Preparing Your Portfolio For Significant Stock Market Swings

Table of Contents

Diversification: Spreading Your Risk Across Asset Classes

Diversification is the cornerstone of a robust investment strategy, especially when preparing for market volatility. It's about spreading your investments across various asset classes to reduce the impact of any single asset's poor performance. A well-diversified portfolio minimizes your overall risk and improves the chances of positive long-term returns, even amidst stock market swings.

Keywords: Diversification, asset allocation, portfolio diversification, risk diversification, asset classes, bonds, stocks, real estate, commodities, alternative investments.

- Allocate assets across various asset classes: Don't put all your eggs in one basket. A balanced approach might include stocks (equities), bonds (fixed income), real estate, and potentially alternative investments like commodities or private equity. The optimal allocation will depend on your risk tolerance and time horizon.

- Consider geographical diversification: Investing in different countries reduces your reliance on any single national economy. International diversification can cushion the blow of regional economic downturns.

- Diversify within asset classes: Within stocks, for example, spread your investments across various sectors (technology, healthcare, consumer staples, etc.) and market caps (large-cap, mid-cap, small-cap). This minimizes the impact of sector-specific market downturns.

- Rebalance your portfolio regularly: Market fluctuations will inevitably shift your asset allocation over time. Regular rebalancing (e.g., annually or semi-annually) helps restore your target asset allocation and maintain your desired risk level.

Understanding Your Risk Tolerance and Time Horizon

Before diving into specific investment strategies, it's crucial to honestly assess your risk tolerance and investment time horizon. These two factors are fundamentally intertwined and will dictate your portfolio's composition and overall investment approach.

Keywords: Risk tolerance, investment time horizon, long-term investing, short-term investing, risk assessment, investor profile.

- Assess your risk tolerance: Are you comfortable with potential short-term losses in pursuit of higher long-term returns? Or do you prefer a more conservative approach with lower risk and potentially lower returns? Honest self-assessment is key.

- Determine your investment time horizon: Are you investing for retirement in 20 years, or do you need the money in the next five? A longer time horizon allows you to ride out market fluctuations more easily, allowing for a more aggressive investment strategy.

- Align investments with your profile: If you have a low risk tolerance and a short time horizon, you'll likely prioritize safety and capital preservation over high growth. Conversely, a higher risk tolerance and longer time horizon allows for a more growth-oriented strategy.

- Seek professional advice: If you're unsure about your risk profile, consider consulting a qualified financial advisor. They can help you develop a tailored investment strategy that aligns with your individual circumstances.

Building a Recession-Proof Portfolio

While no investment is truly "recession-proof," some asset classes tend to hold their value or even appreciate during economic downturns. Incorporating these into your portfolio can provide a buffer against market volatility and inflation.

Keywords: Recession-proof investments, defensive stocks, gold, bonds, real estate, inflation hedge, economic downturn, market downturn.

- Include defensive stocks: Companies in sectors like consumer staples (food, beverages, household goods) and healthcare tend to perform relatively well during recessions, as demand for their products remains relatively stable.

- Consider precious metals: Gold is often seen as a safe haven asset, holding its value or appreciating during periods of economic uncertainty and inflation. It acts as an inflation hedge.

- Invest in high-quality bonds: Government bonds and high-quality corporate bonds provide a relatively stable income stream and can offer some protection against market volatility.

- Explore real estate: Real estate can be a relatively stable long-term investment, although it can be less liquid than other assets.

Utilizing Defensive Strategies During Market Swings

When market volatility increases, defensive strategies can help protect your portfolio and limit potential losses. These strategies aren't about avoiding market participation entirely, but about mitigating risk and managing your exposure.

Keywords: Market correction, market volatility, hedging strategies, stop-loss orders, dollar-cost averaging, value investing.

- Employ stop-loss orders: These orders automatically sell a security when it falls to a predetermined price, limiting your potential losses.

- Consider dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the market price. This reduces the impact of buying high and selling low.

- Explore value investing: This approach focuses on identifying undervalued assets that have the potential to appreciate in value over time.

- Rebalance your portfolio regularly: As mentioned earlier, consistent rebalancing helps to capitalize on market fluctuations by selling overvalued assets and buying undervalued ones.

Conclusion

Preparing for significant stock market swings isn't about predicting the future; it's about building a resilient portfolio that can withstand volatility. By diversifying your investments, understanding your risk tolerance, incorporating recession-proof assets, and employing defensive strategies, you can significantly enhance your chances of long-term success. Remember that proactive portfolio management is an ongoing process, requiring regular review and adjustment. Start preparing your portfolio for significant stock market swings today!

Featured Posts

-

Open Ai Facing Ftc Investigation A Deep Dive Into Chat Gpts Practices

Apr 25, 2025

Open Ai Facing Ftc Investigation A Deep Dive Into Chat Gpts Practices

Apr 25, 2025 -

American Lung Association Receives 230 000 From 2025 Scale The Strat Event

Apr 25, 2025

American Lung Association Receives 230 000 From 2025 Scale The Strat Event

Apr 25, 2025 -

Should You Return To A Company That Laid You Off A Practical Guide

Apr 25, 2025

Should You Return To A Company That Laid You Off A Practical Guide

Apr 25, 2025 -

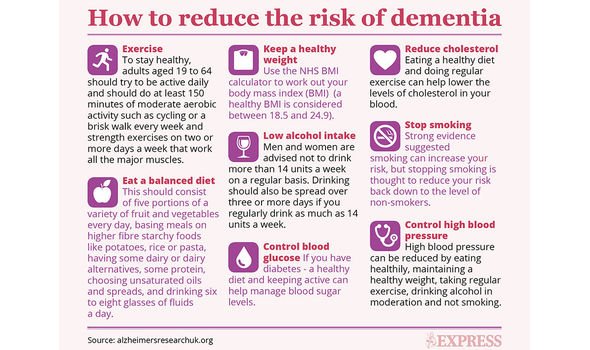

Metabolic Syndrome Reducing Your Risk Of Developing Dementia

Apr 25, 2025

Metabolic Syndrome Reducing Your Risk Of Developing Dementia

Apr 25, 2025 -

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 25, 2025

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 25, 2025

Latest Posts

-

First Child For Aaron Judge And His Wife

Apr 28, 2025

First Child For Aaron Judge And His Wife

Apr 28, 2025 -

Espns Farewell To Cassidy Hubbarth A Look Back

Apr 28, 2025

Espns Farewell To Cassidy Hubbarth A Look Back

Apr 28, 2025 -

Espns Final Broadcast Features Heartwarming Cassidy Hubbarth Tribute

Apr 28, 2025

Espns Final Broadcast Features Heartwarming Cassidy Hubbarth Tribute

Apr 28, 2025 -

A Touching Tribute Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025

A Touching Tribute Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025 -

Emotional Goodbye Espn Celebrates Cassidy Hubbarths Career

Apr 28, 2025

Emotional Goodbye Espn Celebrates Cassidy Hubbarths Career

Apr 28, 2025