr Khsart W Msharkt Ebd Alqadr

May 23, 2025

Mbarat Qtr Walkhwr Khsart W Msharkt Ebd Alqadr

May 23, 2025 -

Horoscopo De Abril 2025 Pronostico Semanal Para Todos Los Signos

May 23, 2025

Horoscopo De Abril 2025 Pronostico Semanal Para Todos Los Signos

May 23, 2025 -

Joe Jonas The Unexpected Center Of A Marital Dispute

May 23, 2025

Joe Jonas The Unexpected Center Of A Marital Dispute

May 23, 2025 -

Muzarabanis Nine Wicket Haul Zimbabwe Clinch Historic First Test Win Against Bangladesh

May 23, 2025

Muzarabanis Nine Wicket Haul Zimbabwe Clinch Historic First Test Win Against Bangladesh

May 23, 2025 -

Dylan Dreyers Near Miss What Almost Kept Her Off The Today Show

May 23, 2025

Dylan Dreyers Near Miss What Almost Kept Her Off The Today Show

May 23, 2025