Powell's Fed And Interest Rate Cuts: A Balancing Act Between Inflation And The Economy

Table of Contents

1. The Inflationary Pressure

Understanding Current Inflation Levels

Inflation remains stubbornly high. The Consumer Price Index (CPI), a key measure of inflation, continues to outpace the Federal Reserve's target rate, signaling persistent inflationary pressures. This isn't just about headline numbers; it's impacting real lives.

- Rising Food Prices: Grocery bills are significantly higher than they were a year ago, impacting household budgets across all income levels.

- Increased Housing Costs: Rent and mortgage payments are escalating, putting pressure on homeowners and renters alike.

- Elevated Energy Prices: The cost of gasoline and other energy sources remains elevated, contributing to overall inflation and impacting transportation and manufacturing costs.

- Supply Chain Disruptions: Lingering supply chain bottlenecks continue to fuel price increases for various goods.

These pressures are reflected in the Producer Price Index (PPI), which measures inflation at the wholesale level. A high PPI indicates that these inflationary pressures are likely to persist for some time.

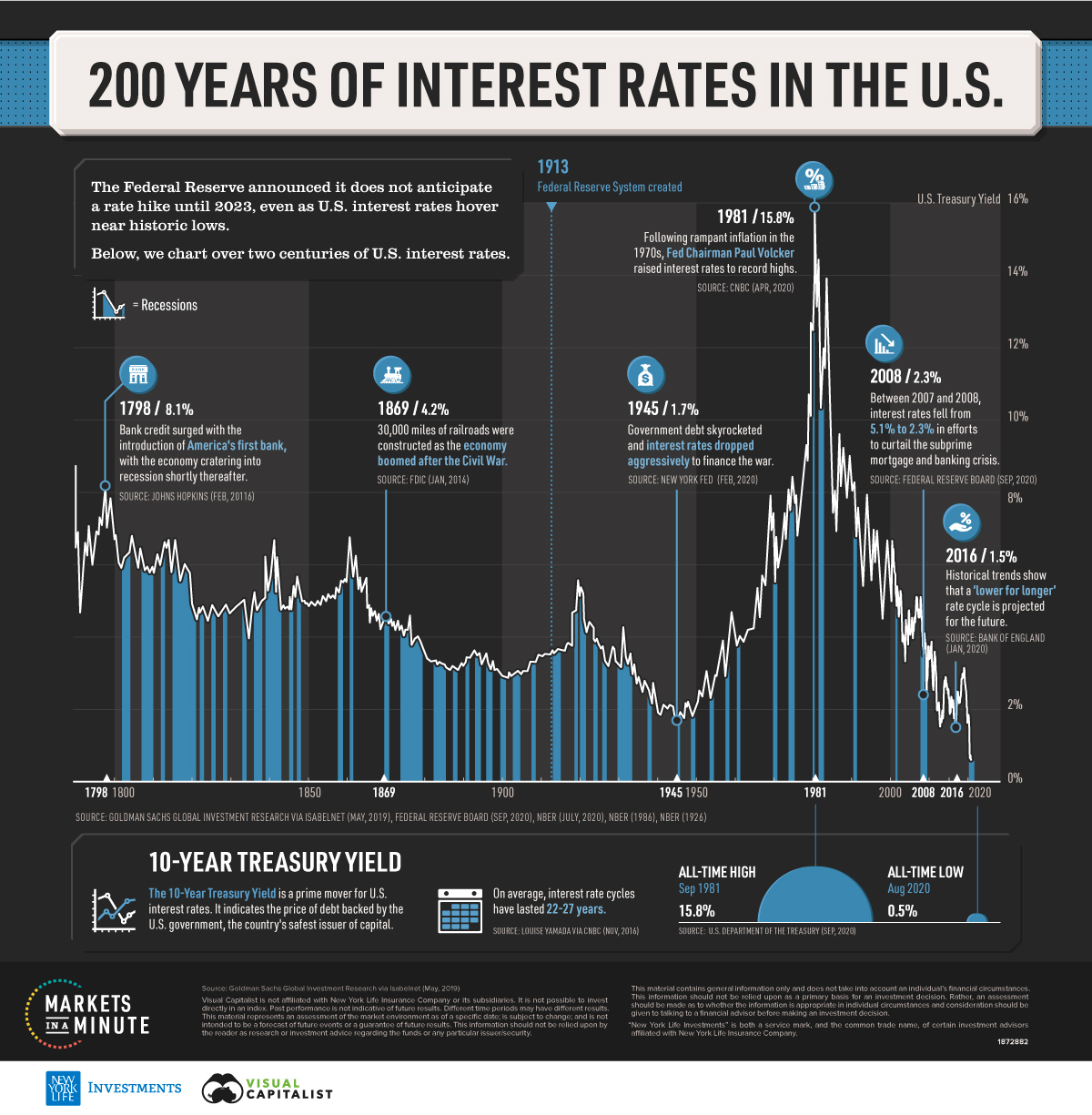

The Fed's Mandate to Control Inflation

The Federal Reserve has a dual mandate: to promote maximum employment and price stability. While full employment is a critical goal, unchecked inflation erodes purchasing power and destabilizes the economy in the long run. Historically, the Fed has responded to high inflation with interest rate hikes, aiming to cool down economic activity and reduce demand-pull inflation. This involves increasing the federal funds rate, the target rate that influences borrowing costs across the economy.

2. The Risks of Aggressive Interest Rate Hikes

Impact on Economic Growth

Aggressive interest rate hikes, while effective in curbing inflation, carry significant risks. Increased borrowing costs can:

- Dampen Business Investment: Higher interest rates make it more expensive for businesses to borrow money for expansion, leading to reduced investment and hiring.

- Reduce Consumer Spending: Consumers, facing higher interest rates on loans and mortgages, may cut back on spending, impacting economic growth.

- Increase Unemployment: Slowing economic growth often translates into job losses, further diminishing consumer confidence and economic activity.

The Debate on the "Soft Landing"

The Fed's ideal scenario is a "soft landing"—slowing inflation without triggering a recession. However, this is a challenging task, and economists are divided on the likelihood of achieving it. Different economic models predict varying outcomes, with some suggesting a significant risk of a recession. The debate centers on the appropriate pace and magnitude of interest rate increases. Some argue for more aggressive action to quickly curb inflation, while others advocate for a more gradual approach to avoid a sharp economic downturn.

3. Powell's Strategic Approach to Interest Rate Cuts

Data-Driven Decision Making

Powell and the Federal Open Market Committee (FOMC) base their decisions on a comprehensive analysis of economic data. They monitor various indicators, including CPI, PPI, employment figures, and consumer confidence indices. This data-driven approach allows for flexibility and iterative adjustments to monetary policy. The Fed's decisions aren't set in stone; they are regularly reviewed and adjusted based on incoming economic data.

Balancing Inflation and Employment

Powell faces the difficult task of balancing the need to control inflation with the desire to maintain healthy employment levels. The risk of stagflation—high inflation combined with high unemployment—is a significant concern. Predicting economic outcomes with certainty is inherently complex. Monetary policy, while a powerful tool, has limitations. The lag between policy changes and their effects on the economy makes accurate forecasting difficult.

Conclusion

Powell's Fed and interest rate cuts represent a complex challenge requiring careful navigation. The inflationary pressures are significant, yet aggressive interest rate hikes risk triggering a recession. The Fed's data-driven approach aims to strike a balance, but the economic outlook remains uncertain. Understanding the nuances of Powell's Fed and interest rate cuts is crucial for navigating the current economic landscape. Stay updated on the latest developments regarding Powell's Fed and interest rate cuts by following reputable financial news sources and engaging in informed discussions. Further research into monetary policy and macroeconomic analysis can provide deeper insights into these complex issues.

Featured Posts

-

El Testimonio De Simone Biles Un Cuerpo Al Limite

May 07, 2025

El Testimonio De Simone Biles Un Cuerpo Al Limite

May 07, 2025 -

Rihannas Parisian Glam Fenty Beauty Fan Encounter

May 07, 2025

Rihannas Parisian Glam Fenty Beauty Fan Encounter

May 07, 2025 -

Cobra Kai And The Karate Kid Exploring Continuity And Connections

May 07, 2025

Cobra Kai And The Karate Kid Exploring Continuity And Connections

May 07, 2025 -

Celebrity Special A Look At The Biggest Wins And Losses On Who Wants To Be A Millionaire

May 07, 2025

Celebrity Special A Look At The Biggest Wins And Losses On Who Wants To Be A Millionaire

May 07, 2025 -

Xrp Price Recovery Derivatives Market Slowdown

May 07, 2025

Xrp Price Recovery Derivatives Market Slowdown

May 07, 2025

Latest Posts

-

Another Aircraft Lost Second Us Navy Jet Goes Down Near Truman Carrier

May 08, 2025

Another Aircraft Lost Second Us Navy Jet Goes Down Near Truman Carrier

May 08, 2025 -

Papal Conclave Cardinals Review Candidate Dossiers

May 08, 2025

Papal Conclave Cardinals Review Candidate Dossiers

May 08, 2025 -

Pennsylvania Senator Fetterman Rebuts Ny Magazine Report On His Health

May 08, 2025

Pennsylvania Senator Fetterman Rebuts Ny Magazine Report On His Health

May 08, 2025 -

Fetterman Responds To Questions About His Health After Ny Magazine Article

May 08, 2025

Fetterman Responds To Questions About His Health After Ny Magazine Article

May 08, 2025 -

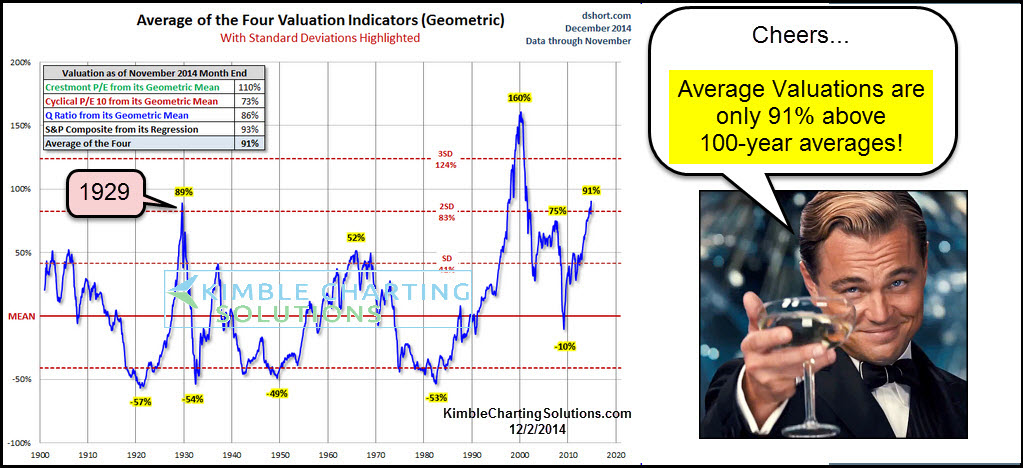

High Stock Market Valuations A Bof A Analysts Take

May 08, 2025

High Stock Market Valuations A Bof A Analysts Take

May 08, 2025