Pre-Earnings Apple Stock Analysis: Key Levels And Potential Price Movement

Table of Contents

Technical Analysis: Identifying Key Support and Resistance Levels

Technical analysis helps predict future price movements based on past price action and trading volume. Identifying key support and resistance levels is crucial for understanding potential price fluctuations before Apple's earnings release.

Identifying Support Levels

Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. For AAPL, several key support levels emerge from chart patterns and technical indicators.

- $150: This level represents a significant psychological barrier and a previous low. A break below this level could signal further downward pressure.

- $145: This level aligns with a key moving average (e.g., 200-day MA), offering additional support. Breaking below this could trigger more significant selling.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can provide further confirmation of support. A bullish divergence (price making lower lows while the RSI or MACD makes higher lows) could suggest a potential bounce from these support levels. Breaking these support levels could indicate a more bearish sentiment and potentially trigger stop-loss orders, accelerating the decline.

Identifying Resistance Levels

Resistance levels represent price points where selling pressure is anticipated to overcome buying pressure, hindering further price increases. For AAPL, several resistance levels are apparent:

- $170: This level represents a recent high and a strong psychological barrier. Overcoming this resistance could signal a bullish trend.

- $180: This level corresponds to a previous all-time high, representing a significant psychological and technical resistance level. Breaking through this would signal considerable bullish momentum.

The RSI and MACD can again be used to gauge the strength of resistance. A bearish divergence (price making higher highs while the RSI or MACD makes lower highs) could suggest a potential rejection at these resistance levels. A strong breakout above these resistance levels could indicate a strong upward trend and attract further buying pressure.

Fundamental Analysis: Factors Influencing Apple Stock Price

Fundamental analysis assesses the intrinsic value of a stock based on its financial performance, business model, and industry dynamics. Several factors could influence AAPL's price movement around earnings:

Earnings Expectations

Analyst consensus estimates provide a benchmark for comparing actual results. Meeting or exceeding expectations usually results in positive price movement, while falling short often leads to declines.

- Expected EPS (Earnings Per Share) and Revenue: Analysts' predictions for EPS and revenue growth are crucial. Significant deviations from these predictions will likely impact the stock price.

- Impact of Exceeding or Falling Short: Exceeding expectations typically triggers a positive market reaction, potentially leading to a price surge. Conversely, falling short often triggers selling pressure, resulting in price declines.

- Market Reaction: The market's reaction will depend on the magnitude of the surprise (positive or negative) and the overall market sentiment.

Product Launches and Market Trends

New product releases and broader market trends significantly influence Apple's stock price.

- Key Product Announcements and Market Impact: Any new product announcements (e.g., iPhones, iPads, Macs) and their anticipated market reception will play a crucial role.

- Influence of Macroeconomic Factors: Global economic conditions, consumer spending, and the overall performance of the tech sector all impact AAPL.

- Competitive Pressures: Competition from other tech giants affects Apple's market share and profitability, influencing investor sentiment.

Trading Strategies for Pre-Earnings Apple Stock

Navigating the volatility around earnings requires a well-defined trading strategy that incorporates risk management.

Risk Management Strategies

Effective risk management is crucial for protecting capital.

- Stop-Loss Orders: Placing stop-loss orders at key support levels helps limit potential losses if the price moves against your prediction.

- Position Sizing: Appropriate position sizing based on your risk tolerance is essential. Avoid over-leveraging your trading account.

- Diversification: Diversifying your portfolio across different assets mitigates risk exposure to any single stock.

Options Trading Strategies

Options trading offers strategies for managing risk and profiting from volatility.

- Straddles and Strangles: These strategies benefit from significant price movements in either direction, but require understanding option pricing and "Greeks" (measures of option sensitivity).

- Pros and Cons: Straddles and strangles offer high potential returns but also come with substantial risk. Understanding these risks is crucial before implementation.

- Potential Risks: Options trading involves significant risks, and it's essential to have a solid understanding before employing these strategies.

Conclusion

This pre-earnings Apple stock analysis highlights key support levels around $150 and $145, and resistance levels at $170 and $180. Factors such as earnings expectations, new product launches, and broader market trends will significantly influence AAPL's price movement. Remember, effective risk management, including stop-loss orders, appropriate position sizing, and portfolio diversification, are essential. Consider exploring options trading strategies like straddles and strangles, but only if you understand the associated risks. Stay informed on Apple's pre-earnings activity and utilize this analysis to make informed decisions regarding your Apple stock investments. Remember, thorough pre-earnings Apple stock analysis is key for successful trading!

Featured Posts

-

A Realistic Look At An Escape To The Country Challenges And Rewards

May 24, 2025

A Realistic Look At An Escape To The Country Challenges And Rewards

May 24, 2025 -

The Ultimate Guide To Escaping To The Country

May 24, 2025

The Ultimate Guide To Escaping To The Country

May 24, 2025 -

Find The Best Memorial Day 2025 Sales A Comprehensive Guide

May 24, 2025

Find The Best Memorial Day 2025 Sales A Comprehensive Guide

May 24, 2025 -

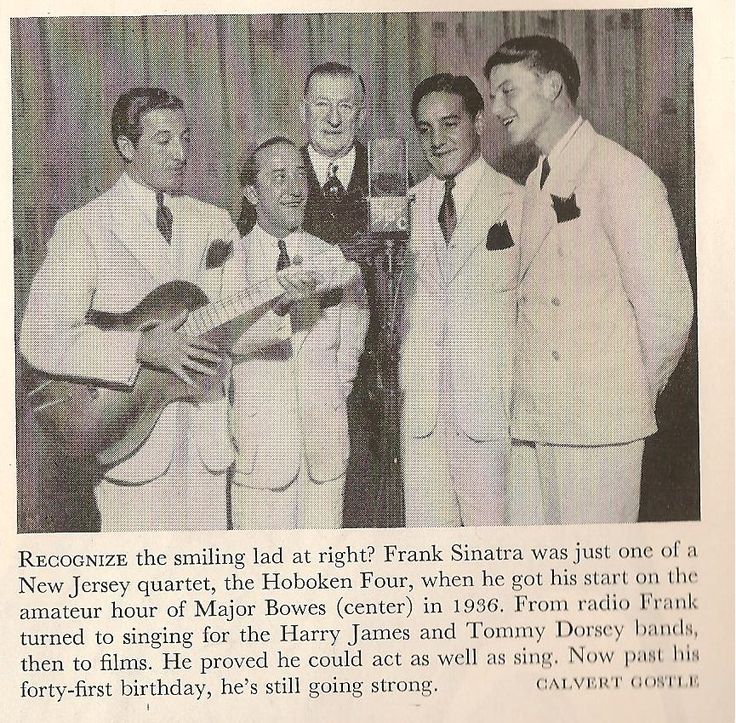

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Former French Pm Discrepancies With Macrons Decisions

May 24, 2025

Former French Pm Discrepancies With Macrons Decisions

May 24, 2025